- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 27 Dec 2024

Good, Bad & Ugly Weekly Review : 27 Dec 2024

Has the downfall been arrested ?

Edition : 27 Dec 2024

Hello, Investor !

Markets Overview

The year-end market seems to be heading into cold storage, with the weather getting colder and the market following suit. After last Friday’s significant drop, this week’s trading has been extremely dull, remaining virtually flat. The market has, however, managed to avoid falling below last Friday’s level, which is at least a small relief in the short term.

Looking at the charts, you can see the large gap-down candle from last Friday, following Thursday’s gap-up. Throughout this week, prices stayed within the range of that big Friday candle. On a technical note, this could either be a flag pattern—implying that if consolidation continues, the market might head lower—or it might lay the foundation for a recovery if prices hold steady for another week or so. For now, Nifty ended the week with a 0.96% gain.

On the daily chart, Nifty remains very close to its 200-DMA (Daily Moving Average). In fact, the market tried to break out above the 200-DMA on all four trading days this week (Wednesday was a holiday) but failed each time, indicating the presence of selling pressure whenever the market attempts to move higher.

From a weekly perspective, this was a quiet stretch compared to the previous week. It’s too early to say the decline is over—several weeks of consolidation might be needed for a reliable bottom. There is also a possibility that next week could bring a more pronounced drop, potentially testing lower levels if the market sentiment shifts. Developments ahead of the Union Budget, as well as anticipation of Donald Trump’s first policy moves after taking office in January, could lead to a volatile month.

S&P 500 Overview

In global markets, the S&P 500 rose by 0.67% despite an earlier dip. It’s possible that Indian markets will continue to track US market trends until budget announcements provide fresh domestic triggers.

GOLD Overview

Meanwhile, gold edged up by 0.46%, staying relatively stable, aided by the weakening Indian rupee, which has slipped to around 85.5-85.7 against the dollar.

Dollar Index Overview

The dollar index continues to climb, indicating a strengthening dollar—usually a negative sign for FII (Foreign Institutional Investors) flows into emerging markets. If the dollar index keeps rising, FII outflows could persist, posing an ongoing risk to market stability.

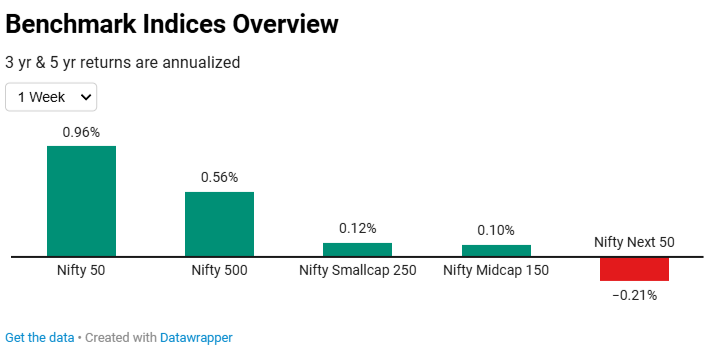

Benchmark Indices Overview

Among Indian benchmark indices this week, Nifty rose 0.96%, while the Nifty 500 performed worse. Both Mid Cap and Small Cap indices were flat, and the Nifty Next 50 declined by 0.21%. Over the last month, the Nifty Next 50 has been the worst hit, down 2.3%, whereas Mid Caps and Small Caps have managed small gains.

Sectoral Overview

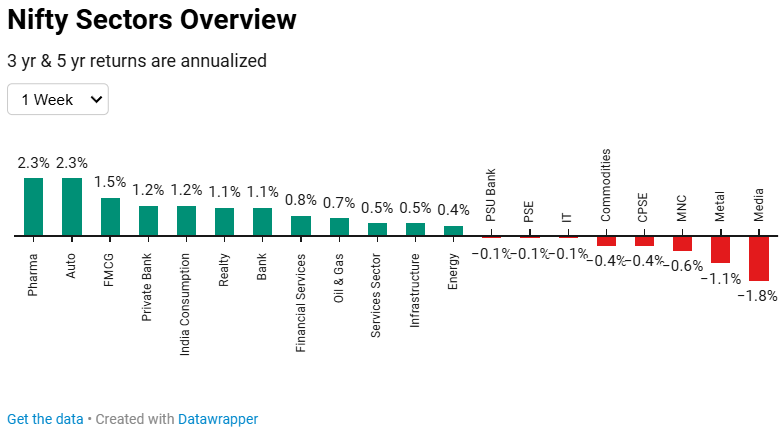

Sector-wise, pharma, auto, and FMCG led the market this week with gains of around 2.3%. Metals dipped by 1.1%, while other sectors moved within a tighter 1% range. Auto stocks had a good week, recovering some ground, possibly driven by expectations of stronger December sales and year-end discounts pushing inventory.

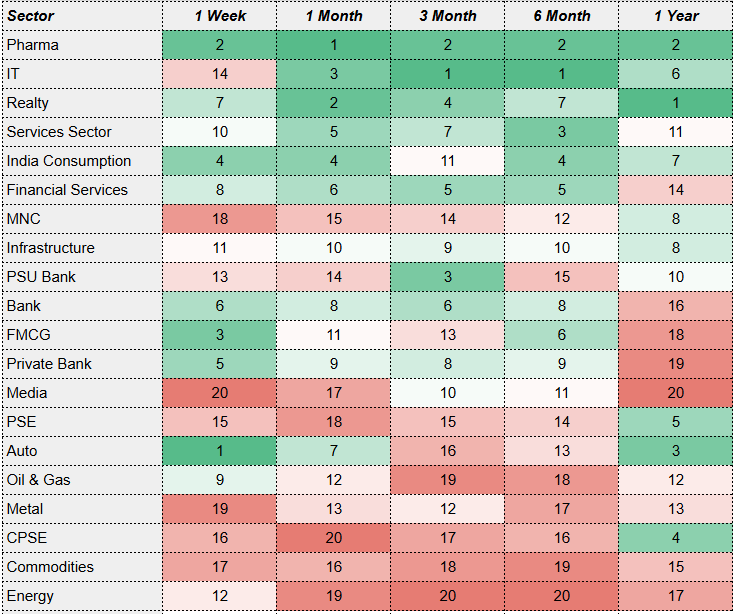

Overall momentum, calculated using multiple timeframes (one year, six months, three months, one month, and one week), still places pharma, IT, and real estate at the top. Discretionary traders should look for opportunities in these sectors, which have consistently shown relative strength. Although autos and FMCG improved this week, the broader trend remains flat, in line with the subdued market sentiment.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply