- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 14 Nov 2024

Good, Bad & Ugly Weekly Review : 14 Nov 2024

Are we headed for a deeper correction ?

Edition : 14 Nov 2024

Hello, Investor !

Markets Overview

It has been a tough week for the markets, with widespread turmoil and a sentiment of desperation. Although the market has only corrected by about 10% from its highs, many investors, especially those who haven’t experienced significant corrections before, are feeling deeply unsettled. The Nifty experienced a complete breakdown this week. Starting near 24,100, it has seen a steep decline, losing over 600 points, or more, on the weekly chart. Out of the last seven weeks, six have been in the red, with only one week of consolidation. This rapid decline is unsettling, but as long as the market stays above 21,300, the overall uptrend remains intact. Below that level, we could see the trend breaking, leading either to sideways consolidation or further downward movement.

The current correction is in line with previous market corrections that typically happen every six months. A sharp correction occurred on election day, and this is the follow-up, coming about five months later. So, while it may feel dramatic, it is not entirely out of the ordinary. Over the last four years, we’ve become accustomed to frequent new highs, but markets don’t always reach new peaks so often. Despite the current 10-15% drop from recent highs, we’re still sitting about 50% higher than where we were a year and a half ago, which is a positive long-term perspective. It's important to remember not to focus only on short-term portfolio losses but also to keep a broader, long-term view, especially if you’ve been in the markets for several years.

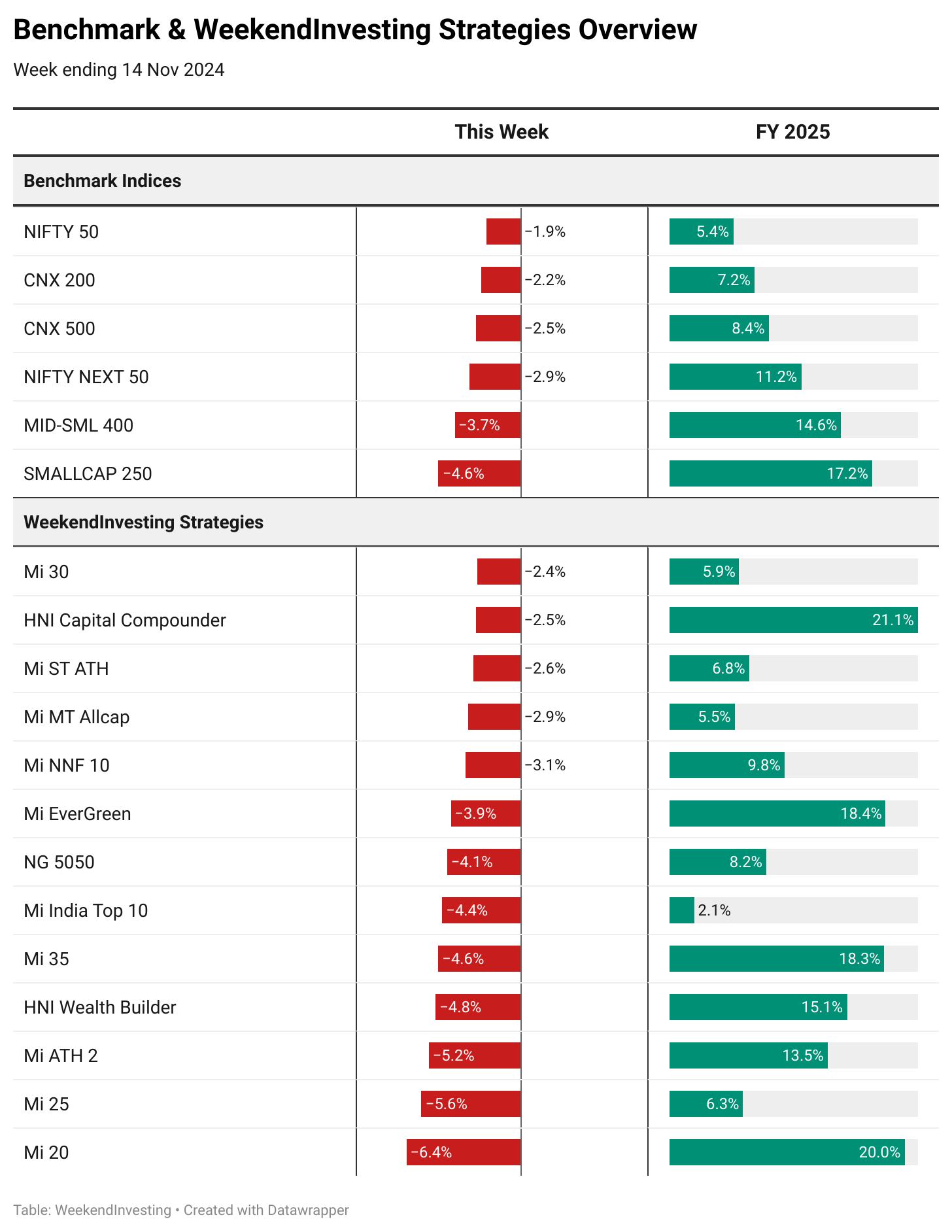

Benchmark Indices & WeekendInvesting Strategies Overview

Looking at the financial year so far, despite recent sharp losses, the overall market remains in green for FY25. However, this past week saw significant declines, with the Nifty 50, CNX 200, and CNX 500 dropping between 2% and 4.6%. The small caps 250 index was hit the hardest.

In the WeekendInvesting strategy space, all strategies saw cuts ranging from 2.4% to 6.4%. While many strategies faced losses, some, like HNI Capital Compounder and Mi Evergreen, managed to outperform their benchmarks. Others, such as Mi India Top 10 and Mi 25, experienced dramatic declines. Mi MT Allcap, interestingly, has moved to over 40% cash, which could prove beneficial if the market continues to fall. Shifting to cash or defensive stocks only shows its alpha during deeper market corrections, so while strategies may fall with the market initially, the real outperformance may emerge if the market drops further.

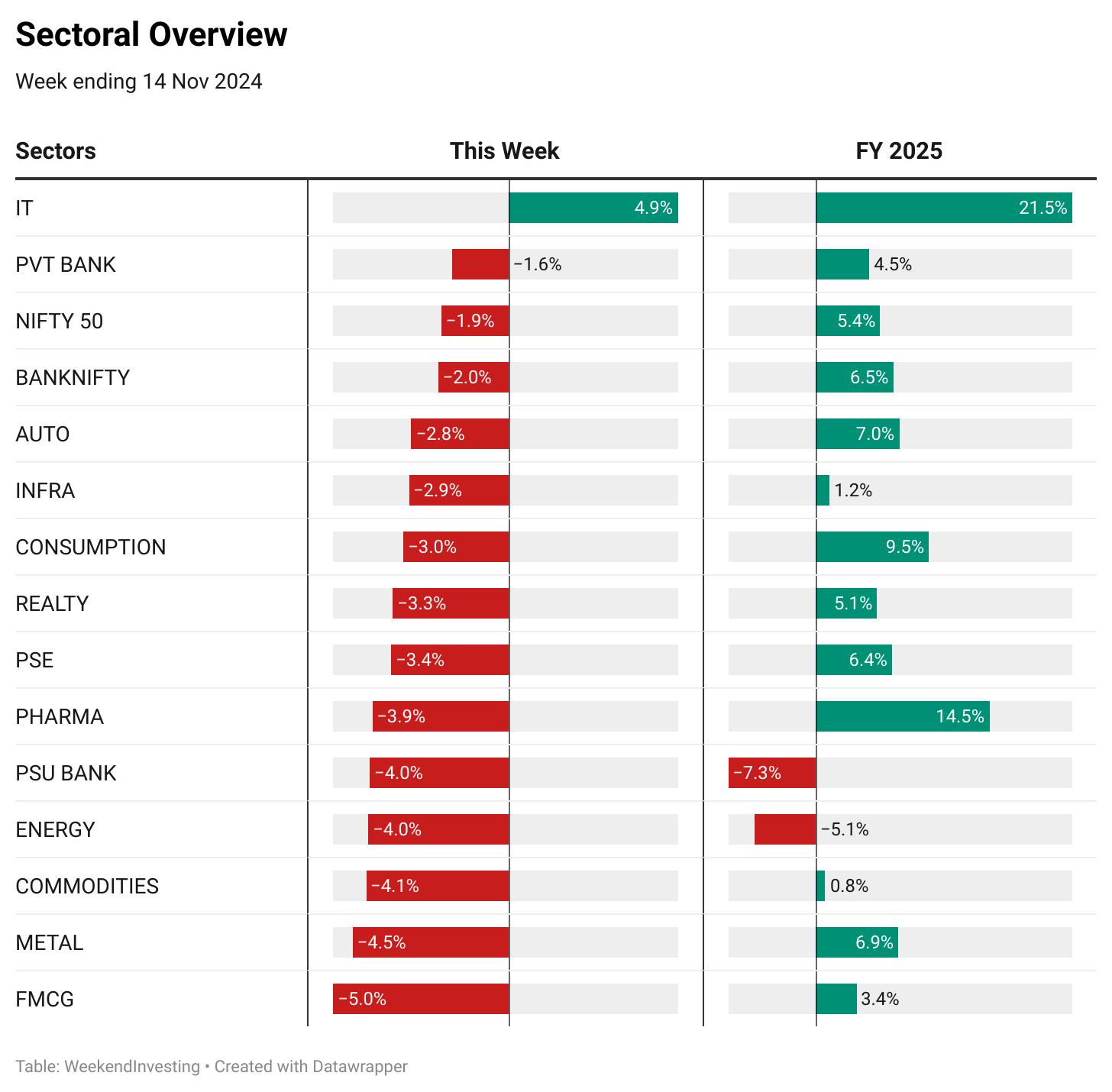

Sectoral Overview

Among sectors, only the IT sector delivered positive performance, up 4.9% for the week and a strong 21.5% for FY25. The outlook for IT stocks has changed dramatically over the past few months. In contrast, private banks were down 1.6%, the Bank Nifty lost 2%, and the Auto sector fell 2.8%. The biggest surprise was FMCG, which was down 5%, despite experts’ positive outlook on the domestic growth story. PSU banks also suffered a sharp decline, down 4% for the week and 7.3% for FY25. Overall, we are heading into a year where even if the market ends with modest gains or losses, say within a 10% range, it wouldn’t be unreasonable considering the stellar performance of the past few years. After every few great years, it’s natural for markets to experience a period of stagnation or pullback.

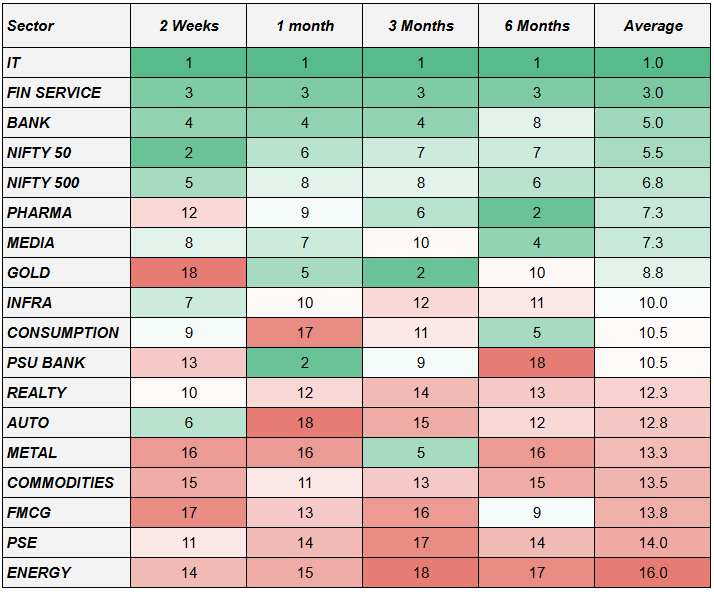

In terms of sectoral momentum rankings, IT remains at the top across all timeframes, followed by financial services and banks. Sectors like pharma are also doing well, but most others, such as energy, PSU, FMCG, commodities, metals, and autos, are near the bottom. Money is clearly rotating out of these sectors, and foreign institutional investors (FIIs) have been pulling funds from the market. Newer market participants, who haven’t experienced corrections before, may panic and sell early, adding to the volatility. It’s worth noting that, according to official data from the Association of Mutual Funds, the average mutual fund investor stays in the system for no more than 1.5 years. This short-term mindset often leads investors to use last year’s returns as a benchmark for this year, without realizing that markets should be viewed over a 5-10 year horizon. Only by taking a longer-term perspective can one truly appreciate the ups and downs of the market.

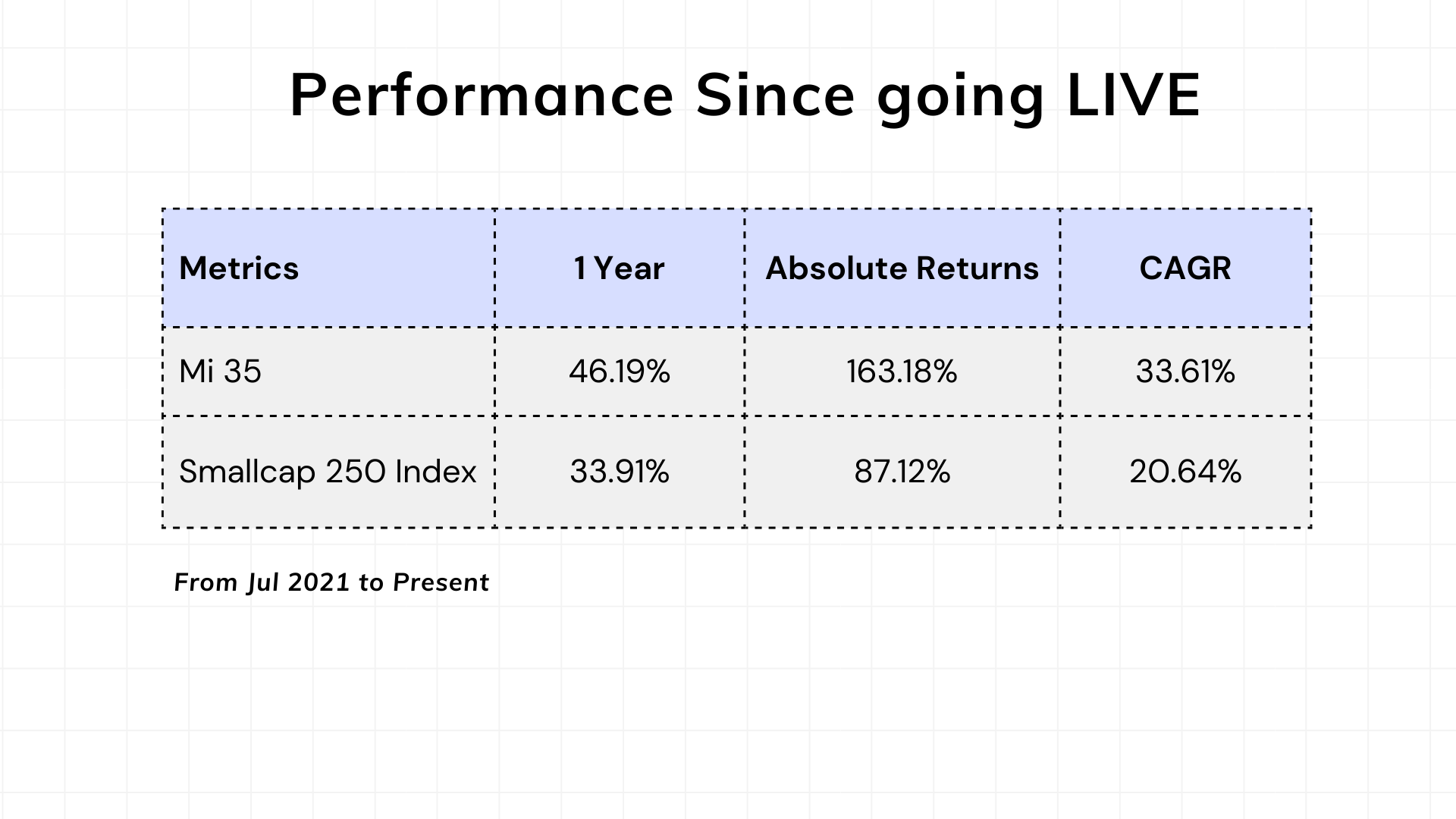

Spotlight - Mi 35

The Need for Patience . .

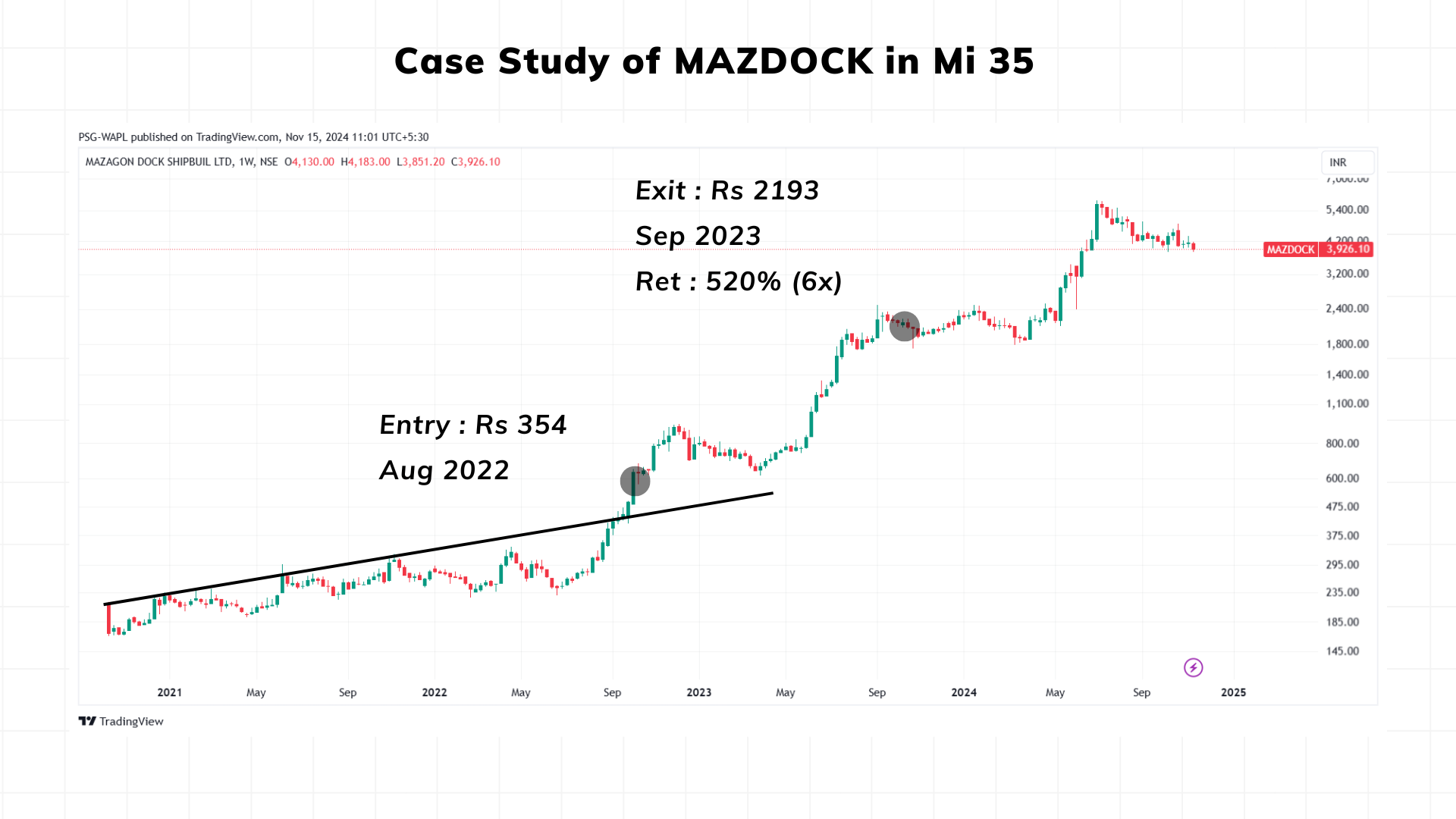

In the spotlight this week is the need for patience. As someone with 30 years of market experience, I can attest that patience and adherence to your rules are crucial for success. A case study is the stock Mazdock, which has seen an incredible rally from 200 rupees in mid-2022 to nearly 6,000 rupees over the last two years. Many may have hesitated to buy when it doubled from 200 to 400, thinking it had already gone up too much. But those who followed their rules would have benefitted from at least part of this massive rally.

For example, in the Mi 35 strategy, Mazdock was bought at 354 rupees and sold at 2,193 rupees when it exited the small-cap space and was reallocated to mid-caps. While the stock went up 25 times overall, the strategy still made a respectable 6x return. The key takeaway is that you don’t need to capture the entire trend. As long as you capture a portion of it and let your winners run while cutting your losers, you will still come out ahead. It’s a game of probabilities, where some stocks will do exceptionally well, some will perform in line with the market, and others will underperform. But collectively, the portfolio should deliver better-than-market returns.

When thinking about the market and your portfolio, it’s important to take a holistic view. The performance of any single stock, whether it’s Mazdock or another, doesn’t matter as much as the overall performance of your portfolio. With a few strong winners and a number of smaller losers, the combined result should be a market-beating return. That’s the expected outcome, and that’s what happened in this case.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply