- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 04 Apr 2025

Good, Bad & Ugly Weekly Review : 04 Apr 2025

Bears to take control again ?

Edition : 04 Apr 2025

Hello, Investor !

Markets Overview

What a week it has been for the markets. It was a complete bloodbath not just in India, but more so across global markets. U.S. stocks fell sharply, driven largely by the ongoing tariff war. China has retaliated with counter tariffs, effectively shaking the very foundation of global trade. To give some perspective, the total value of U.S. imports stands at approximately $3.5 trillion. If an average 20% tariff is imposed, the value impacted would be around $650 to $700 billion.

This estimate assumes demand won’t collapse due to the price hikes. In contrast, the stock market has witnessed a staggering $15 trillion in market cap erosion—$11 trillion in the U.S. alone and the rest globally—over a disagreement involving far less monetary value.

This reveals the sheer scale of damage caused by a single political decision. Beyond market losses, there’s now deep-rooted distrust between nations, eroded investor confidence, and a broken global investment sentiment. These long-term damages take years or even decades to rebuild. Even if the trade decisions are rolled back, the road to recovery will be slow and cautious. At this point, the hope is simply that things don’t get significantly worse. That said, futures for Monday were already looking negative, indicating that more volatility could lie ahead.

The Nifty 50 ended the week with a 2.6% fall. This was especially disappointing because the previous two weeks had shown signs of recovery and even hinted at a potential breakout from the downtrend. That hope was short-lived. The broader environment has crumbled, and the index is now again below the 20-day moving average. The trend suggests that we might go further down on Monday, continuing the slide.

Nifty – Weekly Chart Perspective

Looking at the weekly candle chart for Nifty, the previous week had formed a doji candle—typically a sign of market indecision. However, this week’s breakdown confirms it was indeed a turning point, not a pause. Now the question is: where will the next base form? Whether it’s around 22,000 or lower, it’s clear that the market still has some downside left.

S&P 500 Overview

Meanwhile, the S&P 500 fell 9% this week—one of its steepest drops in decades. Only a handful of times has the index seen weekly falls greater than 10%. This kind of decline is massive, and it underscores the severe impact of policy missteps. While the U.S. President justifies these actions as long-term beneficial, the short-term damage is immense. If the present kills the economy, there’s little point waiting for the supposed long-term gain.

The global financial system has become overly reliant on the U.S., and now that imbalance is beginning to show cracks. Over the next few years, it’s likely we’ll see countries and businesses rework their global exposure and risk strategies to reduce this overdependence.

GOLD Overview

Gold too wasn’t spared—it fell 1.56% this week, sliding from nearly ₹92,000 to around ₹88,500. While this is a notable correction, it doesn’t yet signify a complete trend reversal. In fact, it’s quite likely that gold will resume its upward march soon. That’s because confidence in the U.S. dollar and treasuries is weakening. Countries may no longer want to hold additional U.S. reserves. As their trust wanes, the dollars they earn through trade might not return to the U.S. via investments in treasuries or equity markets, but instead go into safer, sanction-proof assets—like gold. This could mark a significant macro shift in how global reserves are managed.

Dollar Index Overview

The dollar index itself is down 1.08% this week, although there was some recovery in the last session. This fall was actually intended by the U.S. government as a way to make the dollar more competitive. But the U.S. cannot enjoy global dominance and a weak currency simultaneously. One of those privileges will have to go. Either the dollar weakens further, or the country’s economic superiority fades. This contradiction cannot persist indefinitely.

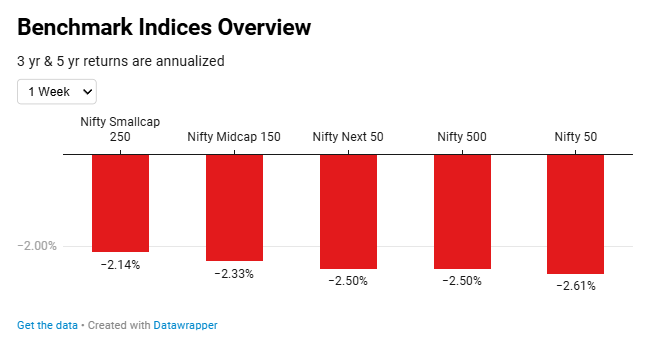

Benchmark Indices Overview

Benchmark indices across the board fell between 2% to 2.5%, showing how this was more of a global macro sell-off rather than anything company- or sector-specific. The pain was widespread.

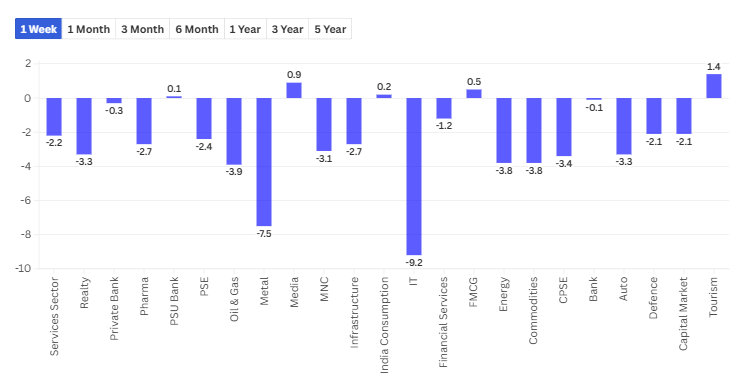

Sectoral Overview

Sectorally, IT stocks were hit the hardest, mirroring the 9% fall in the U.S. markets. Metals too fell by 7.5%, partly due to fears that China may now dump its excess supply into South Asia, including India. On the other hand, FMCG, tourism, consumption-related sectors, media, and banking—particularly PSU banks—were relatively resilient. These sectors did not see much damage, which is a good sign in an otherwise negative week. It’s also worth remembering that Indian exports account for only about 3% of GDP, so even if tariffs hurt export growth, the impact on the overall economy is limited. That context is important when evaluating trade war fears.

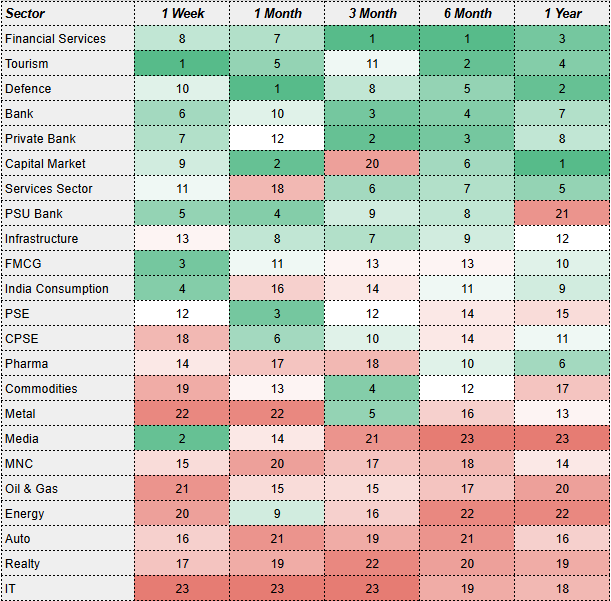

In terms of sectoral momentum rankings, financial services, tourism, defense, and banks—particularly private banks—continue to be among the top performers. Media and FMCG stocks are also showing rapid improvement, while energy and infrastructure sectors are weakening. These momentum shifts offer insights into where investor sentiment is moving. As always, it’s a relative game—some sectors are simply doing less badly than others, and that itself is enough to attract interest in a weak market.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply