- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 06 Sep 2024

Good, Bad & Ugly Weekly Review : 06 Sep 2024

Signs of Weakness ?

Edition : 06 Sep 2024

Hello, Investor !

Markets Overview

It was quite a dramatic week towards the end, with a notable sell-off in the U.S. markets, particularly on Friday night after the jobs data release. The data indicated that the economy is weaker than expected, which suggests that rate cuts may be on the horizon. However, the market is sensing a potential weakness going forward. How the Indian market will react in the short term is anyone’s guess, but the longer trend looks very robust.

Previous instances of global weakness have been handled well by the Indian market. Currently, we are just a couple of percentage points away from the all-time high, so there’s little concern on that front. The broader market, especially mid and small caps, also appears resilient. There has been some churn within certain sectors, particularly in defense, public sector banks, and public sector enterprise stocks, where some have cooled off, but overall, the market doesn’t seem too bad at this point.

Looking at the Nifty this week, the first two days were focused on trying to rise, but the latter part of the week saw a collapse. The gap in the chart has been closed, but there are more gaps visible if we take a longer weekly view. This is the first weekly bearish engulfing candle we’ve seen in quite some time, which may indicate a further downward trend. If the weekly low is broken next week, there’s a possibility that the downward trend will continue. The first pivotal support lies just below 24,000, and the major support may come around 21,200, which was the bottom during election week. In case of a severe market downturn, we could test that support level. These are key mental points to consider for a potential bigger correction in the market.

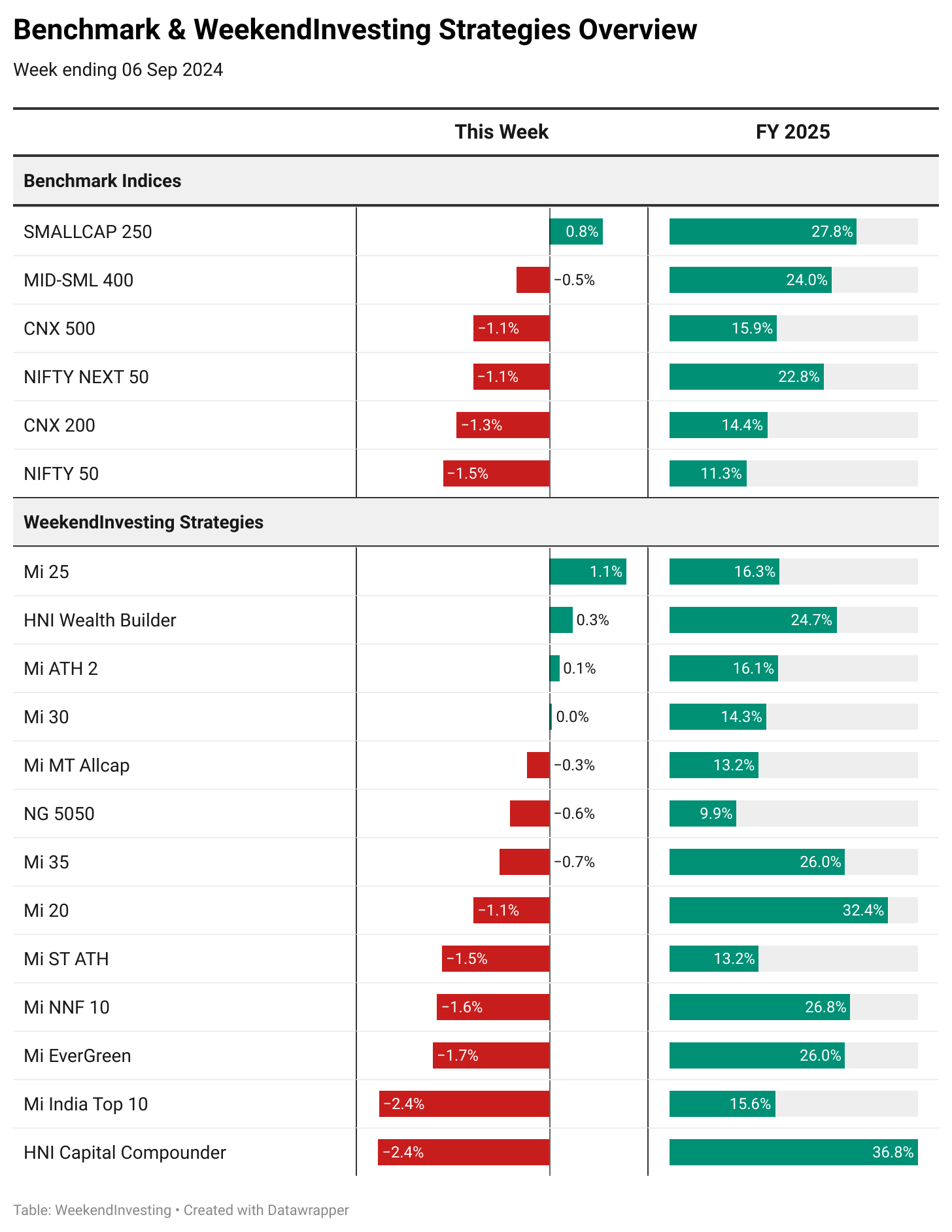

Benchmark Indices & WeekendInvesting Strategies Overview

Nifty 50 lost 1.5%, CNX 200 lost 1.3%, and both Nifty Next 50 and CNX 500 lost 1.1%. Small caps, however, managed a small gain of 0.8%. Among the Weekend Investing strategies, Mi 25 bucked the trend with a 1.1% gain, HNI Wealth Builder rose by 0.3%, and Mi ATH 2 inched up by 0.1%. The rest of the strategies were in the red, with Mi India Top Ten and HNI Capital Compounder each losing 2.4%.

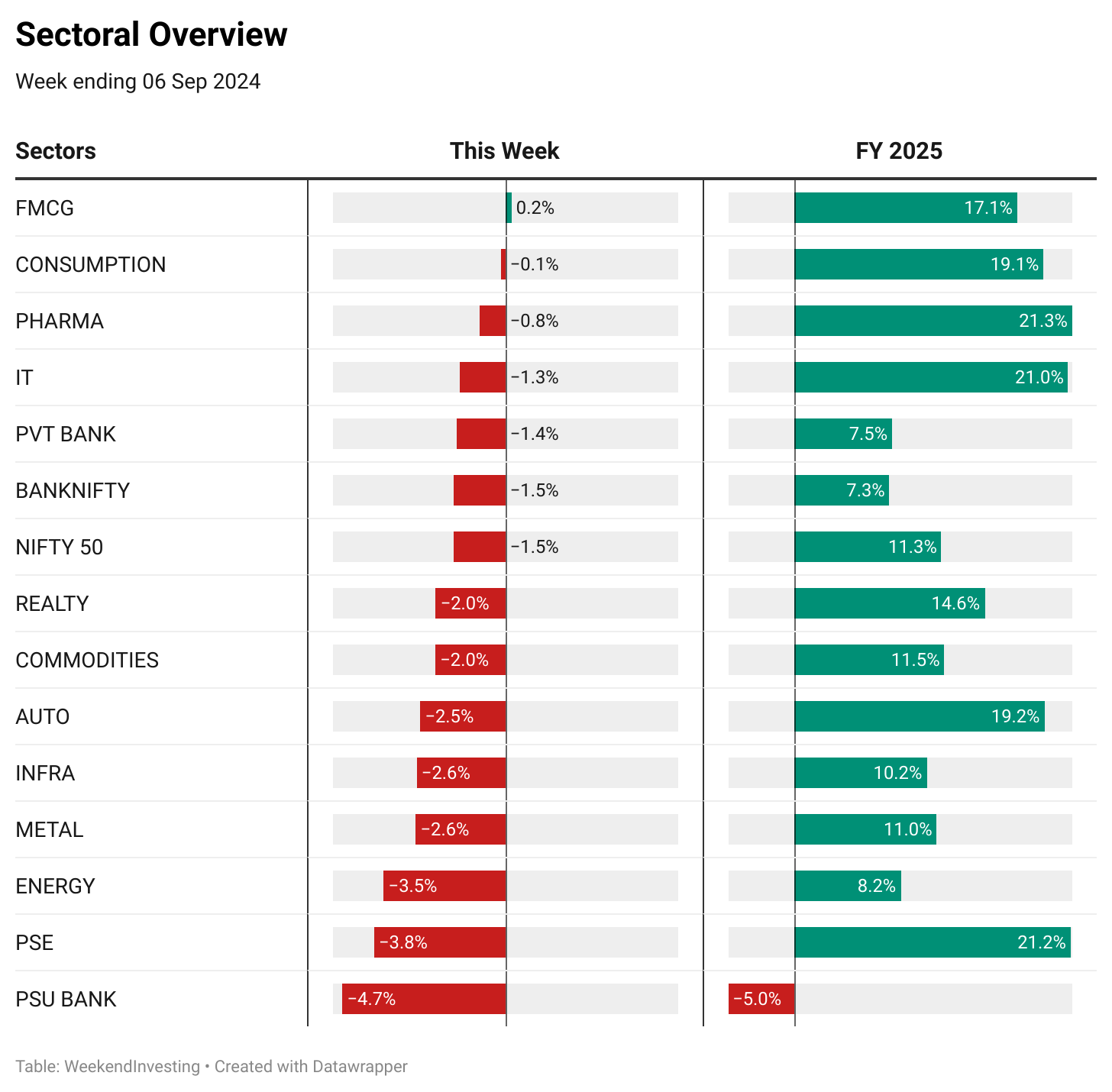

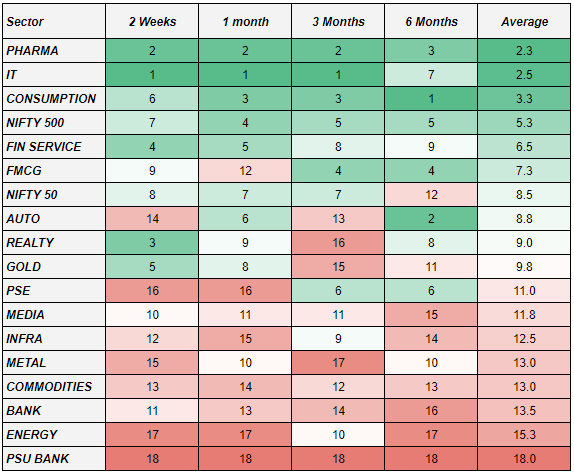

Sectoral Overview

Defensive sectors like FMCG, consumption, pharma, and IT were hit the least, with pharma down only 0.08% and IT down 1.3%. For FY 25, these sectors have led in performance compared to others. On the other hand, PSU banks took the hardest hit, down 4.7%, followed by public sector enterprise stocks (-3.8%), energy stocks (-3.5%), autos, infrastructure, commodities, and real estate, all of which lost 2% or more. High-beta sectors have been hit harder, while defensive sectors experienced relatively lesser damage.

In terms of sectoral momentum over two weeks, one month, three months, and six months, pharma, IT, and consumption are leading. There’s been a shift from sectors like real estate, energy, PSU banks, and public sector enterprises, which were running earlier, to pharma, IT, and consumption. In the short term, real estate and financial services are trying to make a comeback, but their overall ranking remains low. PSU banks are now ranked the lowest among tracked sectors, with energy close behind.

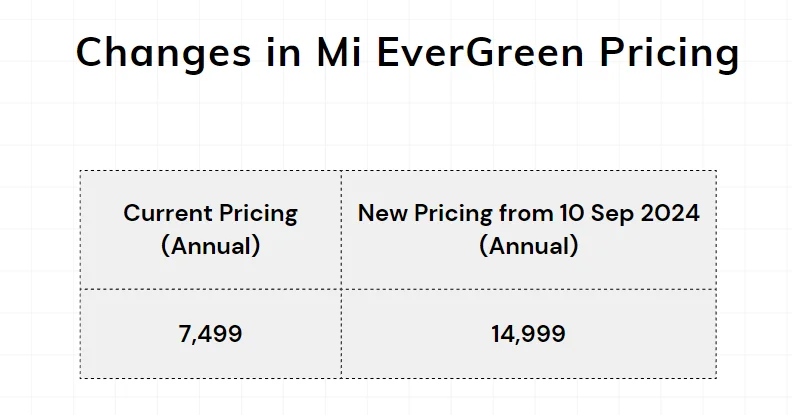

Spotlight - Mi EverGreen

The spotlight is on Mi Evergreen, which will see a price change. The inaugural pricing was initially set for a year but has now continued for over two and a half years. From 10 September 2024, the strategy will revert to its intended price. Until 9 September 2024, new subscribers can still lock in the old price, and auto-renewal at the old price will continue as long as subscriptions remain active. Existing and new subscribers won’t be affected by the price change unless they cancel their auto-renewal and return later.

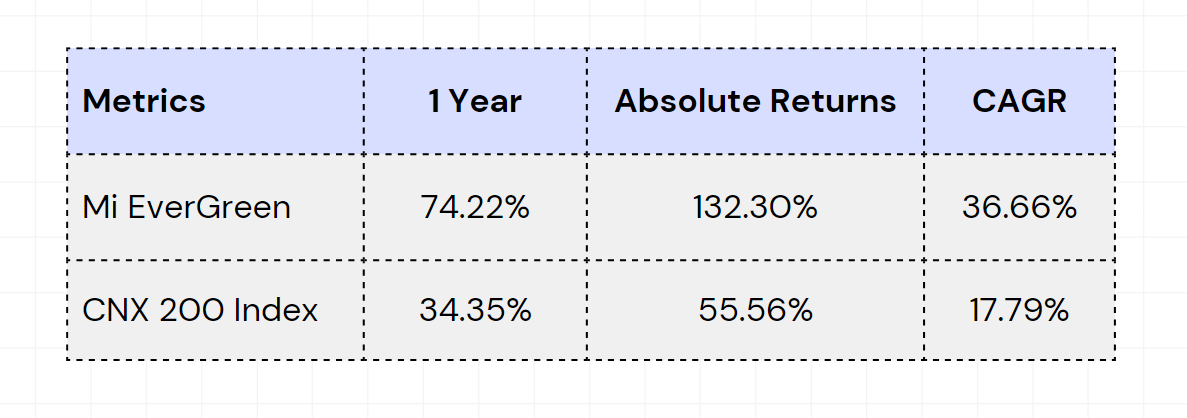

Mi Evergreen is a well-loved strategy, known for its conservative approach. The stock universe comprises the top 200 stocks, with a slower churn as the portfolio is reviewed only once a month. A fixed allocation to a gold ETF provides stability during market volatility. The strategy allows winners to run and resets to equal weight each month, making it an excellent core portfolio. The portfolio includes large-cap stocks (the top 100) and mid-cap stocks (101st to 200th positions).

The strategy is rotational, investing in 20 equally-weighted stocks, with 25% allocated to gold ETFs. The strategy is reviewed and rebalanced monthly, with a few stock changes possible. The recommended capital is ₹5 to ₹30 lakhs, with a suggested investment horizon of four to five years.

The reason for recommending a four to five-year view is that market trends or rallies might not occur immediately. If you’re fortunate, you may catch an uptrend early on, but if not, you may have to wait a few years. The last four years have been unusual, especially since COVID-19, with many new investors thinking that quick gains are the norm. However, this is not sustainable in the long run. Natural market cycles usually have at least one large uptrend within an eight-year period, and the goal is to capture this when recommending a five-year investment window for this strategy.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply