- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 05 Jul 2024

Good, Bad & Ugly Weekly Review : 05 Jul 2024

Momentum continues in Markets . . .

Edition : 05 Jul 2024

Hello, Investor !

Markets Overview

Nifty gained about 300 points this week, although not as strong as the previous phenomenal week. The market is steadily advancing towards the budget event with confidence. The weekly candle is also up, marking four weeks since the election.

Benchmark Indices & WeekendInvesting Strategies Overview

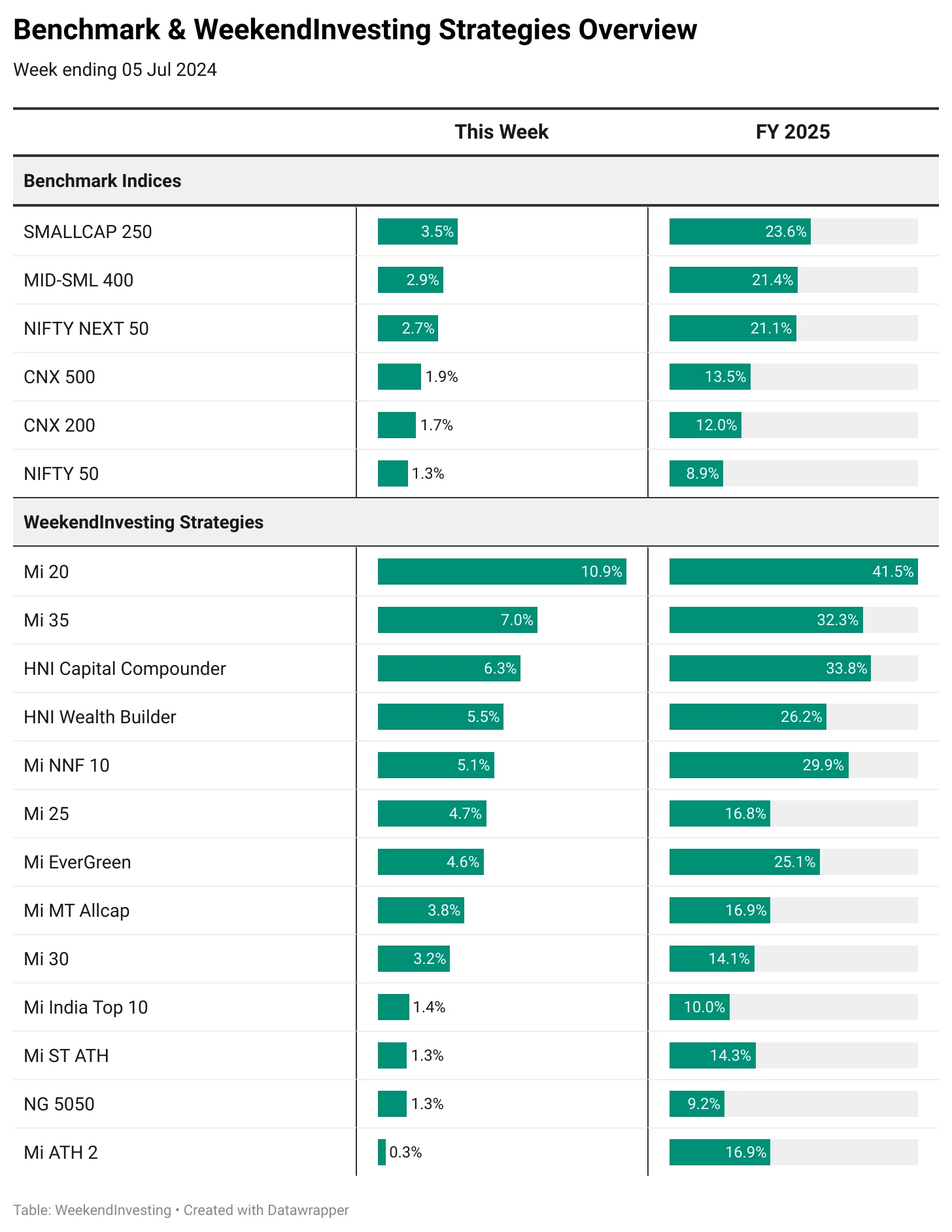

This week, Nifty rose by 1.3%, while the CNX 200 and CNX 500 increased by 1.7% and 1.9% respectively. The Nifty Next 50 saw a 2.7% gain, with mid-small 400 and small caps performing even better at 2.9% and 3.5%. For FY 25 so far, small caps are up 23%, mid caps and the Nifty Next 50 are up 21%, CNX 500 is up 13%, CNX 200 is up 12%, and the Nifty is up 8.9%. This indicates a very healthy first quarter and a strong start to the second quarter.

Mi 20 had an exceptional week, gaining 10.9%, bringing its FY 25 performance to a staggering 41.5%. This strategy continues to outperform it’s benchmark consistently. Mi 35 also performed well with a 7% increase this week. HNI Capital Compounder rose by 6.3%, HNI Wealth Builder by 5.5%, Mi NNF 10 by 5.1%, Mi 25 by 4.7%, and Mi Evergreen by 4.6%, all surpassing their respective benchmarks. Mi India Top 10 gained 1.4%, while Mi ST ATH was up by 1.3%, and Mi ATH 2 remained flat at 0.3%. Among these, Mi 20, HNI Capital Compounder, and Mi NNF 10 have been standout performers for FY 25.

Sectoral Overview

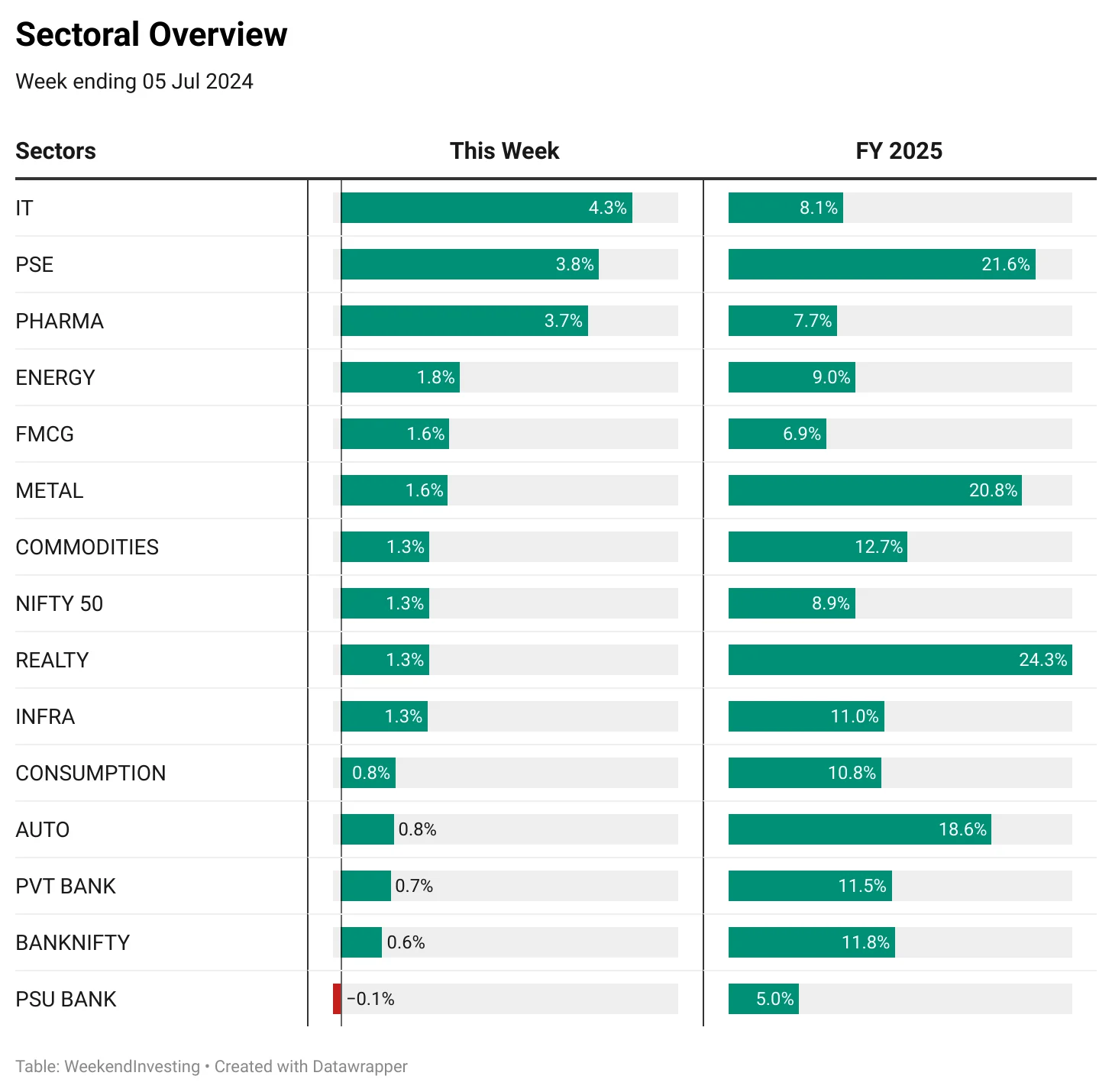

In terms of sector performance, IT is the star of this week. This sector had been languishing at the bottom of our charts for several months and has emerged out of ashes to lead this week’s performance chart clocking 4.3%. PHARMA was another standout performer at 3.7% most importantly breaking out of a medium term range. PSU BANKS have been quite sluggish and it looks like money is flowing into some other sectors and there could be new sectors seeing inflows in the times to come. REALTY and PSEs lead the FY 25 charts with 24% and 21% gains respectively.

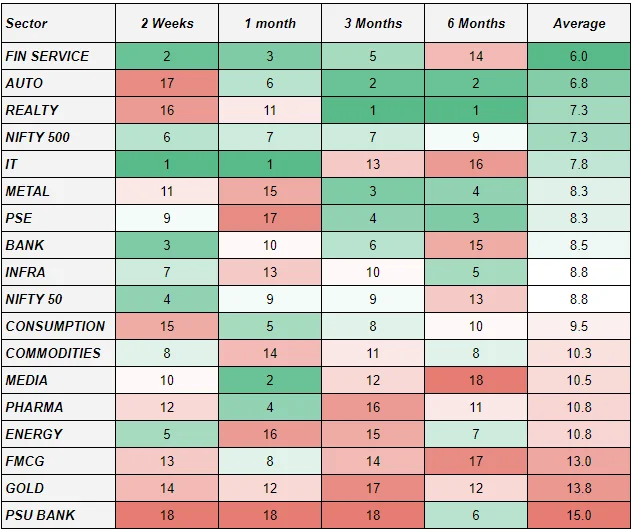

Sectoral momentum shows a significant shift, with autos deteriorating rapidly from the 6th position over a month to the 17th position over two weeks. IT has been on an exceptional recent trend occupying the first position across both fortnightly and monthly basis. Real estate, previously at the top over three months, has slipped to 16th position over two weeks. Financial services and banking sectors have emerged as leaders, while energy stocks have surged in the short term. Meanwhile, PSU banks, consumption stocks, real estate, and autos have all taken a backseat. This highlights a dynamic shift in sectoral performance, emphasizing the importance of staying updated with market trends.

Spotlight - Mi 20

How many Multibaggers do you need ?

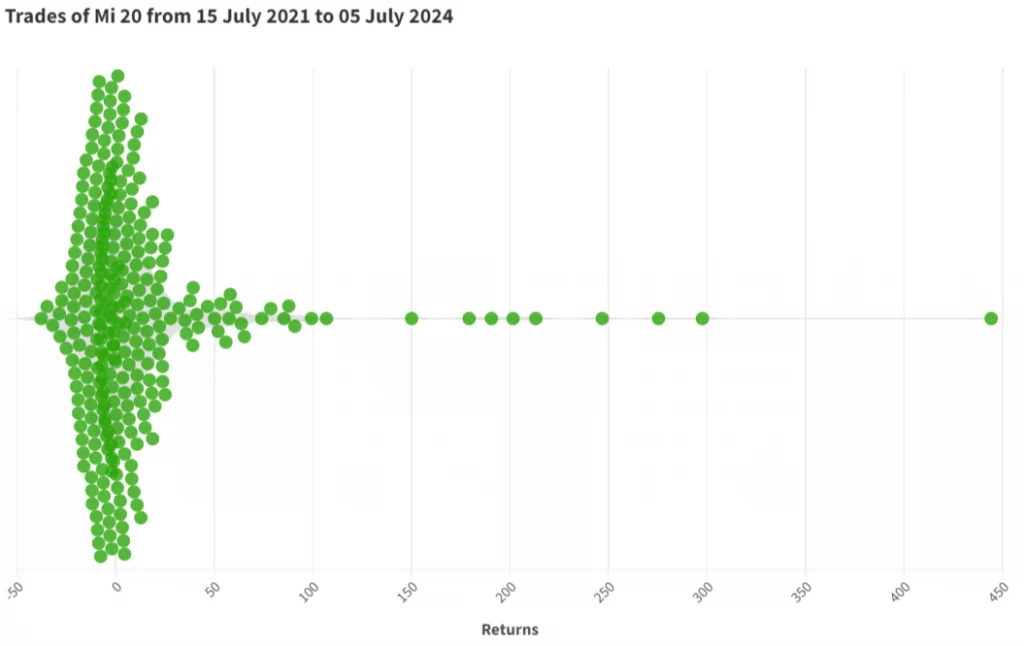

Mi 20 has been a scintillating strategy right since it’s launch back in July 2021. The strategy is our best performer in the last three years and below chart showcases the distribution of the strategy’s trades since it went live.

The data shows most trades fall within a range of -20% to +30%. The worst-case scenario registered a -37% loss. However, the strategy’s success is driven by a few extreme outliers, with gains ranging from 150% to as high as 444%.

Out of 281 trades conducted over nearly three years, 135 were winners and 146 were losers, resulting in a win rate of less than 50%. Yet, the average gain on winning trades was 35%, while the average loss on losing trades was only 10%. This “casino math” approach, where substantial outliers pull the overall performance, creates a significant alpha over the benchmark.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply