- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 09 Aug 2024

Good, Bad & Ugly Weekly Review : 09 Aug 2024

Edition : 09 Aug 2024

Hello, Investor !

Markets Overview

This week was marked by volatility, fear, and a relatively strong performance by the Indian market compared to the rest of the world. The week started with turbulence, particularly from Japan, with the carry trade unwinding scare due to a potential increase in Japanese interest rates. With US interest rates pointing downward, the carry trade—where investors borrow in yen to invest overseas—became less profitable, forcing many to unwind their positions, which led to losses in hedging positions. Despite initial fears of a global collapse, JP Morgan indicated that 75% of carry trades have been unwound, and things are gradually returning to normalcy. By the end of the week, the damage was limited, although there was a steep fall midweek.

The market began the week with a slight decline on the first day, followed by a complete bloodbath on Tuesday. While the market hasn’t fully or even halfway recovered from this fall, the last three sessions of the week suggest increasing stability, especially Friday, which saw a very narrow trading range. To truly come out of this downturn, the market needs to cover the gaps from earlier in the week. However, as long as the market doesn’t break below the recent low, there is a good chance of consolidation going forward. The weekly candle closed green, which is a positive sign, along with the fact that it did not close below the two-week candle, and closed near the higher end of the candle. These indicators suggest that the market has a strong desire to move upward, though only time will tell if it succeeds.

WeekendInvesting Specials !

Special Video (Saturday) : Best PSU Funds for you !

Special Video (Sunday) : Masterclass on Correction !

Benchmark Indices & WeekendInvesting Strategies Overview

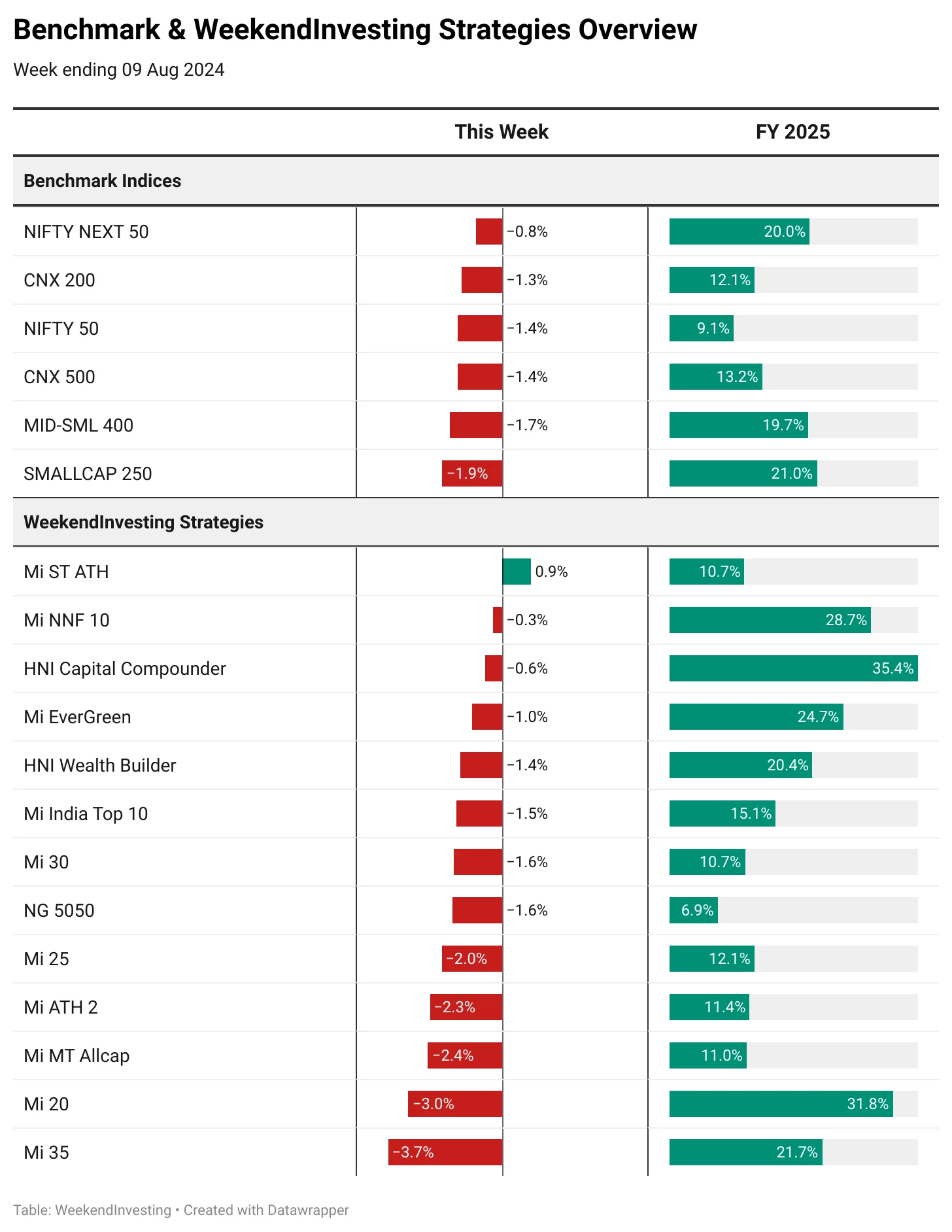

In terms of benchmarks, most indices were in the red this week. The Nifty 50 lost 1.4%, the CNX 200 lost 1.3%, and the Nifty Next 50 was the least affected, with a loss of 0.8%. The CNX 500 lost 1.4%, mid and small caps were down 1.7%, and the Small Cap 250 index suffered the most, losing 1.9%. However, the FY25 figures remain strong for the Nifty Next 50, mid and small caps, and Small Cap 250.

The performance of Weekend Investing strategies was a mixed bag, with most ending deep in the red. Mi 20 and Mi 35 both saw 3% and 3.7% cuts respectively, Mi MT Allcap was down 2.4%, Mi ATH 2 was down 2.3%, and Mi 25 was down 2%, with others losing between 0% and 2%. Mi ST ATH stood out this week, gaining 0.9%. For FY25, the HNI Capital Compounder strategy performed exceptionally well, up 35.4%, which is nearly three times the performance of the base index, and Mi 20 continued to perform well this year, as it did in the previous year.

Sectoral Overview

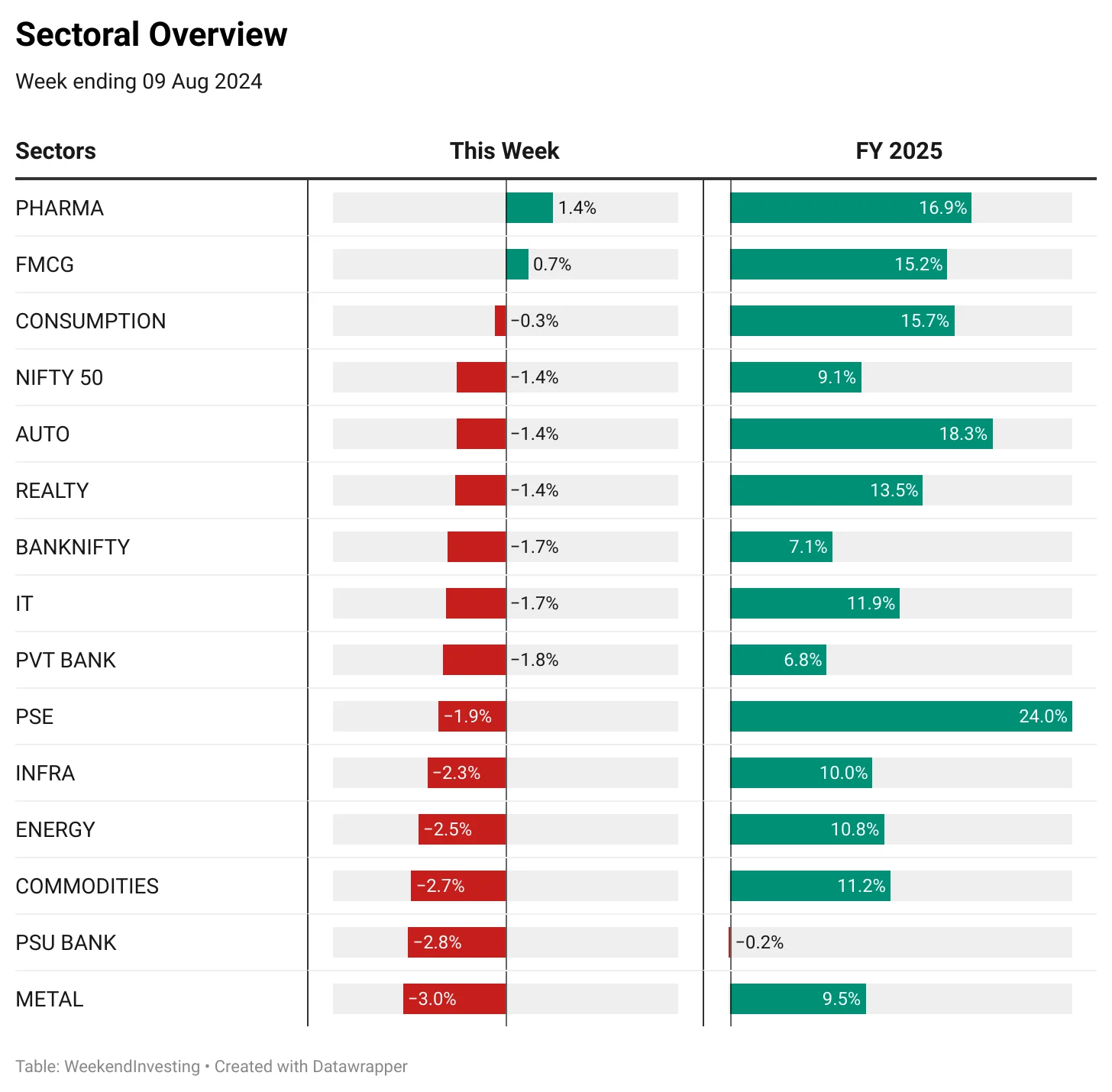

From a sectoral perspective, all sectors were down except for pharma and FMCG, which suggests a market shift towards defensives. Pharma was up 1.4%, and FMCG gained 0.7%. The hardest-hit sectors were metals, PSU banks, commodities, energy, and infrastructure, all down by more than 2%. Public sector enterprise stocks also lost ground, but on an FY25 basis, they are still ruling with a 24% gain in the current financial year. Overall, it was a down week for most sectors.

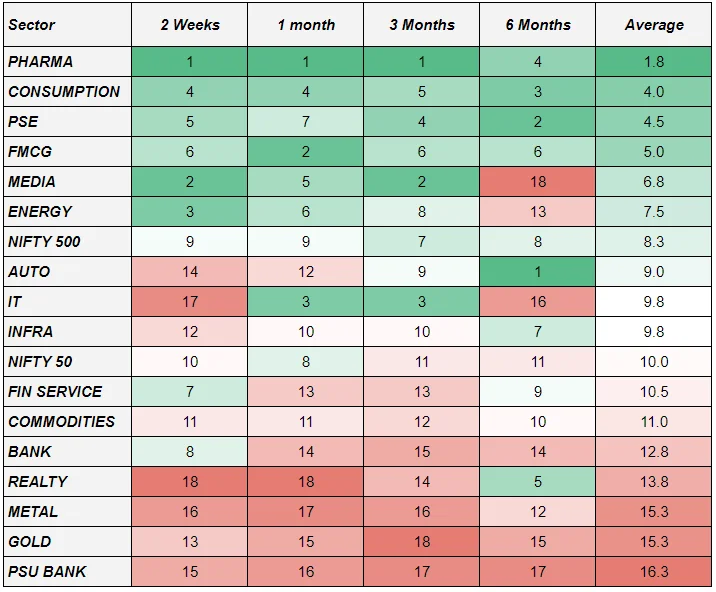

Pharma remained the top-performing sector in terms of momentum score, with media, energy, and public sector enterprises showing improvement in the short term. However, sectors like real estate, metals, PSU banks, and autos, which had been performing well until about six months ago, are gradually losing momentum and slipping to mid-level positions.

Spotlight - Mi India Top 10

Mi India Top 10 celebrated its second anniversary this week, having performed well since its launch. It had a rough start, with the first six months marked by underperformance, but the following year and a half saw a significant recovery, demonstrating the strategy’s strength.

Initially, the strategy lagged, but after almost a full year of underperformance, it began to outperform from October onward. This highlights that while some strategies may take time to show results, they can come back stronger over time.

Mi India Top 10 is one of our most popular strategies due to its simplicity. It involves a monthly review and rebalance of ten equally-weighted stocks chosen from the Nifty universe. The goal is to stick with outperformers within the Nifty 50 to beat the index over time.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply