- WeekendInvesting

- Posts

- A DEMAT Account Revolution

A DEMAT Account Revolution

The Great Indian Market Leap

Monday, 27 Oct 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

It was a good day overall. Things seem to be improving across the globe, with U.S.-China relations showing some positive signs after the weekend announcements. The Indo-U.S. trade talks also appear to be progressing well.

Gold, on the other hand, is taking a bit of a breather and might go down further as there seems to be a technical breakdown.

The market closed at a new short-term high, up by 0.66%, and came very close to the 26,000 mark.

The Nifty Junior also closed at a four- or five-day high, showing that after several sessions of weak closes, the trend is improving. It ended at 69,612, up by 0.37%.

Mid-caps also performed well, closing 0.8% higher — their best close since July. Small-caps were up by 0.65%, though they still lag a bit compared to large caps. It seems that the strength at the top end of the market is pulling the smaller stocks upward.

Banks also had a strong session, up 0.72%, closing at a new all-time high of 58,114.

Gold, however, showed weakness, down 1.32%. It may come down further toward 11,635 or even lower, which would translate to around $3,600–$3,800 on the dollar chart.

Silver fell 0.81%, entering a time correction phase after a strong run-up. It might move sideways for some time before resuming its next leg.

Other Market Triggers

Major gainers in the Nifty included heavyweights like Bharti Airtel, Reliance, State Bank of India, SBI Life, HDFC Bank, TCS, ITC, Tata Motors, Grasim, and Hindalco.

Kotak Bank, however, was down after its results, and Infosys also fell 1.3%.

In the Nifty Next 50 space, Adani Power was down 2.8%, along with minor losses in Naukri, Britannia, HAL, and Divi’s Labs.

Oil and gas stocks like IOC and BPCL also did well, as did steel and commodity stocks like Jindal Steel and Vedanta.

Among individual movers, Hatsun Agro rose 19.5% after strong quarterly results. The stock had been struggling for a while, so this move caught the market by surprise.

U.S. Market Update

Globally, the U.S. markets also did very well in the previous session — the Dow Jones was up 1%, NASDAQ gained 1.2%, and the Russell 2000 rose 1.25%.

Big names like IBM, AMD, Goldman Sachs, General Motors, and Broadcom led the rally. IBM, in particular, jumped from around $260 to $310 in just two sessions.

Some of these names have also been part of the Weekend Investing U.S. portfolio in the past, and it’s always good to maintain diversification beyond the home market.

What to watch next ?

There’s a growing sense that a rate cut might be coming soon. If that happens, sectors like real estate and infrastructure are expected to benefit significantly.

Many companies are reporting better-than-expected results, and there is a sense of buoyancy in the large-cap space.

The Nifty is now very close to its all-time high. With FII selling slowing down and positive cues from multiple sectors, the market continues to stay strong.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

📈 The Great Indian Market Leap: A DEMAT Account Revolution

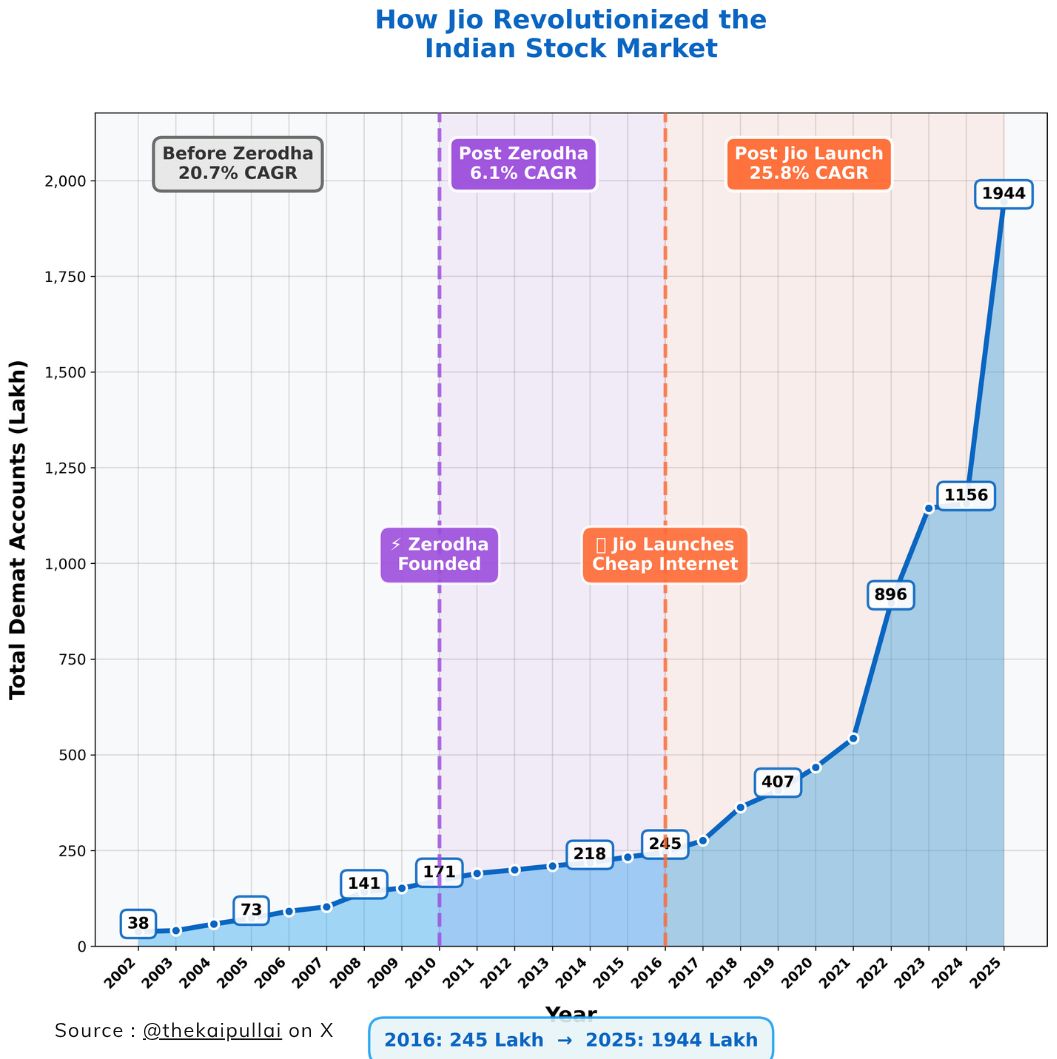

The Big Picture: A 22-Year DEMAT Account Journey

Analyzing two decades of data reveals fascinating shifts in the Indian investment landscape. Prior to the 2008 global financial crisis, the growth rate of DEMAT accounts was robust, running at an impressive 20% Compound Annual Growth Rate (CAGR).

However, the post-crisis environment saw markets flatten for nearly six years, and subsequent growth slowed significantly. Even after the initial years of the first major catalyst, the rate of change dipped to just 6.1% CAGR. This suggests that while a new model was introduced, the mass proliferation required a secondary, more powerful set of factors.

Catalyst 1: The Zerodha Effect

A pivotal moment occurred around 2010 with the formation of Zerodha. As the pioneer of the zero-cost delivery business, Zerodha disrupted the traditional brokerage model, making investing significantly cheaper and more accessible. It was one of the first prominent low-cost brokerages to enter the market.

Pointers on the Zerodha Impact:

Business Model: Introduced zero-cost delivery trading.

Market Position: Established itself as a leading low-cost, technology-driven broker.

Initial Growth: Despite Zerodha's arrival, the overall DEMAT account growth rate in the immediate years following its launch remained modest at 6.1% CAGR, indicating that low cost alone was not the sole driver for mass adoption.

Catalyst 2: The Perfect Storm of 2016-2020

The true inflection point, a phenomenon described as a "hockey curve" of sorts, began post-2016. This explosive growth was engineered by a confluence of critical events that created the ideal ecosystem for market participation.

Dispelling the 'Stagnant Account' Myth

A common argument against this growth is that a significant part of the new accounts are stagnant or inactive. However, an analysis of the previous era (the 20% CAGR phase) shows that even then, a considerable portion of the accounts was "not so active."

The key takeaway is that the percentage of account activeness is likely similar to what it has always been. The real transformation is the sheer proliferation of DEMAT accounts and the reach of internet broking into a much wider, mass audience, a feat achieved primarily after 2016.

Meme Of The Day

Which single factor do you believe was the most crucial in driving the phenomenal rise in DEMAT accounts from 2016 onwards? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply