- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 18 Oct 2024

Good, Bad & Ugly Weekly Review : 18 Oct 2024

Have Markets averted the correction threat ?

Edition : 18 Oct 2024

Hello, Investor

Markets Overview

Nifty was dull and sideways this week. The previous week showed a downward trend, but this week remained mostly flat, except for Thursday, which saw a significant drop. We were forming a right shoulder on a longer chart, but that has been thwarted for now. We are also in a support zone, with several weeks of rotation around this level. Significant pivots exist just below 24,000 and 21,500, and if tested, those levels will be critical. The last two weeks’ candles suggest that the market is not inclined to move downward.

In a downward trajectory, you typically wouldn’t see pullbacks at the end of the week, but this has been happening for two consecutive weeks now. This is despite some poor results coming through, particularly from sectors like auto and FMCG. While auto two-wheeler results have not been impressive and FMCG discussions aren’t very positive, the market appears to be absorbing these setbacks with a “buy on dip” approach, and dips have been limited. This is good news for the market as of now.

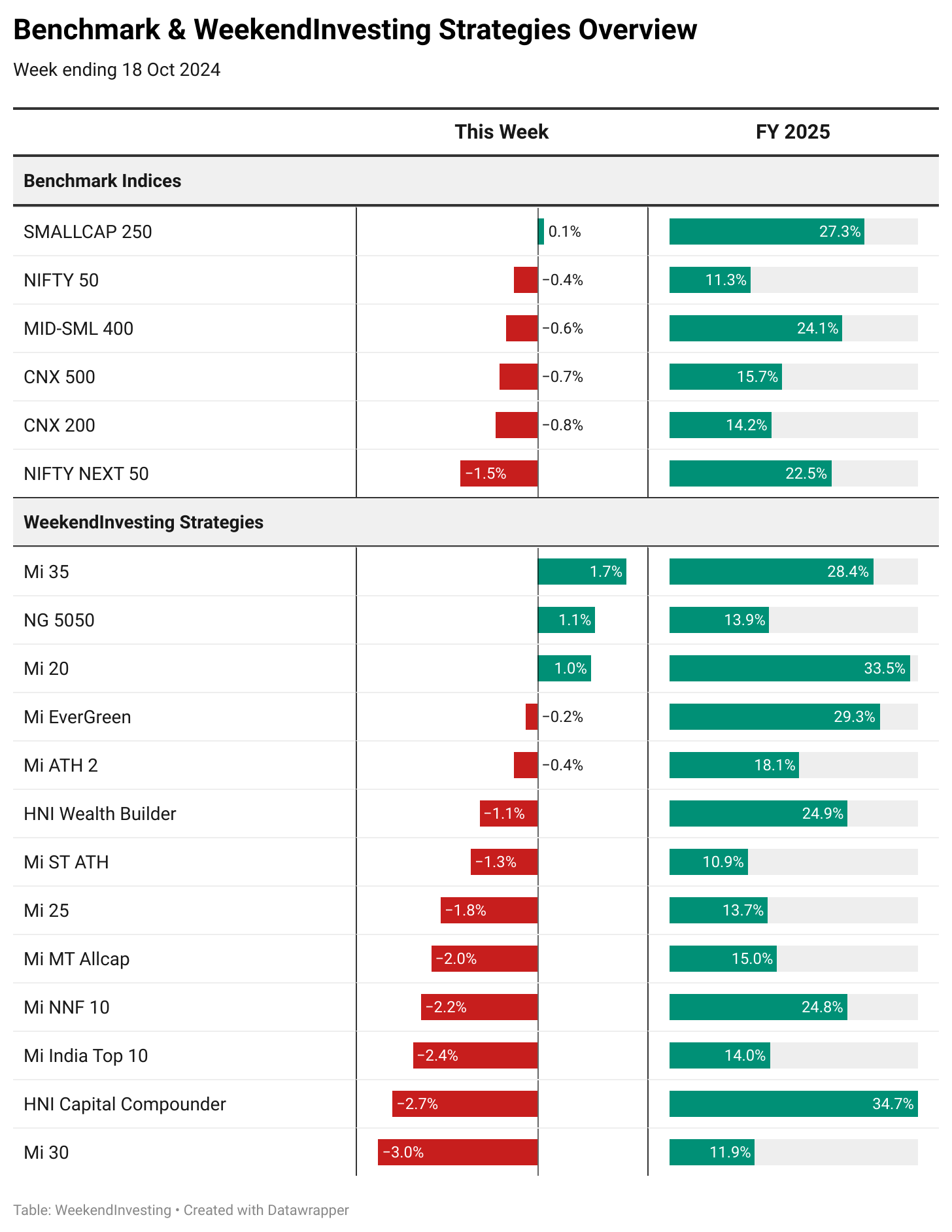

Benchmark Indices & WeekendInvesting Strategies Overview

Nifty Next 50 index took a significant hit this week, falling by 1.5% compared to the CNX 200 and CNX 500, which dropped by 0.8% and 0.7%, respectively. The Mid-Small 400 index fell by 0.6%, while the Nifty 50 saw a smaller decline of 0.4%, and small caps managed to gain 0.1%.

In line with the small cap’s minor gain, Mi 35 clocked 1.7%, Mi 20 saw a 1% increase, while Mi 25 lost 1.8%, and HNI Wealth Builder lost 1.1%. Overall, two strategies favored small caps while two others did not. Mi 30 lost 3%, HNI Capital Compound dropped 2.7%, and Mi India Top 10 underperformed the Nifty significantly, losing 2.4% this week. Overall, markets appear tentative, with continuing trends difficult to identify. As we’ve seen in the past, it’s hard to predict what the next month will bring, so the best approach is to execute your plan and hope for the best.

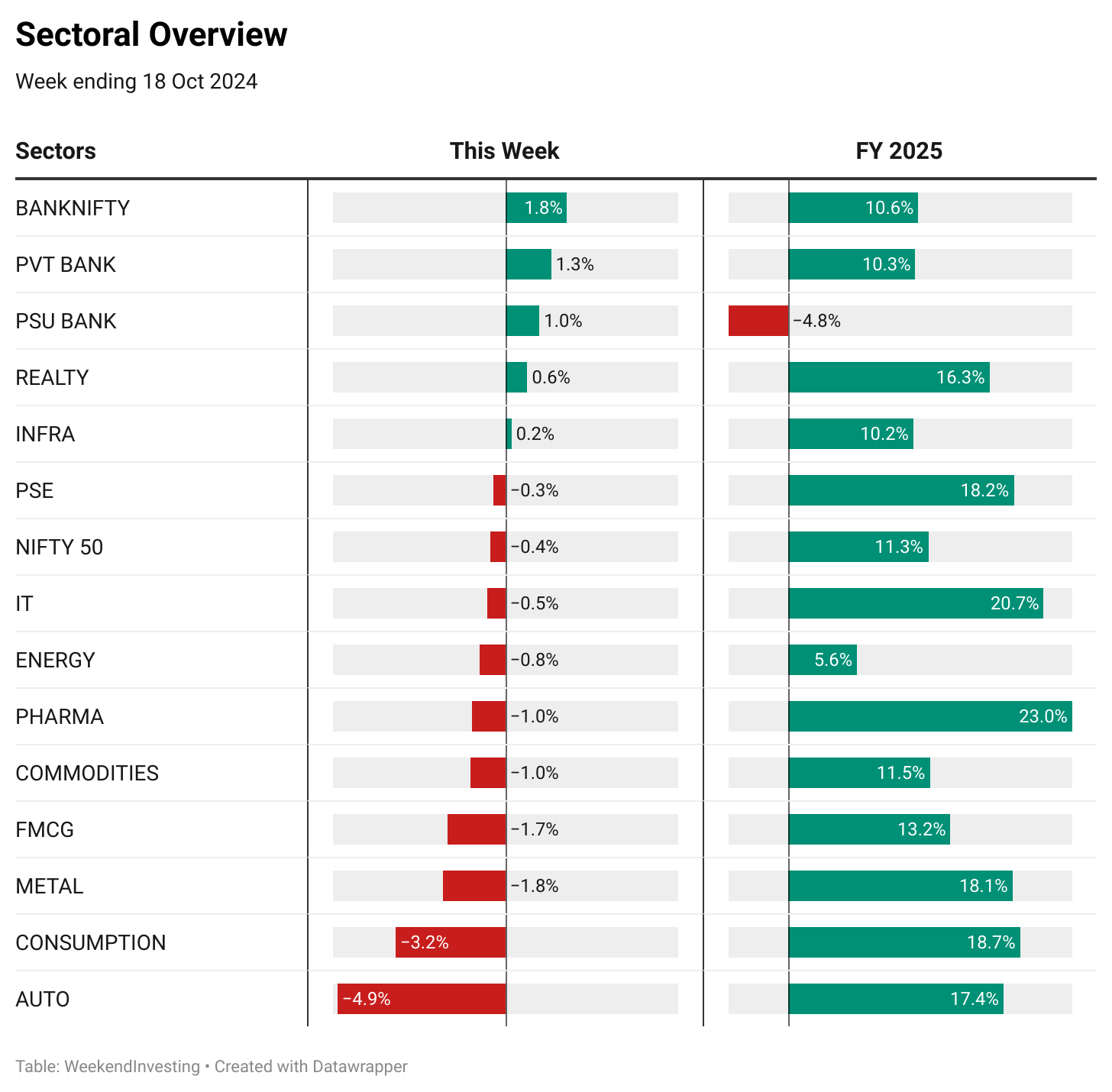

Sectoral Overview

Autos, particularly Bajaj Auto, had a tough week, leading to a significant decline. Consumption stocks also fell by 3.2%, with companies like D-Mart taking a heavy hit. Metals, FMCG, commodities, and pharma all recorded losses exceeding 1%. Net-net, the week was weak across these sectors. However, real estate saw a slight gain, and both PSU and private banks recorded upticks, despite the RBI governor’s comments that cutting interest rates could be risky. The Bank Nifty was up 1.8% this week, highlighting that markets can behave in unpredictable ways. Despite expectations that banks would fall following the RBI’s caution, they actually rose. Often, news like this is already factored in, leading to relief rallies afterward.

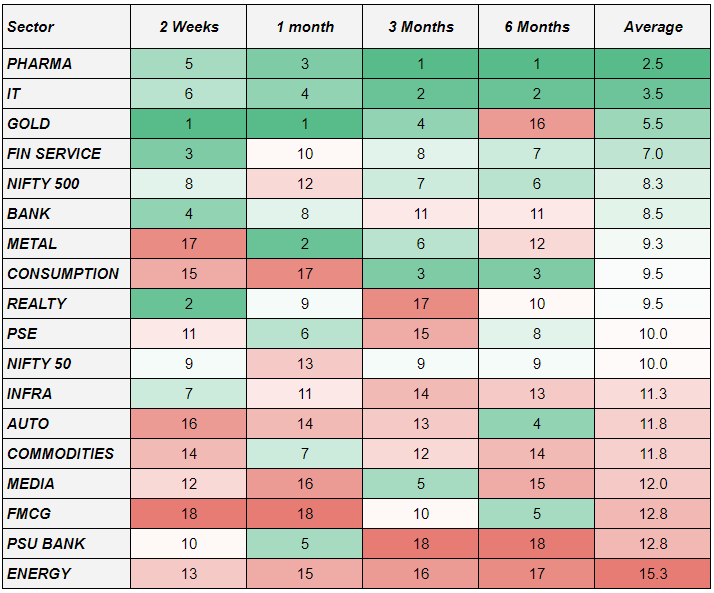

Pharma, IT, gold, and financial services have been the top-performing sectors over the past one, two, three, and six months. Gold, in particular, has been surging, ranking number one in both one-month and two-week momentum scores. Real estate has also gained momentum recently, and financial services have picked up strength alongside the banking sector. Pharma and IT have been top performers, indicating that the market is in a defensive mode, focusing on safer, low-beta sectors. This suggests that while the market may not surge or crash, it is likely to remain relatively stable. Money appears to be flowing into these safer sectors, as reflected in the momentum scores.

Spotlight - Mi India Top 10

In the Weekend Investing Strategy Spotlight, we look at NTPC’s chart. NTPC was stagnant for 15 years. In its first three years, it surged by 328%, but then over the next 13 years, it declined by 64%. However, in the four years that followed, it gained 518%. This highlights the difficulty for investors who entered during its initial rise and then faced a 64% drawdown over the next 13 years.

Many gains have been realized only in the last year and a half. Over a 20-year period, catching the right phases of a stock’s journey can lead to good returns without needing to hold onto the stock for the entire time. This is what we’ve seen with India Top 10, which picked NTPC at Rs 218 and has since made a nice gain.

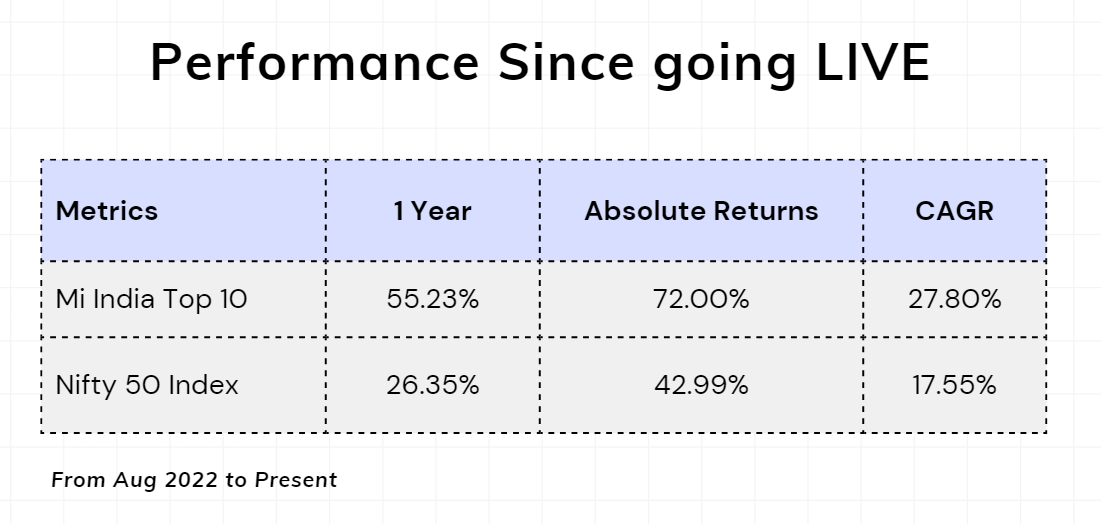

These examples show that there is no need to predict or hold onto underperforming stocks. The key is to jump on when momentum begins. While this approach won’t always work, it increases the probability of success. The momentum strategy has allowed India Top 10, which focuses on Nifty stocks, to outperform the broader Nifty by giving more weight to strong performers.

For example, NTPC’s weight in the Nifty 50 is small, but India Top 10 allocated 10% to it, which allowed for stronger gains. The allocation strategy is crucial in momentum investing. Over the past year, India Top 10 has returned 55%, and since its live inception in August 2022, it has gained 72%. These are very robust numbers for a well-constructed strategy.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply