- WeekendInvesting

- Posts

- A Trillion-Dollar Lesson in Investment Mobility

A Trillion-Dollar Lesson in Investment Mobility

The Five-Year Shock

Thursday, 09 Oct 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

The markets were happy today, boosted by some positive talks with the UK team. There is growing evidence that India is now pushing hard to build stronger business ties with the EU and the UK while slowly reducing its exposure to the US. This seems to be the clear trend at the moment.

Another major headline today was that India may start paying for Russian oil in yuan. These moves are strong signals from India to the US — that while America may still be the big power globally, India is no longer ready to bow down easily.

Apart from this, there was also some positive news about regulations. The talk around weekly expiries seems to be taking a more favorable turn, suggesting they might stay.

Looking at the charts, things don’t look bad. After being hit yesterday, the market bounced back strongly today. Nifty was up 0.54%.

Nifty Junior gained 0.56%, and midcaps and small caps were also showing renewed confidence. Midcaps rose 0.83%, while Small caps remained stable.

Nifty Bank also recovered, up 0.3%. Overall, the market looked well under control.

Gold, meanwhile, is unstoppable at ₹1,22,164 for 10 grams. Since August 20th, there have been only six red days in forty days, and none have led to any meaningful correction.

Other Market Triggers

Stocks like JSW Steel, Tata Steel, Sun Pharma, L&T, Reliance, TCS, SBI, and Hindustan Unilever all performed well.

In the Nifty Next 50, stocks like CG Power, Hindustan Zinc, Vedanta, and Jindal Steel saw fantastic gains.

MCX was the star of the day, jumping 7% as silver and gold futures trading volumes shot up. More volume means more money for exchanges, and investors clearly recognized that.

U.S. Market Update

In the US, markets also continued their winning streak. The S&P 500 gained 0.58%, NASDAQ 1%, and Russell 1%. Over the past six months, the NASDAQ has delivered an impressive 34% return and nearly 26% in the past year.

Stocks like AMD, Broadcom, and Nvidia continue to shine there.

What to watch next ?

Of course, Steps taken by india regaring Russian Oil Deal may invite some reaction in the form of tariffs or other trade actions, but it’s worth appreciating the government’s stand. It takes courage to hold your ground in front of a global superpower.

Countries that have bowed to the US have often suffered later, because once you give in to a bully, the bullying never stops. So it’s a strong position to take, and the markets seem to be taking some relief from this situation as well.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

From 15th of Aug 2025, we have started sharing all our strategy updates, rebalances, and important announcements on our official WhatsApp Channel

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

The Five-Year Shock: A Trillion-Dollar Lesson in Investment Mobility

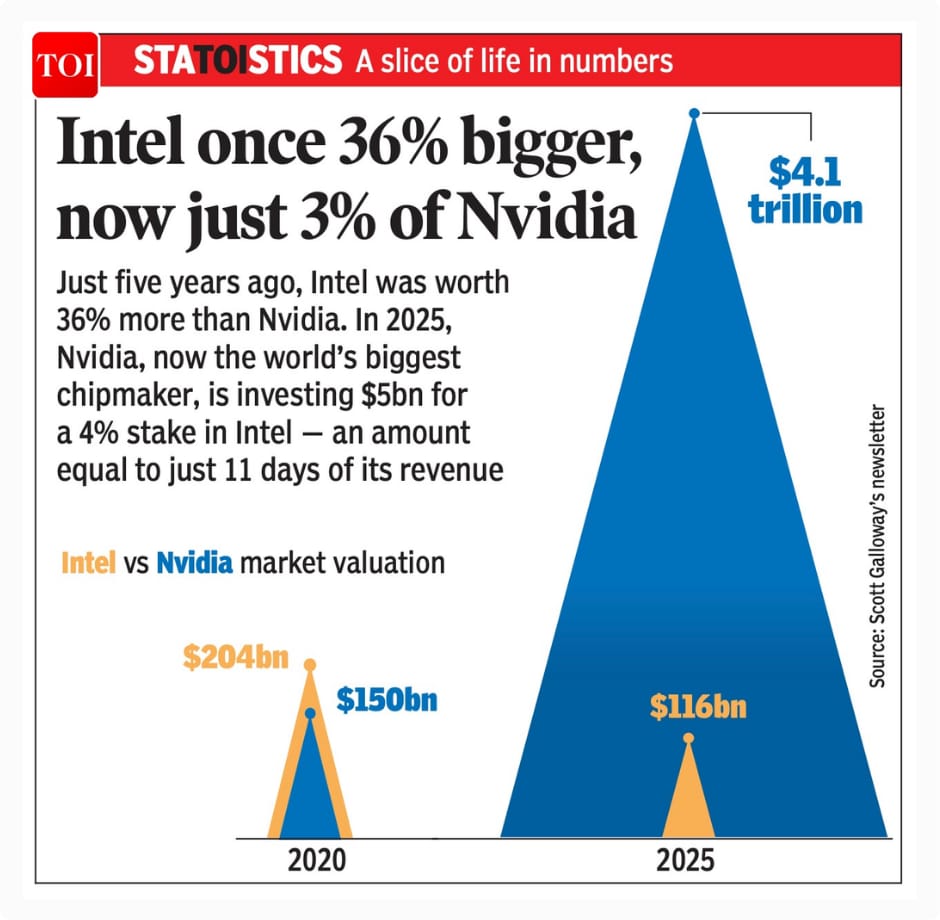

The 5-Year Shock: Intel vs. Nvidia

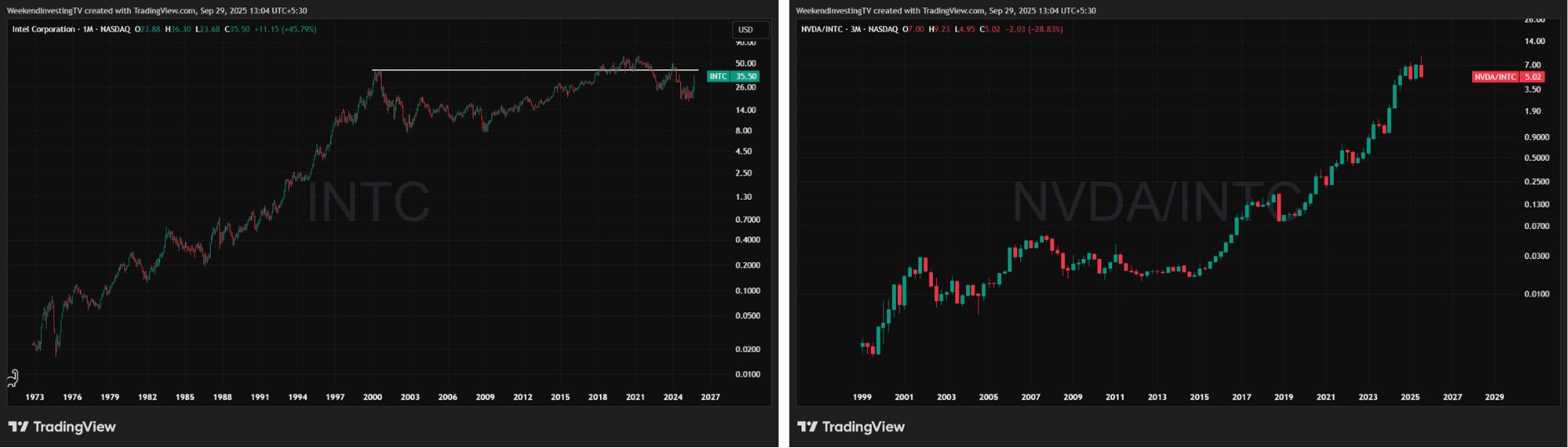

This story, sourced from Vivek Investor on X, serves as an exceptionally powerful illustration of how quickly market dynamics can transform wealth. The comparison between two semiconductor giants—Intel and Nvidia—over just five years is staggering and mind-boggling. It underscores a fundamental truth about modern investing: stagnation is detrimental.

Source : @Vivek_Investor on X

Intel, the historical leader, was clearly ahead. Fast forward approximately five years, and the landscape has been utterly redrawn, highlighting a dramatic shift driven by the AI and data revolution.

The difference between a loss of capital and a 30-fold increase is the difference between adhering to an old investment paradigm and identifying a powerful new trend.

The Danger of the Static Portfolio

The primary risk highlighted by the Intel-Nvidia comparison is portfolio complacency. The investor who sticks rigidly to their initial positions without surveying the global market is likened to someone choosing to stay on a slow, local train while the hyperloop (Nvidia) speeds past on an adjacent track.

An investor holding Intel during this period might have rationalized their position: Intel was the dominant player, the trusted name, perhaps even seen as "safer." Yet, while they were busy justifying yesterday's decisions, they missed a once-in-a-generation opportunity.

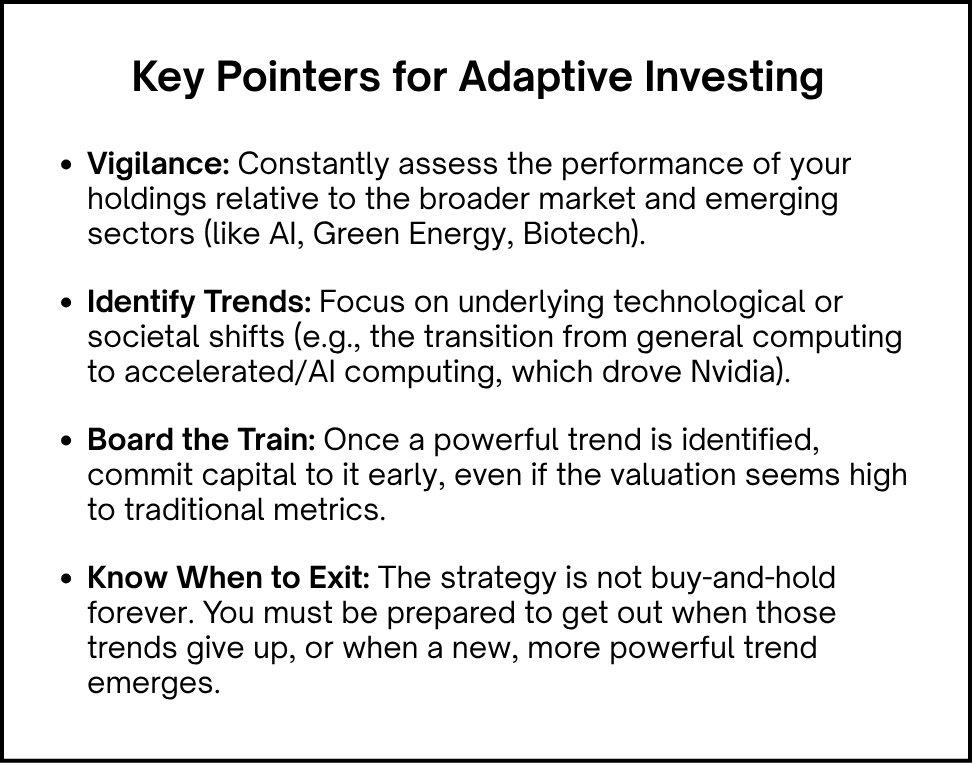

The core takeaway is that the only sustainable game in investing is the ability to identify and "board moving trains." This requires vigilance, adaptability, and a willingness to challenge one’s existing beliefs about the market.

How do we capture these shifts and avoid being stuck with "Intel-kind of investments"?

Meme Of The Day

What is the most critical lesson for investors from the dramatic 5-year shift between Intel ($204B → $116B) and Nvidia ($150B → $4T)? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply