- WeekendInvesting

- Posts

- Gold Headed to $4000 ?

Gold Headed to $4000 ?

Navigating the iPhone Price Index

Monday, 29 Sep 2025

Forwarded this email? Subscribe Now

Good evening, WeekendInvestor

Today’s Market Update

The week started well with markets rushing up, and at one point Nifty was more than 100 points higher. But the second half of the day wiped out all gains. Nifty came down and ended flat. While some parts of the market saw small gains, overall there is lethargy and listlessness in the market.

Gold, on the other hand, is on fire. Both gold and silver are racing. Gold has crossed ₹1,15,000 for 10 grams, and in dollar terms, it has already hit $3,815. At the start of this year, on 1st January 2025, gold was $2,600. In less than ten months, it has jumped more than 50%. Such a sharp rise is unprecedented.

Maybe once in the 1970s we saw a similar year where gold gained over 50%. Gold is often a signal of stress in the world, and right now, it is telling us things are not in good shape. We can’t ignore it.

Nifty almost touched 24,800 before slipping back to 24,600. That makes it eight straight red candles now. The market is oversold and lifeless, with Nifty down 0.08% for the day.

Nifty Jr. gained 1.03% while mid-caps were up 0.25% and small caps slipped 0.1%.

Nifty Bank stayed flat with just 0.13% gain after a volatile day.

Gold again stood out, jumping 17% in just one month. From ₹9,800 per gram, it has shot up to ₹11,513 per gram. This is something investors cannot ignore.

Other Market Triggers

State Bank of India, Bajaj Finance, Bajaj Finserv, Wipro, Titan, ITC, NTPC, and Trent performed well.

On the other side, Maruti, Axis Bank, Jio Finance, Eicher Motors, Hindustan Motors, L&T, Bharti Airtel, JSW Steel, and ICICI Bank lost some ground.

In Nifty Next 50, more stocks were green, with Indigo, BPCL, IOC, Shree Cement, LIC, Bank of Baroda, PNB, Canara Bank, PFC, and IRFC doing well.

Only a few like Pidilite, Swiggy, Adani stocks, Dabur, and Bajaj Holdings were weak.

The big mover of the day was Wockhardt Pharma. After falling 9% on news of US tariffs on pharma, it surged 17% when it was clarified that India would not be impacted.

U.S. Market Update

On 26th September, the S&P 500 gained 0.6%, Dow Jones 0.67%, Nasdaq 0.44%, and Russell 0.97%. Over the last month, Nasdaq rose 4.79%, and in the last year, it has soared 24%. The S&P 500 has also done well with 15.57% gains.

US markets remain dynamic, and diversification there is worth considering.

Stocks like Intel jumped after the US government took a stake, rising 4.4%. Tesla gained 4%, Boeing 3.6%, Accenture 2.7%, and Danaher 2%.

What to watch next ?

Some say gold may not sustain, but nobody knows where it stops. It could go much higher, even to $10,000 before topping. This is a reminder to take note of what is happening.

Get your Portfolio Momentum Report today and ensure your investments are positioned for success!

Important Announcement

From 15th of Aug 2025, we have started sharing all our strategy updates, rebalances, and important announcements on our official WhatsApp Channel

Why this change?

Because it’s simpler, faster, and right where you already are — WhatsApp makes staying updated effortless.

Stay updated with:

• Strategy updates & rebalances

• Exclusive announcements & offers

• Important reminders – all in one place

Here’s an instruction manual if you are new to Whatsapp Channels

Top Trending Strategies

Mi EverGreenPower of Gold with Equity | Allocate 20 strongest CNX200 stocks with Gold ETF | Monthly Rebalanced Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

| Mi AllCap GOLDA core strategy to allocate 25% each to Large Cap , Mid Caps, Small Caps & Gold Mi AllCap GOLD is a robust, rule-based core rotational strategy from the House of WeekendInvesting, curated to cover stocks in the CNX500 universe, designed to offer a balanced asset allocation and diversified wealth creation approach for compounding returns over long periods of time.

|

What To Read This Week ?

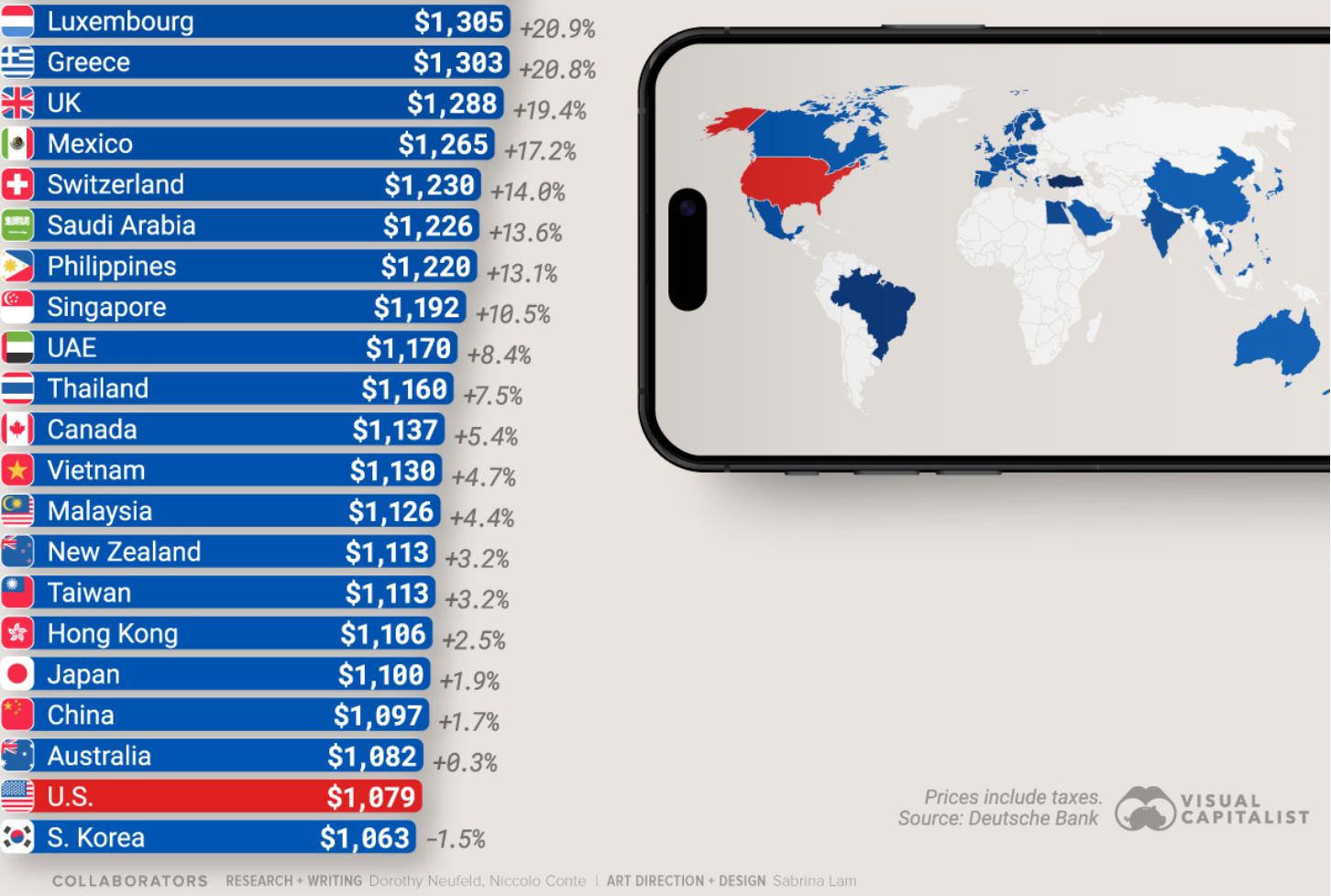

The Global Cost of Connectivity: Navigating the iPhone Price Index

The Visual Capitalist iPhone Price Index offers a striking illustration of global price disparities for a single consumer electronic product. The data reveals that consumers outside the US consistently pay a significant premium for the iPhone, a phenomenon that highlights the intricate relationship between international trade, corporate pricing strategy, and national fiscal policies.

The Premium Landscape

The infographic clearly demonstrates a global pricing bracket for the iPhone, with most countries, including both developed economies (like those in Europe) and developing nations (like India), showing a premium of 20% to nearly 30% relative to the US price.

India: A notable example, with an iPhone priced at $1,401, reflecting a 29.8% premium. This price difference is often a combination of import duties, local taxes (like GST), and currency fluctuation.

Lower Premium Countries (Czech, Germany, Austria, Spain): These European nations show the lowest premiums, typically in the 20-25% range, suggesting a more harmonized market, though still significantly higher than the US price.

This broad, non-US premium suggests that a substantial portion of the price hike is a structural cost that American companies pass on to global consumers, effectively acting as an "American-derived tariff" on foreign markets, regardless of where the device is manufactured.

The Extremes: Brazil and Turkey

The data on Brazil and Turkey stands out, showcasing a radical departure from the general premium bracket.

Turkey (102% Premium): The price is more than double the US price, pushing it to around $2,182 (based on external data points), largely driven by high excise taxes on luxury goods and a high VAT.

Brazil (70% Premium): The price hovers around $1,800, also a result of significant import tariffs and multiple layers of national and state taxes designed to protect local manufacturing or extract maximum revenue from foreign goods.

These extreme cases underscore how specific national policies—namely high, punitive luxury or import taxes—can dramatically amplify the cost of consumer electronics, burdening local consumers with over twice the US price.

The Global Tariff Spiral and Inflation

The increasing implementation of protectionist measures, such as new and escalating tariffs on all imported items into the U.S. (ranging from 15% to potentially 100%), suggests a broader trade war where every country is attempting to gain an economic advantage.

This global spiral of tariffs has profound implications for inflation:

US Consumer Impact: The new US tariffs mean that American consumers will finally "bear the brunt" as the cost of imported goods—including components and finished products—rises significantly. Companies will either absorb the costs (reducing margins) or, more likely, pass them on as price increases.

Global Inflation: When the cost of production and international trade rises across the board due to tariffs and duties, it feeds directly into global inflationary pressures. This general increase in the cost of goods and services worldwide could lead to a significant downturn or the "next crisis."

The core takeaway is that protectionism, while intended to protect local industries and extract revenue, is a zero-sum game that ultimately increases costs for consumers everywhere.

Meme Of The Day

The iPhone Price Index shows that Indian consumers pay a 29.8% premium compared to the US price for an iPhone. Where do you believe the majority of this extra cost (the premium) originates? |

Share this daily insightful newsletter with your market savvy friends and family or sign them up for the newsletter !

For detailed blogs, reports and strategies, check WeekendInvesting.com

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

Disclaimer : This newsletter is for informational and educational purposes only and does not constitute financial advice or an advertisement

Reply