- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 07 Mar 2025

Good, Bad & Ugly Weekly Review : 07 Mar 2025

Unlikely to see negative returns in Mar 2025 ?

Edition : 07 Mar 2025

Hello, Investor !

Markets Overview

Historically, when Nifty spends an extended period within a particular range, such as the first half of 2024 when it hovered between 22,000 and 22,800, those levels tend to act as strong support zones. The market typically does not break such levels easily without multiple tests and retests. Even in earlier declines, a brief pause was observed before further corrections.

Given that five consecutive months have been negative, March was likely to break the streak. It is extremely rare for six straight months to be negative. The first week of March has already posted gains, and the hope is that the remaining three weeks will follow suit. While some liquidity may be drained due to advance tax payments, the RBI’s liquidity measures could offset this. Additionally, investors seem to be finding current levels attractive, encouraging buying activity.

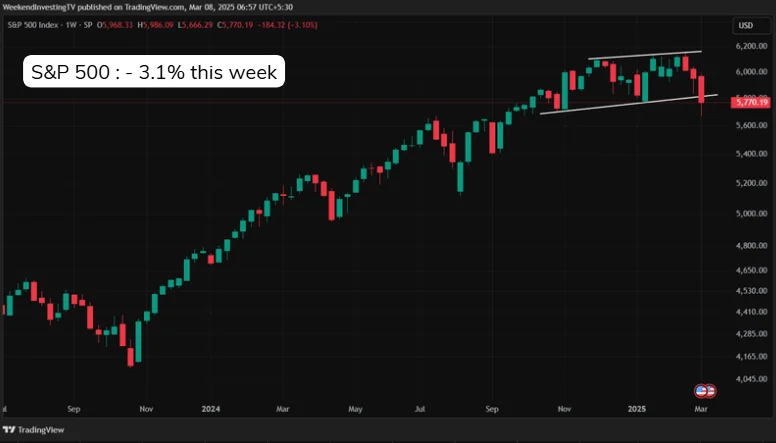

S&P 500 Overview

A significant development this week has been the S&P 500’s decline of 3.1%. This is a major shift. Looking at the trend, the point at which the Indian markets began their downtrend coincided with the confirmation of Trump’s return to office. Similarly, the US markets have now erased all their post-Trump rally gains. Despite the US market appearing stable, all the price movements that resulted from Trump’s anticipated presidency have been nullified. Several Trump-related trades have also reversed.

The dollar index, which had surged on his return, has now weakened. Tesla, which had spiked from $350 to $500, has dropped below $300. Even Bitcoin, which had surged from $85,000 to $109,000, has retraced to $86,000–$87,000. The initial market expectations from the Trump presidency have now been adjusted, and even the White House appears to be reassessing its decisions. Many executive orders are being reconsidered, postponed, or rolled back due to concerns over inflation and supply chain disruptions. The uncertainty surrounding US policies could finally slow the one-way capital inflows into the US, benefiting emerging markets in the process.

GOLD Overview

Gold in rupee terms had another strong week, rising by 1.39% and closing at ₹86,000 per 10 grams—virtually at an all-time high. The trend in gold remains exceptionally strong. Investors should consider gold as a long-term allocation within their portfolio rather than just a short-term trade. A strategic allocation to gold can help smooth out portfolio volatility and provide stability in times of uncertainty.

Dollar Index Overview

The dollar index has been declining sharply, which is a positive development for emerging markets, including India. While it has not yet returned to its September levels, the rapid fall is a good sign. A continued decline in the dollar index would ease foreign fund outflows from India and reduce pressure on the rupee.

Benchmark Indices Overview

In terms of benchmark indices, small caps led the gains this week, with Nifty Small Cap 250 rising 5.5%. Nifty Next 50, which has been behaving more like a small-cap index this year, gained 4.9%, while mid caps rose 3%. Nifty 500 was up 2.8%, and Nifty 50 posted a 1.93% gain. These are solid numbers for a single week.

However, looking at the past three months, small caps are still down 20.3%, while Nifty has lost 8.6%. The six-month performance remains weak, with Nifty Next 50 down 20%. Over the past year, indices are just about breaking even—Nifty is flat, Nifty 500 is also flat, mid caps are up 1.64%, and small caps are slightly negative. While the recent rebound is encouraging, the damage done over the past six months has been significant.

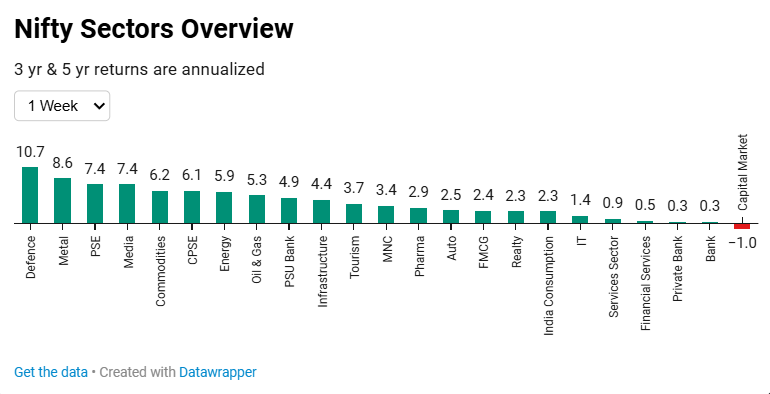

Sectoral Overview

In the sectoral overview, the defense sector led the market this week with a 10.7% gain, followed by metals at 8.6% and public sector enterprises at 7.4%. Media stocks gained 7%, commodities were up 6%, and central public enterprises rose 6.1%. Energy, oil and gas, and PSU banks all saw gains of 5%–10%. On the other hand, autos and FMCG had a more muted performance, up just 2.5% and 2.4%, respectively.

IT stocks remained sluggish, rising only 1.4%. Capital markets continued to decline, signaling that for the broader market to make a strong comeback, capital market stocks would need to recover first. Meanwhile, banking stocks appear to have gone into consolidation mode. They are neither moving up nor down significantly, which is notable given their heavy weight in the index. This stability in banking stocks is helping to counterbalance volatility in the broader market.

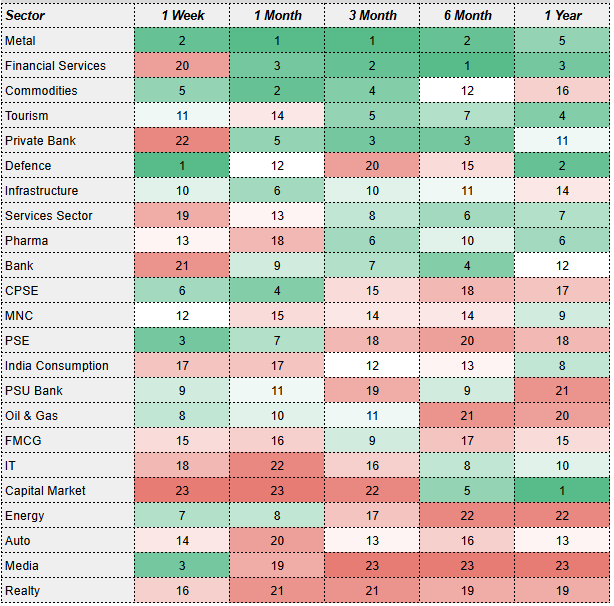

From a sectoral momentum perspective, metals have now taken the top spot across different timeframes. Financial services, which were leading previously, have dropped slightly in the short term but remain strong over longer periods. Commodities have staged a strong comeback, while tourism stocks have weakened. Private banks have started to slip, though defense stocks rebounded this week after a period of underperformance.

Public sector enterprises, both PSEs and CPSEs, along with energy stocks, are showing signs of recovery after being battered over the past few months. These shifts in momentum rankings provide valuable insights into sectoral strength and rotation, helping investors identify potential opportunities in changing market conditions.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply