- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 11 Apr 2025

Good, Bad & Ugly Weekly Review : 11 Apr 2025

Is Volatility here to Stay ?

Edition : 11 Apr 2025

Hello, Investor !

Markets Overview

It was a week to remember, marked by sharp swings, intense volatility, and a global market environment riddled with uncertainty. The early part of the week saw a steep decline, only to witness a surprising reversion by the end. Despite the drama, Indian markets managed to recover most of the losses, though signs of recessionary pressure are becoming clearer—especially when observing bond yields. The week has raised several macro concerns, making it essential to unpack the broader implications.

Looking at the Nifty daily chart, it was a shortened four-day week. The index began with a massive gap down from around 22,850 to 21,780—a drop of nearly 1,000 points. Over the next three sessions, however, the market clawed back nearly all of that ground. By the end of the week, the Nifty had closed just 0.3% lower, essentially ending flat despite the roller-coaster ride.

Nifty – Weekly Chart Perspective

On the weekly chart, Nifty 50 did register a new short-term low, but it managed to hold above the crucial June 2024 bottom. This level has long been regarded as a critical support zone, and its integrity remains intact—for now. The index dropped from over 26,000 to nearly 21,800 before rebounding to close the week near 22,800. While this kind of price action is not ideal, the bounce offers a glimmer of relief.

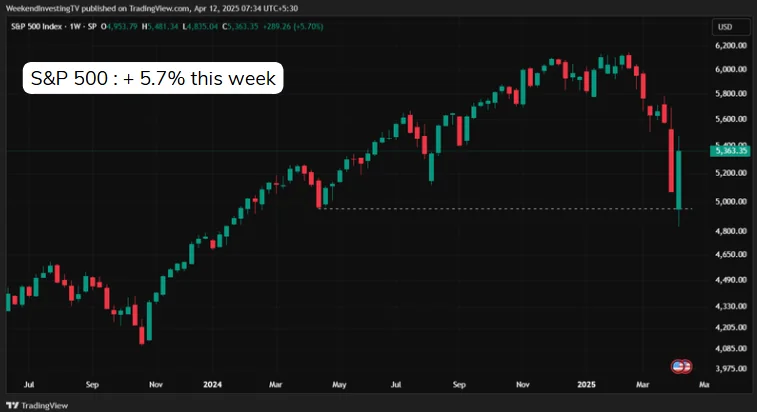

S&P 500 Overview

Across the globe, the S&P 500 also experienced extreme volatility. After falling below the psychologically important 5,000 mark and breaching the April lows, it managed a sharp comeback, posting a weekly gain of 5.7%. While the market isn’t out of the woods, such a strong recovery offers temporary respite to investors battered by the downturn.

GOLD Overview

Gold stole the spotlight this week, rising an astounding 7.4%. This kind of move in just one week is rare, even for someone who has tracked the gold market for decades. The surge in gold prices points to deep-seated investor anxiety. It reflects a flight to safety—not just away from equities but also away from the U.S. dollar and U.S. Treasuries, which traditionally served as safe havens. From ₹64,000 in April 2023 to ₹95,000 now, gold has rallied nearly 50% in just one year. This is a strong signal that something fundamental is changing in the global monetary system.

Dollar Index Overview

The dollar index fell 3% this week and now hovers near a crucial support zone. While this aligns with President Trump’s stated goal of weakening the dollar, the unintended consequences are mounting. A softer dollar has brought down U.S. equity markets, eroded trust in the dollar-based financial system, and failed to reduce bond yields. This disconnect is arguably the most concerning part of the current macro setup.

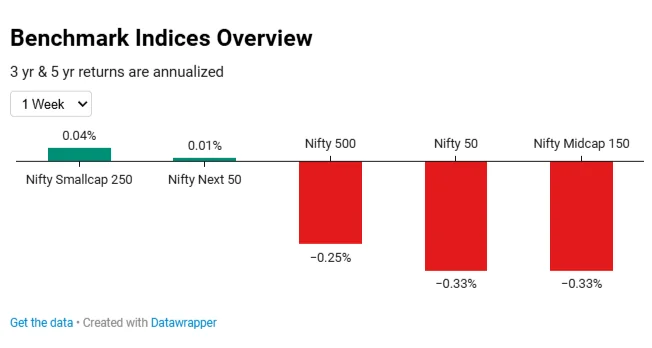

Benchmark Indices Overview

Benchmark indices in India were surprisingly stable this week, despite the global chaos. Small caps even managed a slight gain, and broader indices ended the week largely flat. This resilience in Indian equities was a welcome surprise given the volatile environment.

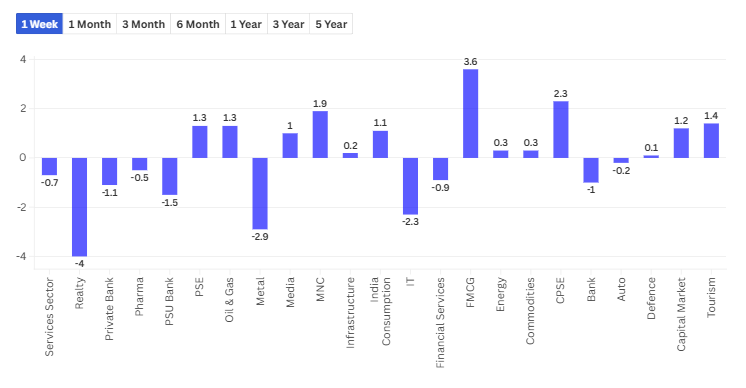

Sectoral Overview

From a sectoral perspective, FMCG was the standout performer, gaining 3.6% for the week. On the other hand, metals, real estate, and IT were among the biggest losers, falling 4%, 2.9%, and 2.3% respectively. IT, in particular, has had a rough few months and is now down 26.6% over the last quarter. Real estate has fallen 18% in the same period, and autos are down by 10.7%.

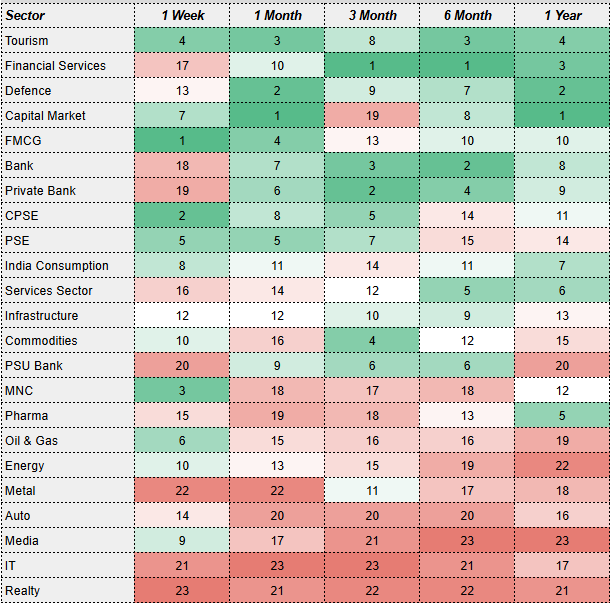

Over a one-year period, energy is still down 19%, PSU banks are down 15%, real estate is down 17%, and capital markets—despite a solid one-year return—have also slipped 8.8% in the last three months. However, when extending the view to three- and five-year periods, nearly all sectors have performed well, with strong double-digit CAGR returns in sectors like defense, capital markets, and financial services.

The sectoral momentum score, measured across various timeframes—one week, one month, three months, six months, and one year—shows some consistent trends. Tourism remains a top performer across periods. Defense and capital markets have also held strong, with FMCG recently making a strong comeback. Public sector enterprises, which were weak over the long term, have improved in the near term. On the flip side, PSU banks have slipped in recent times, and both IT and real estate continue to languish at the bottom of the rankings. These sectoral shifts highlight where momentum is building—and where it is clearly missing.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply