- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 16 Aug 2024

Good, Bad & Ugly Weekly Review : 16 Aug 2024

Edition : 16 Aug 2024

Hello, Investor !

Markets Overview

What a week this has been! The market has bounced back with vigor, fueled by positive data from the U.S. markets. Concerns about a recession seem to have dissipated almost as quickly as they arose. Within just a week’s time, the outlook has brightened considerably. The U.S. markets have recovered, with the Nasdaq bouncing back, and the Indian markets have largely followed suit. Everything seems to be pointing towards a positive trajectory going forward. Adding to the optimism, gold has reached a new all-time high, crossing the $2,500 mark. This suggests that liquidity is ample in the system, and expectations of interest rate cuts in September are solidifying.

This week in Nifty, we saw some volatility, particularly midweek, but the market ended on a strong note. With the 15th August holiday, it was a shorter week. Although the market hasn’t fully recovered from the recent gaps, it appears to be on the path to recovery. The low from August 14th has now become a key pivot point for the Nifty moving forward. On the weekly candle, it’s notable that despite some market pullbacks, there hasn’t been a red candle in the last two weeks. This indicates that the bulls still have the upper hand, managing to recover by the end of the week even when starting on weak footing.

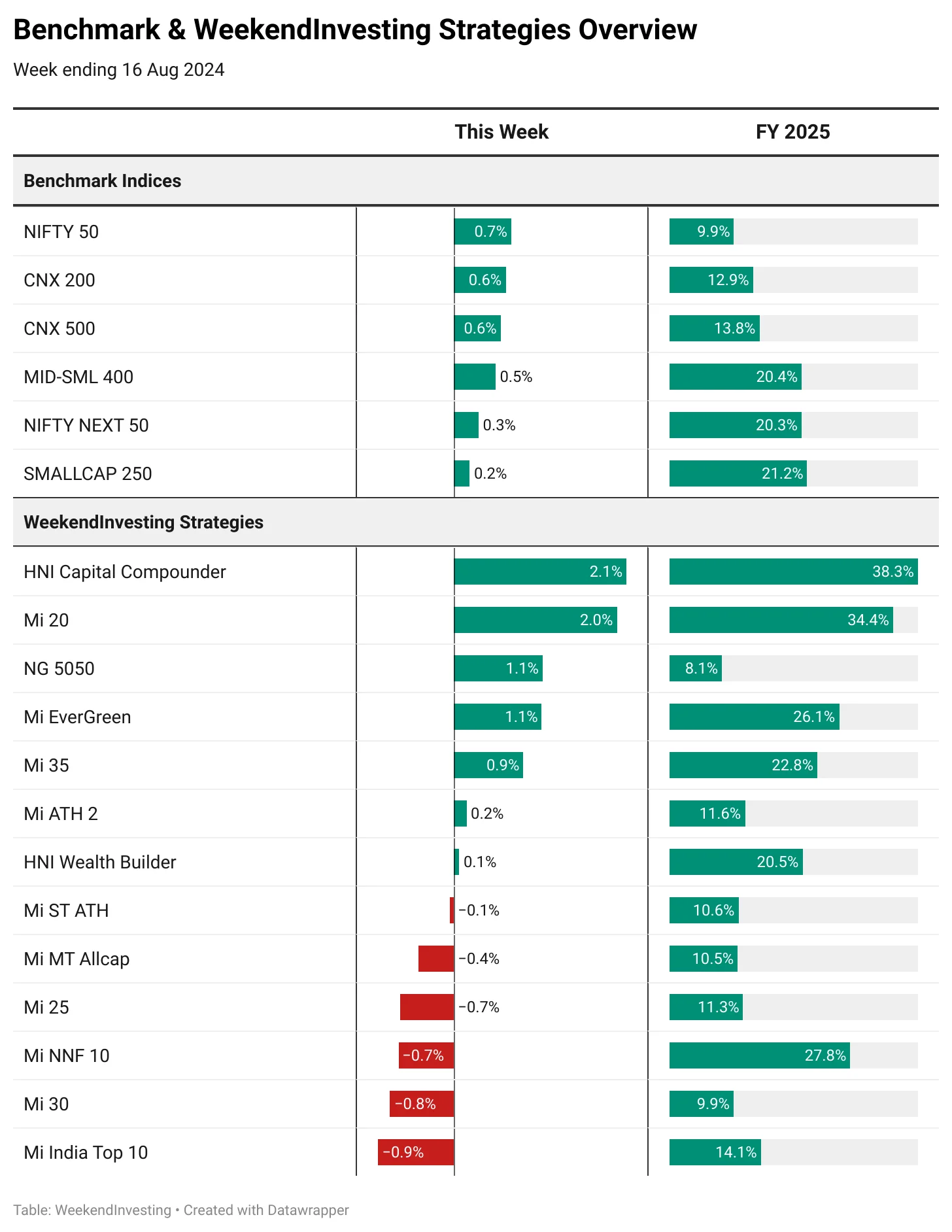

Benchmark Indices & WeekendInvesting Strategies Overview

In terms of benchmarks, the Nifty 50 gained 0.7%, while the CNX 200 and CNX 500 were up 0.6%. Mid and small caps showed muted performance, rising by 0.5%, and the Nifty Next 50 was even more muted at 0.3%. Small caps were nearly flat at 0.2%.

Among the Weekend Investing strategies, several performed exceptionally well, including HNI Capital Compounder, Mi 20, Mi Evergreen, and Mi 35. However, there were some underperformers, with Mi India Top 10 losing 0.9%, Mi 30 down 0.8%, and Mi NNF 10 slipping by 0.7%. Overall, there was no significant damage across the strategies.

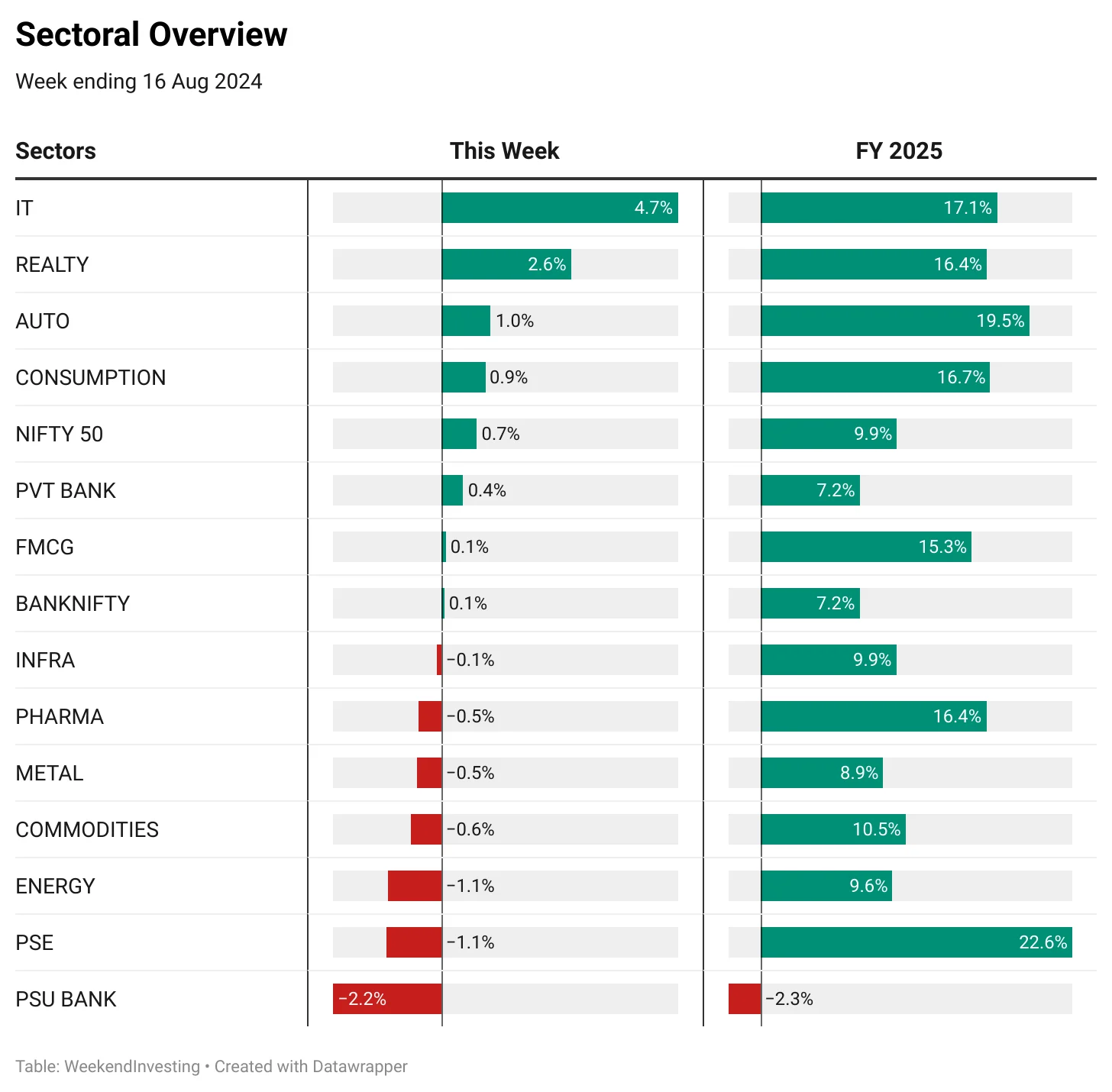

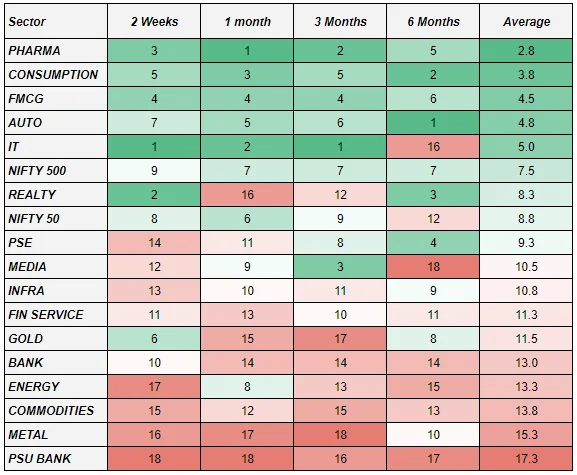

Sectoral Overview

IT stocks led the way with a 4.7% gain, followed by Real Estate at 2.6%. On the downside, PSU banks fell by 2.2%. The upward movement in IT and Real Estate is particularly encouraging, as these sectors have corrected from their previous highs and now seem poised to challenge all-time highs again.

Pharma, Consumption, and FMCG sectors remain the top performers in terms of momentum across various time periods. In the very short term, IT has taken the lead, followed by Realty, Pharma, FMCG, and Consumption. While these are still defensive sectors, there’s a noticeable shift towards higher risk-taking strategies.

Spotlight - APAR INDUSTRIES Case Study

One interesting case study from this week is APAR Industries. We entered this stock at around ₹2,500, much later than its initial rise from ₹285 in 2021. This is a common occurrence in many strategies; a stock doesn’t enter the strategy until the underlying index includes it. However, even though we got in late, we’re still holding, and the stock is now trading at ₹8,400. This example highlights the power of holding onto your winners, even if you enter late. The key skill isn’t just getting in at the right time, but knowing when to exit when the market turns against you.

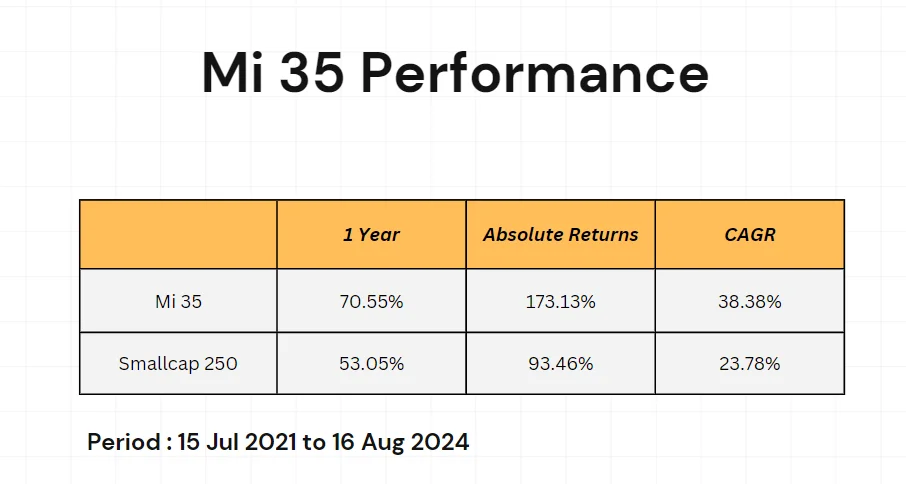

Mi 35 has been another strong performer, consistently beating its underlying benchmark in absolute returns since its inception. The CAGR has also been solid.

Mi 35 is a 35-stock rotational strategy focusing solely on small caps, with a well-diversified portfolio, meaning that one or two stocks won’t drastically impact the overall performance. If you’re interested, it’s worth taking a closer look at this strategy.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply