- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 17 May 2024

Good, Bad & Ugly Weekly Review : 17 May 2024

Edition : 17 May 2024

Hello, WeekendInvestor

Markets Overview

This week, Nifty made a notable comeback from its previous fall. The low was hit on Monday the 13th, followed by a recovery throughout the week. On the 16th, there was a sharp decline followed by a significant upward move by the end of the day. Friday’s trading was more stable. Overall, the week ended on a positive note, with Nifty closing near all-time highs.

For the past two and a half months, Nifty has fluctuated within the 21,700 to 22,400 range. Despite concerns from the first four phases of polling suggesting that the combined entity might secure fewer than 400 seats, the market remains optimistic. Even if the BJP alone achieves a clear majority, the current market trajectory is expected to continue. The market seems to anticipate a favorable election outcome, reflecting this in the pricing and overall sentiment.

Benchmark Indices & WeekendInvesting Strategies Overview

This week saw strong performance across various market indices. Nifty Next 50 gained 5%, small caps were up 4.6%, and the Mid-Small 400 rose by 4.5%. Both CNX 500 and CNX 200 increased by 2.5% to 3%, while Nifty itself gained 2%. Overall, it was a very positive week for all indices. For the financial year, Nifty is now back in the green with a 0.6% increase, and the Nifty Next 50 is up nearly 11%, which is particularly impressive.

This week, WeekendInvesting strategies performed exceptionally well. Mi 35 saw a remarkable 7.9% gain, making it an underrated gem with a 14.9% increase in FY 25. Mi 20, popular among small and mid-cap investors, gained 7.1%, totaling a 13.6% increase for the financial year. Mi NNF 10 also had a strong week with a 7% gain, up 13.4% for FY 25. Mi MT Allcap recovered from a slow start, gaining 6.9% this week and 5.5% for the year. HNI Capital Compounder and HNI Wealth Builder were up 6.4% and 6.1%, respectively. Mi India Top 10 gained 1.3% this week and is beating Nifty by a couple of percentage points for the financial year, with a total increase of 1.9%. Mi Evergreen rose by 3.9% this week, reaching a 10% gain for the year.

Sectoral Overview

This week, real estate led the market with a 6.6% gain, followed closely by metals at 6.5%, which is already up 15% in FY 25. Public sector enterprise stocks also performed well, rising 5.8% this week and 13% for the financial year. These three sectors are currently at the top of the charts, making them prime targets for opportunistic swing trading or buying. Autos gained 1.9% this week, with an impressive 8.7% rise in FY 25, highlighted by strong moves in stocks like Mahindra and Mahindra.

The IT sector, despite being sluggish overall, showed some recovery this week but remains down 4.3% for the financial year. FMCG and PSU banks were flat both this week and for the financial year. Pharma is also flat for the year with a slight -0.1% change. Meanwhile, Nifty is up by 0.6% for the financial year.

Over the past six months, three months, one month, and two weeks, the sectors with the best momentum scores have been metals, real estate, autos, and public sector enterprises. These four sectors consistently rank the highest across different measurement periods, indicating strong performance. In contrast, banking and PSU banks have ranked much lower compared to these leading sectors while IT and Media continue to languish at the bottom.

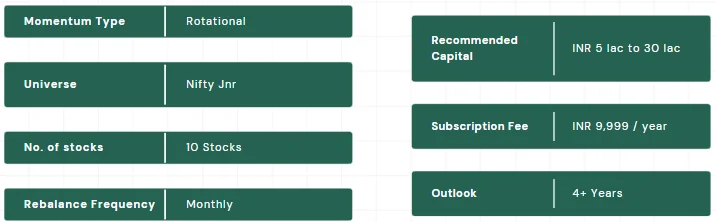

Spotlight - Mi NNF 10

How late is too late ?

Today’s spotlight focuses on the idea of timing in stock investment, specifically examining the example of Hindustan Aeronautics Limited (HAL).

HAL’s stock price was stagnant around Rs 300-400 for a long time. After the COVID-19 crash, the stock surged from Rs 245 to nearly Rs 700, then dropped back to Rs 350. This 50% decline could have discouraged many investors. However, from Rs 340, HAL never looked back, reaching Rs 453, marking a 12x gain from this low point by 17 May 2024.

Even if you missed the initial rise from Rs 245 to Rs 680, momentum investing could have helped you catch significant gains. For example, entering HAL at Rs 1151, after it had already surged, still resulted in a 4x gain. This demonstrates that buying high isn’t necessarily bad if the stock continues to perform.

A structured approach is crucial. Whether you’re buying 20 or 50 stocks, knowing some will outperform significantly can offset minor losses. The BBC principle—Bhav Bhagvan Che (price is God)—emphasizes trusting the price movement as an indicator of future performance.

In essence, it’s never too late to enter a stock if you have a solid plan and strategy for managing your investments. The focus should be on what you do after entering the stock, not on the initial timing.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply