- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 02 May 2025

Good, Bad & Ugly Weekly Review : 02 May 2025

Strong Recovery post Panic !

Edition : 02 May 2025

Hello, Investor !

Markets Overview

It was a substantially eventful week, stirred by geopolitical tensions after the attack in Pahalgam. The markets reacted nervously, with a sharp drop on Friday morning, though some of the losses were recovered by the close. Going forward, uncertainty is likely to linger unless there’s some positive news favoring India. Add to that the fact that markets had already rallied nearly 2,000 points in the previous ten sessions—some cooling off was only natural.

On the Nifty daily chart, we witnessed a sharp move down following a period of three-day consolidation, which itself followed a rapid 2,000-point uptrend. Interestingly, the Nifty found support right at the previous high near the 24,000 mark—technically a healthy sign unless that level is broken. If the index manages to break above 24,400, it would likely trigger a further bullish breakout, with the next resistance around 24,800 (the December peak). In broader terms, markets seem to have exited their medium-term downtrend and entered a consolidation phase, although short-term volatility remains on the table.

Nifty – Weekly Chart Perspective

Zooming out to the weekly chart, this marks the third consecutive week of gains. That’s a notable development, especially in a market that’s been sluggish for some time. The breakout from the prior downward sloping trendline adds further strength to the setup.

S&P 500 Overview

The S&P 500 has also joined the party, gaining 4.5% for the week and taking out highs of the previous two weeks. This is a strong global signal and may provide further tailwinds to emerging markets like India.

GOLD Overview

Gold was subdued this week, slipping 0.24% to close at ₹9,654. Given the meteoric rise gold has had over the past 18 months, some cooling off is perfectly healthy. Even a retracement towards ₹8,500 wouldn’t be surprising, as markets often give back a third of their gains before resuming their trend.

Dollar Index Overview

The dollar index is showing signs of trying to bounce back. After slipping below the critical 100 mark to as low as 98, it is now hovering around 99.5. While the U.S. establishment may want a weaker dollar to boost exports, other countries are not eager to let their currencies appreciate. If the dollar weakens further, the Indian rupee may strengthen, though this could face resistance from exporters and policymakers.

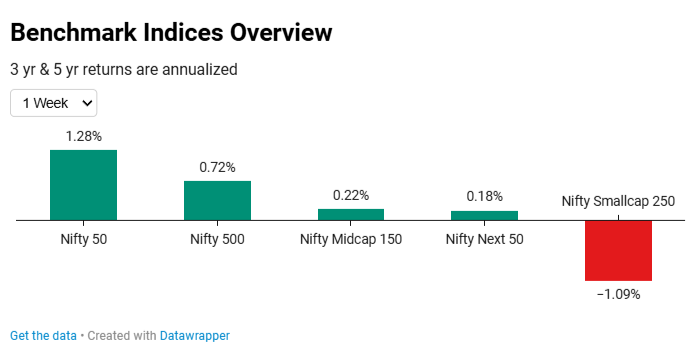

Benchmark Indices Overview

In terms of market breadth, mid-caps led the way this week with a 1.3% gain, while other indices posted more muted moves: Nifty and Nifty 500 were up 0.7%, small caps rose 0.4%, and Nifty Next 50 remained flat.

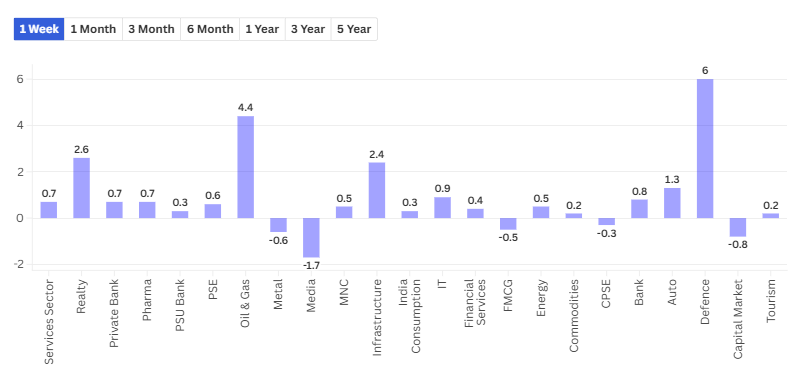

Sectoral Overview

Sectorally, IT was the star performer this week, surging 6.6%, followed by capital markets at 4.8% and autos at 2.9%. On the flip side, media and tourism stocks lost ground—each down around 2.1%, likely impacted by geopolitical developments. Over the past month, capital market stocks have surged 12.9%, with FMCG and banking stocks also gaining strong momentum.

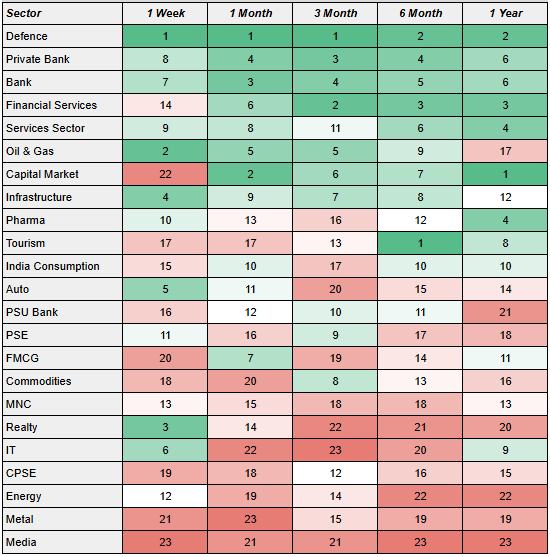

In terms of momentum rankings, banking, defense, and capital markets now lead the sectoral leaderboard. Financial services and private banks have dropped off recently, while tourism and pharma are showing signs of strength in the short term. IT, after months of underperformance, is also making a comeback, as is autos.

Meanwhile, PSU enterprises and infrastructure stocks continue to lag. FMCG and consumption, which had briefly perked up, are once again weakening. The leadership rotation is clearly underway, with capital markets, pharma, autos, and IT showing encouraging signs of momentum.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply