- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 19 Jul 2024

Good, Bad & Ugly Weekly Review : 19 Jul 2024

Edition : 19 Jul 2024

Hello, Investor !

Markets Overview

This week, Nifty remained flat despite significant volatility. After a couple of days of gains, a holiday interrupted the momentum, followed by a rapid surge on Thursday likely due to short covering and positive TCS results. However, by Friday, all gains were erased, closing the week where it started. While Nifty saw no net change, other market segments experienced declines. The weekly candle pattern, an inverted hammer, often signals a potential top and suggests several weeks of consolidation ahead. Given the strong uptrend since March 2023, a cooling-off period seems likely, especially with cautious expectations around the upcoming budget.

Benchmark Indices & WeekendInvesting Strategies Overview

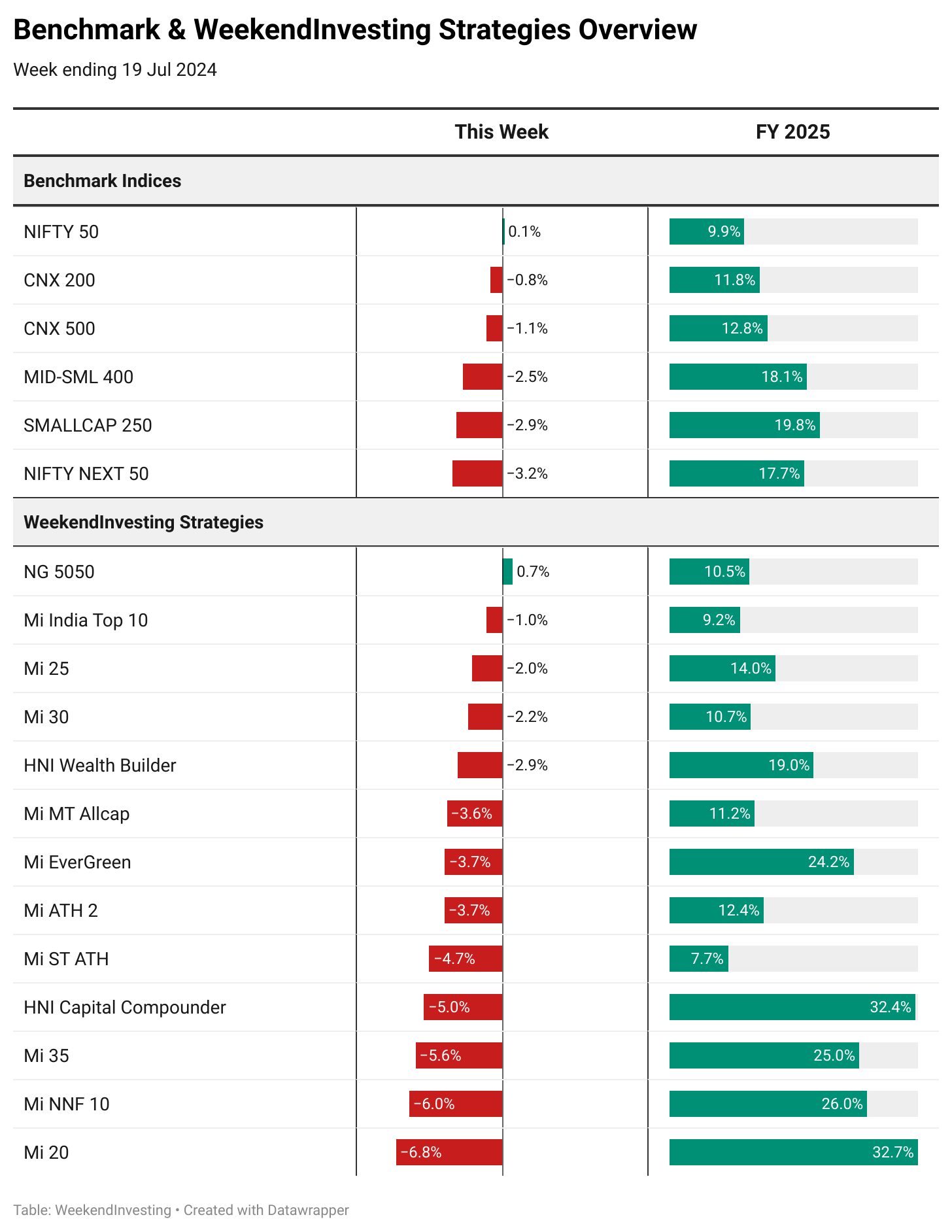

This week, Nifty remained flat, but other indices experienced declines. The CNX 200 and CNX 500 both fell nearly 1%. Midcaps and Smallcaps were hit harder, with the Mid-Small 400 dropping 2.5% and the Smallcap 250 losing 2.9%. Surprisingly, the large-cap Nifty Next 50 fell 3.2%. Despite its recent strong performance, up 17% compared to Nifty 50's 9%, Nifty Next 50 also showed vulnerability to downside risks.

This week, all WeekendInvesting strategies were in the red. Mi 20 lost the most at 6.8% but remains up 32% for FY25. Mi NNF 10 and Mi 35 fell by 6% and 5.6%, still up 26% and 25% respectively this financial year. HNI Capital Compounder dropped 5%, maintaining a 32% gain for the financial year. Mi ST ATH was down 4.7%, clocking 7.7% for FY25. Mi ATH 2, in line with the CNX 500, fell 3.7%. Mi EverGreen dropped 3.7% but is up 24% for FY25. Mi MT Allcap, down 3.6%, aligns with CNX 500 returns. HNI Wealth Builder and Mi 30 lost 2.9% and 2.2%, respectively. Mi 25 was down 2% but up 14% for FY25. Mi India Top 10 fell 1%, in line with Nifty 50. Not every strategy beats benchmarks consistently, but over time, they aim to outperform.

Sectoral Overview

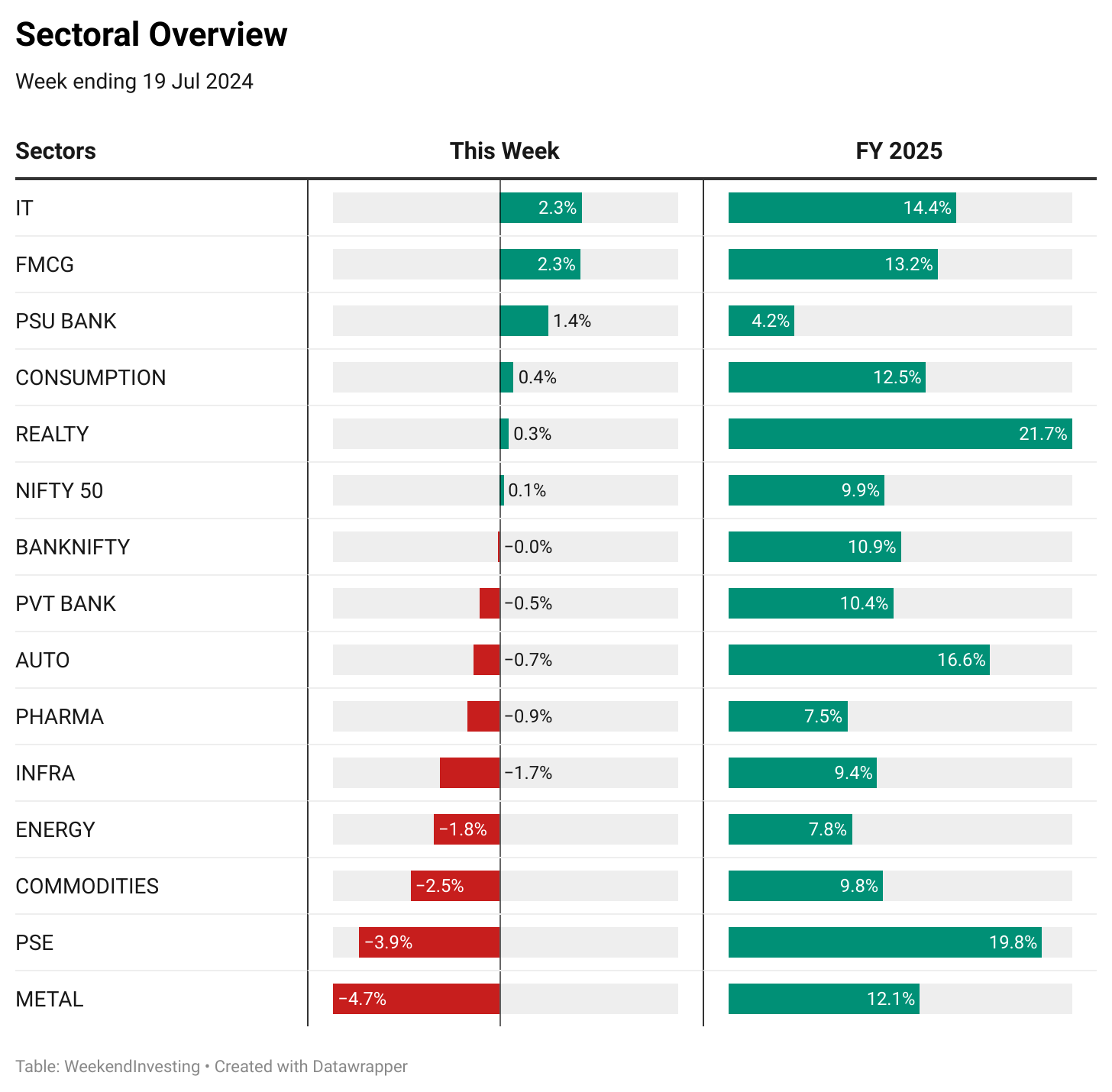

This week, IT stocks and FMCG were the clear winners, signaling a shift towards defensive sectors. While FMCG performed well, pharma dropped 0.9%. Metals, public sector enterprise stocks, and commodities experienced significant losses, aligned with global declines. Energy stocks also fell. Real estate, which is leading in FY25, remained flat, showing no signs of decline. PSU banks, slow at 4.2% for the financial year, saw a modest gain of 1.4%, possibly due to budget expectations. Overall, it was a mixed week with varied sector performances.

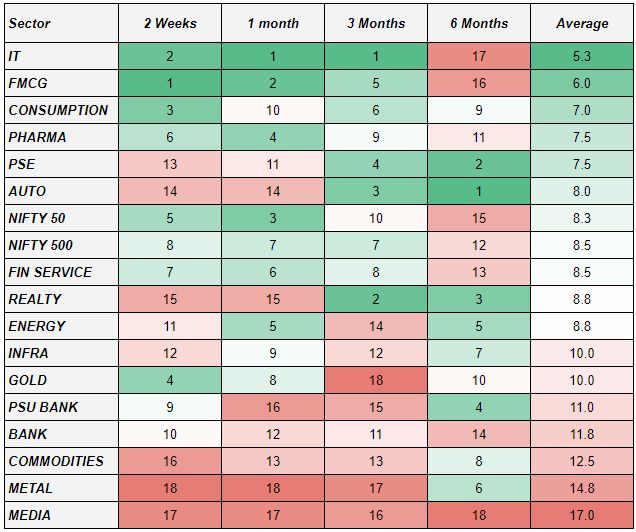

In the very short term, sectoral momentum is favoring IT, FMCG, and consumption. These sectors show strong average momentum rankings across various periods. Conversely, energy stocks have plummeted from rank five to eleven, and public sector enterprise stocks are also declining. Consumption has surged, likely due to anticipated tax relief for salaried taxpayers in the upcoming budget on the 23rd, which could boost consumption. The market seems to be in a cooling-off phase for the rest of the month, awaiting a new trigger. It is hoped that the budget will maintain the current equilibrium without causing disruptions. The election top in the charts is seen as a good support level if further corrections occur.

Spotlight - Anniversary Special

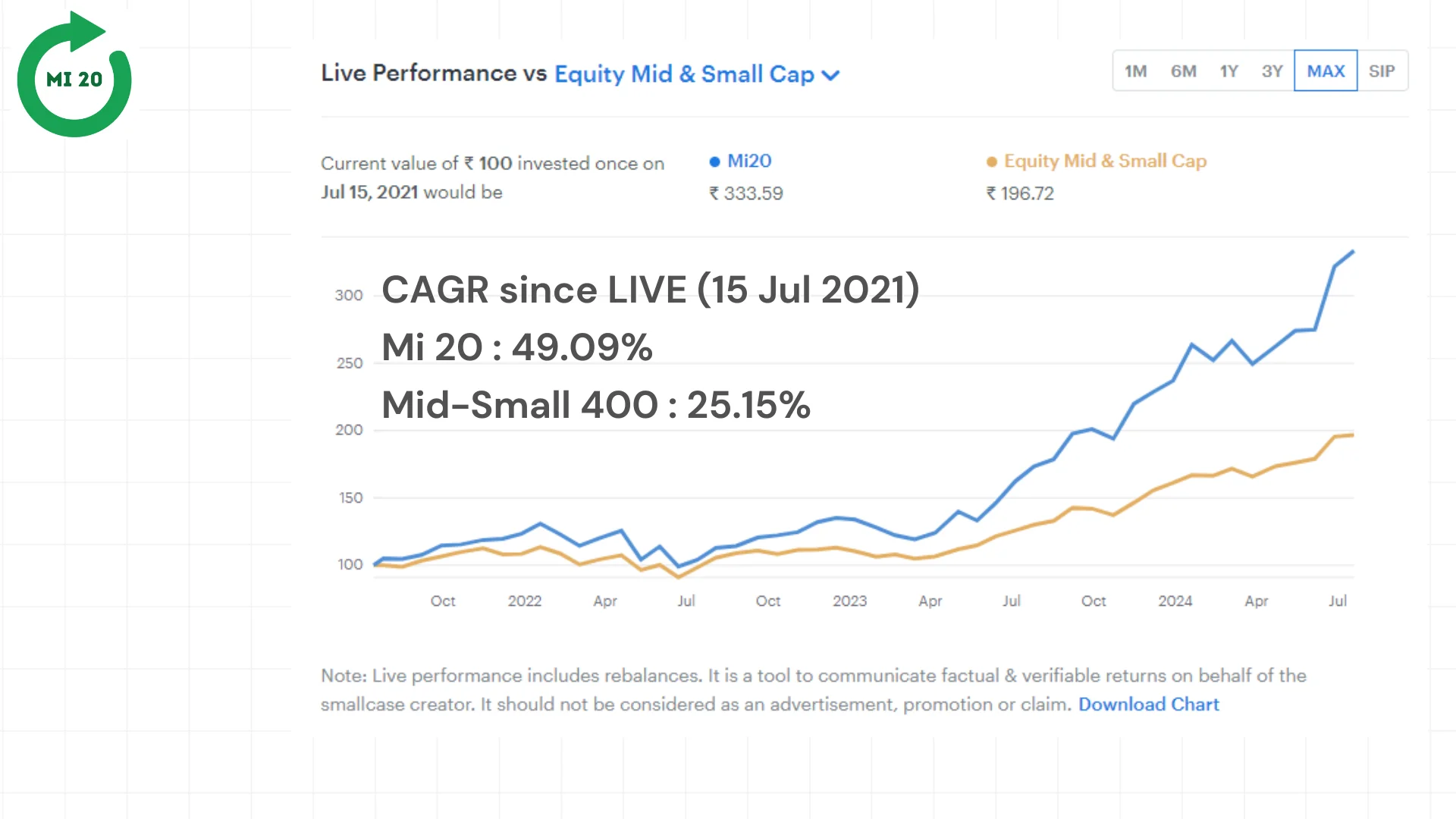

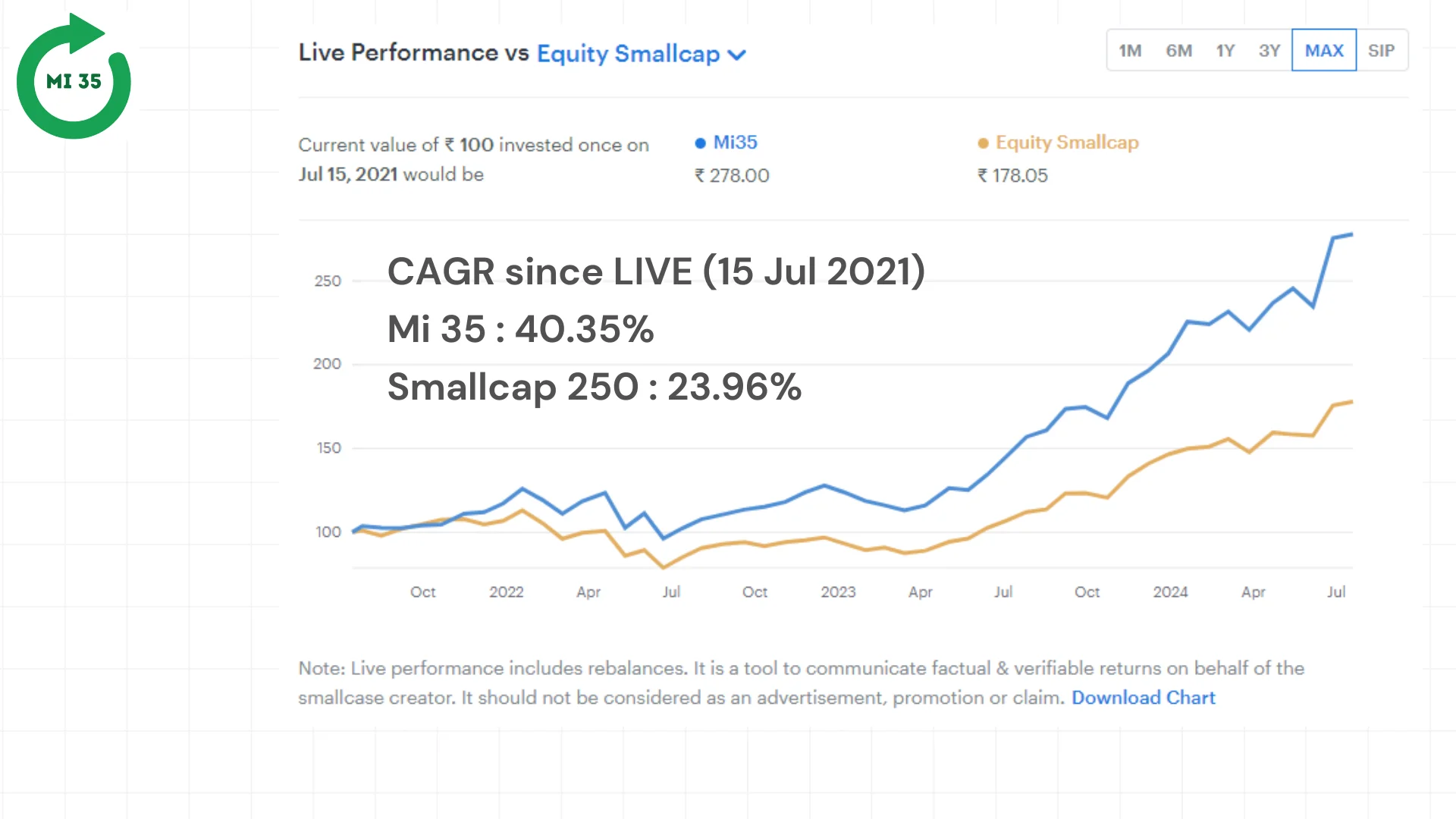

We are thrilled to announce that Mi 20 and Mi 35 have completed three years on the smallcase platform. Mi 20, a mid and small cap strategy, and Mi 35, a pure small cap strategy, have shown exceptional performance right since launch.

You can enjoy a 20% discount using the code AVR20. This code will be valid only till the end of 21 Jul 2024 (Sunday)

We encourage new users to approach these strategies with a long-term mindset of at least five years, especially considering the current elevated situation in small and mid caps. This will provide a better runway for the strategies to perform optimally.

We encourage new users to approach these strategies with a long-term mindset of at least five years, especially considering the current elevated situation in small and mid caps. This will provide a better runway for the strategies to perform optimally.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply