- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 09 May 2025

Good, Bad & Ugly Weekly Review : 09 May 2025

Can markets withstand War ?

Edition : 09 May 2025

Hello, Investor !

Markets Overview

The war is on. While it may not have been intended as a full-blown war—more as an effort to demolish terrorist outfits—the counter-response from the other side has been so intense that it has effectively drawn us into a deeper conflict. As with all wars, it’s difficult to estimate how long it will last or the extent of the damage it may inflict. The situation is undoubtedly serious and raises questions about how and when this conflict will come to an end.

Nifty dropped significantly at the start of Friday’s session, closing the week down by 1.39%. While the overall weekly damage isn’t too steep, the nervousness around the escalation was clearly visible in the last session. There is a possibility of further downside in the coming week.

Nifty – Weekly Chart Perspective

We now have a red weekly candle after four consecutive green weeks, which is not necessarily a negative signal—there may still be support forming in the current region. Despite the war-related anxiety, markets still look reasonably robust from a medium-term perspective.

S&P 500 Overview

The S&P 500 remained largely flat, ending the week with a minor 0.47% decline. The Fed has maintained its interest rate stance for now, with a potential change expected in June. Recession expectations in the U.S. stand at around 50% probability, indicating that the macro outlook remains uncertain but not necessarily dire.

GOLD Overview

Gold made a strong comeback this week in rupee terms, climbing 3.72% and moving from around ₹94,000 to nearly ₹97,000 per 10 grams.

Dollar Index Overview

At the same time, the dollar index is firming up again, crossing the 100 mark to reach 100.42. With the war scenario building up, foreign fund flows into India and other emerging markets are likely to pause or slow. Hopefully, there won’t be a selling spree, but current momentum seems to favor flows back into the dollar.

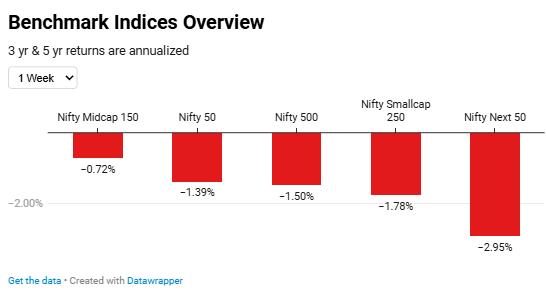

Benchmark Indices Overview

Looking at benchmark indices, Nifty declined 1.39%, Nifty Next 50 saw a sharper fall of 2.95%, and the Nifty 500 dropped by 1.5%. Among broader markets, mid-caps fared relatively better with a -0.72% drop, while small caps declined 1.78%, making mid-caps the best-performing segment this week.

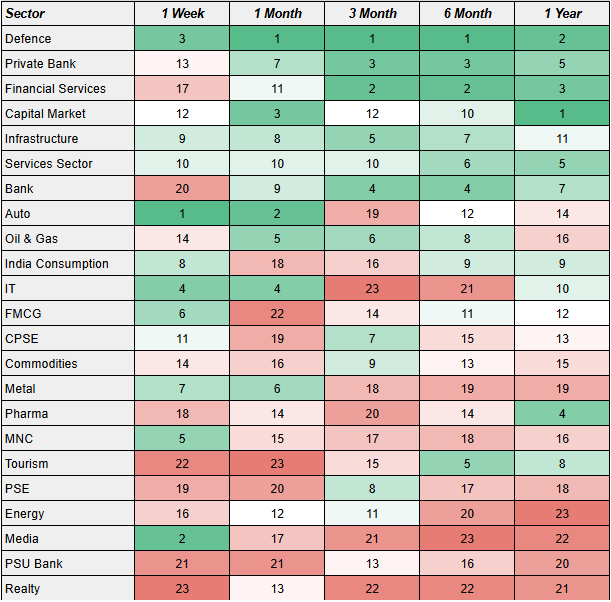

Sectoral Overview

Sectorally, real estate was the worst hit, dropping 6.6%, followed by tourism (-4.8%), PSU banks (-4.4%), and financial services (-2.5%). Overall banks fell by 2.8%, and public sector enterprises lost 2.6%. The only notable gainers were media and autos, both up around 1.5%, and defense stocks, which edged up 0.7%.

Taking a 12-month view, the top performers continue to be defense and capital markets, followed by financial services and private banks (both at ~14%). Pharma has also done well. On the losing side, real estate (-12%), energy (-13%), PSU banks (-11%), and media remain the laggards.

In terms of sectoral momentum scores, defense remains the top-ranked sector. Private banks, financial services, and capital markets are strong but losing ground in the very short term. Autos, media, IT, FMCG, and MNC stocks are starting to pick up in the short term.

However, over the long-term average, the dominant performers continue to be defense, private banks, financial services, capital markets, and infrastructure. On the flip side, sectors like real estate, PSU banks, media, energy, and public sector enterprises have consistently underperformed over the past year.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply