- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 05 Apr 2024

Good, Bad & Ugly Weekly Review : 05 Apr 2024

The Good, Bad & Ugly Weekly Review

Edition : 05 Apr 2024

Markets Overview

Nifty 50 was quite flat this week but this is coming in after a good trend we have been witnessing from 21750 levels (end of Mar 2024). So a pause after a decent trend is also a good sign because it forms a flag and pole pattern after which the uptrend usually resumes post some triggers if any. There was a slight panic on the 04th of March 2024 but it was well countered on the same day further leading to decent stabilization.

Since June 2022, we have seen a fantastic rally where Nifty 50 went from 15200 to almost 22500, a 7000 point rise. Expecting this kind of a trend linearly each year would be irrational. But continuing to invest without expectations, simply taking what we get can be a much better way to approach the markets for better outcomes.

Benchmark Indices & WeekendInvesting Strategies Overview

This week, there was a great recovery in Smallcaps, with the Smallcap 250 index clocking a massive 6.4% followed by Mid-Small 400 index at 4.8%. Nifty Next 50 continues to dominate with a 3.4% gain this week followed by rest of the benchmark indices hovering around 0.8% to 2.3% returns.

WeekendInvesting strategies also had a good start to FY 25 with Mi 20 clocking 7.1%, Mi 35 returning 6.9% while Mi NNF 10, HNI Capital Compounder & Mi EverGreen returning between 5.4% and 5.6%. Rest of the strategies also took a decent start clocking between 0.4% to 4%. Mi ST ATH & Mi ATH 2 had some cash exposure and thus could not make the most of this recovery in markets while Mi India Top was also slightly lagging its benchmark, the Nifty 50.

Sectoral Overview

METALS, PSU BANKS, REALTY and PSE are the top four sectors for the week. These are the same sectors which have been doing consistently well in the recent past and have also taken lead in this new FY. PVT BANKS are looking more rejuvenated with HDFC BANK leading the charge while ENERGY, IT & PHARMA were all muted. Markets might be looking forward to the election results but the outcome may probably already be baked in. FED’s narrative of 2-3 interest rate cuts in 2024, earnings growth, India being the fastest growing economy and many other factors may have already been baked in. So there may be new triggers required to continue to the upward trajectory.

METALS, PSU BANKS and REALTY occupy the top spots in the fortnightly chart. REALTY in particular has done very well to recover from a slump from being at #15 in 1 month chart to coming in at #2 in the fortnightly chart. This sector aso happens to have occupied the top spot in the 6 month analysis. The same story carries on with PSE which has recovered very well after a bit of dullness in the fag end of Mar 2024. CONSUMPTION has lost some steam in the recent timeframe while GOLD continues its impressive run.

Rebalance Update for the week !

Spotlight - The Problem with Nifty 50 & Index Investing

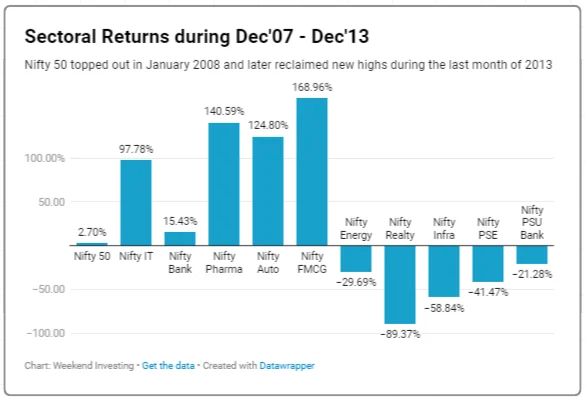

Index investing, particularly in the Nifty 50, has long been hailed as a safe and straightforward approach to the stock market. However, a closer look reveals some inherent limitations in this strategy. Between January 2008 and March 2014, the Nifty index delivered a disheartening 0% return. This prolonged period of stagnation, known as the Global Financial Crisis (GFC), highlights a critical flaw in relying solely on index investing.

During the tumultuous 2007 to 2013 period, while the Nifty remained flat, certain sectors and individual stocks thrived. Pharmaceuticals surged by 140%, Auto by 124%, and FMCG by 168%. Meanwhile, real estate, energy, infra, PSU banks, and other sectors floundered. This disparity underscores the importance of strategic stock selection, even within stagnant market conditions.

Identifying Winning Pockets

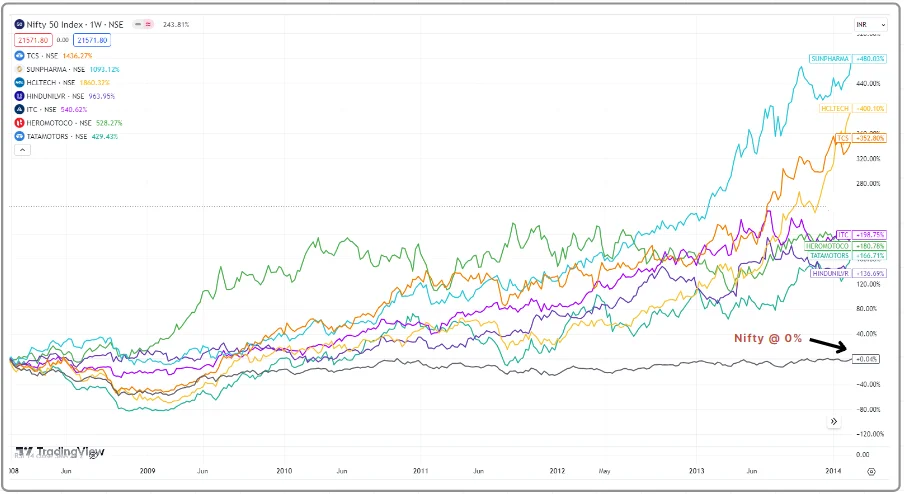

Despite the Nifty’s lackluster performance, select stocks within the index exhibited remarkable strength. Companies like Hindustan Unilever, Tata Motors, Hero MotoCorp, and others saw significant growth during this challenging period.

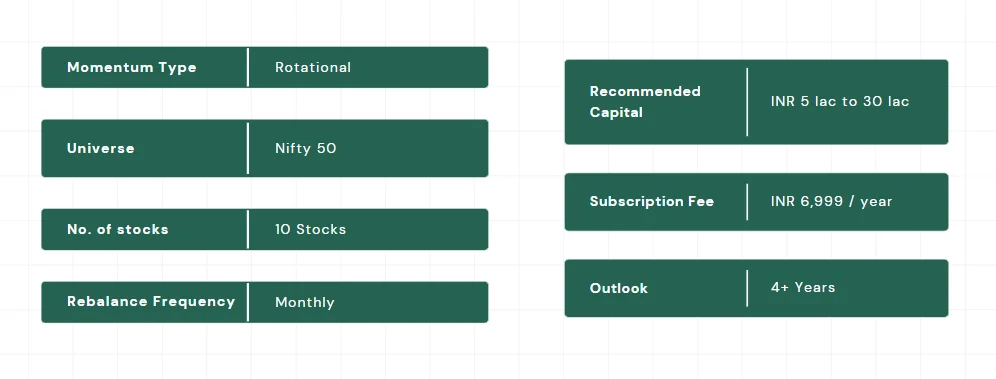

If you held onto Nifty, you would probably have not made much but if you could have a structured approach to identifying momentum pockets within the universe, you can probably create a better opportunity in outperforming the benchmark and this is exactly what Mi India Top 10 aims to do.

We have a special offer of 25% discount on Mi India Top 10 (use code FY2025) to mark the beginning of a new financial year.

Note : Code will be valid till 10th of Apr 2024.

The WeekendInvesting App

The Weekendinvesting App is a one stop solution for everything about Weekendinvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, performance metrics, momentum watchlists, discounts and many other exciting things. This app acts as a medium for us to provide direct support and resolve your queries.

Please write to [email protected] if you have any questions.

Reply