- WeekendInvesting

- Posts

- Does China really need U.S. ?

Does China really need U.S. ?

Undertstanding China-US Trade Dynamics

Thursday, 6 Nov 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

The markets right now are looking very, very dull and are correcting. We've already lost about 600 points from the recent peak, and there are no immediate triggers in sight.

A slight sense of discomfort in the global markets seems to be causing jitters, especially across the AI and semiconductor spaces. We've seen Taiwan stocks bleeding quite badly, and Japanese stocks also took a hit over the last few days.

Today, the Nifty was down 0.34%. However, the real worry comes from the broader market, where we saw a "waterfall-like event," similar to what happened in September.

The Nifty Junior saw a massive fall of 1.24%, which is certainly triggering a shorting wave in Nifty Next 50 stocks.

Mid caps were also bleeding, down 0.96%, and small caps were hit even harder, down 1.49%.

The Bank Nifty is slightly better, down only 0.47%, but it doesn't look extremely good either.

This cautious market sentiment is confirmed and corroborated by the movement in Gold, which is starting to look better after correcting and consolidating over the last 15 sessions. Gold is up 0.91%, hitting a value of 12,113 today.

Silver is also up 1.4%, with its chart showing good support at a key trend line.

Other Market Triggers

Heavyweights like Grasim and Hindalco lost 5% and 6%, respectively, while others like L&T, NTPC, BEL, Eicher Motors, Titan, JSW Steel, and Tata Steel also moved down.

ICICI Bank and Bajaj Finance lost about 1.5%. The Nifty Next 50 was awash in red, with sharp cuts in Chola Finance, PFC, PNB REC, Havells, Jindal Steel, Indian Hotels, Zydus Life, and HAL Hyundai.

Only a handful of stocks, like Reliance among the big heavyweights, and some gains in TCS, Wipro, and Asian Paints, managed to stay in the green.

The breadth of the selling is very broad-based, and such widespread sell-offs typically take time to cool down, consolidate, and then turn around—they rarely reverse in a single day.

The top mover of the day was Redington, which jumped 15.8% after reporting a record quarter.

U.S. Market Update

In the previous session, US markets were sticky but not dramatically bad. The S&P 500, Dow Jones, and NASDAQ were down 0.37%, 0.5%, and 0.6%, respectively, while the Russell 2000 actually did well, gaining 1.54%.

Over the last month, the Russell is down 0.9%, but the NASDAQ is up 2.43%, suggesting things haven't gone too badly there yet, despite all the discussions about a fall in semiconductor and AI stocks.

Leading the rally in the US were Amgen (7.8%), Starbucks (4%), Tesla (4%), Qualcomm, and Caterpillar (both around 3.9%). A disclosure: the Weekend Investing US portfolio may hold some of these stocks.

What to watch next ?

The chart for the Nifty is not looking very promising. As soon as it broke down below a key pivot point, it indicated that the previous upward leg is certainly over, and now we must find a new bottom where we can consolidate before any potential upward move.

This cautious market sentiment is confirmed and corroborated by the movement in Gold, which is starting to look better after correcting and consolidating over the last 15 sessions.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

📰 China-US Trade Dynamics: A Geopolitical Shift in Exports

📈 China's Export Dependency: Less than Perceived

Source: BofA Global Research, Ritesh jain on X

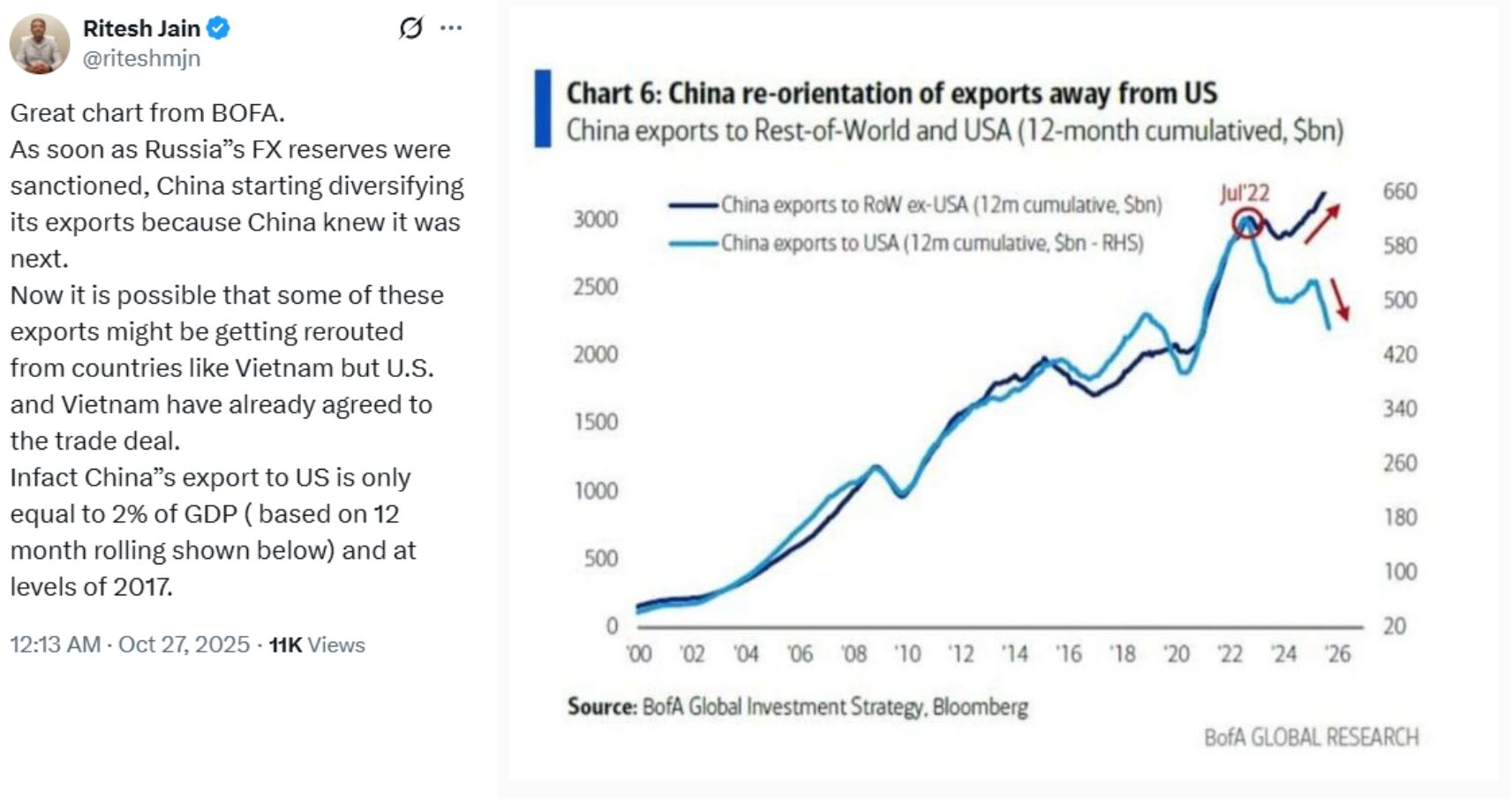

The central argument, drawn from the Bank of America Global Research chart, is a re-evaluation of China's economic dependence on the United States.

US Exports (Light Blue Line): China's exports to the US are approximately $400-$500 billion. This value is indexed on the right-hand axis.

Rest of the World Exports (Dark Blue Line): China's exports to the rest of the world (excluding the US) are roughly $3,000 billion ($3 trillion), indexed on the left-hand axis.

The Proportional Difference: US exports constitute only about 15% of China's exports to the Rest of the World (400-500B vs. 3000B).

Conclusion: The data suggests that the prevailing narrative exaggerating China's critical dependence on the US market may be an overstatement.

🔄 The Geopolitical Re-routing of Trade

A significant shift in export strategy is highlighted, linking trade flows directly to global geopolitical events.

Pre-2022 Trend: For about 25 years, China's exports to both the US and the Rest of the World grew in tandem, showing a consistent policy.

The Turning Point (July 2022): Following the US freezing Russian assets in 2022, a distinct change in the trend is observed.

Strategic Redirection: China began actively reducing its exports to the US (the blue line dropped) and simultaneously increasing its exports to the Rest of the World (the dark blue line rose).

Net Impact: Despite the reduction in US exports, the corresponding increase in exports to other countries meant that there was no significant net negative impact on China's overall export volume. The scale difference on the chart might make the US decline look smaller than the RoW increase, but in absolute terms, the shift effectively neutralized the trade loss.

🛡️ Minimal GDP Exposure and Re-routing

The analysis breaks down the actual risk to China's economy from a potential complete cessation of trade with the US.

GDP Impact: China's total exports to the US currently account for only about 2% of its GDP. This suggests that even a severe disruption would have a manageable impact on the overall economy, which China could likely "absorb."

Comparison to India: The transcript notes that India's US exports also lie in the 1-2% of GDP range, indicating that other large economies share a similar level of "bearable" exposure.

De-risking through Re-routing: It is speculated that China is further mitigating risk by re-routing products through intermediary countries like Vietnam and the UAE. These goods are potentially shipped to these nations and then re-exported to the US, masking the true origin and circumventing tariffs or restrictions.

Key Learning

The dominant global perception of China's economic dependence on the US is fundamentally overstated when viewed against its total global trade and GDP exposure. Geopolitical risks can be, and are being, mitigated by large economies through strategic trade re-direction to the Rest of the World markets and through "re-routing" tactics.

Meme Of The Day

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply