- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 19 Apr 2024

Good, Bad & Ugly Weekly Review : 19 Apr 2024

The Good, Bad & Ugly Weekly Review

Edition : 19 Apr 2024

Markets Overview

Throughout the week, Nifty experienced a downward trend, marked by consecutive declines on Monday and Tuesday, followed by mixed movements on Thursday and Friday. Despite fluctuations, the overall sentiment remained subdued, with the market ending the week with a net loss of several hundred points. Additionally, the US markets, particularly leading stocks like Nvidia, Super Microcomputers, and AMD, also witnessed declines, indicating a potential continuation of negative sentiment into the following week. However, despite the bearish tone, Nifty’s performance for the week was not exceptionally dire, with key support levels around the 21,650 mark holding firm. Nevertheless, there remains a possibility of further downside towards the 21,200 level if current support levels are breached.

Benchmark Indices & WeekendInvesting Strategies Overview

During the week, all benchmarks, including Nifty 50, experienced declines, with Nifty 50 recording a 1.7% decrease. However, small caps (Smallcap 250 index) fared relatively better than Nifty 50, showing smaller losses. The Nifty Next 50 index also saw a decline of 1.9%, indicating broader market weakness.

Among various investing strategies, some managed to mitigate losses more effectively, with HNI Wealth Builder experiencing only a 0.2% loss while Mi 30 & Mi 35 experienced minimal declines. However, half of our strategies faced losses between 2% and 3.5%. The overall FY 25 performance of benchmark indices remained mixed, with some strategies outperforming benchmarks while others lagged behind.

Sectoral Overview

During the week, the metals sector emerged as the least affected among all sectors, demonstrating resilience amid market downturns. Despite market challenges, metals showed a notable uptrend, with a 7.9% increase in FY 25, indicating relative stability. Conversely, the financial sector, particularly PSU banks, experienced declines, with real estate and private banks also showing negative trends. Additionally, the pharmaceutical sector recorded losses, contributing to the overall sectoral downturn. However, despite sector-specific challenges, the overall market performance remained relatively stable, with sectoral losses of 1% to 1.5% aligning with broader market benchmarks.

In the short term, gold has shown upward momentum, acting as a hedge amid market volatility. Additionally, real estate has experienced a slight decline compared to the previous month, while public sector enterprise stocks have shown strength. Metals and energy sectors have exhibited positive movement, indicating short-term resilience. Conversely, PSU banks and pharmaceutical stocks have faced significant declines, positioning them at the bottom. Overall, real estate, metals, energy, and public sector enterprises emerge as leading sectors in the short term.

Rebalance Update for the week !

Spotlight - The art of dealing with (no) emotions !

Investing can be a rollercoaster ride, often driven by emotions like fear and greed. These emotions can lead to impulsive decisions, resulting in market volatility. In the world of investing, there are bulls, bears, pigs, and sheep. Bulls and bears represent confident investors, while pigs and sheep are prone to losses due to emotional trading.

To navigate the market successfully, it's crucial to remove emotions from investment decisions. This requires adopting rule-based strategies that you trust. Just like training a muscle gradually, removing emotions from investing takes practice and discipline. While some investors thrive on emotions, transitioning to a more rational approach can lead to more consistent results over time.

I've spent nearly three decades experimenting with different investment approaches. Despite initial success, emotional investing led to significant gains followed by devastating losses. Transitioning to rule-based investing transformed my experience. By relying on tested strategies and removing emotions from the equation, I achieved more stable returns.

Let's delve into a case study involving Coal India. Imagine holding a stock for over a decade as it fluctuates within a certain price range. Suddenly, the stock price surges, prompting thoughts of selling to chase better opportunities. However, impulsive decisions based on emotions often lead to regrets when stocks continue to soar after selling.

In contrast, a rule-based approach focuses on identifying trends and making calculated decisions. Even if entering a trade late, the key is to exit strategically. While losses are inevitable, focusing on big wins over time leads to overall profitability.

Rule-based strategies also allow for automatic identification of new performing sectors. Unlike conventional investing, where you may feel stuck with underperforming stocks, a rule-based approach adapts to market dynamics. This flexibility minimizes opportunity costs and maximizes capital efficiency.

Key Takeaways

Automatic Identification of new performers / sectors : Momentum helps you discover new leaders / sectors that may have been completely off the radar / interest

Opportunity Cost : You will enter stocks only when there is momentum and will exit when momentum fades away. Your capital remains busy always and is put to maximum work.

Emotion-less approach : No concept of waiting forever for a stock to revive, no attachment to a stock or sector, no regrets in letting a stock go.

Peace of Mind : You remain peaceful forever knowing that the strategy will do what is to be done without you having to interfere

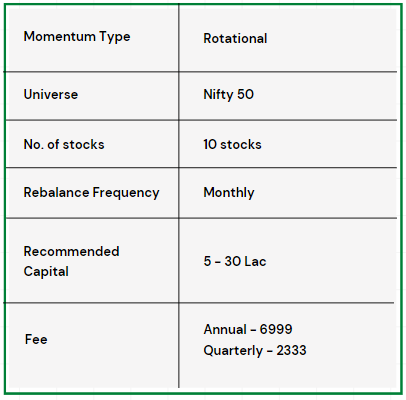

Mi India Top 10 Summary

The WeekendInvesting App

The Weekendinvesting App is a one stop solution for everything about Weekendinvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, performance metrics, momentum watchlists, discounts and many other exciting things. This app acts as a medium for us to provide direct support and resolve your queries.

Please write to [email protected] if you have any questions.

Reply