- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 28 Feb 2025

Good, Bad & Ugly Weekly Review : 28 Feb 2025

Markets in a complete Free Fall !

Edition : 28 Feb 2025

Hello, Investor !

Markets Overview

This past week has been one that investors would prefer to forget quickly. The month as a whole has also been challenging, as reflected in the data. Nifty is in a state of free fall. At the start of the week, it seemed as if Nifty might hold its ground near the 22,800–22,700 range, where it had been hovering. However, that level eventually broke, and the market has been plunging ever since, now well below both the 200 DMA and 50 DMA.

The June low from election day, around 21,300, is still far away. Given the rapid decline from 23,800 to 22,100—almost 1,700 points without any counter move—it is clear that the market is overdue for a bounce. However, the same was expected earlier, and it never materialized. Predicting where the bottom will form is difficult. This selloff has the characteristics of capitulation, and we may even see another large red candle before a turnaround. Regardless, we are nearing an intermediate bottom, and this extended phase of the downtrend seems increasingly overdue for a reversal.

Nifty – Weekly Perspective

Looking at the broader picture, Nifty has essentially wiped out all gains for 2024, making this a lost year for the index so far. While Nifty itself appears stagnant on a one-year horizon, deeper within the market, the damage has been severe.

The Nifty weekly chart has now entered a zone of consolidation similar to what was seen between February and May 2024. It is reasonable to expect that this zone will act as support again, though pinpointing the exact level is difficult. Still, a bottom—at least an intermediate one—is likely to emerge within this range.

S&P 500 Overview

The S&P 500, after a brief pullback, managed a recovery and ended the week down just 0.97%. Since November, the index has flattened, despite the initial rally fueled by the expectation of President Trump’s return. The past three months have been stagnant for the US market, signaling that much of the optimism about the new administration was already priced in.

Even at current levels, the US market is considered highly overvalued based on historical valuation metrics. However, the sheer volume of capital inflows into the US has overridden traditional valuation concerns.

GOLD Overview

Gold, which had been on a relentless upward march, saw a 1.69% decline this week in rupee terms. The price, which had climbed to nearly ₹87,000 per 10 grams, has now corrected to around ₹85,000. This pullback was expected after such a sharp rally. If the correction deepens, a retracement to around ₹70,000 would not be surprising, considering gold has surged nearly 60% since October–November 2023. A one-third retracement of that move would be a natural technical development.

Dollar Index Overview

The dollar index remains firm, rising another 0.87% this week. A strengthening dollar puts further pressure on foreign funds to move back to US markets, as higher yields make US assets more attractive. Despite the new US administration’s desire for a weaker dollar, it remains unclear how they intend to achieve that goal.

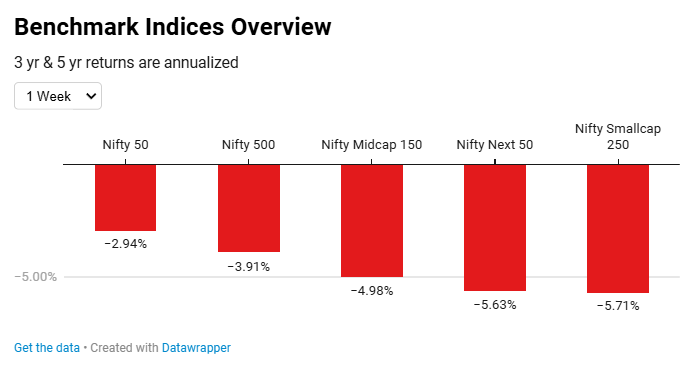

Benchmark Indices Overview

Benchmark indices had a brutal week. Small caps suffered a 5.7% decline, while Nifty Next 50, surprisingly, behaved more like a small-cap index, displaying unusual volatility registering 5.6% loss. Mid caps lost 5%, showing no real differentiation from other market segments. Large caps were not spared either, with Nifty Next 50 down 6.3%, mid caps down 6.3%, and small caps down 8.5% over the past month.

Nifty 50, though relatively better, still dropped 3.6%, while Nifty 500 fell 5%. Over the past year, mid caps have now posted flat returns, while Nifty 50 is marginally positive at 0.7%. Small caps, however, are down 7%. The real picture for portfolios is much worse than the indices suggest, as most individual stocks have corrected far more than their respective indices reflect. This is why relying solely on index performance can sometimes create a misleading perception of the overall market.

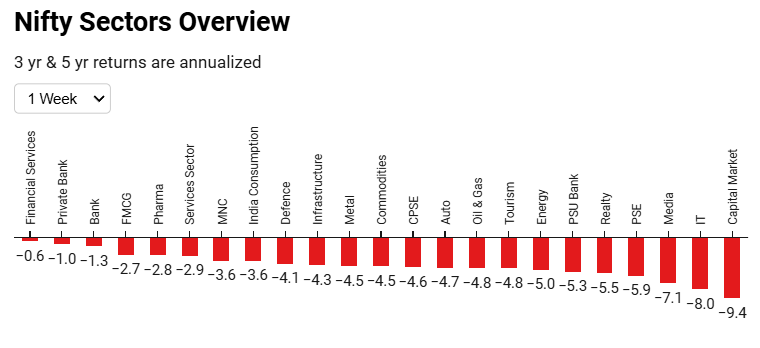

Sectoral Overview

This week, capital market stocks, led by BSE Ltd., collapsed. The stock plummeted from ₹6,000 to ₹4,600 in a short span. IT stocks also faced a sharp selloff, with TCS, Infosys, and Wipro declining by around 8% within the week. Investors are jittery about potential changes to H1B visa policies under President Trump, given the heavy reliance of Indian IT companies on US work visas. This has created an atmosphere of extreme uncertainty. Public sector enterprise stocks, real estate, PSU banks, and energy stocks were all hit hard, declining between 5% and 6%.

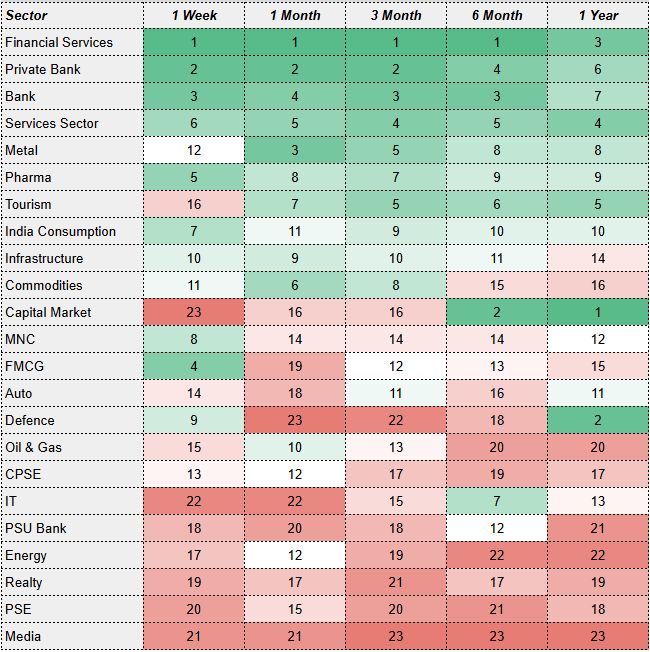

The one notable trend that has persisted throughout this correction is that banking stocks have not fallen as much as the broader market. Over the past month and three months, banks—especially private banks—have shown relative resilience. Even over the past year, PSU banks have suffered, but overall, the banking sector has posted a 5% gain. Private banks have matched that performance with a 5.2% increase. Banking has emerged as a defensive play amid the market-wide rout.

In the sectoral momentum score overview, which ranks sectors based on one-week, one-month, three-month, six-month, and one-year performance, banking and financial services have remained relatively strong. While PSU banks are struggling, private banks and financial services stocks, including Bajaj Finance, continue to display relative strength. The services sector and metals are also holding up better than others, while pharma remains in the mix. However, this strength is relative—everything may be bleeding, but some sectors are simply outperforming others in terms of lesser losses.

Capital markets, which had been doing exceptionally well, have suddenly collapsed, as has IT, which was holding up until recently. Defense stocks seem to have stabilized in the last few sessions, and FMCG appears to be finding some footing. The shift from weaker sector rankings to stronger ones on a short-term basis suggests that some sectors are beginning to stabilize or stage a potential comeback.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply