- WeekendInvesting

- Posts

- Do You Understand the Power of Sector Rotation

Do You Understand the Power of Sector Rotation

Sectors Perform Differently Every Year

Monday, 17 Nov 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

We've had a good start to the week, with the Nifty again flirting with the 26,000 mark. The market showed a good all-round performance. The results season is mostly over, and fundamental experts generally view it as having been a good one.

Some recent IPOs, like Groww, have performed exceptionally well, trading 60-70% higher than their listing or at least above the IPO price. This success has brought good confidence back to the market, as people have made money following an IPO listing after a long time.

Overall, the market looks reasonably sound. Potential triggers, such as what might be announced in the upcoming budget concerning sectors like PSU banking or defense, or a narrative around the US-India tariff deal, could kick off some stocks in our markets.

The Nifty is looking very comfortable today, up 0.4% and just crossing 26,000.

The Nifty Junior was absolutely flat, down 0.09%.

The Nifty Junior was also up half a percent. The broader market is doing well, with Midcaps and Small caps both showing strong gains of 0.68%.

This trend of smaller and mid-cap stocks outperforming large-cap stocks is notable.

The Nifty Bank surged to a new high with a 0.76% gain for the day, closing at 58,962.

Gold was absolutely flat at 0.06%, while Silver was slightly up at 1.23% after two consecutive sessions of decline.

Other Market Triggers

The Nifty Heat Map was largely green across financials, IT, autos, and infrastructure stocks.

Notable exceptions to the gains included Tata Motors moving down by 4.7%, along with Jio Financial, UltraTech Cement, and Naukri also moving down.

In the Nifty Next 50 space, there was a lot of green. While Bajaj Holdings, Vedanta, Zydus Lifesciences, DMart, and Hindustan Zinc were among the losers, there were good gains in TVS Motors, Pidilite, IOC, BPCL, Bosch, ABB, Siemens, Adani Green, Tata Power, and Canara Bank.

The Mover of the Day was Narayana Health, which saw a rocket move of +14.5% following its Q2 results and the announcement of expansion plans, an outcome the market was clearly not expecting.

U.S. Market Update

In the previous session of the US Markets, there were some losses in the Dow Jones, the S&P 500 was flat, the NASDAQ was also flat, and the Russell 2000 was slightly up 0.2%, suggesting a tentative trading day.

Earlier on Friday, stocks had fallen a lot but recovered back.

On the downside, Netflix was down (due to a stock split, not a 90% drop), while Bristol-Myers was down 4%, PayPal 3%, UnitedHealth, and Pfizer also declined. The disclaimer here is that some of these stocks may be part of the Weekend Investing U.S. stock strategy and are certainly not recommendations.

What to watch next ?

There is now an expectation of a US-India tariff resolution, and the market appears to be priming for a breakout above 26,000. It hasn't happened yet, but the level is being tagged very frequently, and once it breaks through, we should see a lift-off.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

Understanding the Power of Sector Rotation 📈

🌟 Analysis of 10-Year Sectoral Returns

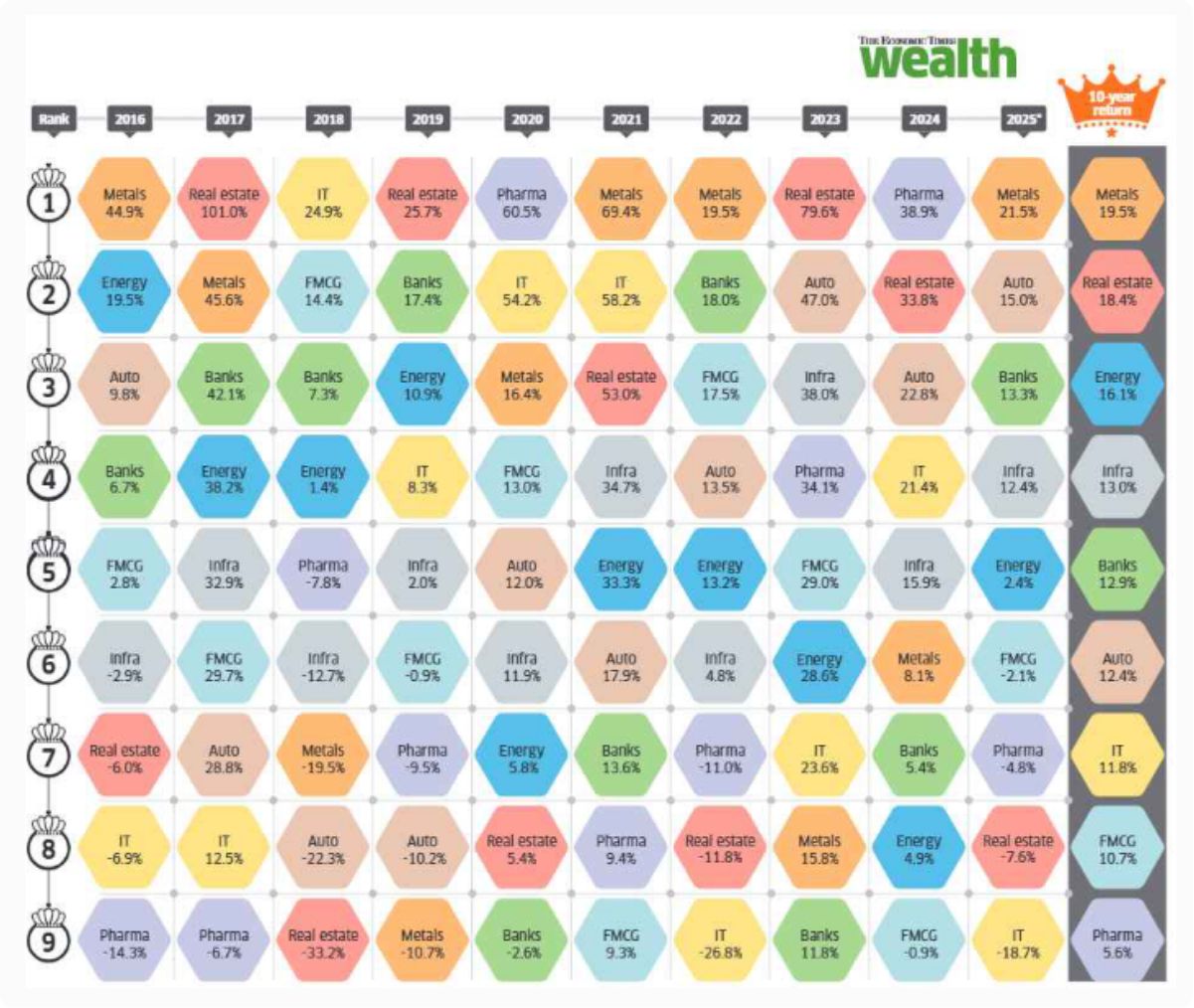

Based on data from ET Wealth, a deep dive into the performance of various sectors in the Indian stock market over the last 10 years reveals that no single sector can consistently top the charts every year. This data highlights annual returns and underscores the critical concept of Sector Rotation.

Source : ET Wealth

Key Observations:

Metals: Topped the performance four out of 10 times, yet ranked in the bottom 3-4 positions in other years—demonstrating that this sector can be both the best and the worst performer.

Banks, Pharma, IT: These sectors also secured top 2-3 positions in certain years but slid into the bottom 3 positions in others.

🔄 The Volatile Nature of Sector Rotation

The analysis clearly shows that different sectors perform differently in different years. This is a classic example of sector rotation, where capital moves out of one sector and into another that is showing strong momentum at that time.

🎯 Example (Real Estate): After being at number seven in 2016, it jumped to the top position in 2017, only to fall to the bottom position the very next year (2018). It climbed back to the top position in 2019 and again fell to the bottom in 2020. This cyclical pattern is a crucial lesson for investors.

💡 Investment Strategy to Counter Volatility

The average return for many sectors has hovered around 10% to 13%. However, sectors like Energy, Real Estate, and Metals have delivered additional, higher returns during their periods of rotation. But for an investor, sticking to a single sector often proves detrimental.

❌ The Wrong Approach:

Remaining invested in only one sector.

Seeing more than half of the previous year's gains vanish the following year.

Eventually, exiting the position at lower levels out of frustration.

✅ The Right Approach:

Adopting a Self-Correcting Strategy.

Staying automatically aligned with the best-performing sectors.

As soon as a sector's trend fades, exiting it and investing in a different, stronger sector.

The Core Learning: "Always Stay With The Strongest Sectors."

The key to successful investing is not maintaining a static approach, but adopting an active (Self-Correcting) strategy that constantly guides capital toward the top-performing sectors.

Meme Of The Day

Which investment strategy do you believe is most effective for maximizing returns in a market experiencing continuous Sector Rotation? |

|

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply