- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 10 May 2024

Good, Bad & Ugly Weekly Review : 10 May 2024

The Good, Bad & Ugly Weekly Review

Edition : 10 May 2024

Markets Overview

This week, Nifty witnessed a significant downward trend, marking a clear directional movement. Starting from a new high of 22,800 last Friday, it closed this week at 22,000, indicating a loss of around 500 points from the previous week’s close and 800 points from the peak. This decline represents a notable correction in the market, which is often considered healthy for its overall stability.

The weekly candles of the last two weeks have failed to show upward movement, suggesting a continued congestion zone that has persisted since the end of February. This range is characterized by 22,500-22,600 at the top and 21,700-21,800 at the bottom. However, there is anticipation for potential support around the 21,200 level or even a slight dip to 20,000, although a significant fall seems unlikely without a substantial market event.

Benchmark Indices & WeekendInvesting Strategies Overview

This week, the benchmarks experienced a notable downturn, with Nifty down by 2%, CNX 200 down by 2.1%, and Nifty Next 50 down by 2.3%. Mid and small caps faced even steeper declines, with drops of 3.2% and 4.24% respectively. This indicates a significant cut in the lower segment of the market, reflecting considerable bearish sentiment and selling pressure at least in the shorter timeframe.

In terms of weekend investing strategies, there were cuts ranging from 2% to 6% across various portfolios. Some strategies experienced particularly deep cuts, notably in Mi ATH 2, Mi 20, Mi 35, and Mi NNF 10. Despite this, most of the strategies still managed to retain some gains for FY 25. However, Mi ATH 2, Mi 25 & Mi MT Allcap are currently in the red for FY 25.

Sectoral Overview

Most sectors experienced losses except for FMCG, which saw a 2% increase, and Auto’s, which rose by 1.4%. Auto’s performed well, with positive numbers reported and stable consumption contributing to the sector’s resilience. Rural consumption is reportedly growing faster than urban consumption, which is positive news for India’s economy. Despite overall stability this week, the financial year has been challenging for many sectors, with losses ranging from 2% to 6%. PSU banks faced significant losses, eroding most of their gains for the current financial year. However, the metal sector remained strong, topping the sectoral list with an impressive 8.7% increase.

In various timeframes, Auto’s stands out prominently, followed closely by public sector enterprises. Gold has shown an upward trend in recent months, indicating its strength. Consumption stocks are maintaining stability, suggesting potential opportunities in consumption-related stories. Although FMCG and metals experienced a decline in the short term, they remain among the top five sectors overall.

Rebalance Update for the week !

Spotlight - Mi 35

How Momentum Investing is hell bent on making best use of your capital ?

Mazdock experienced a choppy phase between July 2021 and August 2022 before breaking out in August 2022. Mi 35, a rotational strategy focusing on small caps, identified this stock during its breakout phase. While one might expect a modest increase, Mazdock saw a remarkable rerating, soaring from 350 to 2193, marking a staggering 520% gain. Exiting in September 2023 allowed investors to avoid the subsequent consolidation phase.

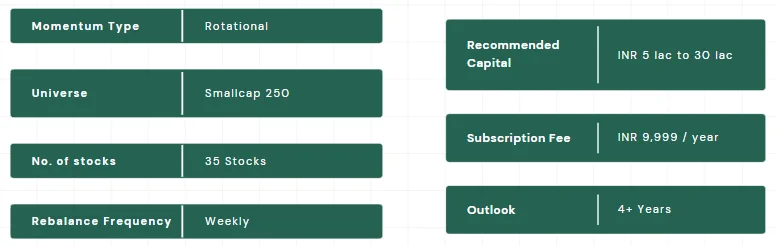

This strategy relies on algorithms to identify the strongest stocks in the small cap basket, adapting based on momentum scores across different time frames. It moves into stronger stocks if available, ensuring capital is utilized optimally.

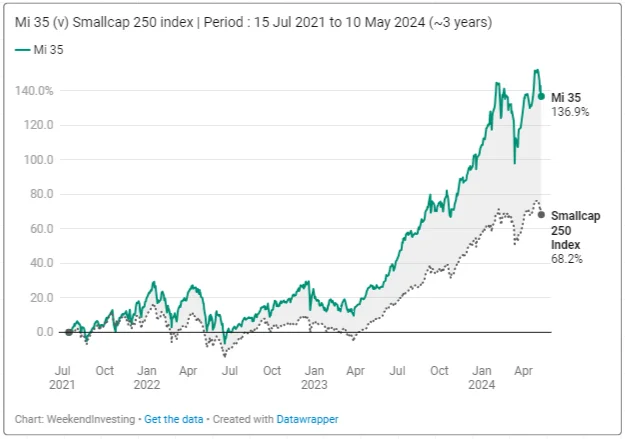

Mi 35, since its inception, has shown significant growth, up by 136%, outperforming the base index, which rose by 68.2%. The strategy focuses on the small cap 250 universe, consisting of 35 stocks initially held in equal proportion. Every six months, as the underlying index rotates, the weights are reset to equal weight. Weekly reviews ensure timely adjustments, with a recommended investment outlook of four to five years for best results.

The WeekendInvesting App

The Weekendinvesting App is a one stop solution for everything about Weekendinvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, performance metrics, momentum watchlists, discounts and many other exciting things. This app acts as a medium for us to provide direct support and resolve your queries.

Please write to [email protected] if you have any questions.

Reply