- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 22 Nov 2024

Good, Bad & Ugly Weekly Review : 22 Nov 2024

Signs of Strong Recovery ?

Edition : 22 Nov 2024

Hello, Investor !

Markets Overview

It was quite a volatile week, primarily due to the news of a case filed against Adani in the US, which rattled the markets. Adani stocks were hit hard, and this negativity impacted the broader market as well. However, surprisingly, on the last day of the week, the market rebounded with a rally of over 500 points, shrugging off the earlier fears. This suggests that the markets may have found a bottom for now. Another major event this week is the state election results, due on Saturday, which is expected to influence the markets significantly next week.

The rally on the last day, especially in a shortened four-day trading week, was unexpected. I've been mentioning for a few weeks now that the June election day high is a critical support level for the market. If this level gets broken, it could signal a weakening market. However, the base around 23,300-23,400 seems to be holding, and the 500-point jump on a pre-election poll day gives some confidence. While a disaster could reverse these gains, this move upwards might indicate the start of a new leg in the rally. Looking at technical indicators like the RSI, the market appears oversold, and past patterns show that relief rallies have followed sharp declines. With the market closing at a two-day high, there's a possibility that this upward momentum could continue.

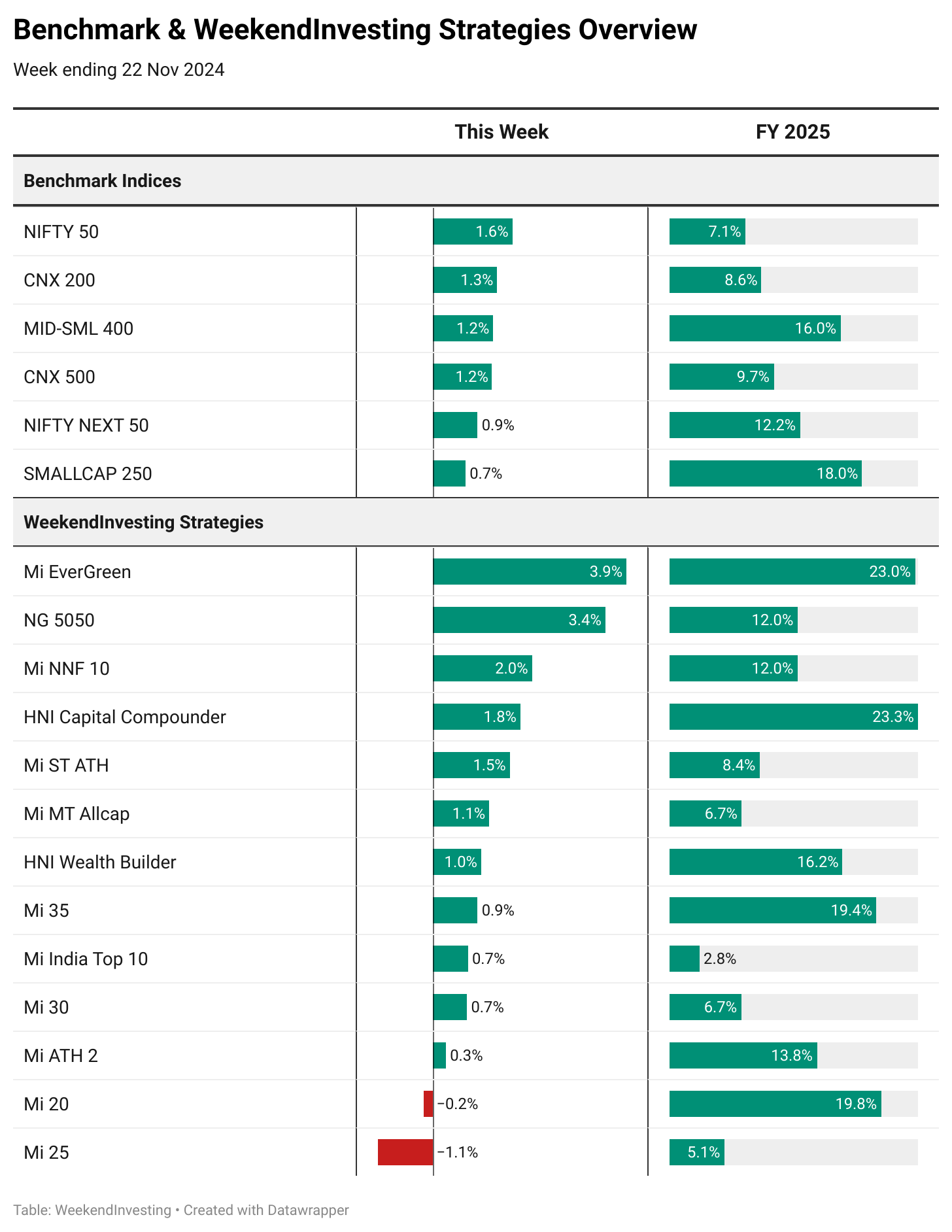

Benchmark Indices & WeekendInvesting Strategies Overview

For the week, Nifty recorded a 1.6% gain, while other indices like Nifty 50 and Next 50 gained around 1.2%-1.3%, with Next 50 underperforming largely due to the Adani stocks. Smallcap 250 lagged behind, gaining only 0.7%.

In the WeekendInvesting strategies, Mi Evergreen performed well with a 3.9% gain, while NG 50-50 followed closely with a 3.4% gain. However, small-cap-focused strategies like Mi 25 saw losses, with Mi 25 down by 1.1%. Despite some underperformance, particularly in Mi India Top 10, past trends suggest that these strategies may recover during a market boom phase.

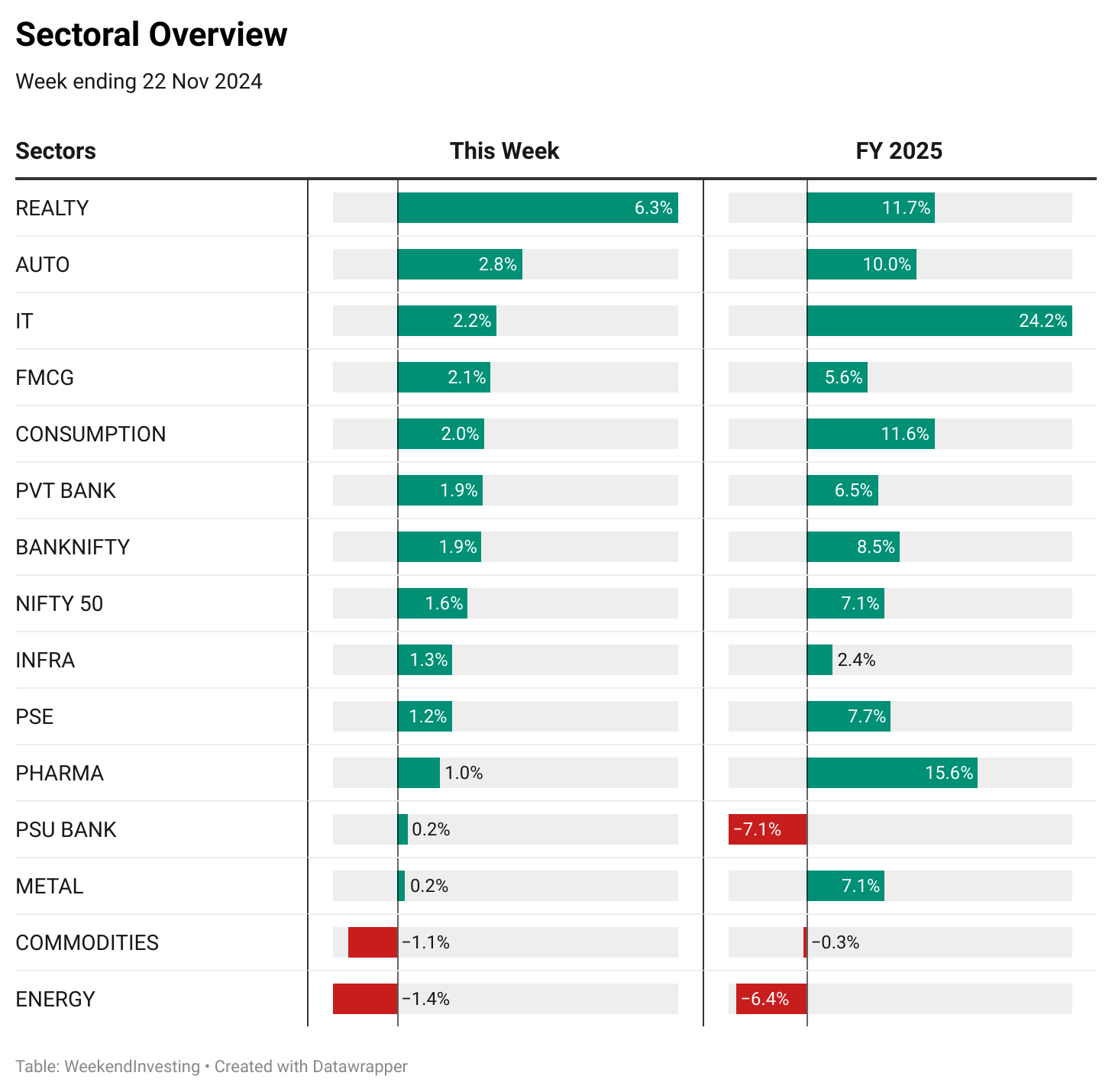

Sectoral Overview

Real estate stocks performed exceptionally well this week, gaining 6.3%, which is significant because these high-beta sectors typically get hit hard when markets are weak. IT and auto stocks also did well, indicating that the overall market wasn't damaged too severely.

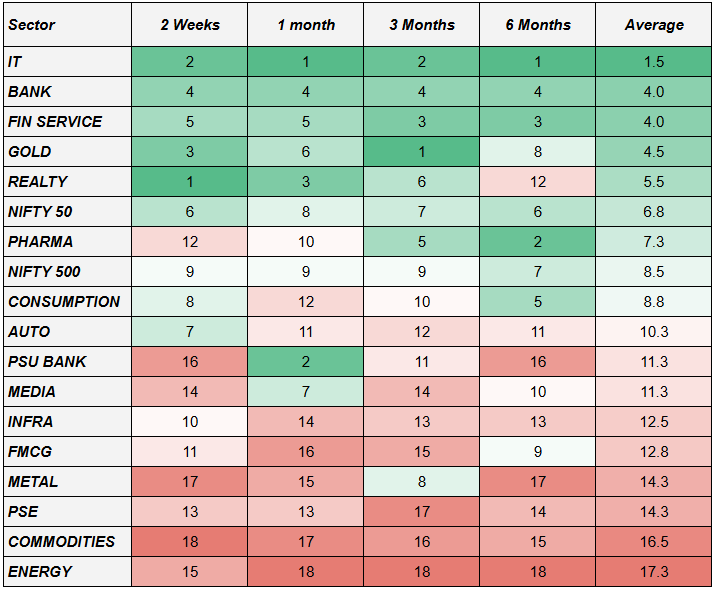

Financial services, banks, and IT stocks continue to lead in sectoral momentum, followed by real estate and pharma. These are the sectors to watch for trades, especially if you're a discretionary trader.

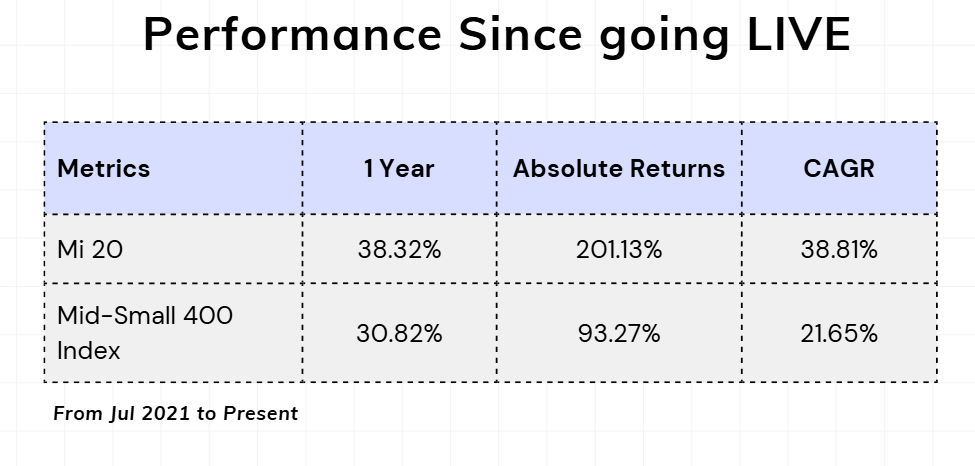

Spotlight - Mi 20

In the strategy spotlight, there were two contrasting trades involving BSE Ltd. In one trade, we bought and incurred a 37% loss, but in a subsequent trade, the same strategy gained 273%, and the stock is still being held at 3.7 times the entry price. This highlights a key behavioral issue in discretionary investing: many investors avoid stocks that have previously caused losses. However, when following a strategy without bias, the same stock can provide significant returns later. Even if a stock incurs multiple losses, one substantial return can make up for it.

It's important not to develop biases against any particular stock, especially in non-discretionary investing. This approach removes all biases, simplifies investing, and ensures that you follow your algorithm's signals without hesitation. Of course, there should be no red flags like regulatory issues or volume concerns, but past performance alone shouldn't dictate future decisions.

Mi 20, a strategy based on the mid and small-cap index, has performed well since its launch in July 2021. It selects 20 stocks from a pool of 400 and rotates them weekly, depending on market conditions.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply