- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 20 Sep 2024

Good, Bad & Ugly Weekly Review : 20 Sep 2024

Edition : 20 Sep 2024

Hello, Investor !

Markets Overview

Another week where Nifty surprised everybody and closed at an all-time high. Nifty was very steady throughout the beginning of the week, but after the Fed’s announcement of a half-percent rate cut on the 19th, the market opened with a gap up, giving back most of its gains. On that day, the sentiment was that there might not be any further upward movement in the short term since all the expected news had already come out. However, the next day surprised everyone as the market surged, experiencing a big intraday swing before closing at 25,820, catching short sellers and bears off guard.

The Nifty weekly chart now shows a bullish engulfing pattern, countering the previous week’s bearish engulfing. This is a strong signal, and the bottom formed over the last two weeks is now a significant level. If that bottom is broken, it could indicate the start of a downtrend.

Benchmark Indices & WeekendInvesting Strategies Overview

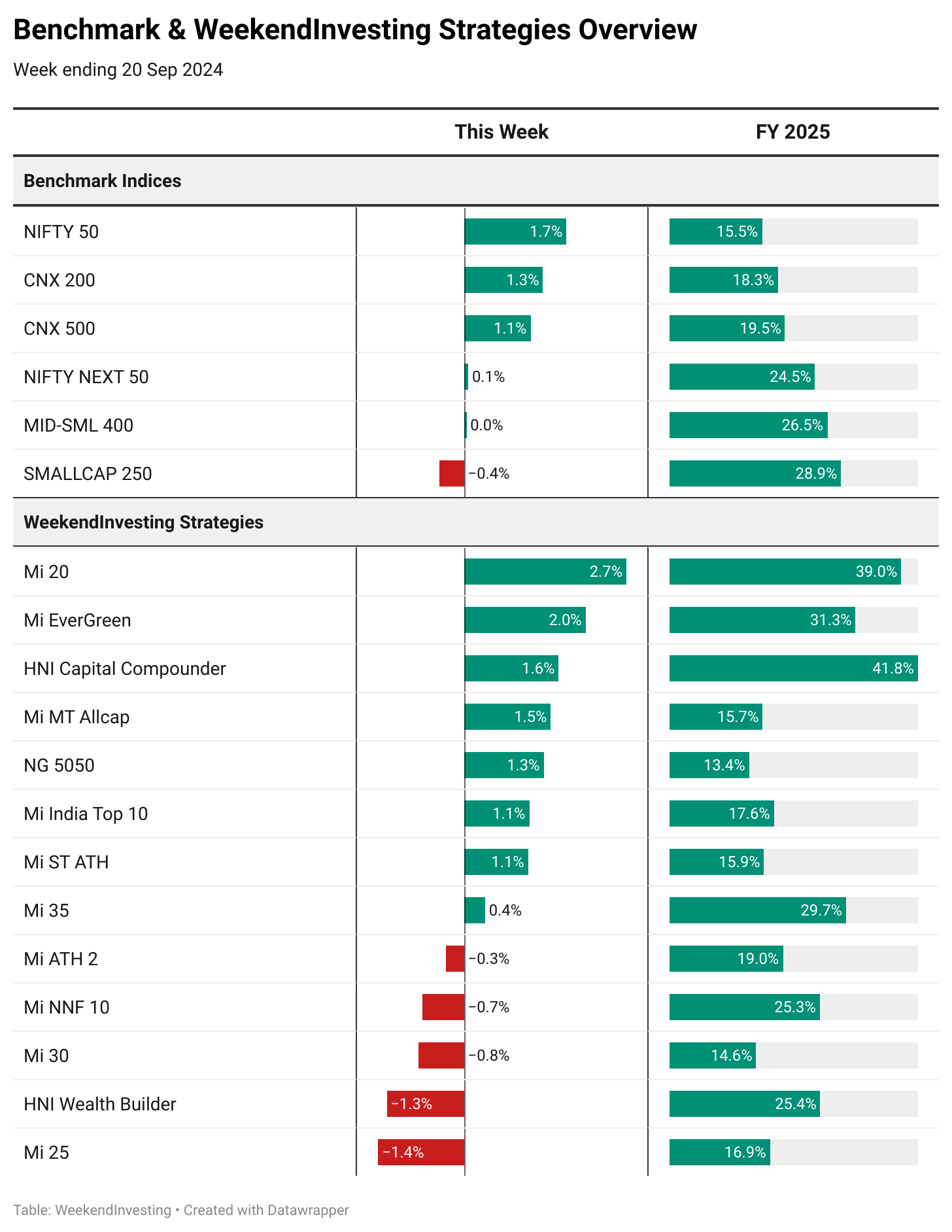

Nifty gained 1.7%, CNX 200 was up 1.3%, and CNX 500 rose by 1.1%. However, Nifty Next 50 only managed a 0.1% gain, and the Mid and Small Cap index was flat. The Small Cap 250 index actually lost 0.4%, indicating that the action was primarily in large caps, though Nifty Next 50 didn’t participate.

Among the WeekendInvesting strategies, Mi 20 stood out with a 2.7% gain for the week, followed by Mi Evergreen at 2%, and HNI Capital Compounder at 1.6%, making it the top performer of FY25 at 41.8%. Mi All Cap gained 1.5%, India Top 10 was up 1.1%, and Mi ST ATH rose by 0.4%. On the other hand, some strategies lost ground: Mi ATH 2 dropped by 0.3%, Mi NNF 10 by 0.7%, Mi 30 by 0.8%, HNI Wealth Builder by 1.3%, and Mi 25 lost 1.4%.

Sectoral Overview

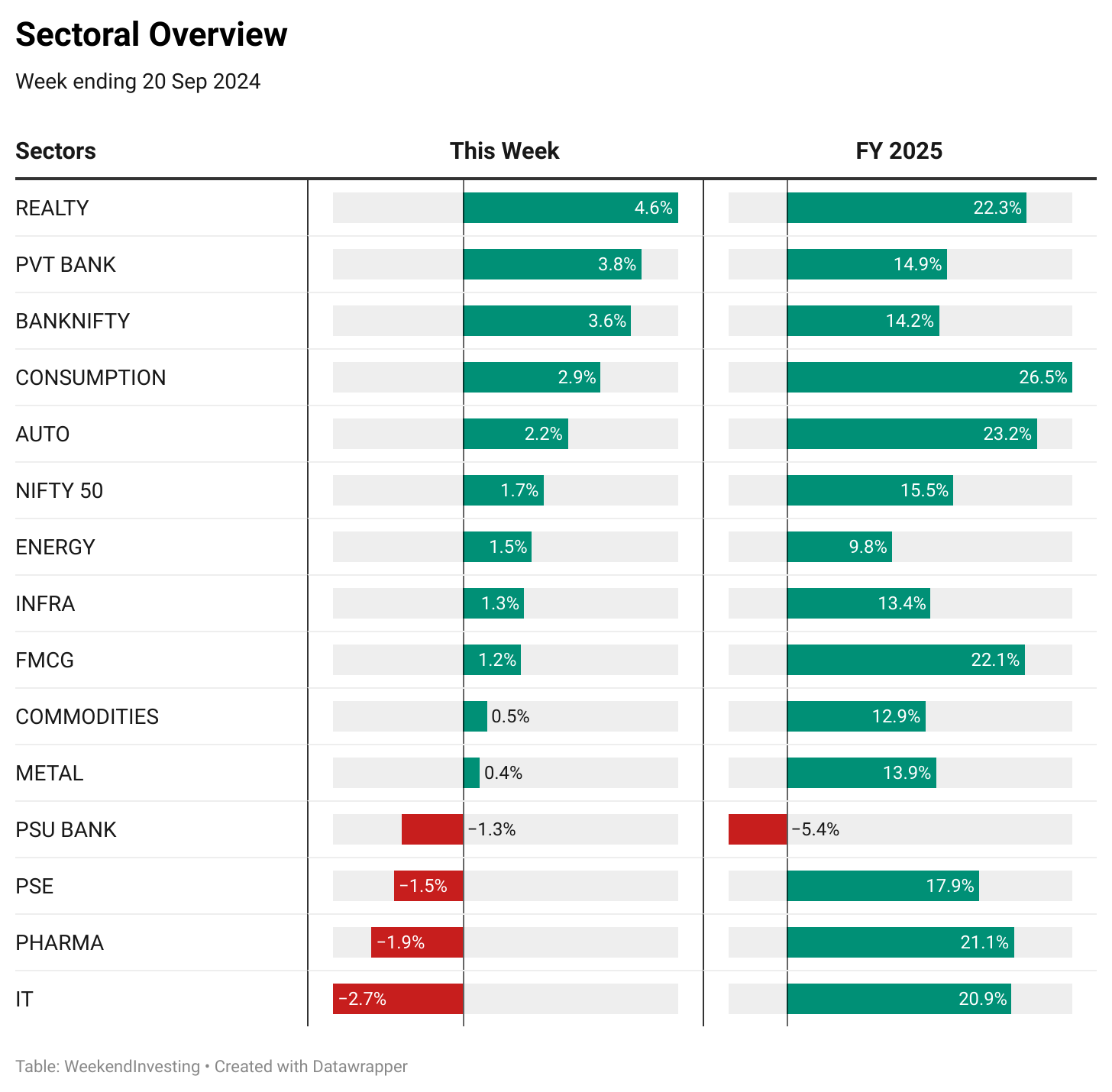

Sector-wise, real estate led the way with a 4.6% jump, while private banks rose by 3.8%, supported by rate cuts and expectations of future credit growth. Consumption stocks also performed well, anticipating a softer interest rate regime. Autos gained 2.2%, with expectations of better festive sales and potentially lower auto loan rates. Most other sectors saw gains between 0% and 1%, while PSU banks did not rise with private banks, showing a divergence. Public sector enterprise (PSE) stocks also lost 1.5%, and the sheen seems to be fading from some public sector companies, though some like shipping and railway companies are still performing well. Pharma and IT stocks also declined this week, which is understandable as the market has shifted from defensive sectors to more risk-on parts of the market.

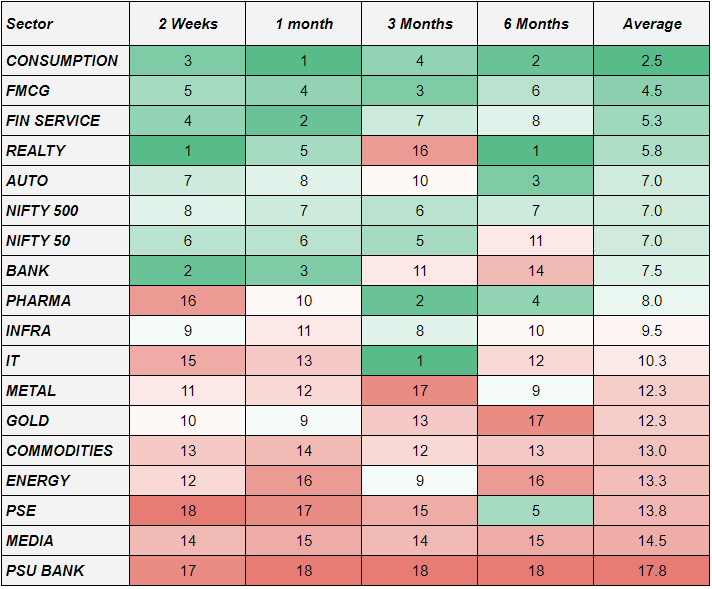

Looking at sectoral momentum rankings, consumption leads, followed by FMCG, financial services, real estate, and autos. Real estate, which was down over the last three months, has been running hard in the last two weeks, while pharma, which was strong over the previous three months, has slumped recently. This highlights the ongoing sector rotation, with consumption and FMCG still dominating overall.

Spotlight - Mi 35

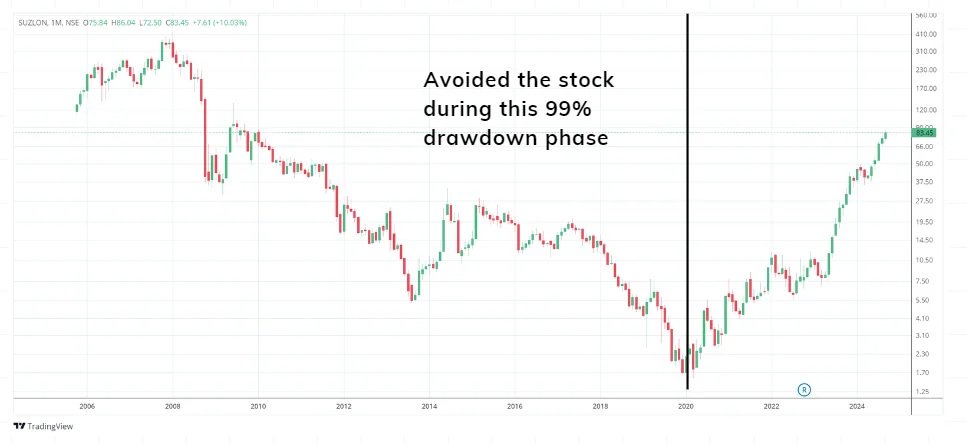

In the WeekendInvesting strategy spotlight, there’s a case study on Mi 35, focusing on Suzlon. Suzlon, which fell from over Rs400 in 2008 to below Rs2 at its lowest during the COVID period, has now resurrected to Rs83.45.

During the drawdown, no momentum strategy picked up the stock, but once the upward phase began, Mi 35 was able to enter at Rs15 and exit at Rs42, while some strategies are still holding the stock. This shows how momentum strategies avoid stocks that are in continuous decline and only capture them when they enter an uptrend.

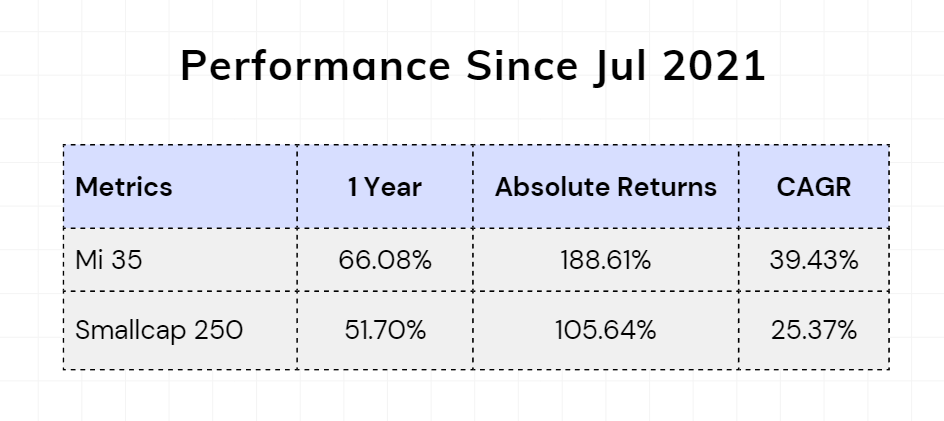

The Mi 35 strategy has returned 188% since its inception, compared to 105% for its benchmark. The strategy focuses on small-cap stocks, reviewing the portfolio every week. It’s a rotational strategy with 35 small-cap stocks, and the recommended capital for this strategy is between Rs5 and Rs30 lakh, with a 4-5 year outlook.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply