- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 14 Jun 2024

Good, Bad & Ugly Weekly Review : 14 Jun 2024

Edition : 14 Jun 2024

Hello, Investor !

Markets Overview

This week was notably calm compared to the previous week’s extreme volatility driven by election results and exit polls. The market exhibited a consistent pattern of daily gap-ups followed by evening sell-offs. Despite this repetitive behavior, the market managed a steady upward movement, gaining just under 200 points over the week.

Last week, we witnessed an exceptionally unusual weekly candlestick pattern, where the market’s low point dipped to levels seen several months prior, but then closed at a high. This week, the market closed above that previous high, marking a new all-time high on a weekly close. This is a very bullish indicator. Typically, if a highly volatile candle is followed by a candle that exceeds its extremes, it suggests a strong trend in that direction. Despite the individual daily moves not being highly volatile this week, the overall trend remains very strong.

Benchmark Indices & WeekendInvesting Strategies Overview

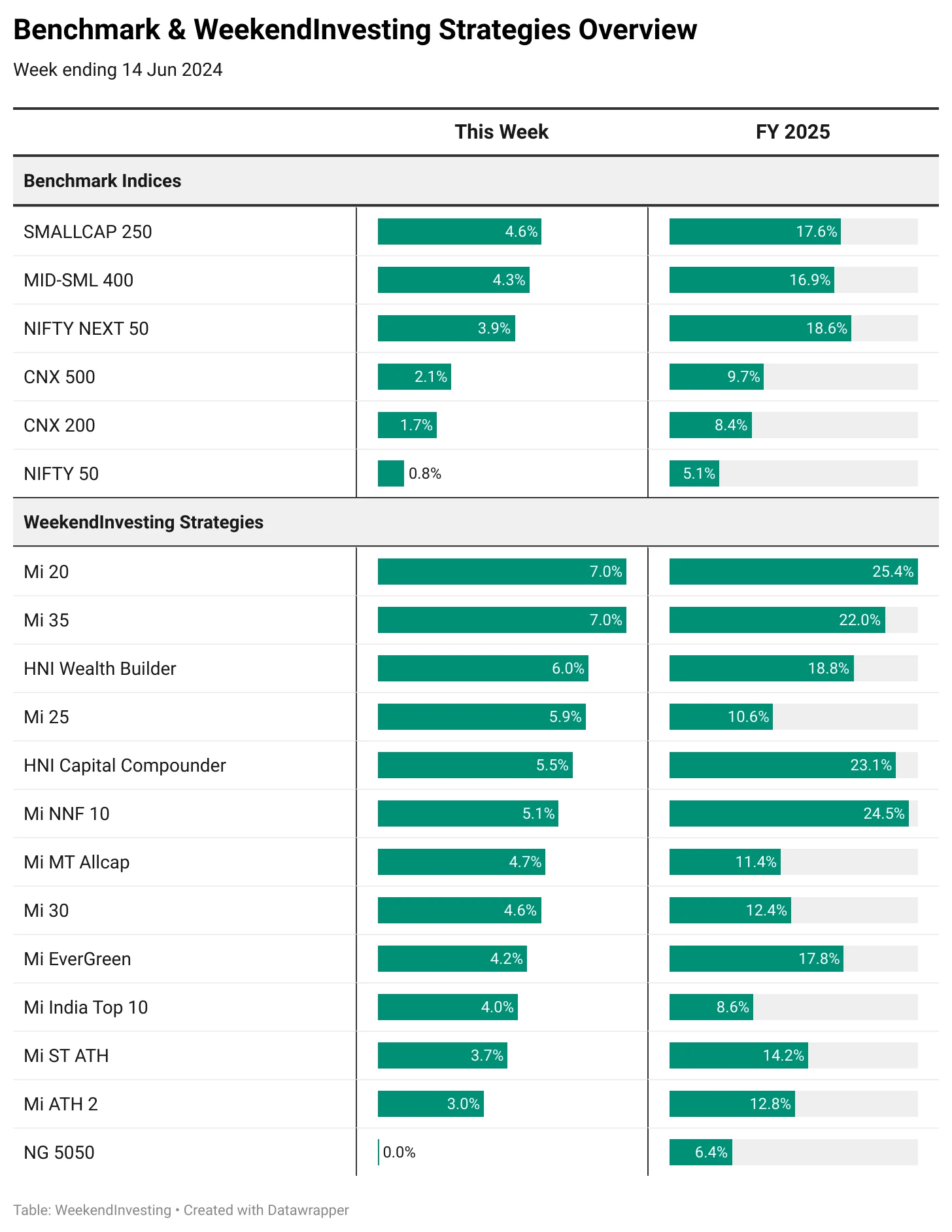

This week, Nifty showed a gradual increase, rising by 0.8%. The CNX 200 and CNX 500 gained 1.7% & 2.1% respectively, while the Nifty Next 50, a favored index, rose by 3.9% this week and is up 18% for FY 25, despite being early in the first quarter. The mid and small-cap indices performed strongly, with the mid-cap index up 4.3% and the small-cap index up 4.6%, contributing to a 16.9% & 17.6% increase so far in FY 25 respectively.

Weekend investing strategies performed strongly this week, particularly in small and mid-cap segments.

Mi 20: Focused on mid & small caps, up 7% this week, totaling 25.4% for FY 25.

Mi 35: Concentrates on small caps, also up 7% this week, achieving 22% for FY 25.

HNI Wealth Builder: A highly diversified strategy with up to 50 stocks, up 6% this week and 18.8% for FY 25.

HNI Capital Compounder: Primarily a large-cap strategy, up 5.5% this week and 23.1% for FY 25.

Mi NNF 10: A highly favored strategy, up 5.1% this week, achieving 24.5% for FY 25, outpacing its benchmark by a significant margin.

Sectoral Overview

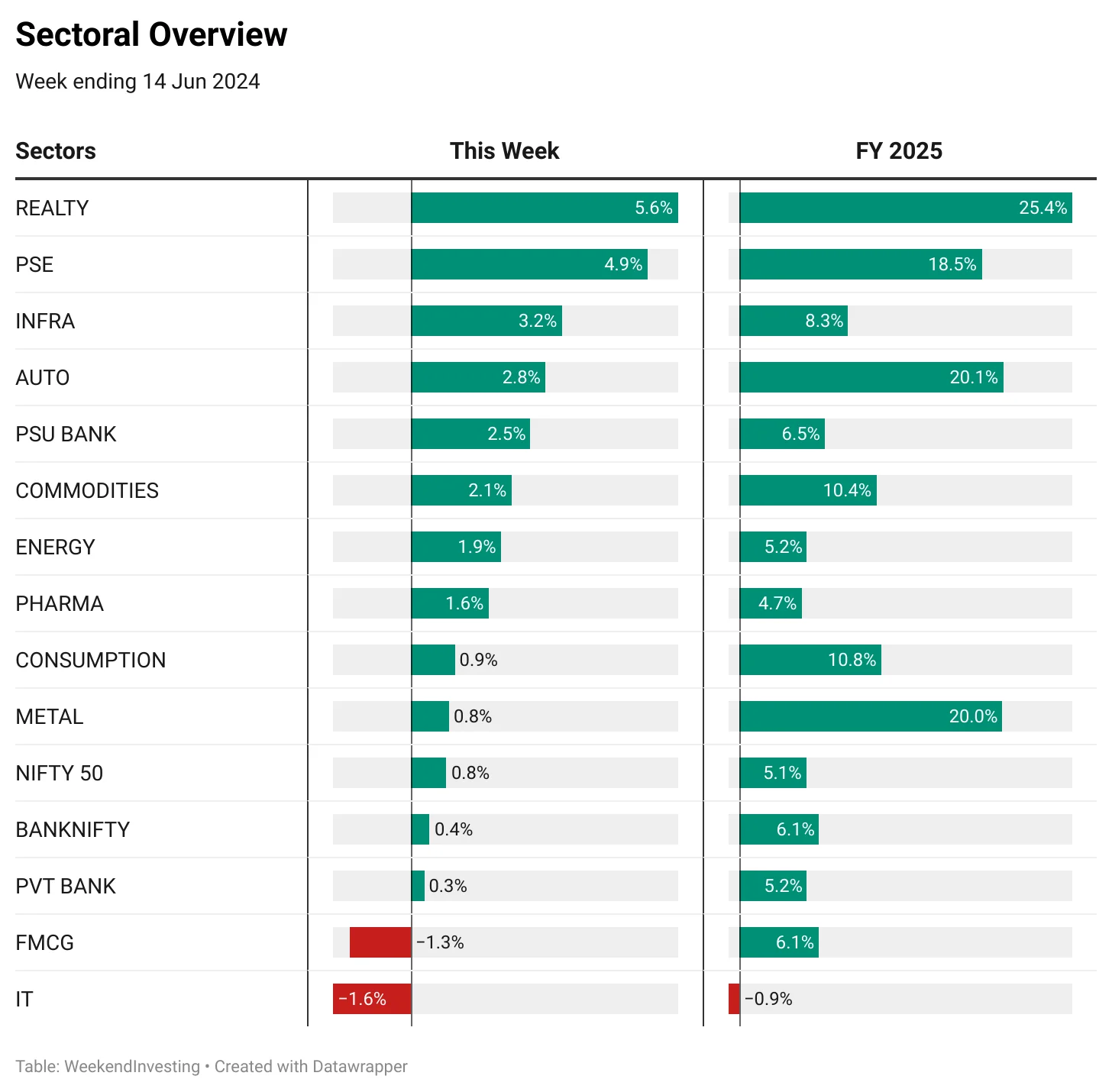

Year to date, the real estate sector continues to lead the market, with significant gains this financial year:

Real Estate: Up 25.4% for the financial year, with a 5.6% increase this week.

Public Sector Enterprise: Also performing well, up 18.5% for the financial year and 4.9% this week.

Infrastructure: Up 3.2% this week.

Autos: Extremely strong performance, up 20% this FY 25, driven by gains in major companies like M&M, Tata, and Maruti.

Metals: Up 20% for the financial year, but slightly muted this week with a 0.8% increase.

FMCG: Down 1.3% this week but up 6.1% for the financial year.

Private Banks: Slow growth at 5% for the financial year.

IT: Completely flat in this financial year.

Overall, it’s been a strong year for most sectors, with notable lagging in FMCG, private banking, and IT. Sector rotation and automatic sector selection are crucial strategies to navigate these changes.

Over the past two weeks to six months, sectoral momentum has highlighted several trends. Consistently strong sectors include real estate, automobiles, media (mainly driven by Zee), public sector enterprises, metals, and consumption. However, public sector enterprises and metals have shown recent declines, along with infrastructure and commodities. FMCG has seen an improvement in ranking over the last few weeks.

On the other hand, Pharma, IT, and financial services remain the laggards of the market. This suggests a focus on consistently strong sectors while being cautious with consistently weak ones. The recent declines in public sector enterprises and metals should be monitored to determine if they are temporary or indicative of a longer-term trend.

Spotlight - Avoid the Laggards !

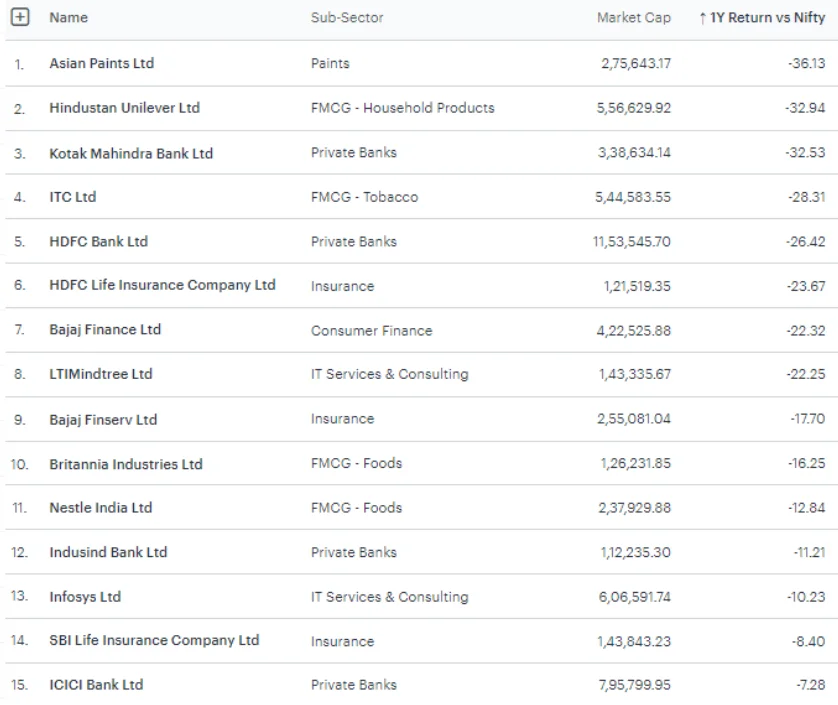

Investors often gravitate towards big names like Asian Paints, Hindustan Unilever, Kotak Mahindra Bank, ITC, and HDFC, drawn by their strong narratives and established market presence.

However, despite their prominence, these companies have shown significant underperformance compared to the Nifty 50 over the past year. This shortfall highlights the critical lesson that even the most reputable firms can experience extended periods of stagnation or decline, causing substantial pain for investors who hold onto them with unwavering faith. Thus, it’s essential to remain flexible and open to adapting one’s investment strategy.

The modern market is characterized by rapid technological advancements and industry disruptions. For example, Hindustan Unilever experienced years of stagnation, and HDFC Bank has struggled to perform well in recent times.

Similarly, Asian Paints might face challenges from increasing competition or industry shifts. In such a volatile environment, holding onto a stock for too long, hoping for a turnaround, can be risky. Investors must assess their patience levels and the potential for industry disruption, which could derail a company’s growth trajectory, making it imperative to avoid emotional attachments to specific stocks or sectors.

Instead, adopting a momentum-based strategy can help investors capitalize on current market strengths while mitigating risks associated with laggards.

For instance, stocks like Coal India, Bajaj Auto, Mahindra & Mahindra, and Power Grid have outperformed the Nifty 50 significantly, demonstrating the benefits of focusing on strong performers. These stocks, once overlooked, have emerged as leaders, showcasing the importance of remaining vigilant and responsive to market trends. This approach allows investors to ride the wave of strong performance and avoid being anchored down by underperforming stocks.

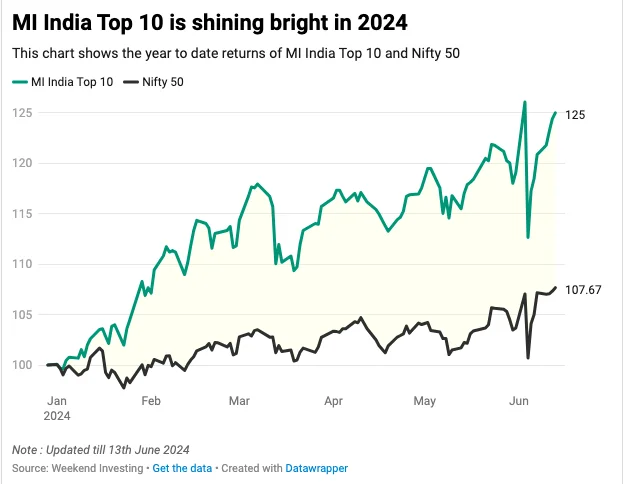

One such effective strategy is the Mi India Top 10, which selects the strongest stocks within the Nifty 50. This methodology has yielded impressive results, with a 25% gain compared to the Nifty’s 7.6% since January.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply