- WeekendInvesting

- Posts

- Did You Know the Hierarchy of Money and Risk

Did You Know the Hierarchy of Money and Risk

Understanding Exter's Pyramid

Friday, 10 Oct 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

As the week comes to an end, many people seem relieved that there has been no fresh tantrum from the US so far. Donald Trump, however, has lost the race for the Nobel Peace Prize, so there’s always that worry that he might react in some unpredictable way over the weekend — something we’ll find out by Monday.

The good news from yesterday was that FIIs finally turned buyers after a very long time, and the markets welcomed that move with cheer. Whether this buying will continue as a new trend or it’s just a one-day event, we’ll know only in the coming days.

On the corporate side, the results are coming through quite well. The announcement of a new data center by TCS added excitement, and most other company updates are meeting expectations. Overall, the market seems steady and range-bound for now.

Today’s numbers show Nifty up by 0.41%, Nifty Junior by 0.24%, and midcaps doing well with a 0.41% rise.

Small caps also moved up 0.62% after being stuck for five days, marking their highest level in over a week.

Nifty Bank had a strong 0.74% gain, helped by the inverse head and shoulders pattern that has been forming in the last few sessions.

Gold, meanwhile, is unstoppable at ₹1,22,164 for 10 grams. Since August 20th, there have been only six red days in forty days, and none have led to any meaningful correction.

Silver, however, has been a completely different story. There’s been chaos in the market, with silver trading at crazy premiums due to lack of availability. Even though Kotak AMC recently said they won’t add more fund-of-funds allocation to Silver ETFs, the ground reality is that silver is scarce.

Other Market Triggers

Top performers in the Nifty were SBI, Maruti, Bajaj Auto, and Cipla. In the next Nifty group, we saw gains in real estate and pharma stocks — Lodha, DLF, Divi’s Lab, and PNB were some of the strong movers.

Metals, which had risen yesterday, saw mild profit booking today, with Jindal Steel and Hindustan Zinc among those cooling off.

The biggest mover of the day was Tata Communications, which surged over 10% after Tata Capital’s listing and ahead of its own results.

Yes Bank also rallied sharply from ₹18–20 recently to ₹24, with talks about a possible stake sale by SBI fueling the move.

U.S. Market Update

In the US, markets were slightly down overnight — S&P 500 slipped 0.28%, Dow Jones fell 0.52%, and Russell 2000 lost 0.61%.

Stocks like Boeing, Charter, RTX, Honeywell, and Comcast were among the bigger losers, down 2–4%.

Some of these major names seem to be in a distribution phase on the charts, which may indicate near-term weakness.

What to watch next ?

Looking at the charts, after a small lull, we have seen two days of continuity, which is a positive sign.

Usually, there’s a small run-up in the markets as we move closer to Diwali, which is now just 10 days away.

If the market crosses its current pivot point, we could see a burst of energy and optimism return.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

Understanding Exter's Pyramid: The Hierarchy of Money and Risk

The Genesis of the Inverted Pyramid

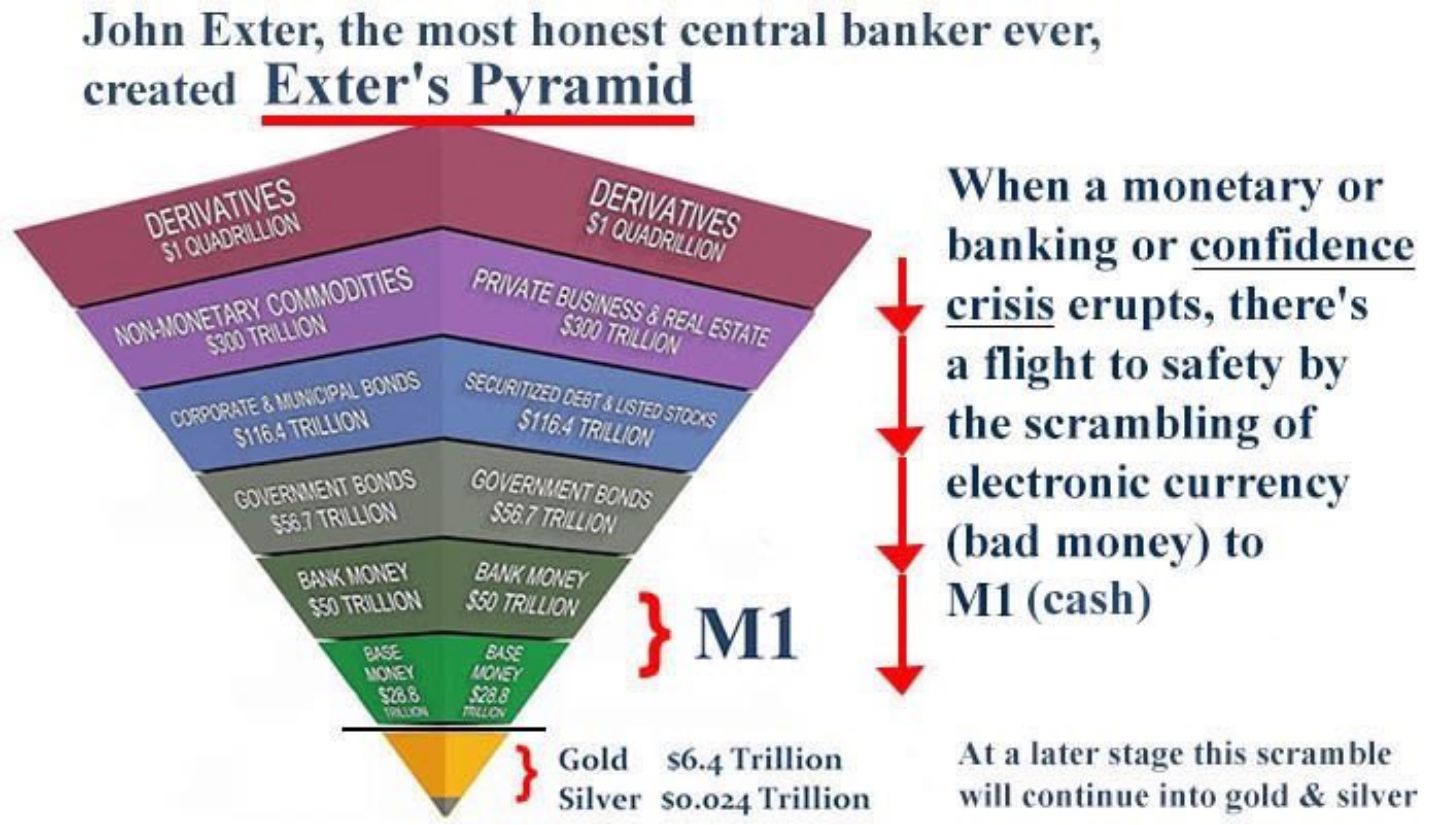

The concept of Exter's Pyramid was developed by the late central banker, John Exter. He proposed this model in a time when global currencies were still backed by gold, aiming to illustrate the underlying structure of the monetary system and the varying degrees of risk associated with different asset classes.

Source : Bullion Star on X

The key structural feature of the model is that it is an inverted pyramid, with the smallest, safest, and highest-quality assets forming the pinnacle at the bottom, and the largest, riskiest assets forming the wide top.

The Layers of the Hierarchy: From Gold to Derivatives

Exter’s model organizes assets into distinct layers, reflecting a clear hierarchy of safety and credit risk. This is the order of assets, starting from the safest base:

Pinnacle (The Safest Haven): Precious Metals

Gold and Silver occupy the base. They represent assets with no counterparty risk, making them the ultimate flight-to-safety assets.

Layer 2: Base Money

This includes the actual currency or "base money" in the system, which can be subject to significant leverage. The transcript notes an American concept where leverage allows a large amount of money (e.g., $9) to be put into existence for every small unit of issuance ($1).

Layer 3 & 4: Government Debt

Moving up, the pyramid includes Government Bonds and Treasuries, followed by State, Local, and Municipal Bonds. These carry sovereign or municipal credit risk, making them riskier than base money.

Layer 5: Private Assets

This broad category includes private business debts, Real Estate, stocks, and other general asset categories. The default risk here is significantly higher.

The Cap (The Riskiest Asset): Derivatives

The largest layer at the top consists of Derivatives and highly leveraged instruments. These assets are built upon all the layers below them, hugely increasing the system's total size and risk exposure. This is the first place major systemic risk materializes, as seen in the 2008 financial crisis.

The Mechanism of Inflation and Leverage

The entire pyramid's stability is reliant on the small base of precious metals and base money. Human tendency drives the system to create derivatives and apply leverage, constantly inflating the size of the top layers. The fundamental idea is that we are sitting on a very large plate of assets, all supported by a comparatively small, stable base.

This structure—where the base is small but supports a massive inverted structure—is inherently sensitive to shifts in confidence.

The Collapse Scenario: The Flight to Safety

The model is most illustrative during a banking crisis or a crisis of confidence in the economy or currency. When this occurs, there is a flight to safety, and assets collapse from the top down, meaning the riskiest layers are shed first:

Derivatives collapse first (The 2008 example).

Private Businesses, Real Estate, and securitized debt start to fail.

Stock Markets experience a sharp decline.

The risk then migrates to Government Bonds.

Finally, the stability of Base Money and banks is challenged.

According to Exter's theory, the final and safest assets, Gold and Silver, cannot be destroyed. Instead, they can be repriced higher and used as the foundation to rebuild the entire monetary structure, acting as the ultimate store of value.

The fundamental insight of Exter's Pyramid is that during a crisis, the direction of money flow is always toward the smallest and safest assets (the bottom of the pyramid), causing a collapse that starts with the largest and riskiest assets (the top).

Meme Of The Day

Which layer do you believe is most vulnerable to a collapse in confidence in the current economic climate? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply