- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 11 Oct 2024

Good, Bad & Ugly Weekly Review : 11 Oct 2024

Markets in a consolidation mode ?

Edition : 11 Oct 2024

Hello, Investor !

Markets Overview

First of all, a very happy Dussehra to you and your family. I hope this festive season brings you great joy, good health, and immense wealth.

This week, the markets were somewhat in a limbo, with no significant trends forming. Nifty remained largely flat, with some fluctuations throughout the week. The initial days saw a decline, followed by a rise, and then a dip again. It seems like the market is attempting to consolidate. The trend we witnessed in the previous week appears to be broken, but it’s uncertain whether we will see a continuation or if the market will stabilize and move upward. The 24,700 level, which was the bottom for this week, holds significance going forward.

When viewed on a weekly timeframe, the market (Nifty 50) remains in the same trend zone that has persisted since March 2023, marking nearly 18 months of upward movement from 17,000 to 25,000. The key levels to watch include the 24,000 bottom hit in August and the major bottom reached on the election outcome day. These levels will be pivotal for the market’s direction. If breached, the market may seek either the August low or the top of the election day, both of which are significant.

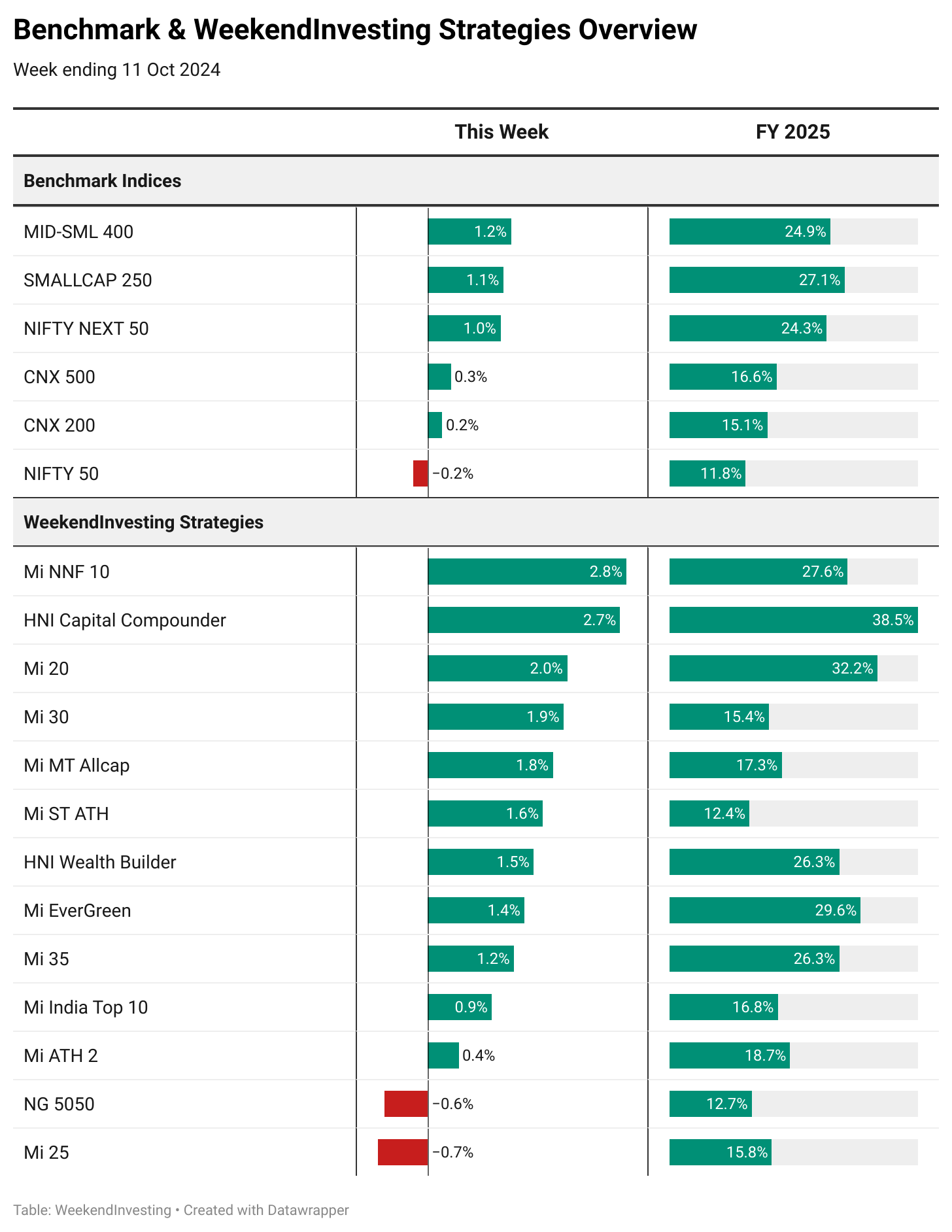

Benchmark Indices & WeekendInvesting Strategies Overview

Nifty declined by 0.2%, CNX 200 rose by 0.2%, and CNX 500 increased by 0.3%, indicating that large caps, mid caps, and larger small caps didn’t move much this week. However, Nifty Next 50 rose by 1%, the Smallcap 250 index by 1.1%, and the Mid and Smallcap index by 1.2%. Higher beta stocks performed better, and the financial year numbers for these indices look strong. Interestingly, the Nifty Next 50 continues to behave uniquely, with 24.3% gains in FY25 compared to Nifty’s 11.8%, despite it being composed of large caps.

This week, Mi NNF 10 had an outstanding performance, rising by 2.8%, and HNI Capital Compounder led with a 38.5% gain for FY25. Mi 20 was up 2%, Mi 30 up 1.9%, and Mi ATH 2 recorded a 0.4% gain. Mi India Top 10 also performed well, increasing by 0.9% and now showing a 16.8% gain in FY25 compared to Nifty’s 11.8%. However, Mi 25 experienced a slight decline of 0.7% this week.

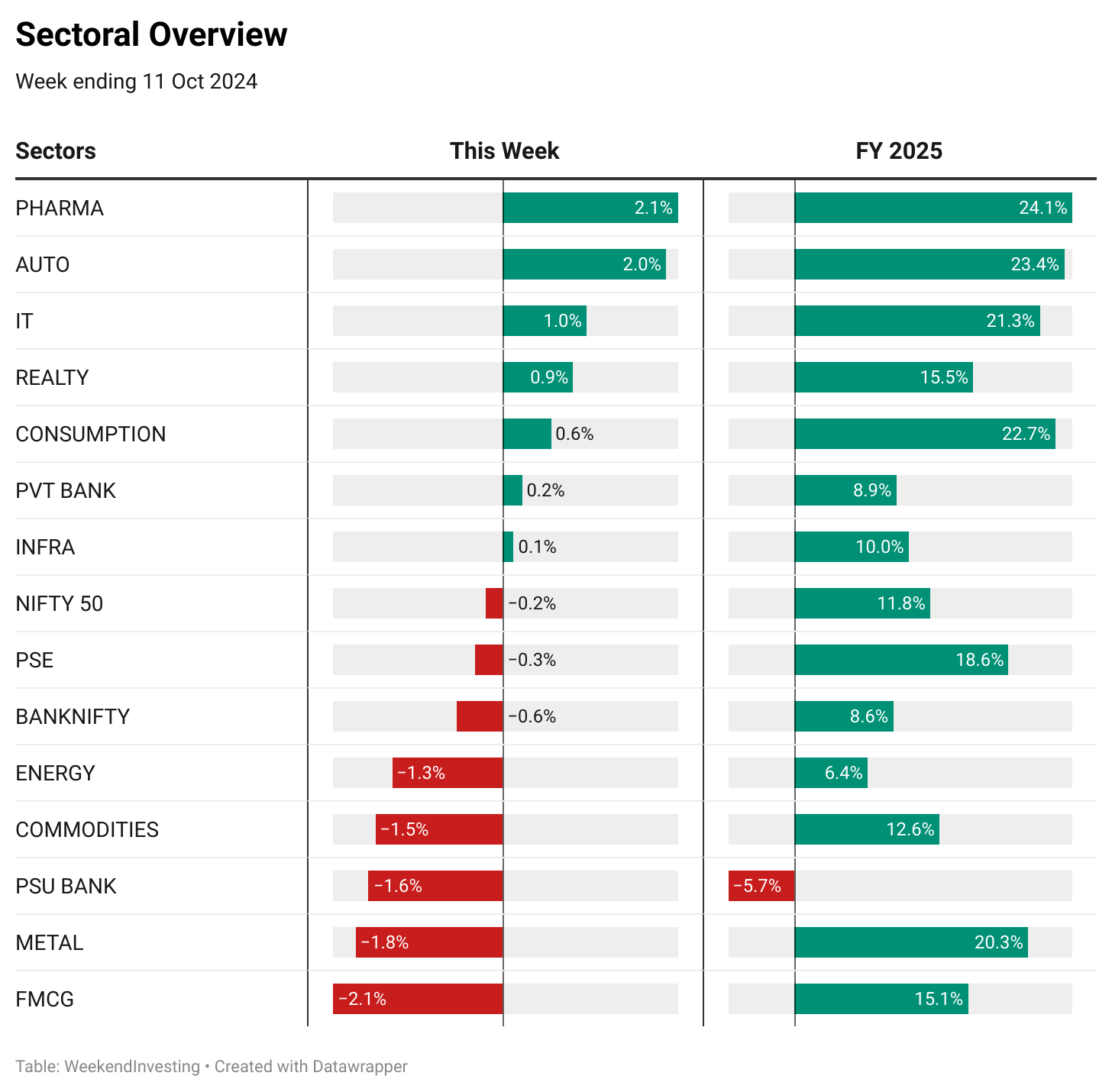

Sectoral Overview

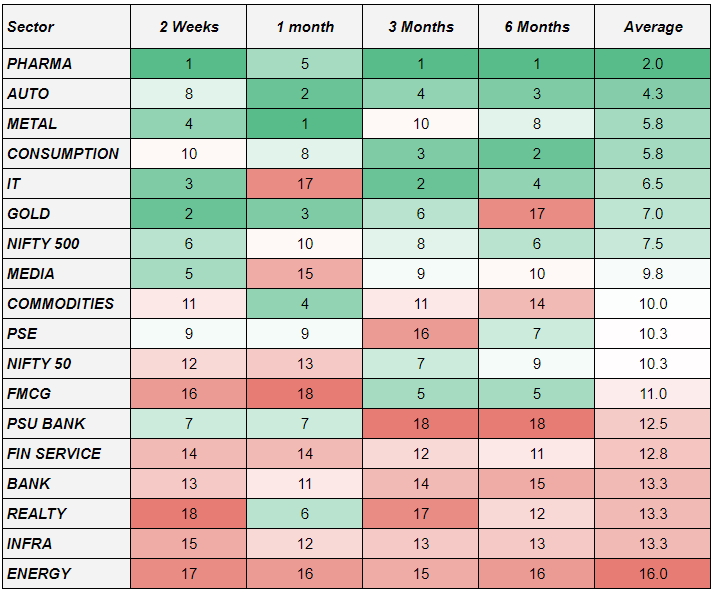

Looking at the sectoral overview, pharma and autos took the lead, with gains of 2.1% and 2%, respectively. On the other hand, FMCG, metals, PSU banks, and commodities were the laggards, showing losses. The market seemed divided across sectors without a clear trend. In the short term, pharma moved from the fifth to the top position, securing the leadership spot in sectoral momentum.

Sectors like pharma, autos, metals, and consumption are currently leading, making them good areas for discretionary trades. However, autos and consumption stocks are losing steam, while IT and media stocks are picking up momentum. Gold has also made a notable rise.

Spotlight - Mi MT Allcap

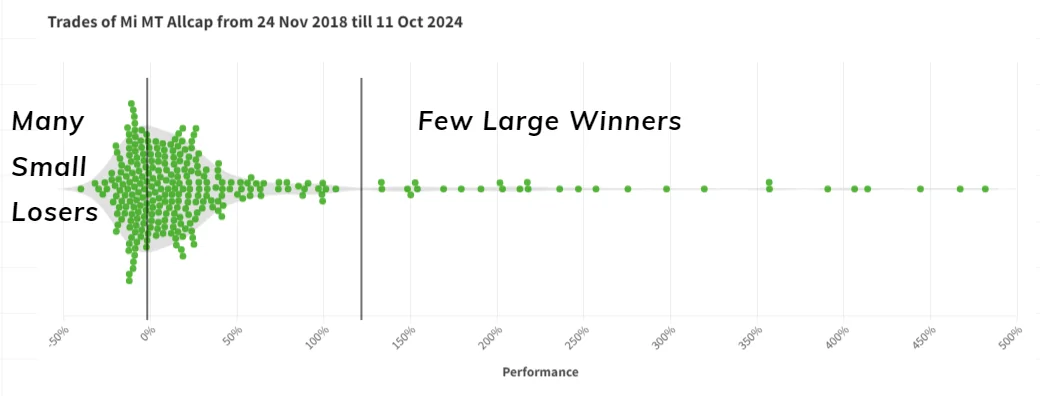

Mi MT Allcap – All Trades since Launch

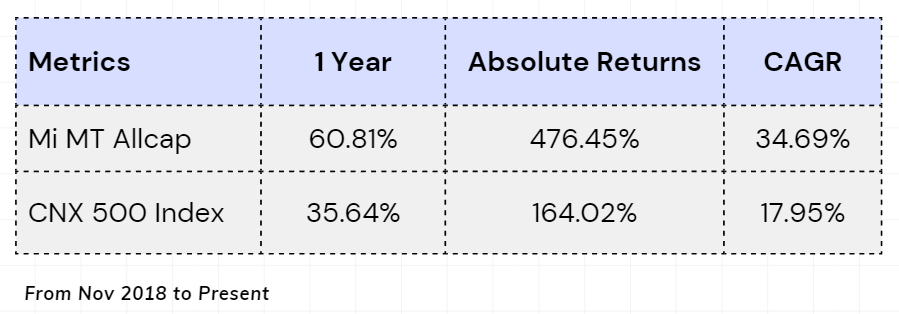

In the WeekendInvesting Strategy Spotlight, the focus is on Mi MT Allcap. As it approaches its sixth anniversary, an analysis of its transactions since launch reveals a distribution typical of momentum strategies, with many small losers and a few big winners. While there are a significant number of trades with small losses, the real performance driver is the few large winners.

Outliers in the range of 40% to 481% gains have contributed to the strategy’s success. To benefit from this strategy, one must stay invested for several years to allow the winners to emerge. The key to momentum investing is having equal or fewer winners compared to losers but ensuring that the winners provide much larger gains than the losses incurred by the losers.

Since its inception, Mi MT Allcap has maintained a win rate of 54%, with average gains of 63% per winning trade, while the average loss per losing trade is just 11%. This “momentum casino math” may give the impression of frequent losses, but the larger wins more than make up for it. The strategy has delivered exceptional absolute returns, and even though there may be periods of underperformance, it requires a long-term outlook of five years or more.

The strategy focuses on companies with a market cap of over 1,000 crores, holding a maximum of 20 stocks. It is also designed to go to cash when necessary during downturns.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply