- WeekendInvesting

- Posts

- Are You Also Feeling The AI Euphoria

Are You Also Feeling The AI Euphoria

Global Market Alert

Monday, 24 Nov 2025

Today’s Market Update

The week started off with a dull session, lacking major action, and with the larger part of the market slipping. Overseas cues are not particularly positive; there's continued tension in Japan due to their new stimulus measures, which is making the Japanese currency a bit vulnerable.

Domestically, there has been no news or clarification regarding the US-India tariff treaty, nor has the RBI explained why it allowed the rupee to crack on Friday.

The Nifty moved down 0.42% today.

The weakness is more pronounced in the broader market. Nifty Junior was down more dramatically, at 0.98%, bringing it very close to its September lows.

Midcaps were down 0.32%, and Small caps were down 0.65%.

The only space that did not decline was the banking sector, with the Nifty Bank closing only 0.05% down.

Gold was absolutely flat at minus 0.21%, and Silver was also flat at 0.16%.

Other Market Triggers

The Nifty Heat Map shows a lot of heat (selling), with Mahindra & Mahindra, ITC, Bharat Electronics, Reliance, TCS, Bajaj Twins, Axis Bank, JSW Steel, and Tata Steel all losing ground.

Stocks in the green for the Nifty were Wipro, Tech Mahindra, Hero MotoCorp, and Bajaj Auto.

In the Nifty Next 50 space, there was hardly any green, with only Canara Bank showing a marginal gain. Endurance Technologies, CG Power, Adani stocks, Hindustan Aeronautics, Solar Industries, BPCL, Mazagon Dock, PFC, and IRFC all lost ground for the day.

The Mover of the Day was Orient Electric, which crashed very hard, losing 9% today. The stock has plummeted from near ₹215 recently down to the ₹150s.

U.S. Market Update

In the previous session, the US market showed decent gains: S&P 500, Dow Jones, and Nasdaq were up approximately 1%, while the Russell 2000 saw a huge markup with a 2.7% gain, reflecting strength in the broader US market.

Stocks like Target Corp, Accenture, Charter Communications, PayPal, and UPS were going up. The disclaimer notes that some of these stocks might be part of the Weekend Investing U.S. stock strategy and are not recommendations to buy or sell.

What to watch next ?

The market is stuck in a bit of a limbo, not really going anywhere today, but tomorrow's expiry day could potentially bring back some volatility.

Today’s Nifty move broke a two-day low, and the very short-term upward momentum that suggested we might challenge the previous high has been aborted. While it can always come back, today's move doesn't instill immediate confidence.

The small-cap index has now broken even its September low, having bounced two or three times from the 16,500-16,600 level previously. We will have to see what happens this time.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

📰 Global Market Alert: Lessons from History on the AI Euphoria

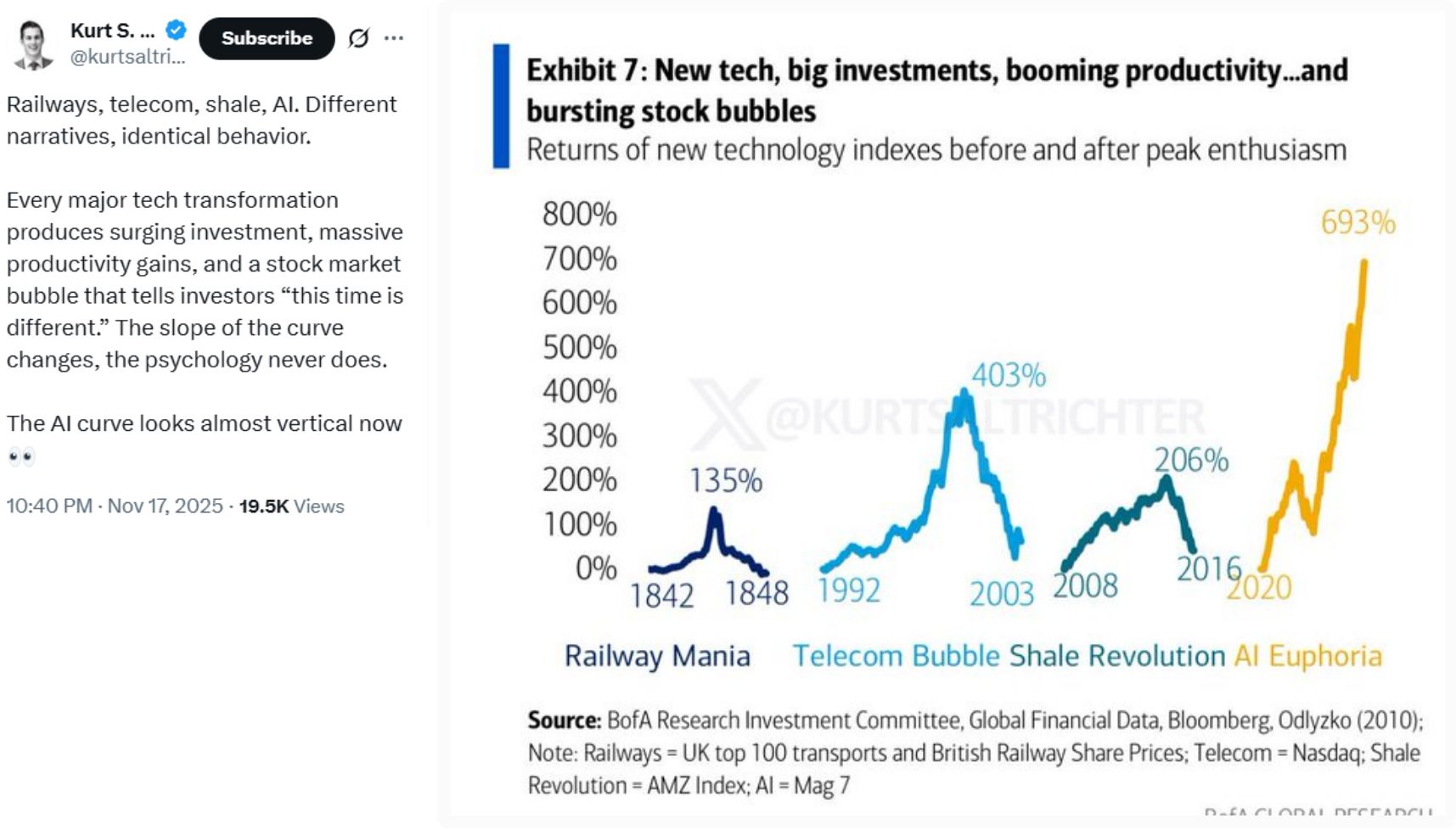

A critical discussion based on a recent market observation highlights the parallels between the current AI Stock Euphoria and major technological transformations of the past. The source of this insight is Bank of America Global Research.

Source : BofA Global Research

🚂 The Four Historic Bubbles: Railway to AI

The transcript draws a direct comparison between the present AI boom and three historical periods of massive technological investment that led to speculative bubbles:

Railways

Telecommunications

Shale Oil

Artificial Intelligence (AI) (The current phenomenon)

Every major technology transformation, in the past 150-200 years, has followed a similar script: Surging Investment, Massive Productivity Gains, and a Stock Market Bubble.

🤔 "This Time is Different": The Investor's Folly

A core psychological tendency of investors during a boom is the belief that "This time is different."

When a new technology sparks tremendous investment and market enthusiasm (like AI), investors tend to believe the current price appreciation is a permanent "regime change" or a systematic shift, rather than a temporary bubble.

This psychological setup leads to the assumption that high-growth trends will continue indefinitely.

The current run-up in AI stocks, especially in the US and, to an extent, China, shows this pattern. Since 2020, AI-related stocks have surged by about 700%.

📉 The Disconnect: Valuation vs. Real-World Impact

A key concern raised is the significant gap between the stock price surge and tangible, widespread business effectiveness:

Valuation Surge: AI stocks are up ~700% since 2020.

Productivity Clarity: The full productivity and business-changing effectiveness of AI is not yet clearly apparent. This suggests a potential speculative excess in the current valuations.

🚨 The Risk of Mean Reversion

Historical technology bubbles have consistently demonstrated a massive mean reversion—a significant decline from the peak.

In past bubbles, the reversal has typically been in the range of 60%, 70%, or even 80% of the peak valuation.

If a similar correction were to occur in the current AI market, the impact would be devastating globally.

This massive potential risk to global markets means no market, including India's, can remain untouched if a global market crash is triggered by the AI bubble bursting.

✅ Key Investor Takeaways

The analysis provides two crucial pieces of advice for navigating the current high-risk environment:

Define Your Exit Strategy:

Never invest without knowing when you will exit.

This exit strategy must be based on clear parameters, whether they are Price Behavior (Technical Analysis) or Fundamental Value Watch.

Always keep an exit point in mind.

Practice Asset Allocation:

Do not keep all your capital in Equities. The current equity market is deemed a high-risk environment.

Distribute your assets across different classes (Asset Allocation).

This strategy ensures that if the bubble reverses, a portion of your capital is protected from the loss, mitigating the overall damage.

Meme Of The Day

Based on the historical comparison to the Railway, Telecom, and Shale Oil bubbles, how do you view the current AI stock market surge? |

|

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply