- WeekendInvesting

- Posts

- Are you riding the trend or getting stuck in the mud?

Are you riding the trend or getting stuck in the mud?

🏠 Real Estate: The High-Beta Rollercoaster

Market Update - Wednesday, 04 Feb

Not a day goes by without a major story playing out, and today the spotlight was firmly on IT services. The American AI company Anthropic, which operates with only 2100 employees and carries a market cap of approximately 350 billion dollars, has smashed IT services companies across the world.

It seems that many existing firms have not kept up the pace required to counter this kind of AI capability. This resulted in a massive impact on the market, with companies like Infosys and TCS losing 7 to 8% of their market cap in just one day.

While this was the shocker of the day, the rest of the market remained reasonably stable. It is the second day after digesting the US-India deal, and so far there have been no fine-print surprises.

The current markets remained quiet today, with the Nifty still digesting these moves at 0.19%.

Other indices showed more movement, with Nifty Junior up 0.65%, Mid-caps up 0.6%, and Small-caps up 0.76%.

Nifty Bank also rose 0.33%. Gold is moving up at breakneck speed, returning to 1,56,000 from 1,36,000 with a 2.4% move today.

Silver also moved up 4.75%, though it appears silver may take more time to consolidate while gold looks more aggressive.

Interestingly, smaller micro-cap companies, especially those with an export orientation, have suddenly started to do well.

Other Market Triggers

The Nifty heat map shows a distinct red block in IT services, with HCL Tech, Wipro, Tech Mahindra, Infosys, and TCS all smashed down.

On the Nifty Next 50, LTIM was hit hard along with HAL and Naukri, while Divi's Lab was down 2.5%.

On the positive side, Adani continues to rise as the market assumes it has cleared previous issues.

PFC and Chola Finance also performed well.

The mover of the day was Avanti Feeds, a big exporter, which clocked 11.6% today and 35% over two days after a long lull.

U.S. Market Updates

Global markets also faced a tough day. The NASDAQ was down 1.5% and the S&P 500 fell almost 1%. PayPal dropped 20%, while Intuit, Accenture, Booking Holdings, and Adobe fell between 7% and 10%.

Even creative leaders like Adobe are finding it difficult to keep pace with new-age companies.

Major tech players like Nvidia, Microsoft, Meta, Google, and Amazon all saw moves down, though Palantir surprisingly rose 6.8%.

Some of these may be part of the Weekend Investing US stock strategy, though these are not recommendations.

What to watch next ?

The IT fall raises a larger question about whether technology development will lead to significant deflation. As technology improves productivity, there may be a loss of labor requirement, potentially making things cheaper.

Conversely, these developments require enormous energy and natural resources like copper and silver, causing those asset classes to ramp up quickly.

There will likely be a mix-and-match scenario where some items are extremely inflationary while others are in deep deflation.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Forwarded this email? Subscribe Now

Important Announcement

We are now live on our official WhatsApp Channel. We share all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

🏠 Real Estate: The High-Beta Rollercoaster

The Extreme Pendulum of Reality

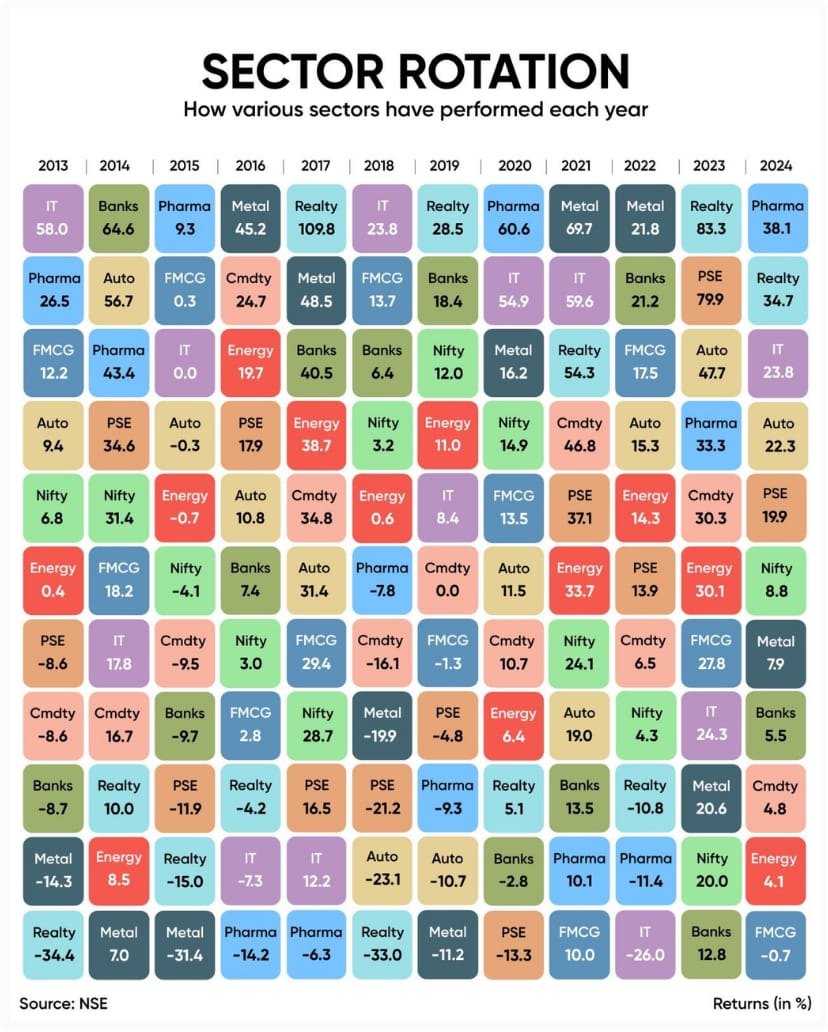

Real Estate isn't just another sector; it is arguably the highest beta segment in the market. As highlighted by Sandeep Kulkarni, this index doesn't believe in "average" years. It operates in extremes. When the wind is in its sails, it outperforms everything else on the board. When the tide turns, it can be the heaviest anchor in your portfolio.

A Decade of Peaks and Valleys

Looking at the data from 2013 to 2024, the performance swings are nothing short of breathtaking. This sector is consistently either the "Valedictorian" or the "Dropout" of the market classes.

The Danger of "Sector Loyalty"

The biggest risk an investor faces is becoming emotionally attached to a sector. While long-term investing is usually praised, staying married to a high-beta sector like Real Estate during a downturn can lead to years of dead capital. As we've seen, after a crash, it might take three, five, or even ten years for the sector to find its footing again.

Master the Art of Sector Rotation

The secret to navigating these swings is Trend Following.

Ride the Wave: Stay invested as long as the sector shows strength and follows the upward trend.

Know the Exit: The moment the sector breaks its trend, it’s time to rotate your capital elsewhere.

Don't wait for a decade for a recovery when other sectors are starting their own bull runs.

Meme Of The Day

What is your move when a high-beta sector starts to dip? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Reply