- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 12 Jul 2024

Good, Bad & Ugly Weekly Review : 12 Jul 2024

Markets go past 24500 as budget nears . . .

Edition : 12 Jul 2024

Hello, Investor !

Markets Overview

This week saw the markets continuing their upward trend, driven by various sectors participating in the bull rally. With less than two weeks until the Union budget, the market environment remains calm, without significant global influences. The Nifty index was mostly flat throughout the week, maintaining its position near last Friday’s closing level. However, a substantial upward move on Friday has positioned the Nifty back on its path to a new all-time high.

The weekly trend for Nifty has been consistently positive for several weeks, continuing the momentum that began in November. Despite the possibility of a sell-off or a corrective phase around the budget announcement, the current major trend, which started in March 2023, shows no signs of reversing. Over this period, Nifty has climbed from 17,000 to 24,000, marking an impressive 40% gain in a year and a quarter. Although the market may appear slightly overbought, the prevailing trend remains strong.

Benchmark Indices & WeekendInvesting Strategies Overview

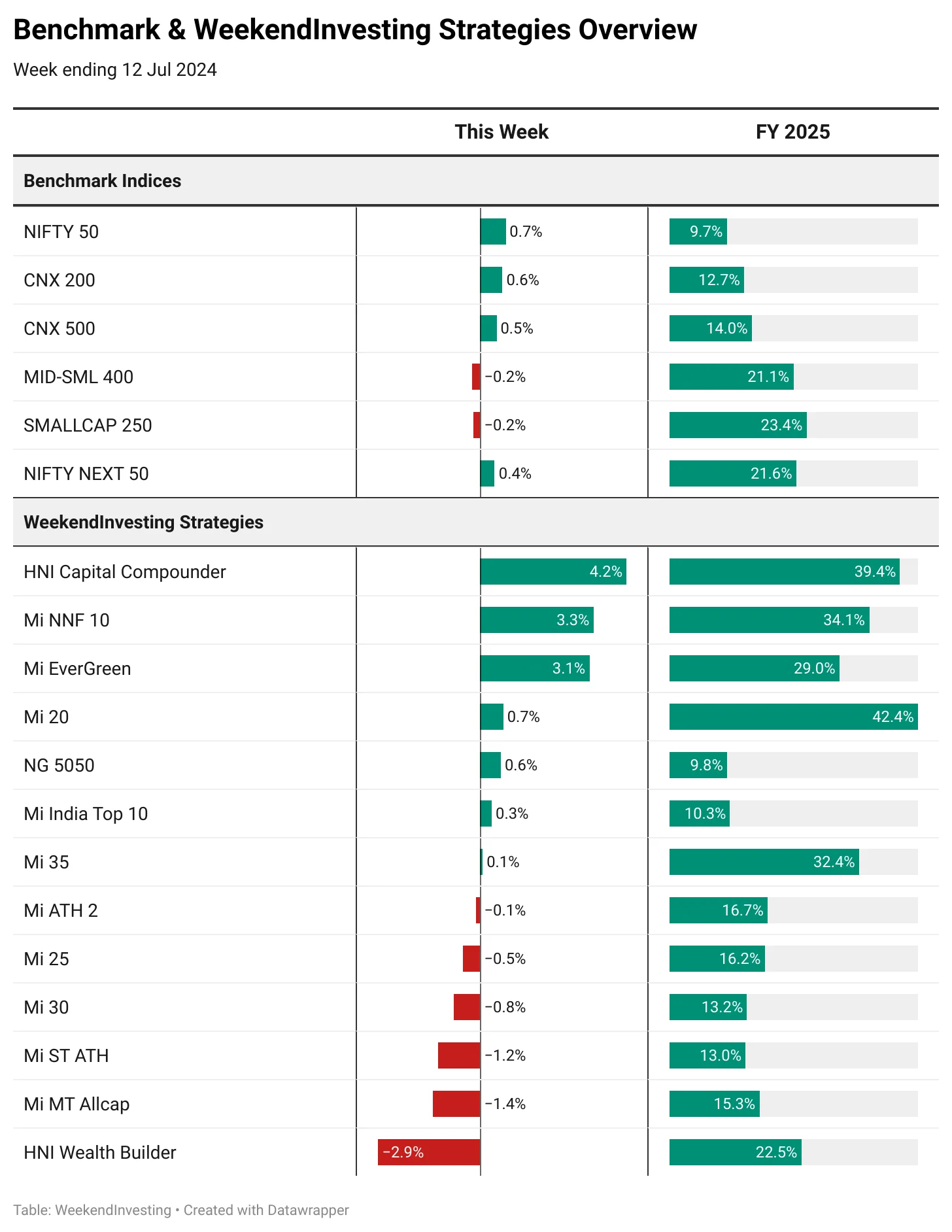

This week, the benchmarks showed modest gains, with Nifty 50 increasing by 0.7% and CNX 200 by 0.6%. The CNX 500 remained flat, while the mid and small-cap indices didn’t move. The Nifty Next 50 gained 0.4%. Despite the muted performance this week, the fiscal year 2025 has been strong overall. Small caps have surged by 23.4%, and mid-small 400 by 21%. The Nifty Next 50, which includes large caps beyond the top 50 stocks, has achieved a 21.6% gain for FY 25, indicating robust performance across these segments.

Within the WeekendInvesting strategies, the HNI Capital Compounder was the standout performer this week, gaining 4.2% and reaching 39.4% for FY 25. Mi NNF 10 followed closely, up 3.3% this week and 34% for the fiscal year. Mi Evergreen also did well, rising 3.1% this week and 29% for FY 25. Mi 20 aligned with the benchmark at 0.7% this week but achieved a remarkable 42% for the fiscal year. Mi India Top 10 slightly lagged behind Nifty, gaining 0.3% this week and 10.3% for FY 25. Mi 35 remained flat this week but has grown 32% for FY 25. Mi ATH 2 was flat, while Mi ST ATH fell by 1.2%, still up 13% for the year. Mi MT Allcap dropped 1.4%, up 15% for the fiscal year. HNI Wealth Builder experienced the largest decline, losing 2.9% this week but achieving 22.5% for FY 25.

Sectoral Overview

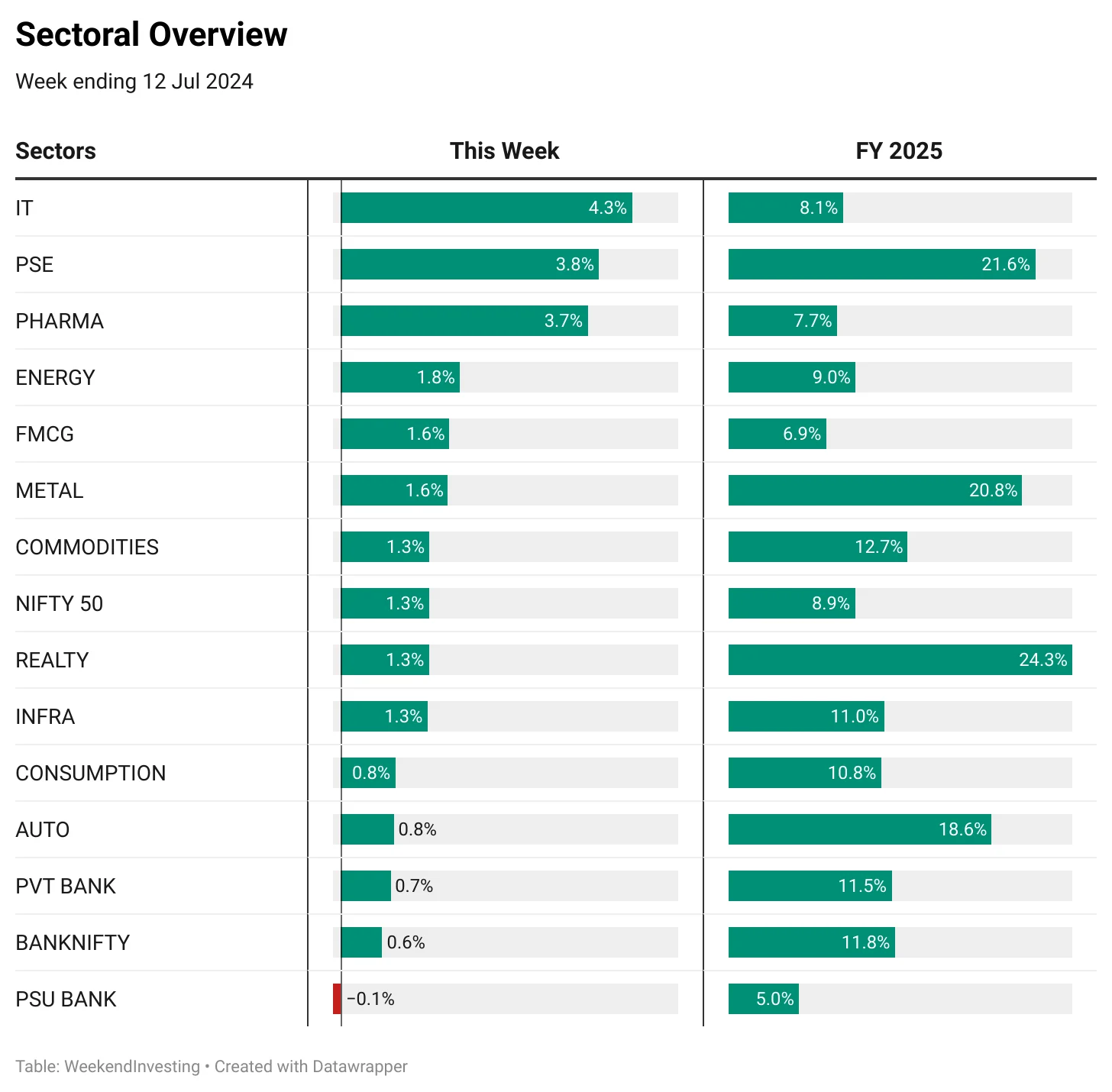

In terms of sector performance, the IT sector was the standout, particularly after the TCS results, soaring 4.3% this week but only up 8% for FY 25. Public sector enterprise stocks gained 3.8%, and pharma stocks rose 3.7% this week. Other sectors saw gains ranging from 1.8% to 0.5%, with autos up 0.8% and private banks up 0.7%. PSU banks were the only sector losing ground. Overall, sector advances remain robust and consistent with previous weeks, indicating a strong and steadily progressing market across various sectors, though some are advancing faster than others.

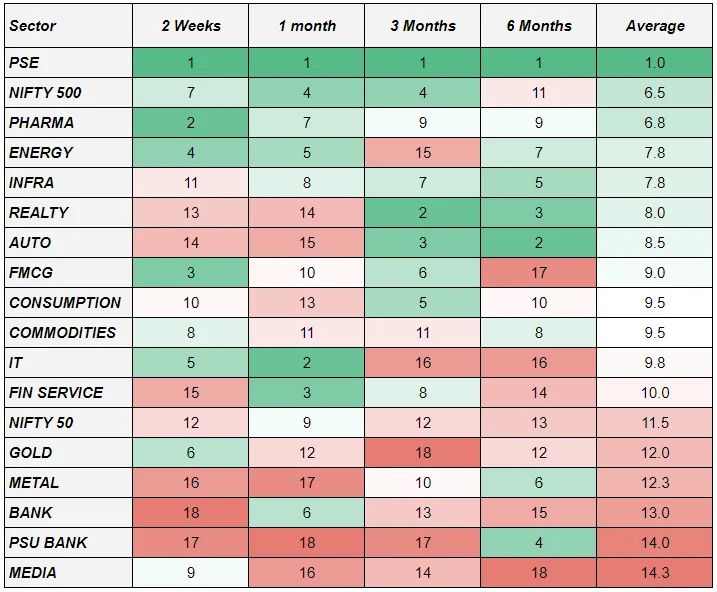

In the very short term, sectoral momentum remained with public sector enterprise stocks and pharma stocks. FMCG and energy sectors showed recovery, and gold also made gains. The Nifty 500 segment lost some ground. Over the long term, public sector enterprise stocks have consistently performed the best across various time frames, followed by pharma stocks and energy stocks, which gained 7.8%. There’s noticeable churn, with IT stocks making a strong comeback over the past month and two weeks after lagging in the previous three and six months. Conversely, banking names, which had performed well recently, experienced a slowdown and dropped to a lower position.

Spotlight !

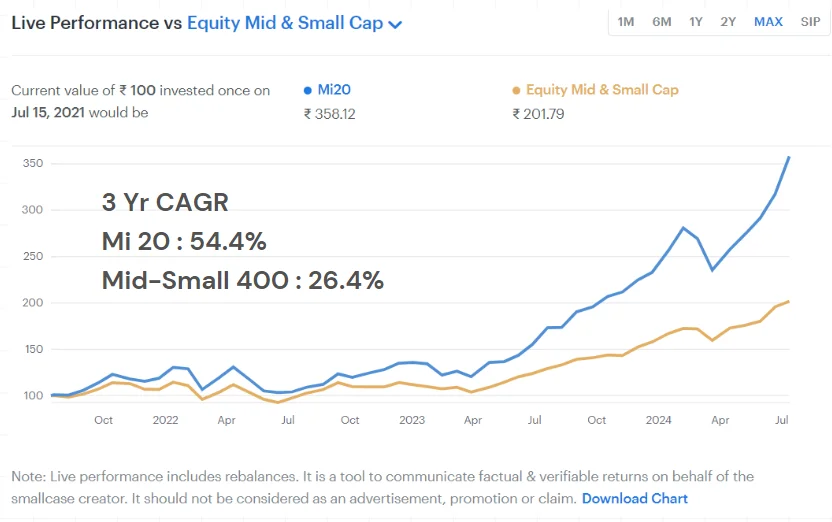

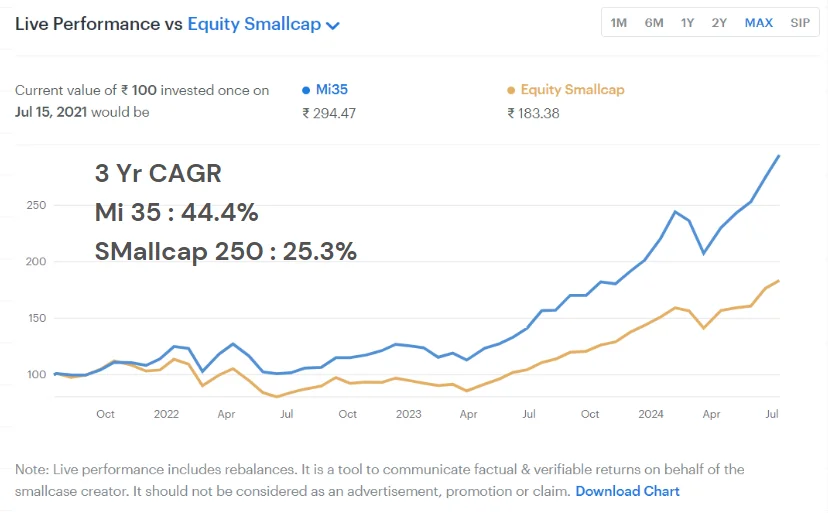

We are thrilled to announce that Mi 20 and Mi 35 have completed three years on the smallcase platform. Mi 20, a mid and small cap strategy, and Mi 35, a pure small cap strategy, have shown exceptional performance.

Over the three-year period, Mi 20 achieved a 54% CAGR compared to the mid and small cap index’s 26.4%, demonstrating robust performance. Similarly, Mi 35 recorded a 44% CAGR, significantly outperforming the small cap 250’s 25.3%. This anniversary week marks a milestone for these strategies, and we will be making a special announcement soon. If you haven’t yet utilized these strategies, this might be a great opportunity to consider them.

Special Announcement coming tomorrow (14 Jul 2024). Please stay tuned !

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply