- WeekendInvesting

- Posts

- A Simple Guide to 10 Years of Asset Allocation

A Simple Guide to 10 Years of Asset Allocation

How Easy Asset Mixes Performed

Market Update - Wednesday, 05 Dec

This marks the end of the week, and it wasn't a great one for the broader market overall. However, for the large caps and some larger mid caps, it turned out to be not such a bad day.

The RBI monetary policy announcement came in the morning and included a quarter percent cut in the interest rates. This move was somewhat expected, I would say, but not entirely. The market did get surprised.

Before the announcement, we were trading pretty much in negative territory, but post the announcement, we quickly moved into the green. So, there was definitely an element of surprise for the market participants.

Yes, President Putin is in India, and that perhaps puts the US-India treaty on the back burner. Nobody is even talking about it now, and if we are going to announce more defense deals, that treaty is going to be in even more jeopardy.

The funny part about today's RBI narrative, post the announcement, was that the growth rates they mentioned as likely, and the inflation that is likely in the next year, did not enthuse the rupee at all.

Nifty closed up 0.59%. The Nifty chart is not looking bad at all.

Nifty Jr., as you can see, came back from the lows, closing at 0.22%. It's not too hot in terms of the gain made today, but nevertheless, it is hanging in there.

Mid caps also swung back from a bottom of 22,021 to close at 22,207. So, that's almost a 200-point swing in the mid cap space, meaning mid caps also seem to be stabilizing a bit.

Small caps is where the trauma is, as despite the U-turn in the market, small caps continued to fall, closing 0.5% down.

Bank Nifty, of course, was very enthused with the rate cut, closing up 0.82%, again closing very near its daily as well as weekly highs.

Gold is inching up, up 0.65% today. The rate is 12,958 per gram, so almost 13,000, or you can say 1,30,000 per 10 grams, and we are very near the previous highs.

Silver is also moving up, gaining 1.87% to 1,78,387 per kg, and is also looking good in terms of the charts.

Other Market Triggers

Hindustan Unilever was a major loser, dropping 5%.

There were some good gains in banking and finance stocks.

The IT stocks continued to gain, I think, on the back of the fact that the rupee is not yet showing any strength.

Autos, cement, and steel all moved up due to the interest rate advantage that they would get.

The Nifty Next 50 Heat map, however, had a significant number of reds alongside the greens.

PSU banks recovered today after the drubbing they took yesterday.

Some stocks in the FMCG space like Britannia, Godrej CP, United Spirits, and other stocks like DMart, BPCL, moved up, while there were some losses in LIC, Hyundai, and Vedanta.

In the Mover of the Day segment, the stock that moved the most is Mahindra and Mahindra Finance, up 5.92%.

U.S. Market Update

In the US markets in the previous session, you had some good gains in Russell, up 0.75%. Others were very muted; Nasdaq, S&P 500, and Dow Jones were extremely muted.

Some of the stocks that lost yesterday were Intel (down 7.5%), UPS, Costco, Starbucks, and 3M. These were the stocks losing ground. Some of these stocks may be part of the Weekend Investing strategy on the US markets, and these are certainly not recommendations.

What to watch next ?

People who only invest in bank FDs are going to have an even tougher time going ahead. The reason here being that interest rates are coming down and there is no immediate inflation fear inside.

So, perhaps we've cut a quarter percent now, and perhaps we will cut another quarter percent in the coming months. That will, of course, translate into lower and lower FD returns.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

The Power of Simple Asset Allocation

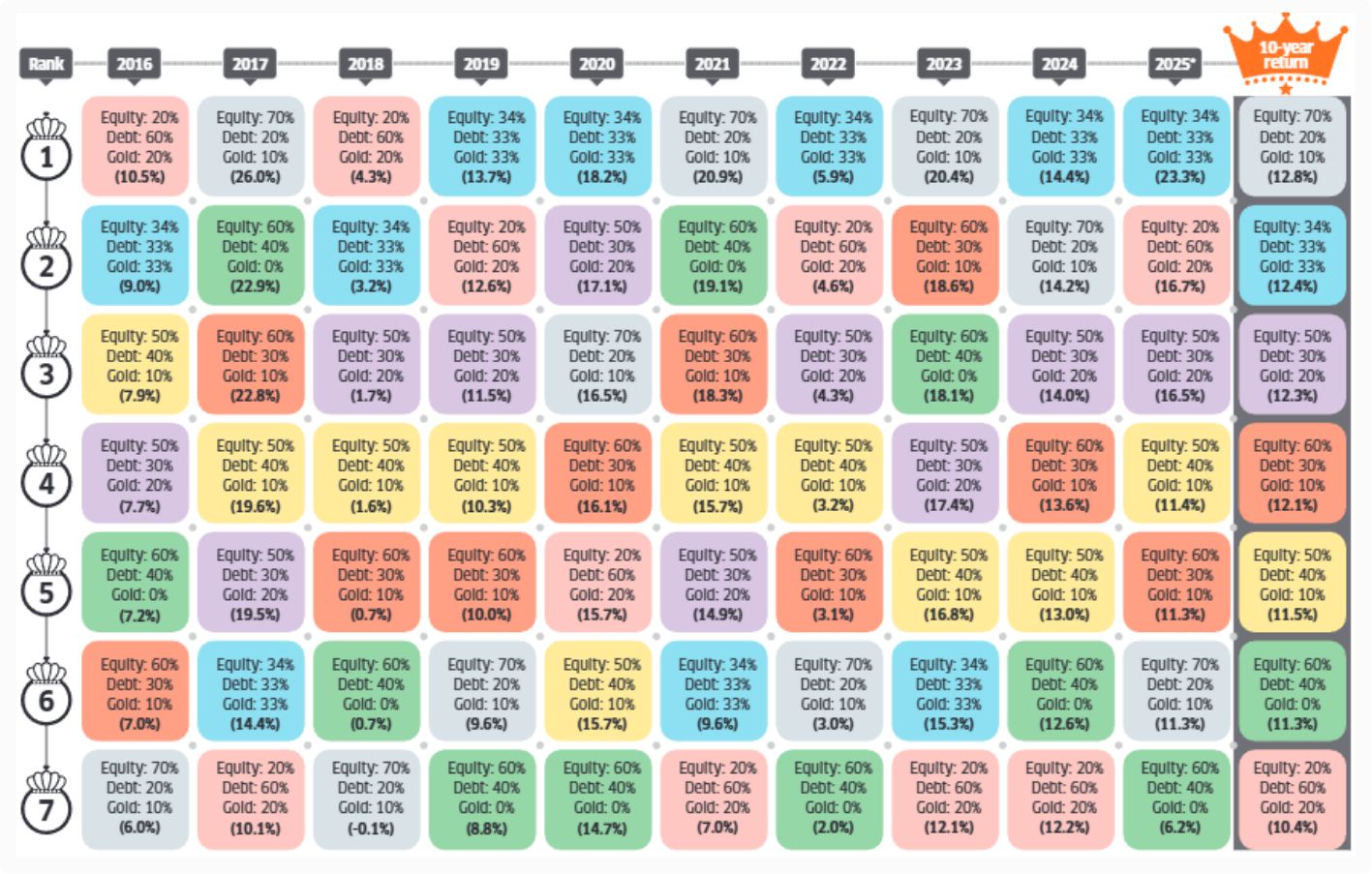

📊 The Seven Allocation Options Analyzed

This analysis compares the performance of seven different asset allocation strategies across the 10-year period. The options vary significantly in their exposure to Equity, Debt, and Gold:

Source : ET Wealth

🏆 Annual Performance Trends (2016-2025)

The yearly analysis reveals interesting patterns regarding which allocation combination topped the charts:

Option 7 (70% Equity) was the Best Performer in years like 2017, generating a strong 26% return.

Option 2 (The 1/3, 1/3, 1/3 split) demonstrated remarkable consistency, emerging as the top performer in five out of ten years (2018, 2020, 2022, 2024, and 2025).

Option 1 (20% Equity) also had its moments, topping the performance chart in two years, proving that even a highly conservative portfolio can outperform aggressive ones during certain market cycles.

Key Finding: The highly aggressive Option 7 (70% Equity) delivered the best return at 12.8%. However, the truly striking observation is how close the performance of the simple, balanced Option 2 (1/3, 1/3, 1/3) came, achieving a return of 12.4%. The difference is a mere 0.4 percentage points over ten years!

✅ Key Takeaway: Simplicity Often Wins

The main message from this 10-year data is that investing does not need to be overly complicated.

This strategy offers a robust, easy-to-manage approach that protects against major losses while still participating effectively in market gains.

Meme Of The Day

Based on the analysis of the 10-year asset allocation data (2016-2025), which portfolio characteristic is most important to you as an investor? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply