- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 17 Apr 2025

Good, Bad & Ugly Weekly Review : 17 Apr 2025

Are the Bears finally buried ?

Edition : 17 Apr 2025

Hello, Investor !

Markets Overview

It was a short trading week with only three sessions due to holidays on Monday and Friday, but despite the reduced time, it turned out to be a surprisingly strong one. Markets staged a sharp rebound from the bottom, a move few were expecting. As is often the case, the market caught most participants off guard with its swift recovery.

Looking at the Nifty, the last candle of the week was particularly impressive, registering a 4.48% weekly gain. The index has climbed above its 100-day moving average and is now approaching pivotal breakout levels. This zone has resisted three previous attempts, and it remains to be seen if this time will be different. While the recent downtrend appears to be stabilizing, a confirmed uptrend is still pending.

Nifty – Weekly Chart Perspective

On the weekly charts, the picture becomes even clearer. The gap-down opening from the previous week turned out to be the low point, and this week’s gap-up rally completely reversed that bearish pressure. The bears were denied any momentum, and most participants were taken by surprise. A break above the current level at 23,850 could trigger a bout of short covering, with the next significant resistance likely around the 25,000 mark.

S&P 500 Overview

In contrast, the S&P 500 fell by 1.5% during the same period. Interestingly, a divergence is emerging between U.S. markets and Indian equities. It appears that global investors are beginning to distinguish India from the ongoing geopolitical tensions between the U.S. and China. In fact, India might even be seen as a potential beneficiary of that friction, which could explain the strength in local equities.

GOLD Overview

Gold, on the other hand, continues its dream run. It added another 1.83% this week after a series of explosive moves in recent weeks. From a high of around ₹98,500, it dipped slightly to ₹96,777 but remains in an aggressive uptrend. Since September 2023, when gold was trading near ₹52,000, the metal has nearly doubled in value—an extraordinary run in just a year and a half. This sustained rally reflects growing unease in global financial systems and rising demand for safety.

Dollar Index Overview

The dollar index is looking weak and teetering on the edge of a significant breakdown. While it may consolidate or bounce from current levels, any convincing breakdown could lead to broader dollar weakness against global currencies. Interestingly, the Indian Rupee is not strengthening against the dollar but is instead weakening against other global currencies like the Euro, GBP, and Swiss Franc—making imports from those regions more expensive.

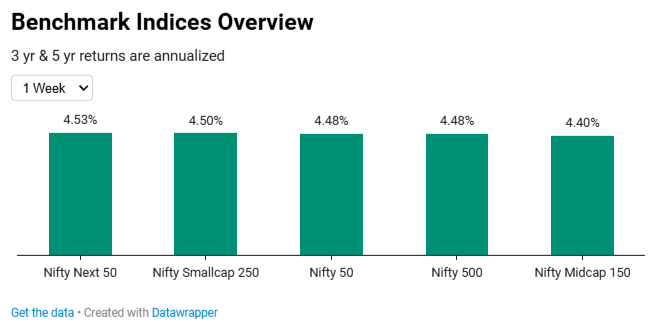

Benchmark Indices Overview

In terms of benchmark index performance, Nifty Next 50 led with a 4.5% gain, but what stood out was the uniformity of returns—almost all indices clocked similar gains around the 4.5% mark. This brings the one-year returns into better shape, with Nifty up 7.5% and Nifty Small Cap turning green. Over the last three and five years, all indices continue to show strong double-digit annualized returns. For long-term investors, this is a reminder of the rewards of staying invested through volatile periods.

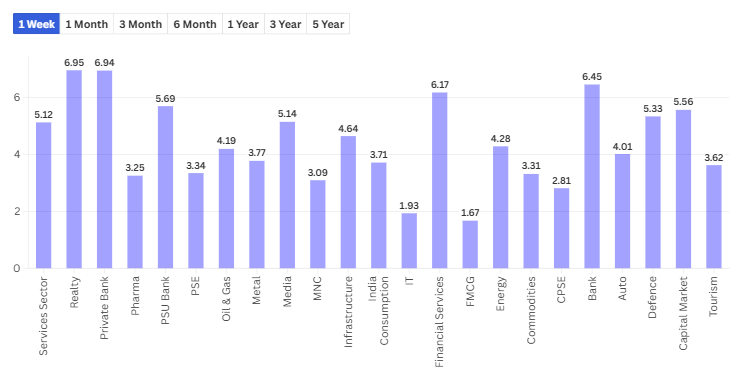

Sectoral Overview

From a sectoral perspective, real estate delivered a standout performance with a 6.95% weekly gain. Private banks also surged by 6.94%, marking a strong comeback after a relatively quiet year. In fact, private banks have returned 14.3% over the last year, while financial services have performed even better at 23.6%.

Banking as a broader sector was up 6.4%, and capital markets gained 5.5%. Capital markets have been the best-performing sector over the past year, while energy and real estate, despite a bounce this week, remain the laggards. IT and FMCG continued to underperform, largely due to underwhelming results from major IT companies.

The momentum score rankings also paint a clear picture. IT, auto, energy, and metals are currently at the bottom, while real estate has started to recover on a short-term basis. FMCG, which had earlier shown signs of strength, has slipped again. On the brighter side, capital markets are reviving, and private banks along with financial services are dominating the top ranks. PSU banks are also making a notable comeback. As of now, the market’s momentum is clearly tilted towards financials and banking, which are driving the current uptrend.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply