- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 04 Oct 2024

Good, Bad & Ugly Weekly Review : 04 Oct 2024

Can Markets Bounce Back ?

Edition : 04 Oct 2024

Hello, Investor !

Markets Overview

It was a dramatic week as the Chinese market skyrocketed in the first part before going on a holiday. Meanwhile, the Indian market dipped, driven by talks of some hot Foreign Institutional Investors (FII) money shifting to China. Over the past few days, we’ve seen approximately ₹30,000 crore or slightly more moving out from FIIs. Interestingly, Domestic Institutional Investors (DIIs) stepped in, matching that outflow with significant investments, which has helped stabilize the market.

There are several reasons behind the market movement. Tensions have been rising in the Middle East, with rockets fired between Israel and Iran this week, which caused crude oil prices to spike. This is always bad news for India, as the country is heavily dependent on oil imports. Moreover, there’s increasing uncertainty around the upcoming U.S. elections, which are just a month away. Although the Federal Reserve has cut rates, it’s unclear what the future holds on that front. On the domestic side, there are no indications that the Reserve Bank of India (RBI) will cut rates, adding another headwind for the Indian market. Despite these challenges, market levels remain relatively strong, even after a 3-5% decline. Given the exceptional performance over the last 18 months, some consolidation isn’t necessarily a bad thing.

Nifty witnessed a significant drop this week. Last week we were celebrating new highs, but this week it has fallen from 26,300 to 25,000. If you look at the market’s trajectory over the past few years, this correction is pretty much in line with expectations. Even if it dips further to 24,000, it wouldn’t be too concerning. The pivotal level to watch is around 21,200, which marked the bottom on election day. If we break below that, it could signal a significant trend reversal. However, this seems far off, and the worst-case scenario right now looks to be around 23,000. The best-case scenario would be a bounce back from 25,000 next week. The reopening of the Chinese markets, which have been running hard, could further fuel an upward trend in China, potentially triggering more FII selling in the Indian market. However, if the Chinese market slows down, our markets may avoid further declines.

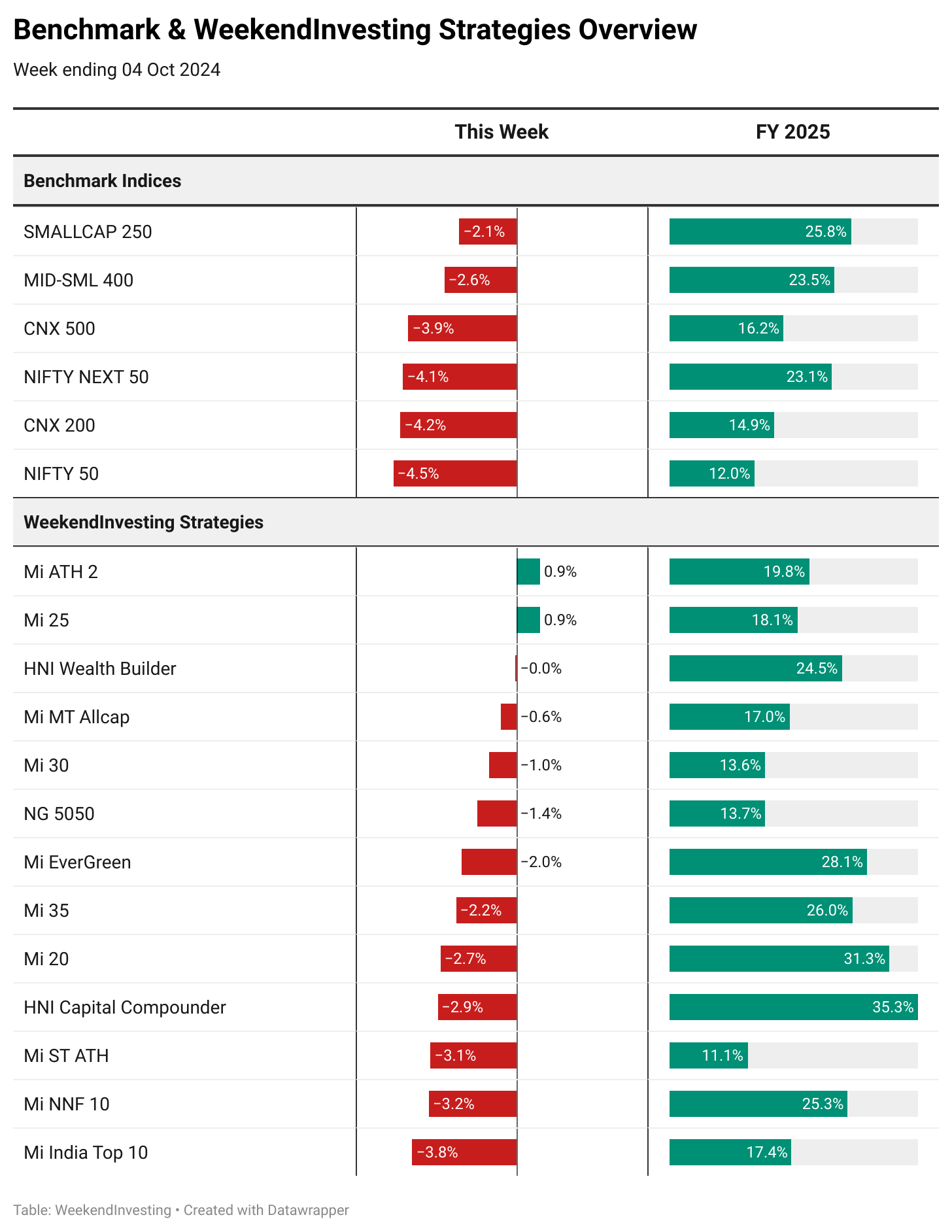

Benchmark Indices & WeekendInvesting Strategies Overview

This week, the Nifty 50 lost 4.5%, CNX 200 dropped 4.2%, Nifty Next 50 lost 4.1%, and CNX 500 was down 3.9%. Mid and small caps were relatively spared, with losses of 2.1% and 2.6%, respectively, as FIIs have limited exposure in this segment of the market.

Surprisingly, Mi ATH 2 and Mi 25 both managed to finish the week in the green, while HNI Wealth Builder had a flat week. Other strategies like Mi MT Allcap and Mi 30 saw small declines of -0.6% and -1%, respectively. Mi EverGreen performed relatively well with a -2% decline. Across the board, most of the WeekendInvesting strategies outperformed their respective indices this week.

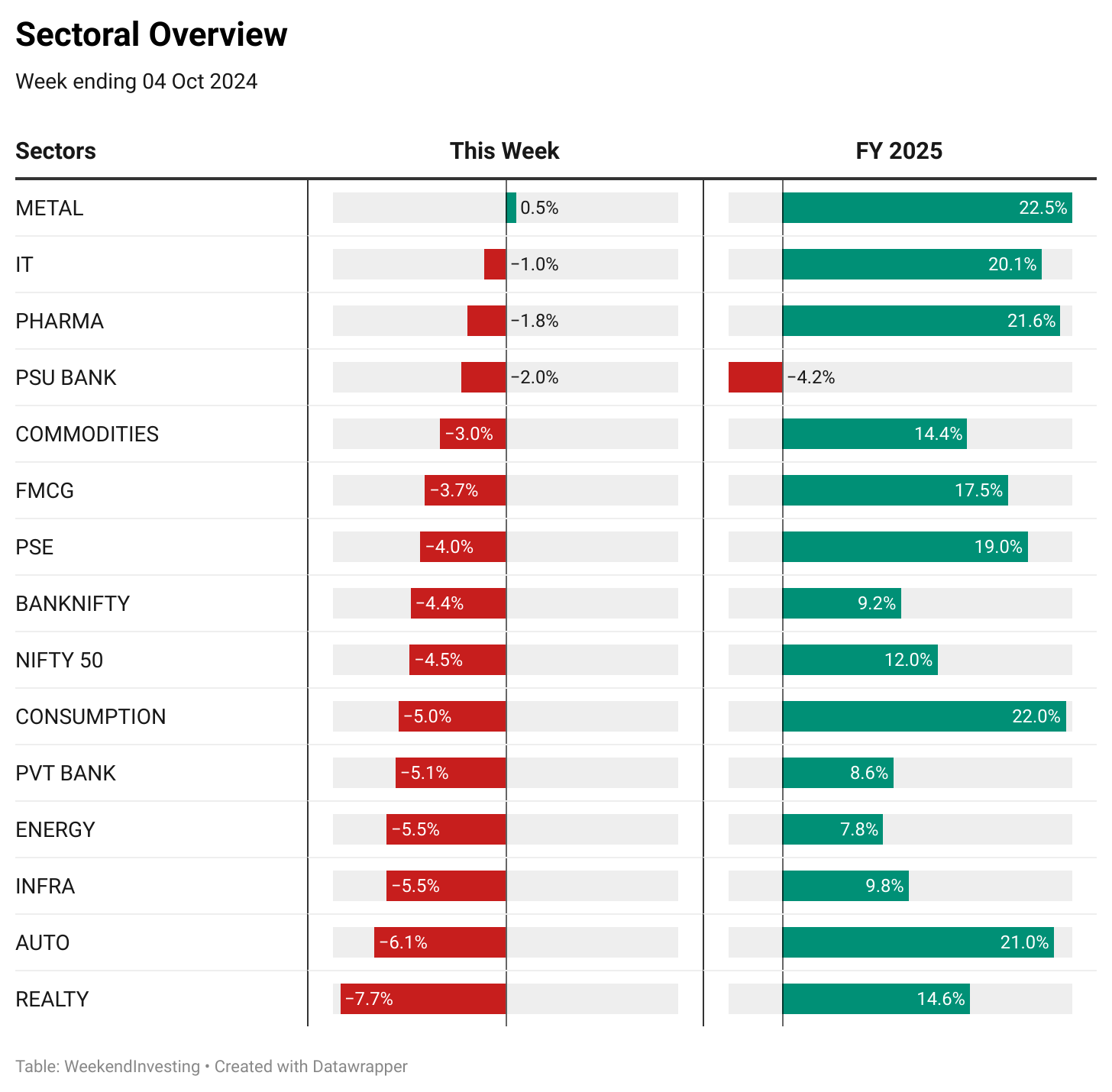

Sectoral Overview

In terms of sectoral performance, real estate took a major hit, losing 7.7% this week. The auto sector fell by 6.1%, energy by 5.5%, infrastructure and private banking by 5.1%, and consumption by 5%. Public sector enterprises were down by 4%, indicating some profit-taking and weak hands exiting the market. On the positive side, sectors like pharma, metals, and IT did well, with gains of 21-22% in just the first six months of the financial year. Despite the corrections, these sectors remain healthy, and there doesn’t seem to be anything fundamentally wrong.

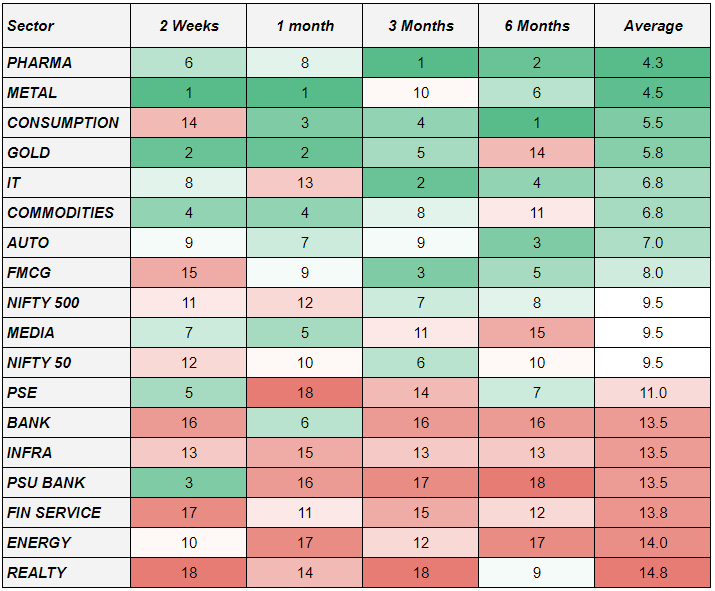

In terms of sectoral momentum, pharma, metals, consumption, and commodities have been leading the pack. FMCG and PSU banks have shown relative strength in recent weeks, and public sector enterprise stocks have stopped their earlier slide. These insights can provide valuable insights into which segments are seeing traction.

Spotlight - MCX in Mi MT Allcap

In this week’s WeekendInvesting strategy spotlight, we highlight a long-term momentum strategy using the stock MCX. For the past ten years, MCX had been a frustrating stock for investors, showing no significant growth. However, in the last year and a half, it has surged nearly 4x. Momentum strategies, which largely ignored the stock during its stagnant phase, have now entered at the right time, capturing impressive gains.

For example, one of our strategies entered MCX last year and is now sitting on a 2.75x gain. The beauty of momentum strategies lies in their pre-decided exit rules, which allow investors to remain calm during volatility. Even if some trades result in small losses, the overall portfolio will benefit from larger gains in winning trades.

The key to successful investing isn’t necessarily about beating benchmark returns but having confidence in your strategy. When you trust that your strategy will deliver decent returns over the long term, you can remain patient through short-term fluctuations. Like driving a car with supreme safety, you can invest with confidence, knowing your portfolio is well-protected.

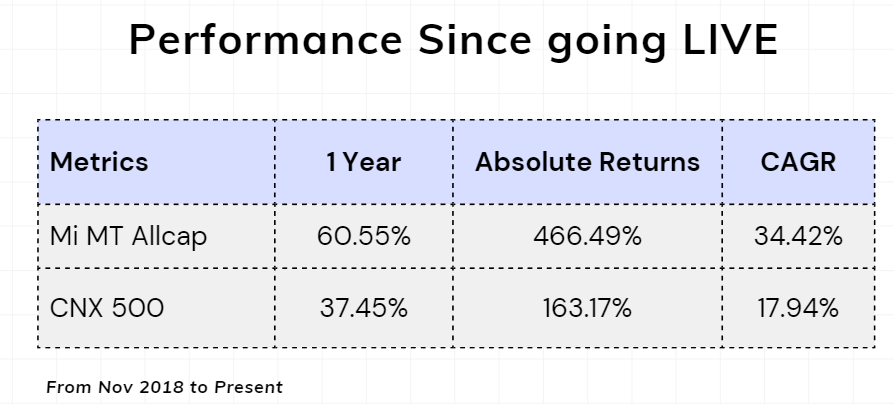

This approach has been exemplified by our Mi MT Allcap strategy, which has delivered 466% absolute returns since November 2018, compared to 163% for the CNX 500. Though there were periods of underperformance, those who stuck with the strategy have been handsomely rewarded.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply