- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 13 Sep 2024

Good, Bad & Ugly Weekly Review : 13 Sep 2024

Edition : 13 Sep 2024

Hello, Investor !

Markets Overview

What a week this was! At the start of the week, it felt dull and gloomy, but by the end, the markets had perked up to a new all-time high, not just in equities but also in precious metals. Suddenly, the entire world has pivoted on the expectation that interest rates are coming down. The EU has already cut rates twice, and there’s talk of a 50 basis points cut from the Fed in the coming week. Whether it’s 50 or 25 basis points, the probability is gradually shifting toward 50.

India is yet to announce any interest rate cuts, but I think it’s time for them to at least signal that cuts are on the way. India is in a favorable position right now: oil prices are down to multi-year lows, yet at the pumps in India, prices haven’t dropped. Similarly, the interest rate yields on Indian ten-year bonds have fallen dramatically, but banks haven’t reduced interest rates on home or auto loans.

Additionally, despite GST collections increasing every month, the average GST rate hasn’t come down. Taxation remains a situation where the benefits aren’t trickling down to boost consumption. In good times, more disposable income isn’t being allowed, which might hurt consumption during a downtrend when liquidity becomes scarce. The government will then be forced to do deficit spending to get the economy going.

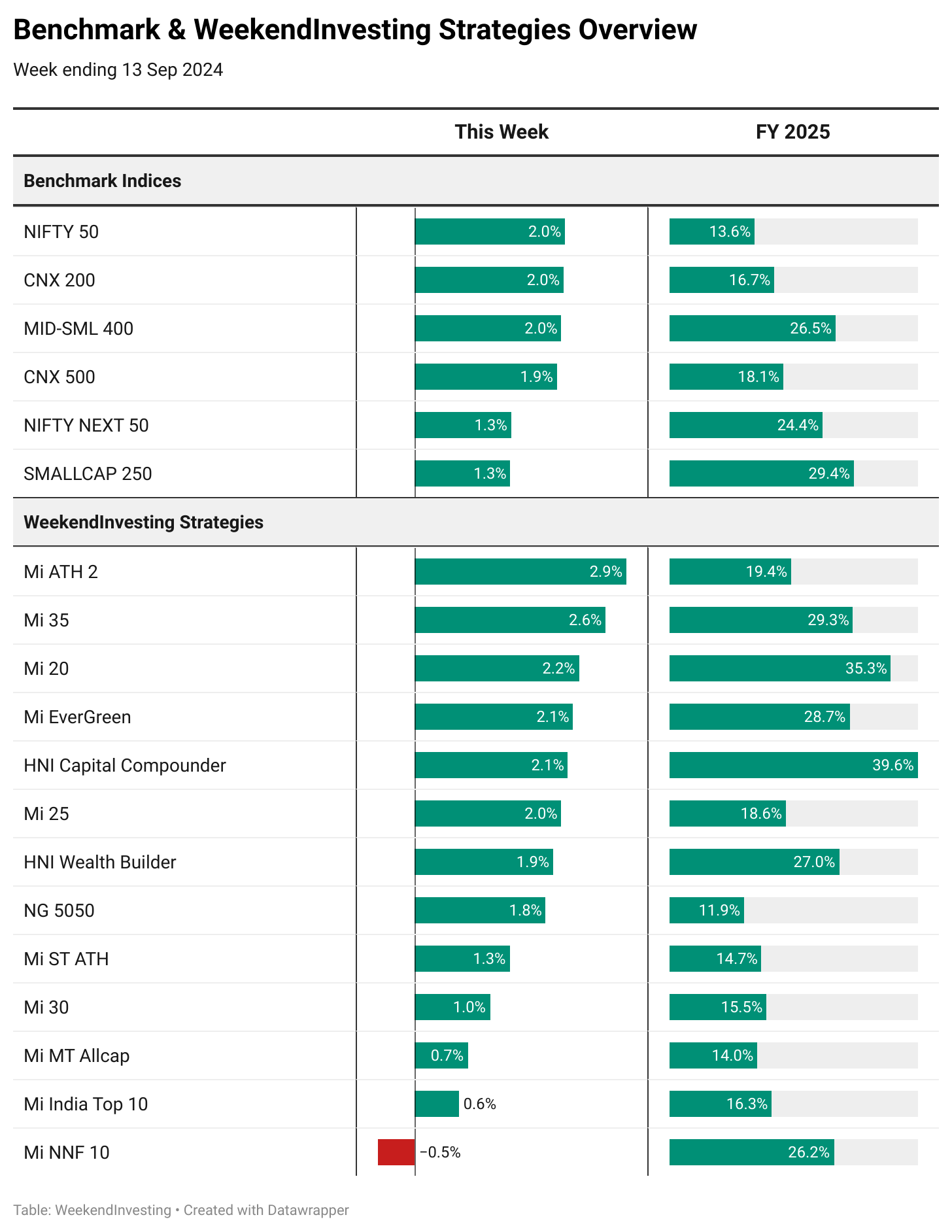

Benchmark Indices & WeekendInvesting Strategies Overview

Across the indices, there was a 2% gain, with Nifty, Nifty Next 50 and Smallcap 250 slightly behind. As for the WeekendInvesting strategies, many were in line with gains ranging from 2.9% to 1%. Mi NNF 10, however, lost 0.5% this week, but despite that, it remains on track for FY25, still beating the benchmark on a yearly basis.

There will always be times when certain strategies underperform, even for an entire year, but patience is crucial. For instance, during a market rally, stocks with fantastic momentum may outperform, and then during a downtrend, they may fall faster than the broader market. The initial phase of a downtrend can result in higher losses, but as the market turns back up, a churn happens where the weaker stocks are weeded out and new winners are brought in. Over the long term, this process helps the strategy come together. Over the last eight years, we’ve seen all kinds of markets, from heady rallies to COVID crashes and sideways markets. If you’ve been with WeekendInvesting for a while, you’ve likely observed that sooner or later, the strategy realigns and delivers as expected.

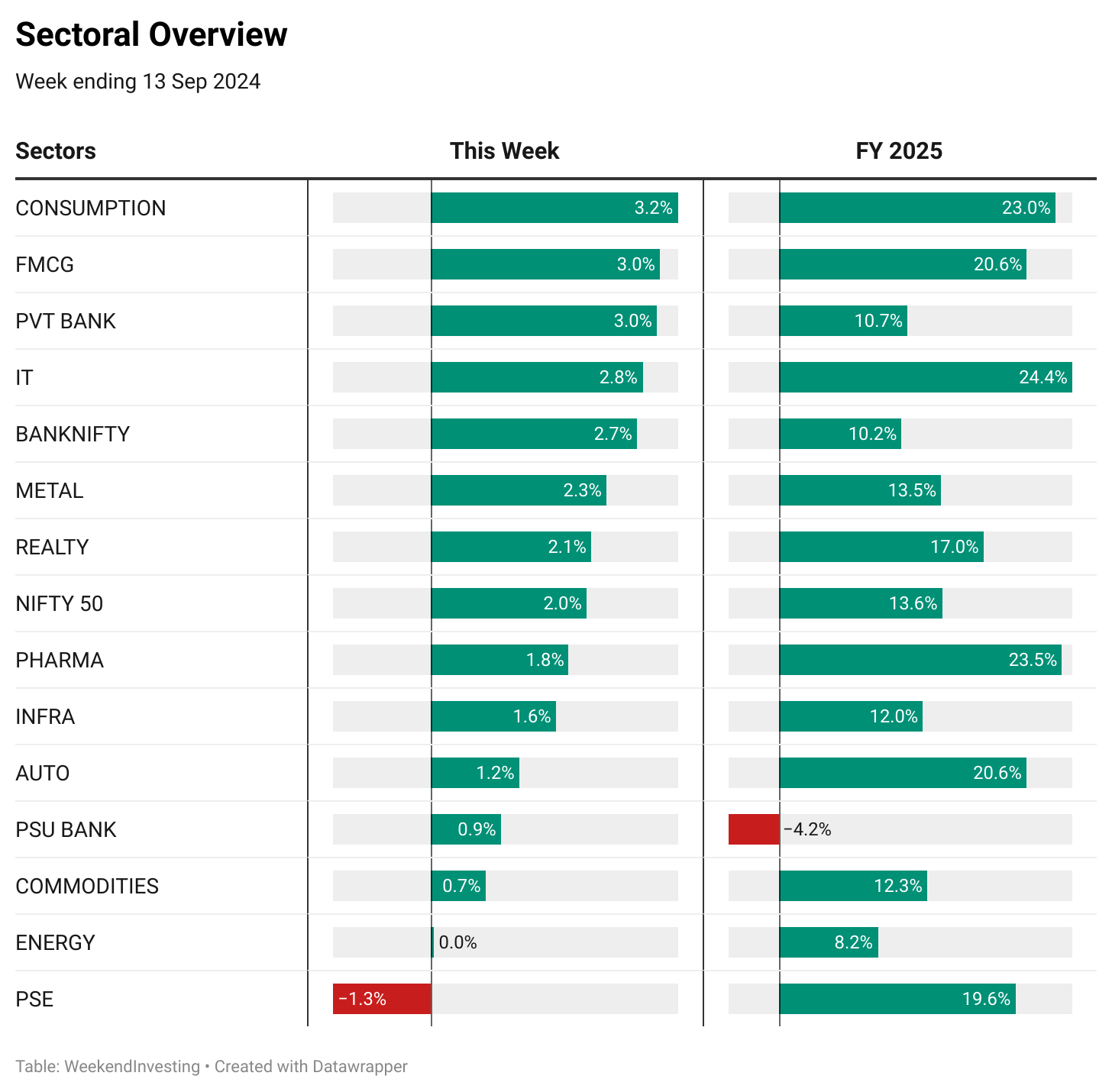

Sectoral Overview

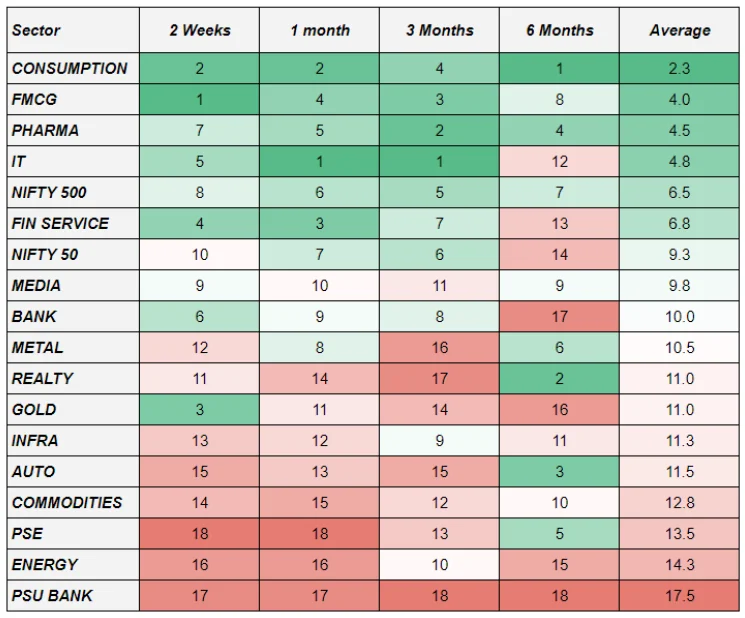

Consumption stocks led the pack with a 3.2% gain, followed by FMCG and private banks, each gaining around 3%. IT stocks were up 2.8%. Most of these sectors, except for private banks, are more defensive in nature. Towards the end of the week, metals and real estate made a comeback along with autos. On the other hand, PSU banks and public sector enterprise stocks faced continued pressure. As a result, many strategies are now rotating out of these sectors and into pharma, metals, and FMCG.

In terms of sectoral momentum ranking, consumption, FMCG, and pharma are at the top, while PSU banks, PSE, and energy are at the bottom. This shift in momentum is happening both in the short term and across longer frequencies, highlighting the sector rotation in play. Even over a three-month basis, the top sectors remain consistent, with financial services also picking up momentum.

Spotlight - Mi India Top 10

Bajaj Auto – A break out stock

Bajaj Auto is in the spotlight this week due to a major breakout that has seen the stock nearly triple in value. Despite being a slow mover over the years, it took off in a major way, moving from Rs 4000 to almost Rs 12,000. This highlights the importance of staying unbiased toward any stock, focusing solely on the strategy, and allowing winners to run their course. A few large gainers, like Bajaj Auto, can make up for underperforming stocks in a portfolio.

Mi Evergreen is a well-loved strategy, known for its conservative approach. The stock universe comprises the top 200 stocks, with a slower churn as the portfolio is reviewed only once a month. A fixed allocation to a gold ETF provides stability during market volatility. The strategy allows winners to run and resets to equal weight each month, making it an excellent core portfolio. The portfolio includes large-cap stocks (the top 100) and mid-cap stocks (101st to 200th positions).

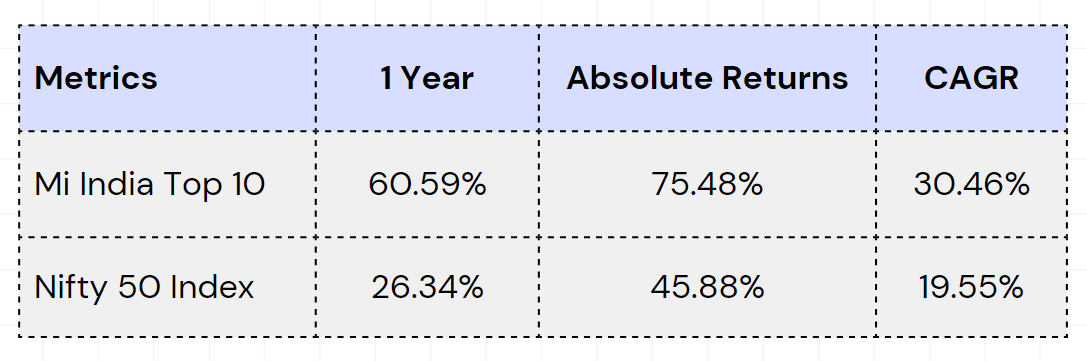

Mi India Top 10 gained 60% last year, compared to the Nifty’s 26%. Since going live, it has outperformed by nearly 30 points. The strategy focuses on extracting strength from the Nifty, investing only in the strongest components. This approach is ideal for investors who want to move beyond index investing without adding unnecessary risk. Unlike holding the entire Nifty 50, which may include underperformers like Yes Bank, these strategies allow you to avoid laggards and focus on the strongest performers.

Nifty 50 is the universe for Mi India Top 10, with ten stocks and a monthly rebalance. The outlook for this strategy, as with any long-term strategy, should be at least four to five years. That’s the underlying theme for long-term investing with any of these strategies.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply