- WeekendInvesting

- Posts

- Are You tracking Silver ?

Are You tracking Silver ?

The 2024 Breakout: A New Era for Silver

Tuesday, 07 Oct 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

The market started the day on a strong note but lost most of its gains by the end of the session. It has been the third consecutive day of good performance, but today it seemed to fall under its own weight. After an energetic opening, the momentum faded, and the day closed almost flat.

The Nifty touched 25,220 but later gave up most of its gains to end just 0.12% higher.

Nifty Next 50 also closed with a small gain of 0.12%. However, its chart looks more like a flag pattern, suggesting that a dip may also be possible.

The mid-cap space performed well again, up 0.39%, showing better strength than large caps. Small caps, on the other hand, stayed quiet and showed no real participation, up just 0.11%.

The Bank Nifty gained 0.24%, and an inverted head and shoulders pattern seems to have formed there, hinting at a potential 2,000-point upside if momentum continues.

Gold prices stayed calm after a strong move last night, holding near ₹11,967 per gram. Despite the steady rise, gold could correct towards ₹11,000, which would be an 8–10% pullback.

Other Market Triggers

Among key stocks, HDFC Bank was the main driver, up 0.93%. ICICI Bank, Reliance, Maruti, Mahindra, Airtel, HCL Tech, and Bajaj Finance also contributed to gains.

On the losing side were SBI, Hindustan Unilever, Tata Motors, Infosys, Axis Bank, and Kotak Bank, which dragged the Nifty down.

In the Nifty Next 50 space, the real estate sector saw action with Lodha and DLF gaining modestly. Divi’s Labs jumped 4.7%, and GAIL rose 1.8%.

On the other hand, stocks like Pidilite, United Spirits, Britannia, Jindal Steel, Motherson, Bank of Baroda, ICICI General, and Tata Power slipped.

The biggest mover of the day was Vodafone Idea, which surged 8.38% as the market awaited the Supreme Court’s October 13 verdict on the AGR dues issue.

Tata Investment Corporation fell sharply by 7% after a month-long rally of nearly 78%, triggered earlier by the Tata Capital IPO news.

U.S. Market Update

In the U.S. markets, the S&P 500 rose 0.36%, Dow Jones stayed flat, and Nasdaq gained 0.7%. Over the past month, the S&P 500 has gained 3.9% and the Nasdaq 5.7%, marking a strong performance.

Weekend Investing also runs a U.S. portfolio tracking the S&P 100 index, where some top performers included AMD, which soared 24% after a deal with OpenAI. Tesla gained 5%, while Palantir, PayPal, and NextEra also posted solid gains.

The buzz in AI-related stocks continues to drive excitement, with companies like Nvidia, Oracle, and now AMD seeing sharp rallies.

What to watch next ?

Globally, the demand for physical gold and silver is rising sharply, and many suppliers are reportedly running out of stock. Bullion Star reported that 50-gram and 100-gram silver coins are becoming unavailable as supply fails to keep up with demand.

While this could be a short-term rush, it suggests that prices may not drop soon unless demand cools off.

At the same time, festive demand in India is strong across several categories.

This surge in demand is a positive sign for the economy, and by the end of October, GST data will likely show how strong this festive momentum has been.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

From 15th of Aug 2025, we have started sharing all our strategy updates, rebalances, and important announcements on our official WhatsApp Channel

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

🚀The Silver Surge: History Rhymes with a Six-Fold Opportunity in INR

The 2024 Breakout: A New Era for Silver

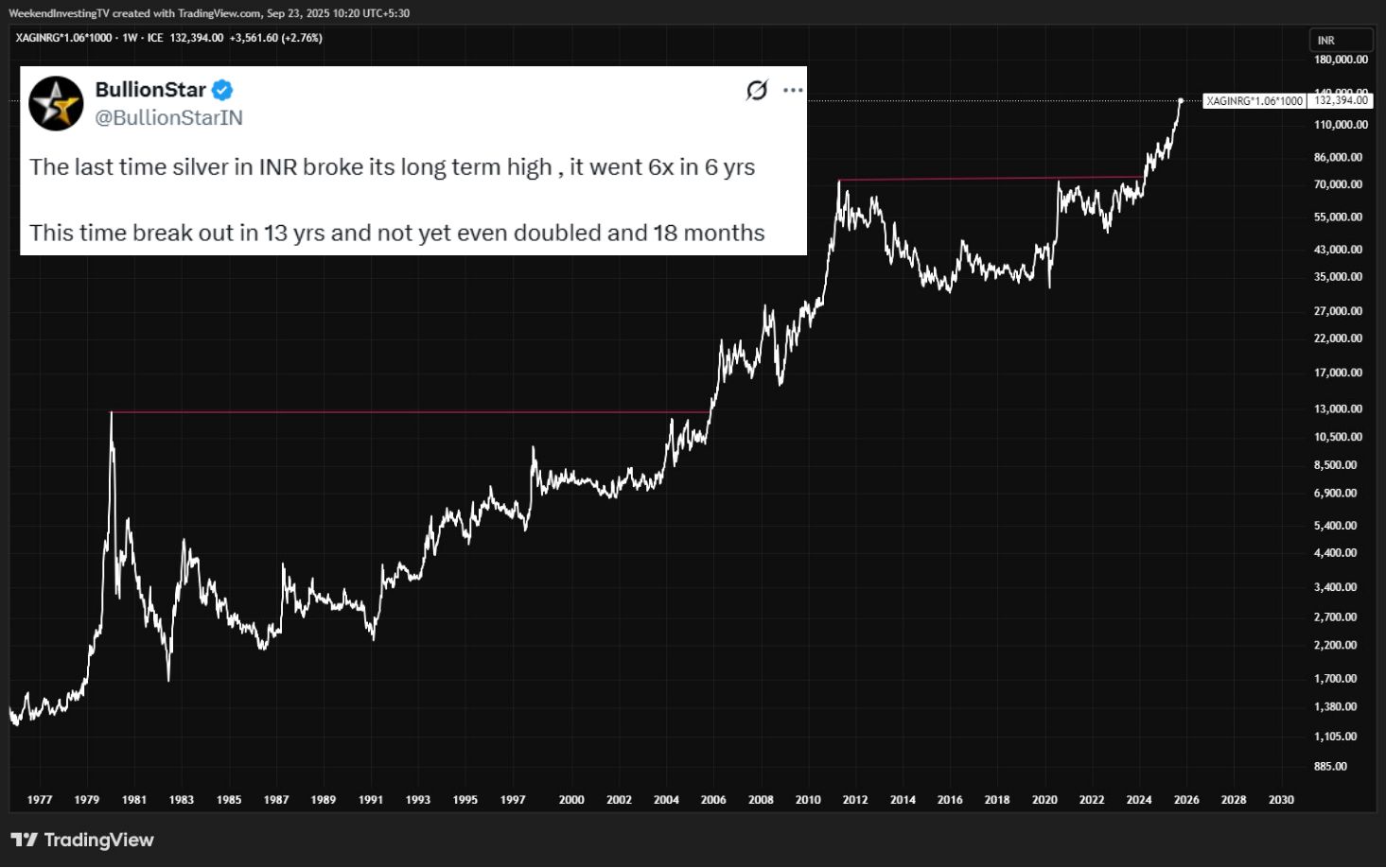

A recent analysis, highlighted by Bullion Star, suggests that the current silver price movement in Indian Rupees (INR) bears a striking resemblance to historical patterns that led to massive gains.

Silver has notoriously long consolidation periods, only to be followed by breathtaking rallies. The current breakout is significant because it marks the end of a long, 13-year period of stagnation, setting the stage for potentially historic moves ahead.

The Six-Year, Six-Fold History Lesson

Silver's price trajectory in INR has been defined by two major, decades-long peaks. When the price finally breaks such a long-term high, the resulting rally has been exceptionally powerful.

Source : Bullion Star on X

Current Trajectory: Just Getting Started

The latest rally is viewed as being in its nascent stage compared to its historical precedent.

The Breakout Point: The long-term high was broken at approximately ₹70,000 per kilogram.

Current Status: The price is currently around ₹114,000 per kilogram.

Gain So Far: The price has not even doubled yet (it's roughly a 1.6x gain).

Time Spent: We have only been in this move for about 18 months.

If history were to repeat the 6x in six years pattern, the price from the breakout level of ₹70,000 could target a figure around ₹420,000 per kilogram.

This projection underscores silver's tendency to move very rapidly—historically, silver has seen 12x to 13x type of gains in a matter of just 3 to 4 years during certain periods. This metal is inherently volatile and moves significantly whenever a long-term bull market commences.

Key Learning

When silver breaks its long-term high against the INR, the subsequent rally has historically been characterized by massive, swift, and sustained growth, exemplified by the 6x gain over six years following the 2006 breakout.

Meme Of The Day

What do you think the potential is for the current rally that started after the 2024 high was broken? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply