- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 08 Nov 2024

Good, Bad & Ugly Weekly Review : 08 Nov 2024

End of Downward Trend ?

Edition : 08 Nov 2024

Hello, Investor !

Markets Overview

What an action-packed week we had! This was probably one of the most significant weeks of the year, with multiple major news events taking center stage. The US elections saw Donald Trump winning, raising expectations of new policies. Meanwhile, both the Fed and the Bank of England announced a 25 basis point cut, with Fed Chairman Powell expressing optimism about the US economy. In the context of the Indian markets, which have performed well over the past few years compared to other major global benchmarks, things seem to be changing slightly from a shorter term perspective. While US markets have shown continued strength, reacting positively to the change in government, the Indian markets seem to be in a correction mode, finding support around the 24,000 mark.

After a recent downward trend, the Nifty appears to be showing signs of trying to stabilize. Last week, we briefly dropped below the 24,000 mark but found some support. The markets rallied from 23,800 to 24,500 but encountered resistance at this level, indicating that 24,500 could now a critical resistance to watch out for. As long as the 24,000 support holds, there may not be too much of a concern. However, if we break below this, we might see Nifty retesting levels around 23,500 or even 22,000.

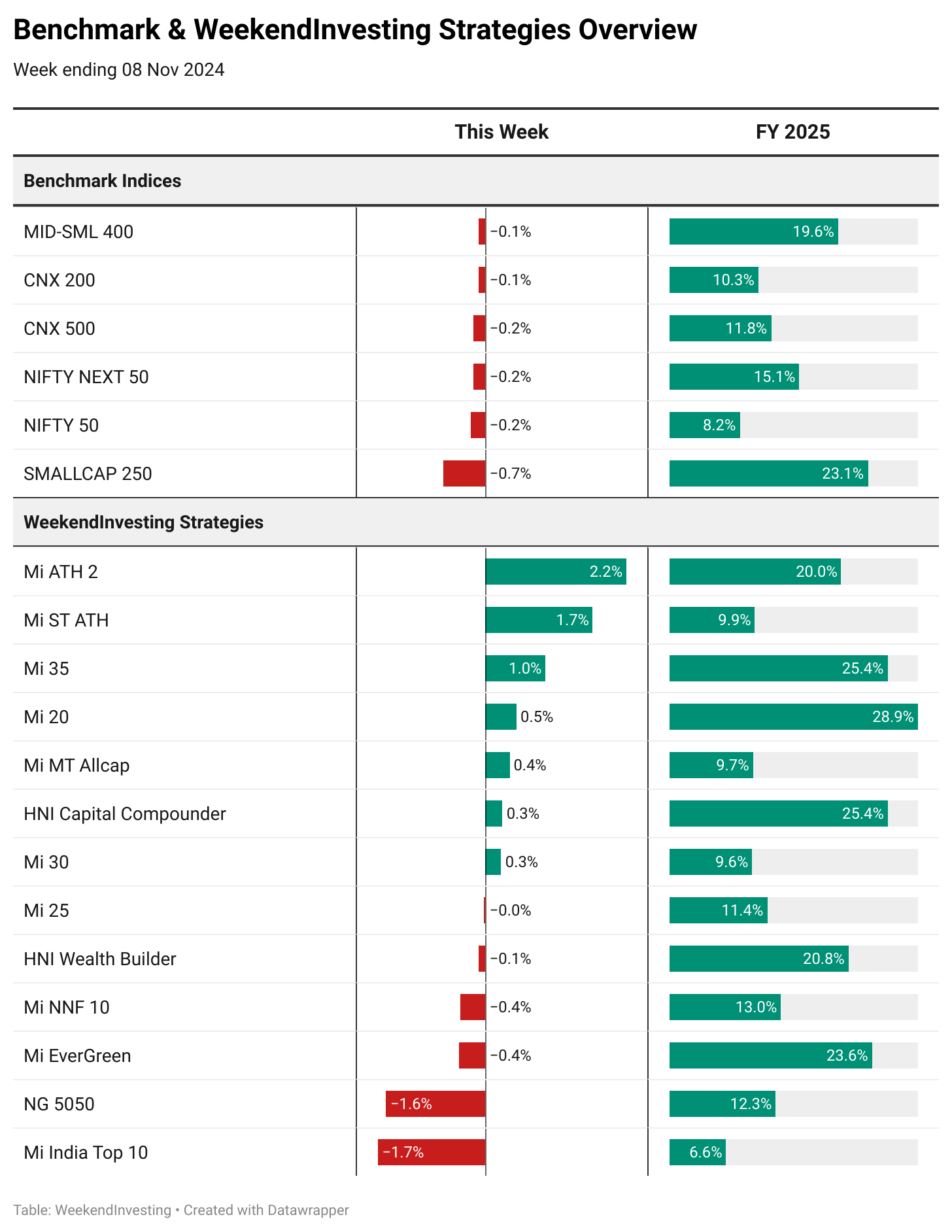

Benchmark Indices & WeekendInvesting Strategies Overview

In terms of benchmark indices and weekend investing strategies, it was a mostly neutral week. Mid-small 400, CNX200, CNX500, and Nifty Next 50 hovered between -0.1% and -0.2%, with small caps down 0.7%.

Despite this, some strategies performed well. Mi ATH 2 continued its streak of strong recent performance, alongside Mi ST ATH with gains of 1.7%, Mi 35 up 1%, and Mi 20 and Mi MT Allcap showing gains of 0.5% to 0.4%. In contrast, NG 5050 and Mi India Top 10 lagged behind. As for FY25 metrics, the Small Cap 250 remains the leader with a 23% gain, followed by Mi ATH 2 with 20% gains. Mi 20 tops the list with 28.9% gains, followed by Mi 35 and Mi EverGreen with 23% gains.

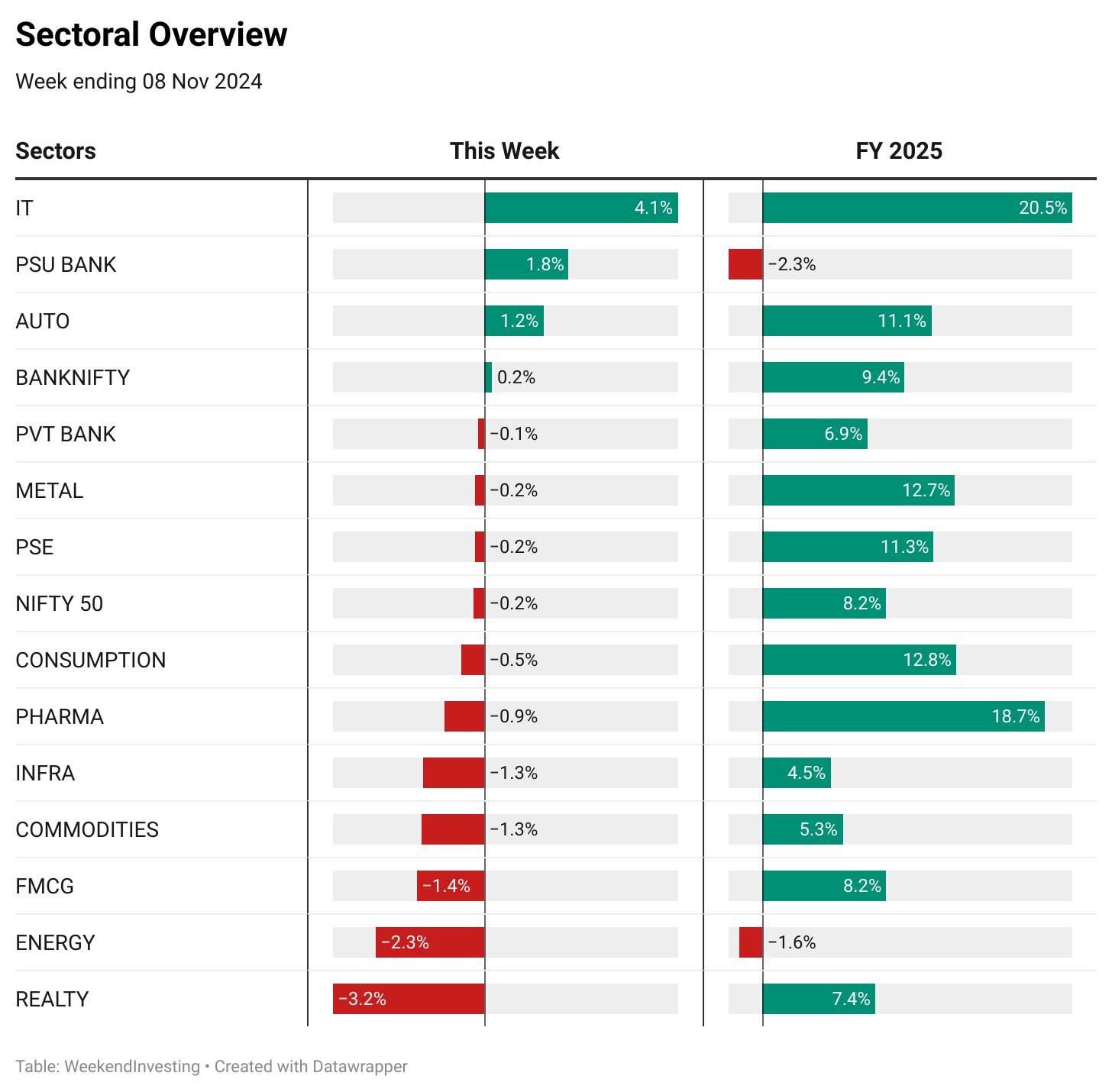

Sectoral Overview

Looking at sectoral performance, most sectors struggled except for IT and PSU banks, which posted modest gains of 1.2% to 1.8%. Private banks and Bank Nifty remained neutral, while sectors like realty, energy, FMCG, commodities, and infrastructure saw losses beyond 1%. Pharma was down around 1%, and consumption stocks lost 0.5%. PSU banks, which have been weak this year, are showing some signs of recovery, though it's unclear if this is a temporary bump or a sign of long-term improvement. The IT sector continues to lead the FY25 charts with 20% gains, followed by pharma at 18%.

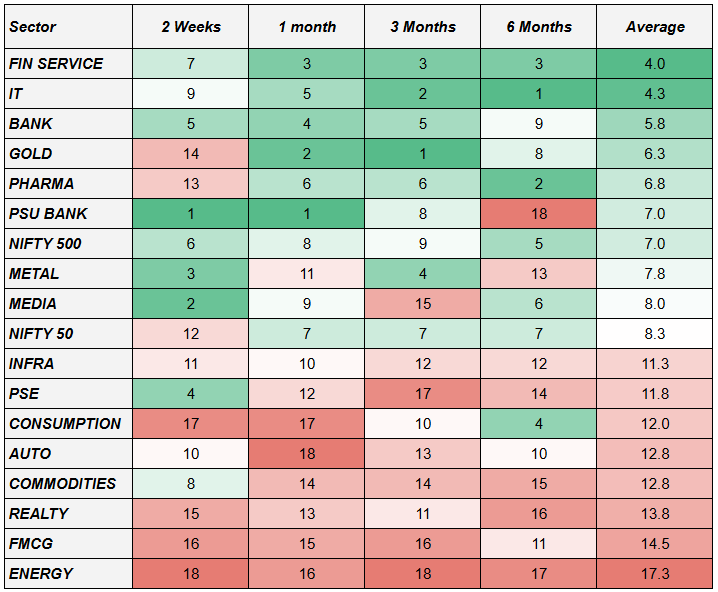

In sectoral momentum, IT and financial services maintained their strong positions, with IT topping the rankings. Gold, however, has slipped in momentum, now ranking 14th in two-week performance. Pharma has also dropped significantly, landing in 13th place. PSU banks have performed well, topping both two-week and one-month momentum rankings. On the other hand, FMCG has quickly fallen to the bottom of the charts, a surprising shift given its earlier top position.

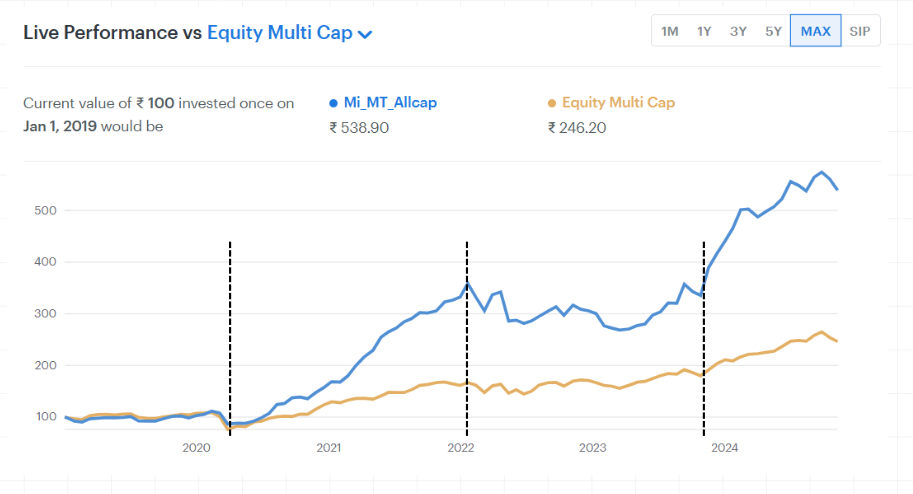

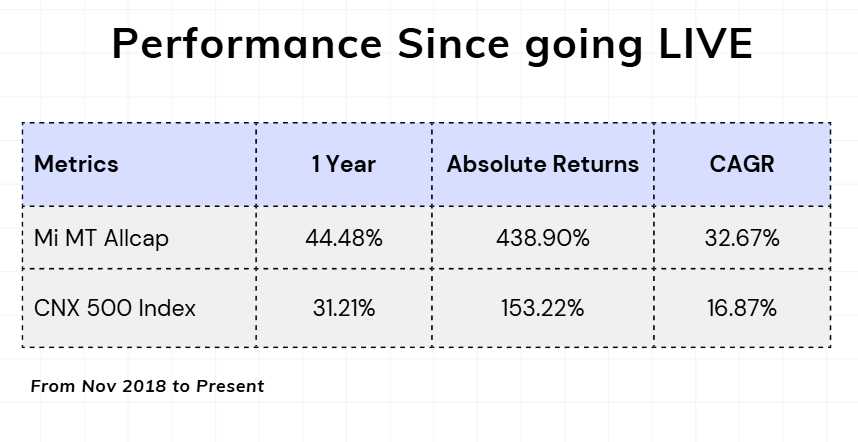

Spotlight - Mi MT Allcap

Getting used to the concept . . .

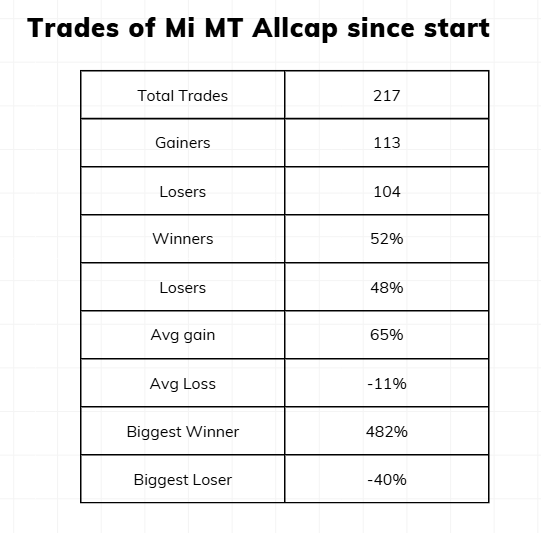

Since going live in late 2018, Mi MT Allcap has executed 217 trades with 52% of them being winners and 48% being losers. This is important to discuss because many investors who may have entered the strategy during its highs might be concerned about the many small losers that may be seen during rebalances. Momentum investing is designed to book multiple small losses and capture a few big winners. The objective is to have strict rules to minimize losses, exit weak stocks, and make way for potential winners.

It's critical to understand that you need to give these strategies time to work. The average gain in this strategy is 65%, while the average loss is 11%. To be able to fully realize and align with the core principles of the strategy, we recommend staying invested for at least four years. Trying to time your entry perfectly is difficult and not recommended too, but with enough time in the strategy, you can neutralize the impact of short-term volatility and sow the seeds for better outcomes in the longer term.

So be patient, stick with your strategy, and you'll increase your chances of success over time.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply