- WeekendInvesting

- Posts

- Global Gold Reserves Update You Should Know

Global Gold Reserves Update You Should Know

A Central Bank Trend Spotlight!

Friday, 7 Nov 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

It was a good end to the week for the markets, following a recent period of losses. The market opened with a significant gap down. However, surprisingly, strong buying activity was initiated, which helped to recover a substantial portion of the day's losses.

The Reserve Bank of India (RBI) also made a significant announcement, calling out strong capital inflows for the coming times and assuring the market of the strength of the currency, which itself moved up slightly.

The Nifty closed at a minor loss of -0.07%. After hitting a low of 25,318, it closed about 170 points higher from that bottom, ultimately losing only 17 points from the previous session's close.

The Nifty Junior made a truly remarkable comeback, recouping almost a thousand points that were lost in the morning, closing with a loss of only 17 points.

Mid-caps also staged a strong recovery, actually gaining beyond yesterday's close at 0.47% up. Small-caps ended the day with a small loss of 0.24% but still recovered significantly, gaining almost 200 points after touching a bottom of 16,825.

The Nifty Bank made a good move, closing 0.56% up for the day.

Gold is stabilizing at the current rate of 12,103 per gram, up 0.74% for the day.

Silver was up nicely by 1.9%, trading near 1,48,000 per kg.

Other Market Triggers

The Heat Map showed strong performance from stocks like ICICI Bank, Bajaj Finance, Bajaj Finserv, HDFC Life, Sriram Finance, Mahindra and Mahindra, Tata Steel, and Naukri.

Conversely, stocks that lost some ground included ITC, Bharti Airtel, Reliance, TCS, HCL Tech, Hindustan Unilever, and State Bank of India.

The Nifty Next space saw Divi's Lab, ABB, LTIM, Indian Hotels, Godrej CP, Adani Power, and Bajaj Holding lose ground.

However, LIC, PNB, Mazdoc, Britannia, Jindal Steel, Hindzinc, Vedanta, Torrent Pharma, Pidilite, and Solar Industries made notable gains in the mover of the day segment.

BSE was a standout performer, moving up 9% in a single session. This move coincided with a possible inverse head and shoulders pattern, which could imply a target of up to 500 points above the neckline, potentially taking BSE up to 3,000 in this rally.

U.S. Market Update

The U.S. markets session the previous day was negative, with the S&P 500 down 1%, the Dow Jones down nearly 0.8%, and the NASDAQ and Russell both down nearly 2%.

Stocks like AMD (lost 7.2%), Palantir (lost almost 6.8%), Salesforce (down 5%), Nvidia (down 3.6%), and Qualcomm (down 3.6%) were among the biggest losers in the S&P 500 space.

What to watch next ?

While this cannot yet be called a full trend reversal in Nifty, it certainly suggests there is some buying support at the current levels. The stability of this support will be tested in the coming week, as there are many corporate results scheduled that are likely to influence market behavior.

Currently, there are no major new developments in US-India relations or the US-China deal. When those developments do occur, they may lead to a market reset.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

We are now live on our official WhatsApp Channel. We have been sharing all our strategy updates, rebalances, and important announcements here. Please watch this video to know more & join in at the earliest possible.

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy Updates & Rebalances

• Exclusive Announcements & Offers

• Important Reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

📰 Global Gold Reserves: A Central Bank Trend Spotlight!

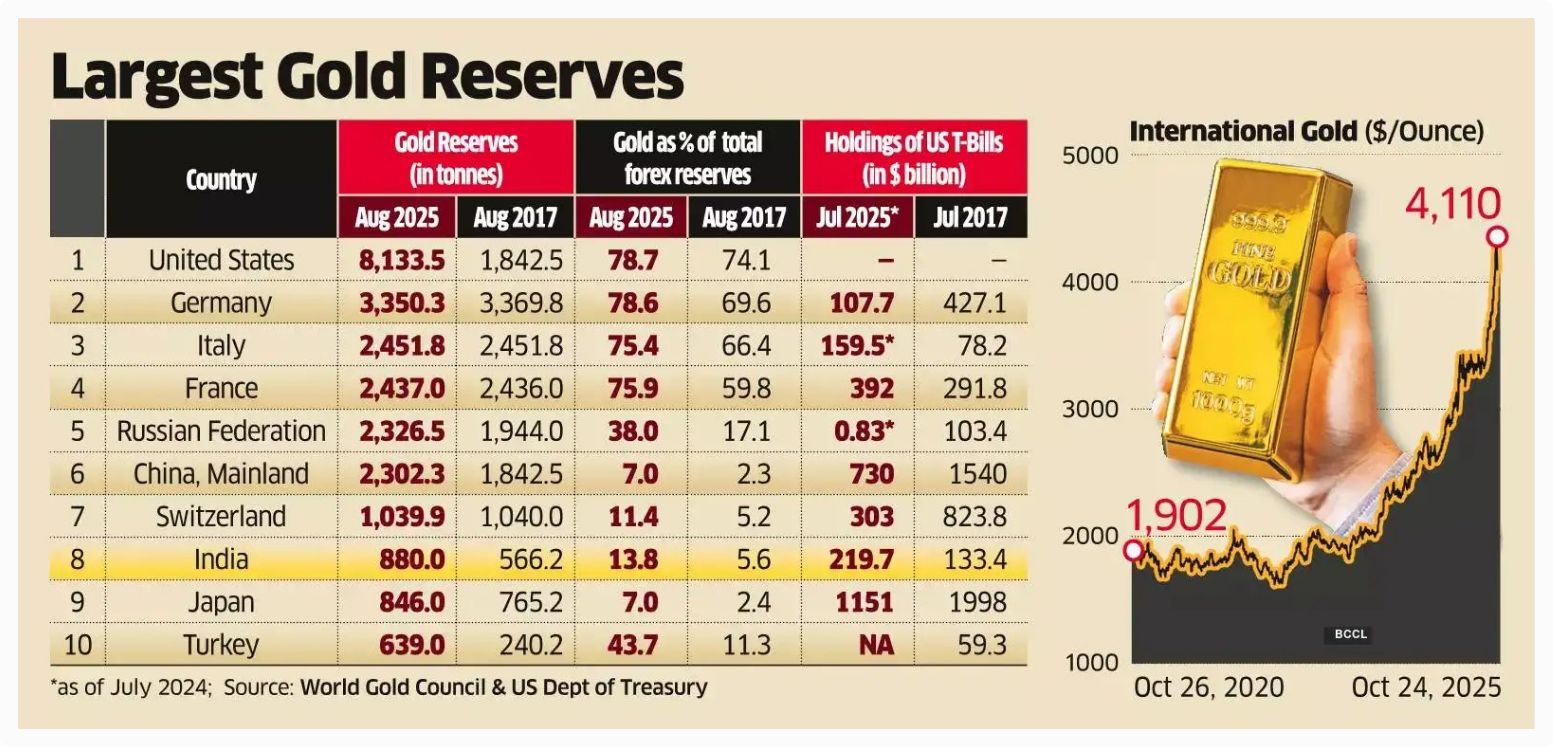

We recently came across an insightful table in a major newspaper detailing the largest gold reserves worldwide. This data offers a fascinating look at which nations are holding how much gold and, perhaps more importantly, the growing trend among central banks to bolster their holdings.

🥇 Top 10 Countries by Gold Reserves (in Metric Tons)

The sheer volume of gold held by nations underscores its role as a key reserve asset. The United States leads by a significant margin.

Source : ET

📌 Note on China: While officially reporting 2,300 tons, many experts estimate China's actual gold holdings could be significantly higher—perhaps 10,000 to 12,000 tons.

📈 Gold as a Percentage of Forex Reserves

This metric is arguably more telling than the absolute amount, as it shows how much a country relies on gold within its overall foreign exchange portfolio.

USA: Holds the highest proportion at 78.7%. As the dollar is the global reserve currency, the US has less need to hold other currencies.

The European Bloc (Germany, Italy, France): These countries show a remarkably high and similar percentage, generally in the 70-75% range. This suggests a coordinated regional preference for gold as a reserve asset.

Russia: Stands at a robust 38%.

Emerging Economies (India & China):

India is at approximately 14%.

China remains relatively low at 7%, which aligns with the speculation that their reported tonnage might be understated.

Turkey: Boasts a strong 44% share.

🚀 The Massive Shift: Increased Gold & Reduced US Treasuries

The most significant takeaway is the clear global trend of Central Banks increasing their gold percentage while simultaneously reducing their holdings of US Treasury Bills (USTBs).

Focus on Gold's Growth (Percentage of Forex Reserves):

The appetite for gold is evident in the historical data, showing a sharp rise across the board:

India: Rose from 5.6% (2017) to approximately 14%.

Turkey: Jumped from 11% to 44%.

Japan: Increased from 2.4% to 7%.

China: Grew from 2% to 7%.

European Countries: Moved from the 60-70% range to the 75-80% range.

Focus on the Drop in US Treasury Bills (in Billions of USD):

As gold holdings rise, the presence of USTBs in central bank reserves is rapidly declining:

Germany: Reduced from $427 Billion to $107 Billion.

Russia: Has virtually eliminated its USTB holdings, stating a desire not to hold US dollars.

China: Has halved its holdings.

Japan: Has also halved its holdings.

India and Italy are among the few countries that have increased their USTB holdings in recent times, though the overall trend is down.

Key Learning:

The global financial system is undergoing a quiet, but significant, de-dollarization trend driven by central bank policy. Central banks worldwide are deliberately diversifying their foreign exchange reserves away from the US Dollar and into gold, viewing it as a safer, more neutral asset.

Meme Of The Day

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply