- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 02 Aug 2024

Good, Bad & Ugly Weekly Review : 02 Aug 2024

Markets Nervous at 25k ?

Edition : 02 Aug 2024

Hello, Investor !

Markets Overview

It was an important week where global markets began to unwind. The trigger was the FOMC meeting, where the Fed chairman indicated a likely rate cut in the next meeting in September. Although signs pointed to a possible cut immediately, the market yields, specifically the ten-year yield on US bonds, moved sharply down. Japanese markets also increased their interest rates by a quarter percent. This shift caused a significant impact on the carry trade, where investors borrow at lower costs in Japanese yen and invest in US yields for higher returns. With US yields falling and Japanese yields rising, many hedge funds and investors found themselves caught on both sides.

The unwinding of this trade led to a fast appreciation of the Japanese yen against the US dollar, moving from nearly 160 USD/JPY to about 145. This situation caused huge unwinding in many markets, with tech stocks taking a hard hit due to some earnings misses. Amazon opened 10%-11% lower, Intel opened 28% lower, and many other stocks experienced significant declines. The Japanese market lost close to 8%-9% in two sessions, and a 5% cut was expected on Monday. This could make Monday unnerving for the Indian market, presenting either an opportunity to accumulate stocks or the start of a longer correction.

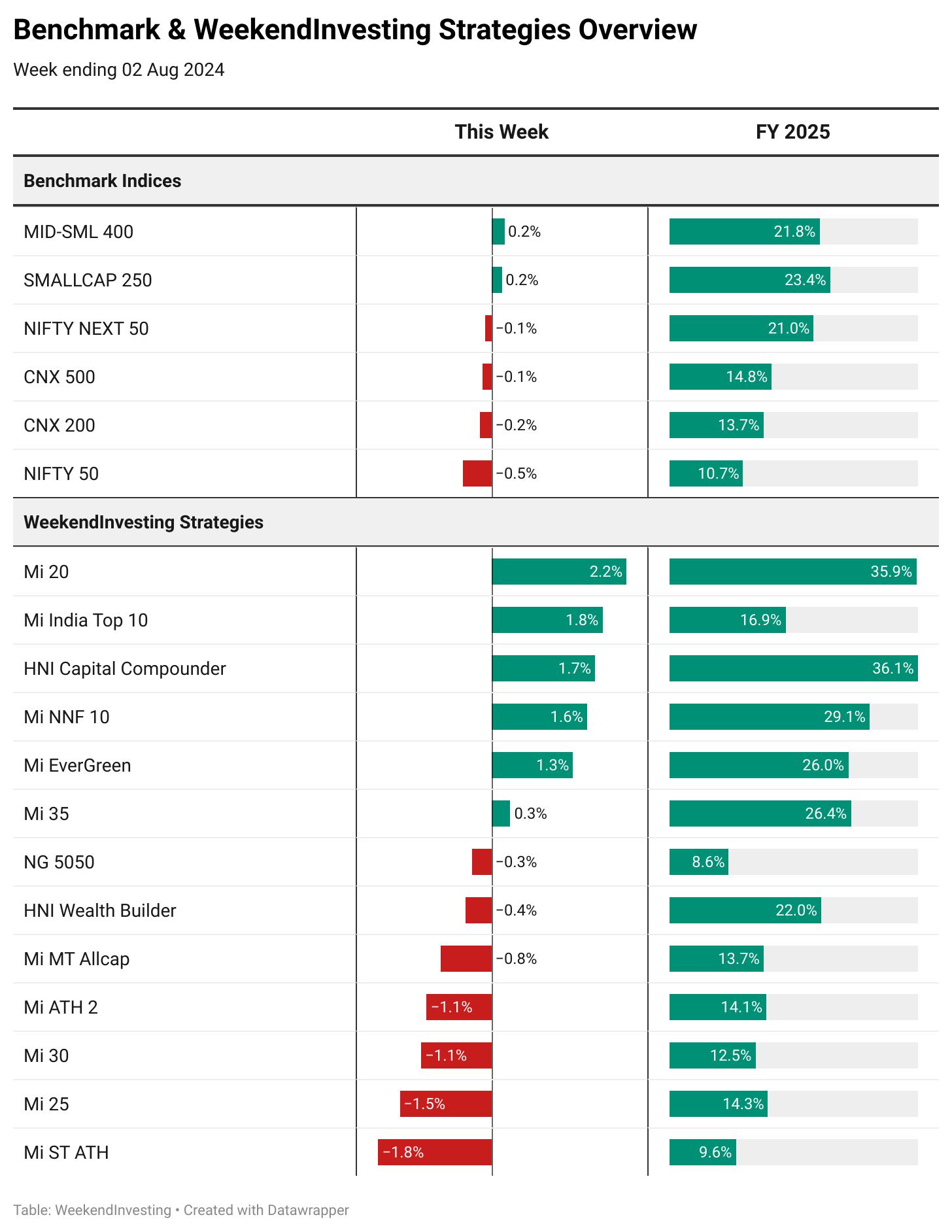

Benchmark Indices & WeekendInvesting Strategies Overview

This week, four sessions saw mild gains, but on Friday, the market lost all the ground, closing the Nifty in the red for the week. However, the decline was minor and not alarming, indicating a continuation of the current trend. Nifty closed 0.5% lower, CNX 200 was down 0.2%, and CNX 500 was down 0.1%, reflecting a very slow and steady market.

Despite the overall sluggishness, some strategies were more volatile. Mi 20 gained 2.2% this week, Mi 35 was muted at 0.3%, and Mi India Top 10 gained 1.8% while Nifty lost 0.5%. For FY25, Nifty is up 10.7%, but Mi India Top 10 is up 16.9%. HNI Capital Compounder did exceptionally well, up 1.7% for the week and 36% for FY25, significantly outperforming the CNX 200, which is up 13% for FY25. Mi NNF 10 was up 1.6% for the week, while Nifty Next 50 was down 0.1%, with Mi NNF 10 up 29% for FY25 versus 21% on the index. Mi Evergreen also performed well, up 1.3% for the week and 26% versus 13% on CNX 200 for FY25. However, some strategies lagged: HNI Wealth Builder lost 0.4%, Mi MT Allcap was down 0.8%, Mi ATH 2 down 1.1%, Mi 30 down 1.1%, Mi 25 down 1.5%, and Mi ST ATH down 1.8%, all losing more than the market and performing in line or slightly lower for FY25.

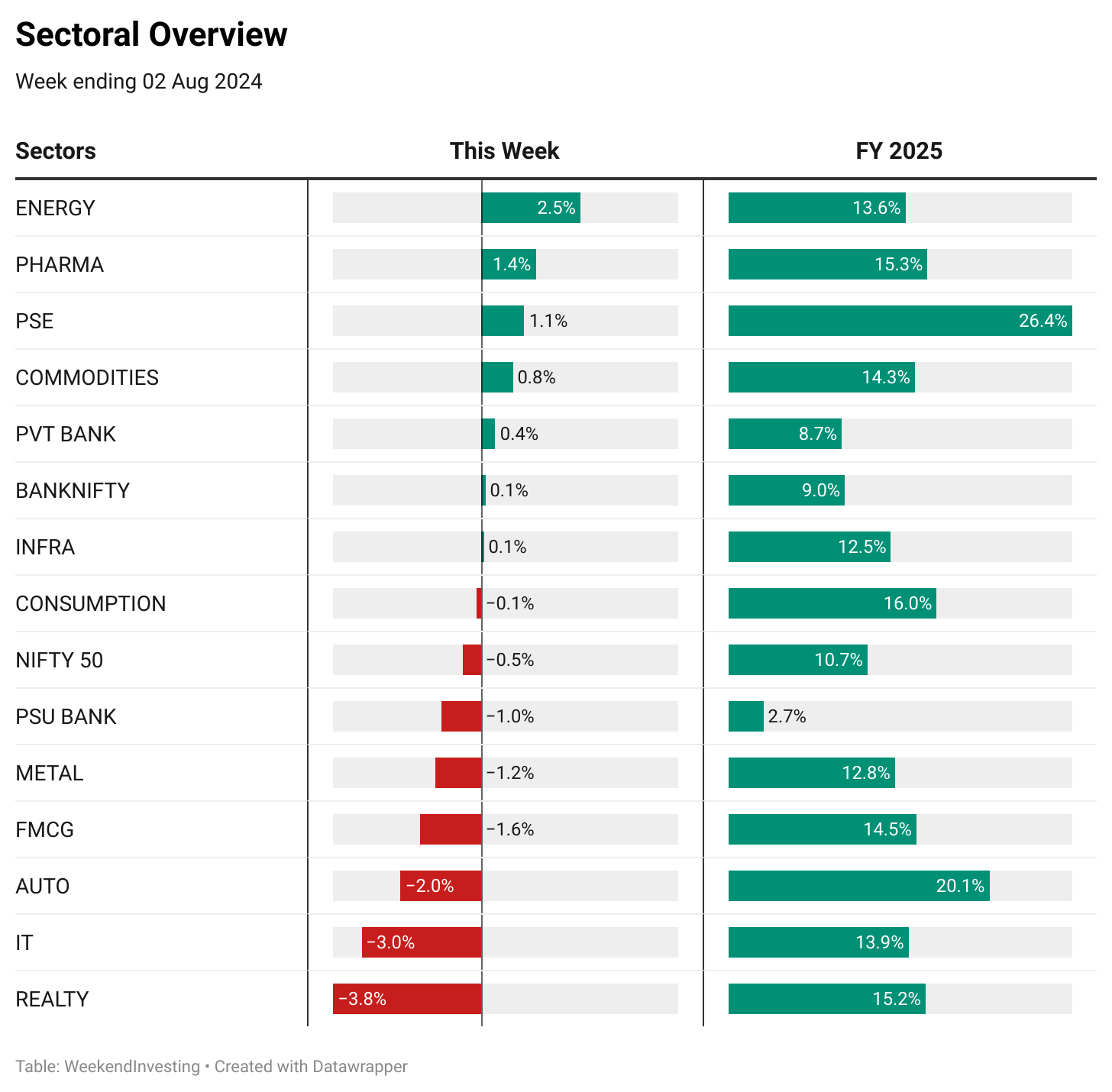

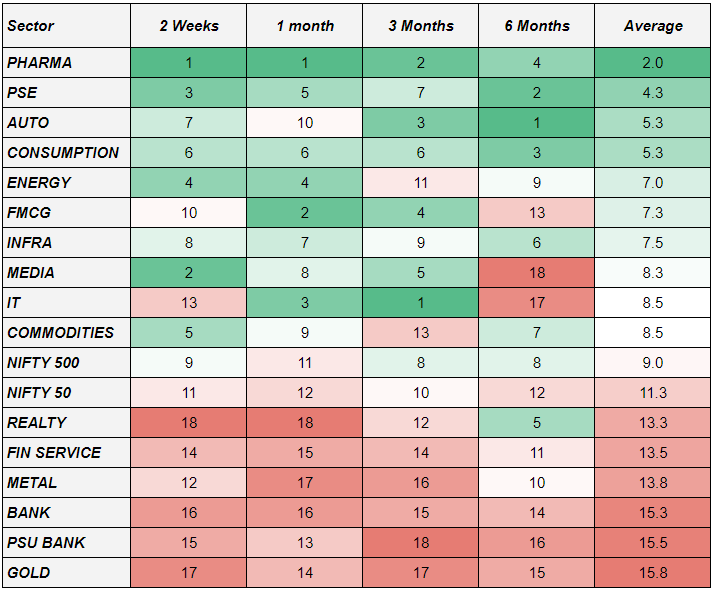

Sectoral Overview

In the sectoral overview, energy stocks did well, up 2.5% this week, and pharma, a defensive play, was up 1.4%. Public sector enterprises lost ground towards the end but still managed a 1.1% gain for the week and a 26.4% gain for FY25. However, real estate, IT stocks, and autos lost ground. Auto's were expecting some hybrid and EV policy, and FMCG was down, signaling a potential economic slowdown. Metals were down 1.2%, and PSU banks were down 1%. While some sectors were up and others down, autos and FMCG showed short-term volatility, with pharma maintaining top momentum across different periods.

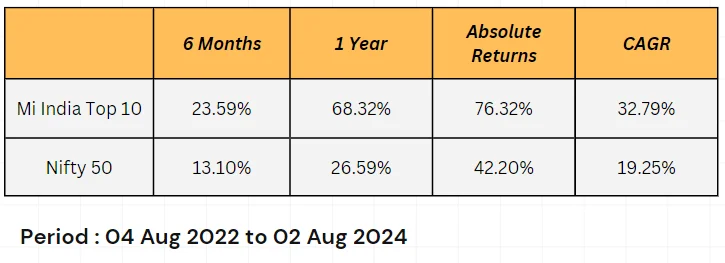

Spotlight - Mi India Top 10

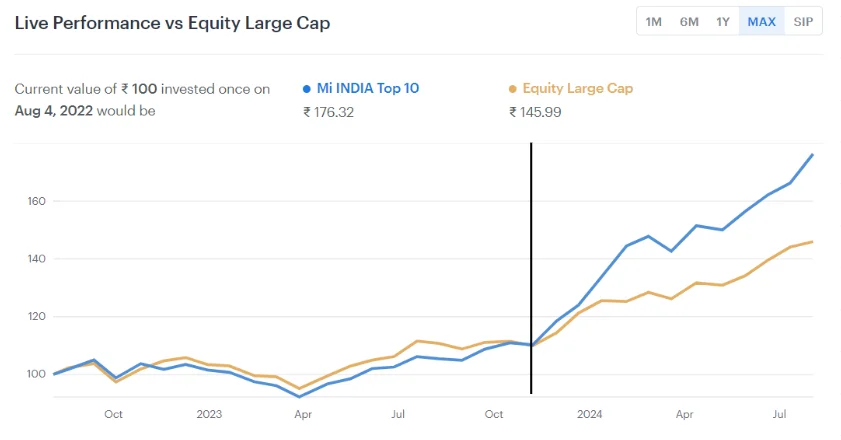

In the Weekend Investing strategy spotlight, Mi India Top 10 celebrated its second anniversary. Launched in August 2022, it had a rough start with a disastrous first six months, underperforming the Nifty. However, in the subsequent year and a half, it rebounded strongly. Over the last year, it is up 68%, compared to Nifty 50’s 26.59%.

The strategy aims to select the ten strongest stocks from the Nifty 50, leading to an absolute return of 76% since its inception, versus Nifty’s 42% in the same period. The CAGR highlights the strategy’s success. Though it experienced a lag initially, the strategy gained momentum after April 2023 and showed significant returns by October-November 2023.

This strategy’s cyclicality means it may not outperform the index every month, but it aims for superior long-term performance. It’s a rotational strategy involving monthly stock selections, typically changing one or two stocks per month. The recommended holding period is three to five years to realize its full impact, making it ideal for new investors looking to start their market journey with a robust strategy focusing on Nifty stocks.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply