- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 01 Mar 2024

Good, Bad & Ugly Weekly Review : 01 Mar 2024

The Good, Bad & Ugly Weekly Review

Edition : 01 Mar 2024

Markets Overview

A fantastic day on 01 Mar 2024 saw Nifty churn out an impressive 1.6% to make a new all time high daily & weekly close. This week started off on a cautious note with markets looking for cues. The news did come in the form of strong GDP numbers propelling the markets to resume the uptrend.

Benchmark Indices & WeekendInvesting Strategies Overview

Thanks to the solid recovery on 01 Mar 2024, markets managed to pull up and post decent numbers for the week. Nifty 50 and Nifty Next 50 closed the week at 0.6% while CNX 200 and CNX 500 stayed flat at 0.2% and 0.3% respectively. Smallcaps and midcaps struggled with relative underperformance.

But on the contrary, it is Smallcap 250 index that leads the FY 24 chart with a solid 71.4% gain followed by midcaps at 62.7% gains. These two indices face a steeper correction compared to larger caps when markets enter weak territories. Nifty Next 50 has impressed everyone with a fantastic 57.4% return in FY 24.

Almost all strategies ended up underperforming their respective benchmarks barring Mi ST ATH which posted gains of 1.2% along with Mi India Top 10 at 1.1%. There was some consolidation in Mi 20, Mi 35, Mi 25 and Mi ATH 2.

Mi 20 continues to lead the FY 24 chart with a staggering 118.6% gains followed by Mi 35 at 102.6%.Mi NNF 10 and Mi MT Allcap are in the nervous 90s with under 1 month to go for the close of FY 24. Overall, it has been an exceptional year for WeekendInvesting with all strategies outperforming their respective benchmarks by a handful margin.

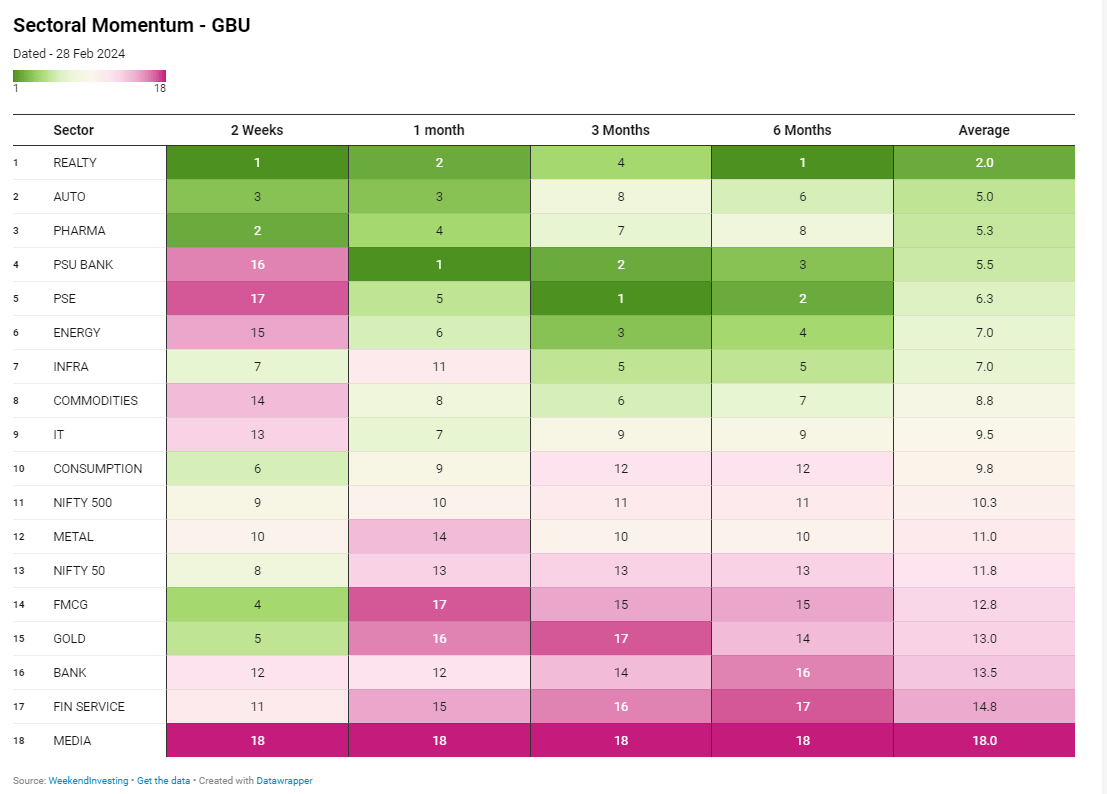

Sectoral Overview

METALS had a ball this week clocking 2% gains while BANKS and AUTOs clocked 1.2% each. REAL ESTATE remained choppy for the week but hold fort for FY 24 with an astounding 136% gains. PSE’s and PSU BANKs have done extremely well to sit pretty at the top of the FY 24 table. PHARMA has been a silent performer with a more than decent 56% gain in FY 24.

PSE, PSE BANKS and ENERGY have dropped dramatically to occupy the last few positions in the last two week momentum ranking owing to some poor performance off late. But, these three sectors still occupy rank 2, 3 & 4 on the 6 month chart respectively. This may have been a small profit booking considering how these sectors bounced on 01 Mar 2024. COMMODITIES and IT has slipped down the rankings a bit on the shorter term. CONSUMPTIONS stocks are also coming up quite well in the shorter term while REAL ESTATE took the throne after being under the pump for a bit.

Rebalance Update for the week !

Spotlight - HNI Capital Compounder

Can a strategy based on a large & mid cap index put up a performance similar to or better than a Smallcap index ?

When we compare the CNX 200 index & Smallcap 250 index between 28 Sep 2021 and 28 Feb 2024, the latter has taken an obvious lead especially post Apr 2023 owing to the extra alpha that the lower cap segments possess during uptrends.

Now, take a look at the same when we add our latest / brand new HNI strategy – HNI Capital Compounder.

To know more, do check out our live session on 02 Mar 2024 at 11 am where we unveil HNI Capital Compounder in a live QnA sessions with you all.

The WeekendInvesting App

The Weekendinvesting App is a one stop solution for everything about Weekendinvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, performance metrics, momentum watchlists, discounts and many other exciting things. This app acts as a medium for us to provide direct support and resolve your queries.

Please write to [email protected] if you have any questions.

Reply