- WeekendInvesting

- Posts

- Finally 100% Tariff on Pharma Companies ?

Finally 100% Tariff on Pharma Companies ?

The Golden Stagflation Warning

Friday, 26 Sep 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

Another day begins, and once again a big shock comes from Mr. Trump’s tweet. He has announced that the US will put a 100% tariff on all non-generic pharma imports. Only those companies that are currently building plants in the US will be spared. Any other pharma product that enters the country will face these tariffs starting next week.

Back home, the Indian markets are in a tizzy. Our ministers have been in Washington D.C. for the past four days and keep releasing press reports saying discussions are going well. But the tone of those press notes shows that India is probably on the weaker side of the negotiations.

Looking at the charts, the Nifty lost nearly 1% today, erasing almost all the gains made at the end of August.

The Nifty Junior fell sharply from 70,400 to 67,001 in just four days, a 4.68% fall. Midcaps dropped 1.94% and Small caps 2.14%.

Banks too lost 1.07%. The damage has been broad-based.

Gold, on the other hand, is sitting near all-time highs at ₹11,341 per gram, adding another 0.07% today. It refuses to fall despite every correction.

Other Market Triggers

Pharma stocks like Sun Pharma, Cipla, Zydus, and Dr. Reddy’s were down.

IT stocks were hit even harder, while auto and steel also fell.

Even recent gainers like Asian Paints, Wipro, Bajaj Finance, and Trent slipped.

Only a few names like ITC, Reliance, Tata Motors, and Eicher Motors held some ground.

Vodafone Idea was in focus as the Supreme Court once again deferred its verdict to October 6th. The stock had risen from ₹6.20 to almost ₹9 on hopes that its dues to the government might be converted into equity, but today it fell 7.6% after the delay.

What to watch next ?

Most Indian pharma exports are generic in nature, but some companies will still get impacted. The pharma industry usually begins with generics and then moves to more advanced products and licenses.

That entire value addition process can suffer badly unless Indian companies have manufacturing units in the US. Trump is pushing what can be called an “Atmanirbhar” strategy for America, asking factories to be set up in the US and jobs to be given to Americans.

While the intent may be fair, the way it is being done by upsetting friends and allies is creating big trade tensions.

The uncertainty is killing sentiment, and stocks have been falling sharply. This week has turned into a total washout.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

From 15th of Aug 2025, we have started sharing all our strategy updates, rebalances, and important announcements on our official WhatsApp Channel

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

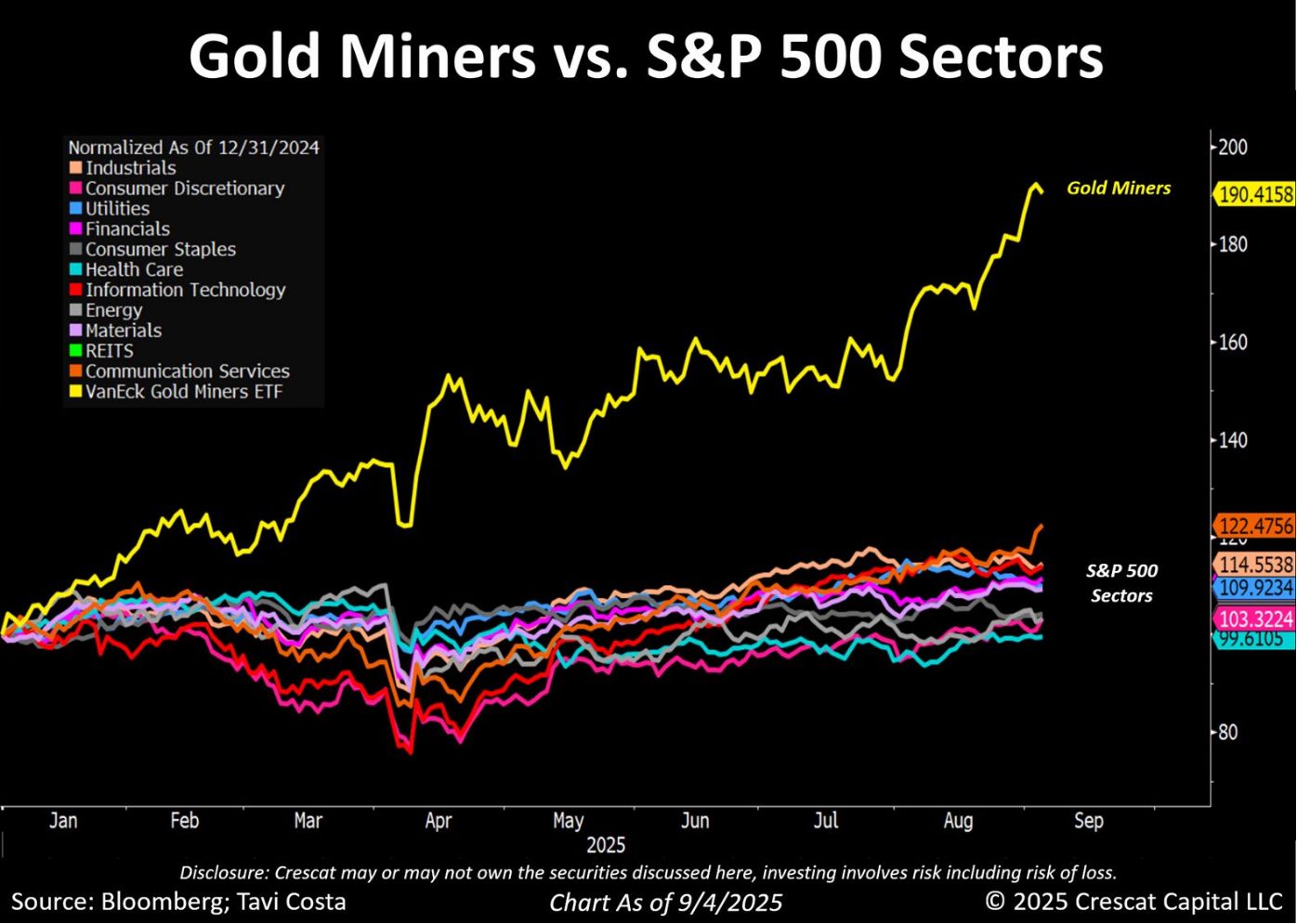

The Golden Stagflation Warning: Why Gold Miners' 90% Surge Signals Trouble for the S&P 500

The Great Divergence: Gold Miners Outpace the Market

Year-to-date market data reveals a striking divergence: Gold Miners have surged approximately 90%, dramatically separating themselves from traditional S&P 500 sectors.

Source : Tavi Costa on X

In contrast, the performance of broad sectors—including Industrials, Consumer Discretionary, Financials, Healthcare, and Energy—has largely fallen into a range of minus 1% to plus 22%.

This massive outperformance in a non-traditional sector points to a clear dislocation. When the usual growth engines stall, and a defensive, inflation-hedging play like gold (and its leveraged derivative, gold miners) takes the lead, it signals underlying systemic issues.

Decoding Classic Stagflationary Behavior

As noted by market strategists like Tavi Costa, this market behavior is a classic example of stagflationary dynamics. Stagflation is defined by an economy experiencing:

High Inflation: Prices continue to rise significantly.

Little to No Growth (Stagnation): Economic output is flat or declining.

The current run-up in gold miners suggests that the market is acutely recognizing that this combination is plaguing US markets. Furthermore, expectations of continued interest rate cuts—with a quarter basis point already realized and potentially a half percent more to come this year—are likely to extend and accelerate this phenomenon.

The "Melt Up" Prophecy and Historical Context

The move in gold miners is particularly significant because of its timing. Historically, gold miners tend to lag the initial rally in physical gold, only starting their ascent after gold itself has moved up for a long period. A sharp, powerful move by the miners, such as the current one, often precedes a final, dramatic market phase—a "melt up" of some kind.

The last major cycle where this signal was distinctly observed was during the 2008-2011 period. This recurring pattern serves as a powerful warning sign that the broader market is struggling to find organic, sustainable growth, pushing capital toward hard assets and inflation hedges.

Strategic Asset Allocation: Direct Gold is Key

While the performance of gold miners validates the need for asset allocation shifts, investors must carefully consider the inherent risks. We specifically advise caution regarding gold miners for the following reasons:

Pointers for Gold Exposure:

The Counterparty Trap: Gold mining stocks introduce both counterparty risk and typical equity risk. The value of the stock is not a direct reflection of the gold in the ground.

The Derivative Problem: Gold miners are a derivative of gold. A company may be sitting on a resource that, for regulatory, logistical, or economic reasons, may never be effectively mined. This is similar to a holding company where significant assets are known to never be divested.

If you want exposure to the economic conditions driving gold's performance, the superior path is to play the metal directly, avoiding the corporate and operational risks associated with mining companies.

Meme Of The Day

Given the market's current signal of weakness in traditional growth sectors, Which defensive action is most appropriate for your portfolio right now? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply