- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 21 Jun 2024

Good, Bad & Ugly Weekly Review : 21 Jun 2024

Edition : 21 Jun 2024

Hello, Investor !

Markets Overview

This week, Nifty remained flat, with no significant movement over four trading sessions. After the initial recovery from the election day results, the market showed a lack of momentum, suggesting it is in a resting phase. The market’s inactivity indicates a period of consolidation, with the weekly candle also showing minimal action. This lull suggests that the market is waiting for the next significant trigger to initiate movement.

Benchmark Indices & WeekendInvesting Strategies Overview

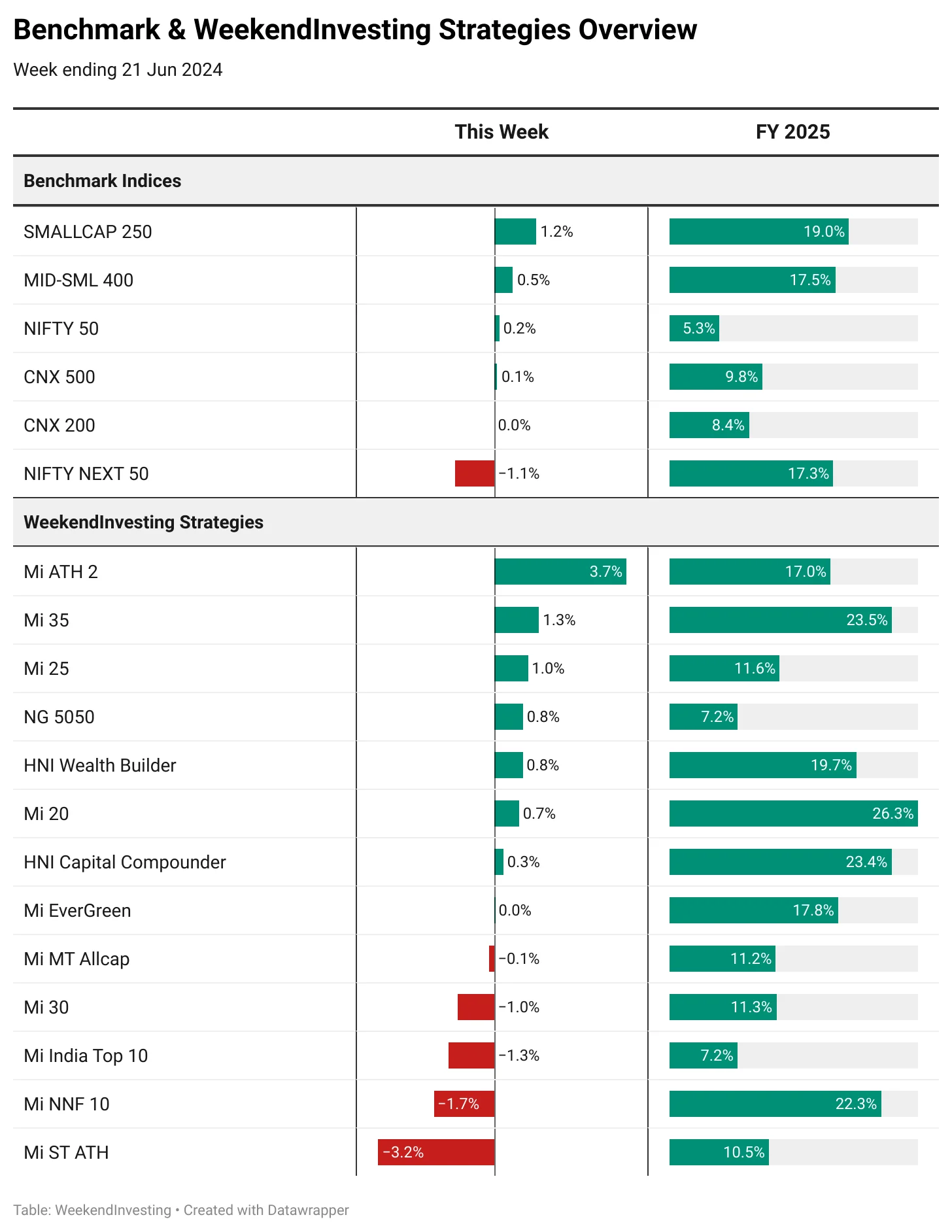

This week, Nifty showed a slight increase of 0.2%, essentially remaining flat. The CNX 500 and CNX 200 also showed minimal movement, with gains of 0.1% and 0%, respectively. The Nifty Next 50 saw a slight decline of 1.1%, while mid and small caps experienced some activity, rising by 0.5% and 1.2%, respectively. As we approach the end of the first quarter of FY 25, small caps, mid caps, and Nifty Next 50 have performed notably well, achieving gains of around 19%, which is impressive for such a short period.

This week, Mi ATH 2 stood out with a 3.7% gain, bringing its FY25 performance to 17%, significantly outperforming the CNX 500’s 9.8%. Mi 35 gained 1.3% this week, aligning with small caps and achieving a notable 23.5% in FY25. Mi 25 rose 1%, while NG 5050, a free strategy investing in gold and Nifty ETFs, increased by 0.8% this week and reached 7.2% in less than a quarter. HNI Wealth Builder performed well at nearly 19% in FY25, up 0.8% this week, with Mi 20 remaining a top performer at 26% in FY25 and 0.7% this week.

HNI Capital Compounder achieved 23.4% in FY25, compared to 8.4% on the CNX 200. Mi Evergreen remained flat this week, while Mi MT Allcap was also flat but reached 11.2% in FY25. Mi 30 and Mi India Top 10 lost ground, with the latter dropping 1.3%, yet still slightly ahead of Nifty at 7.2% versus 5.3% in FY25. Mi NNF 10, despite falling in line with Nifty Next 50, performed reasonably well in FY25. Mi ST ATH experienced a 3.2% loss this week but maintained a 10.5% gain in FY25, outperforming the CNX 500’s 9.8%.

Sectoral Overview

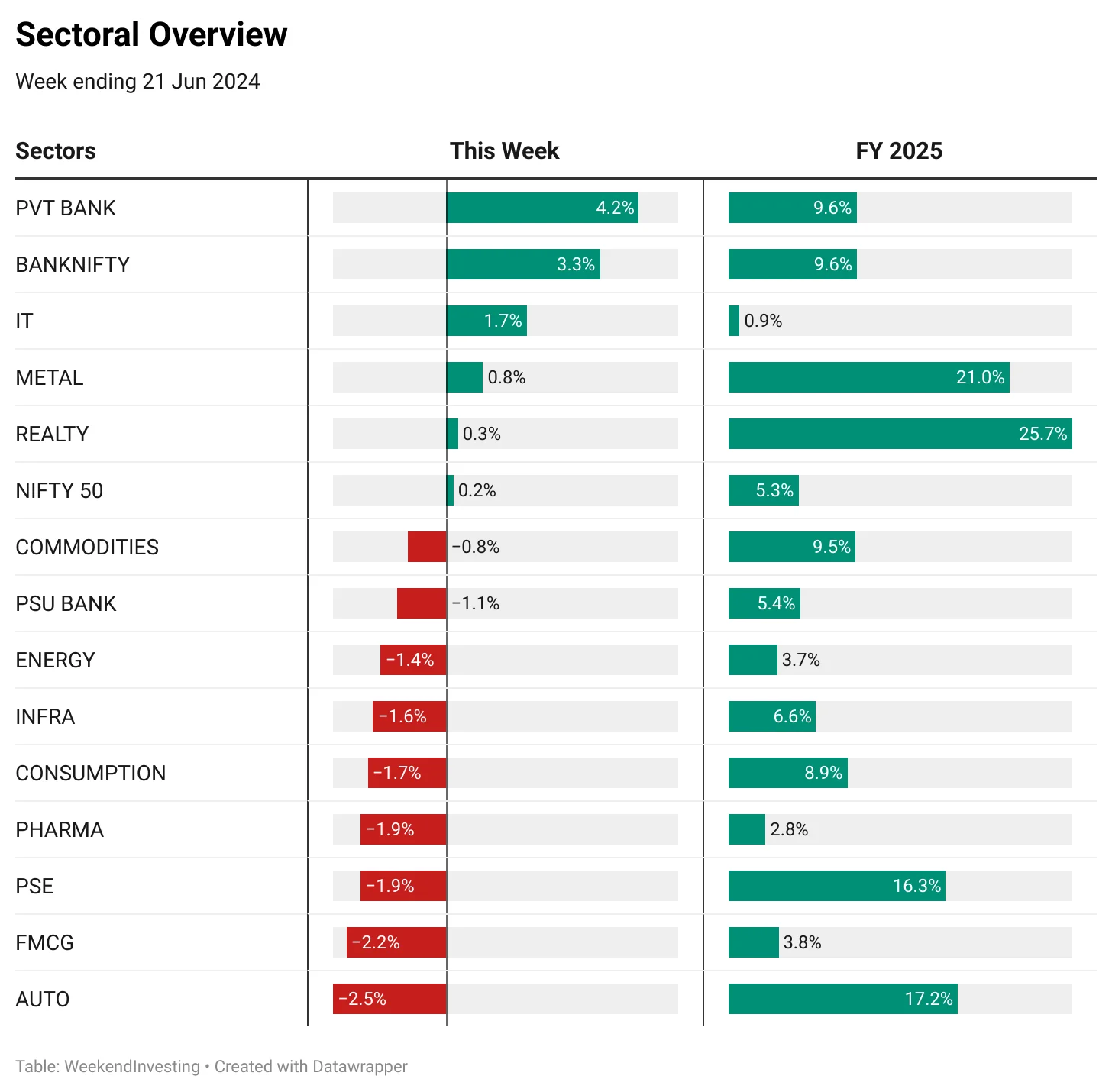

This week, private banks led the market rally, gaining 4%, which contributed to a 1.7% rise in the Bank Nifty. The market displayed a relay race pattern, with different sectors taking turns to support it. IT moved on one day, metals on one or two days, and private banking on two days. However, other sectors did not fare as well. Energy, infrastructure, consumption, pharma, public sector enterprises, FMCG, and autos all lost ground.

In the auto sector, concerns about a slowdown are rising as manufacturers offer discounts and inventories pile up. FMCG is also underperforming, reflecting a disconnect between stock movements and on-ground reality, suggesting a potential market cool-off soon. Public sector enterprise stocks declined this week but have surged 16% for the financial year. Real estate continued its impressive performance with a 25% gain in the first quarter, following a triple-digit gain last year. Metals also showed strong performance with a 21% gain, highlighting its resilience.

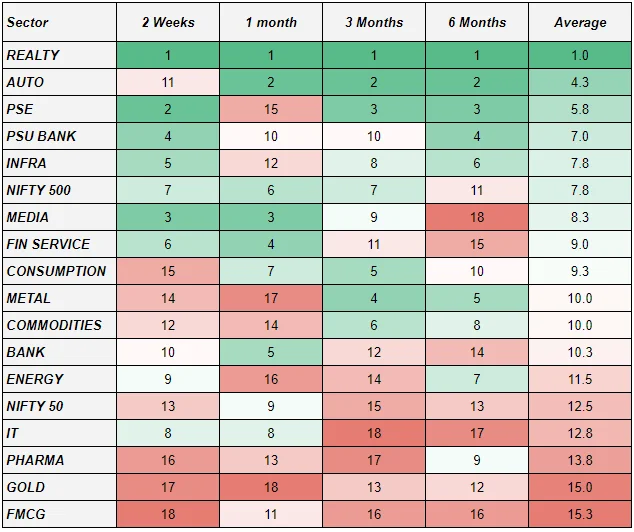

Sector rotation plays a crucial role in ensuring capital remains deployed in high-performing areas, avoiding stagnation in underperforming sectors. Currently, real estate maintains the top spot across various time frames, while other sectors lag significantly. Autos are losing momentum, and public sector enterprises, PSU banks, and infrastructure are also receding month-on-month. Consumption and the bank index have lost ground recently, indicating a general market stagnation and loss of momentum, especially among larger cap names. The market seems to be awaiting a trigger, likely from budget expectations.

Speculation surrounds potential tax cuts for the salaried class, which could boost consumption if implemented. Another significant concern is the potential reclassification of FNO (Futures and Options) as speculative rather than business income. If such a reclassification occurs, it could lead to a reduction in volume and interest in that segment, particularly if accompanied by unfavorable tax implications, which would negatively impact the market.

Spotlight - Mi India Top 10

Why hold when there is no performance ?

Sometimes, stocks do not perform well, and it can be frustrating. Let’s take ITC as an example. Over the last year, ITC has not done much after reaching a high near Rs 500. It has fallen about 18% from that peak. Although the long-term trend looks okay, the medium-term trend shows stagnation.

Looking at data from the past 30 years, there have been many long periods where ITC did not gain much. For example, from 1999 to 2005, ITC did not see any net gain for six years. Again, from 2006 to 2010, it stayed in a range. Similar stagnation happened from 2013 to 2017 and now, once more, it is consolidating. About 15-20 years out of the last 30 years have been spent in these frustrating periods.

To avoid such stagnation, momentum strategies can be helpful. These strategies help investors to avoid bear phases and use their capital more effectively. When you are not stuck in losing stocks, you can avoid the negative energy that comes with it. It can be very demotivating to sit with stocks that are not performing well. By focusing on winners, you can feel more positive and optimistic about your portfolio.

By not holding onto losing stocks, you can avoid the uncertainty and negativity they bring. Instead, focus on stocks that are performing well. Momentum investing, in particular, has been shown to be an effective strategy. Studies have shown that momentum is one of the best factors for investing. Even if the returns are similar to other methods, momentum investing can make the journey less painful.

One effective strategy is the Mi India Top 10. This strategy focuses on large-cap names from the Nifty 50. Each month, it selects the ten stocks with the highest momentum. You invest in these ten stocks and review the portfolio a month later. If a stock needs to be replaced, you do so, keeping only the healthiest stocks in your portfolio. Over time, this method can help create an alpha, meaning it can outperform the Nifty.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply