- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 23 Aug 2024

Good, Bad & Ugly Weekly Review : 23 Aug 2024

Lower caps rally well as Nifty comes closer to . .

Edition : 23 Aug 2024

Hello, Investor !

Markets Overview

There has been a gradual uptick in the markets after the drubbing from a couple of weeks back. Although the markets are somewhat stagnating to some extent, they remain strong enough in terms of the underlying current to avoid further decline. The Fed meeting minutes from last night, which suggested potential rate cuts going forward, provide additional clarity on where the interest rate cycles might be headed.

Nifty has been drifting upwards nicely this week. We started the week at around 24,500 and are now at 24,800. While we haven’t fully recovered from the fall experienced in the first week of August due to the yen carry trade issue, the recovery has been significant, with the potential to reach 25,000 and above. The situation remains somewhat mixed, as there’s a lot of promoter selling and new IPOs entering the market, leading to a stronger supply side. Although demand is present, it has stabilized or plateaued, which raises some uncertainty about how much further the market can rise in the short term. Nevertheless, the current position appears stable.

Nifty weekly chart has closed right at the top, at 24,832, almost matching the previous all-time high. The last three weeks have shown recovery after the fall, which is a positive sign, indicating that the uptrend is intact and the market is likely to seek new ground upwards.

Benchmark Indices & WeekendInvesting Strategies Overview

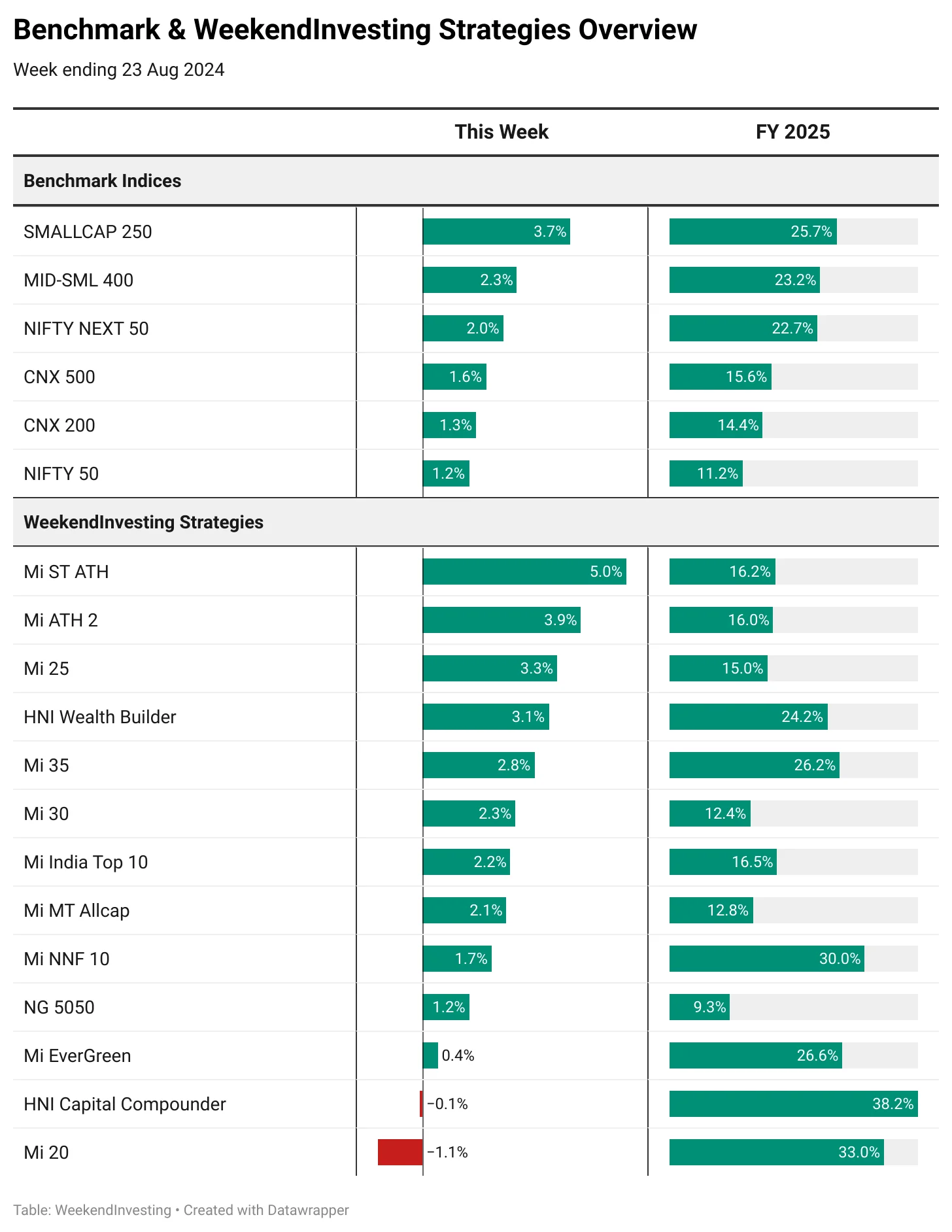

Small caps performed exceptionally well this week, with a 3.7% increase. The Mid and Small Cap 400 Index rose by 2.3%, Nifty Next 50 by 2%, CNX 500 by 1.6%, and CNX 200 by 1.3%, with the Nifty 50 up 1.2%.

Among the Weekend Investing strategies, Mi ST ATH and Mi ATH 2 rebounded strongly this week, with gains of 5% and 3.9%, respectively. Both strategies had lagged in recent times, but there seems to be some recovery. Mi 25 was up 3.3%, and HNI Wealth Builder rose by 3.1%. There has been a churn in small caps, which may take some time for older strategies to transition into newer stocks gaining momentum. Mi 35 was slightly behind at 2.8%, while Mi 30 and Mi India Top 10 did well, gaining 2.2%. Mi MT Allcap increased by 2.1%, and Mi NNF 10 by 1.7%. For the current financial year, the performance is already up by 30%. Mi Evergreen gained 0.4%, while HNI Capital Compounder didn’t make any gains this week but is already up by 38% for FY 25. Mi 20 lost ground, down 1.1%, but is still up 33% for FY 25. While there will be short-term fluctuations, the key is to evaluate whether the strategies meet the benchmark over the long term.

Sectoral Overview

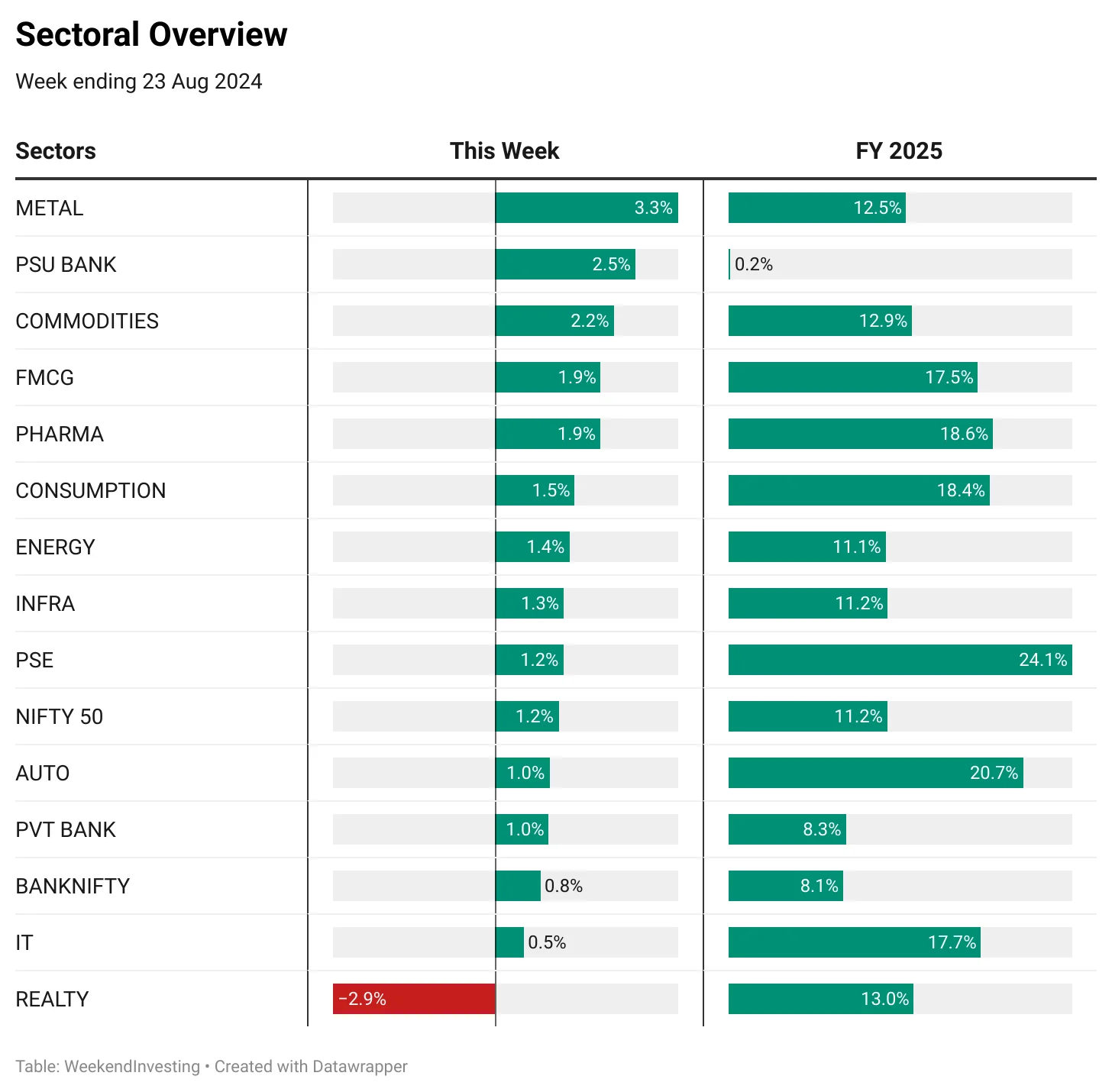

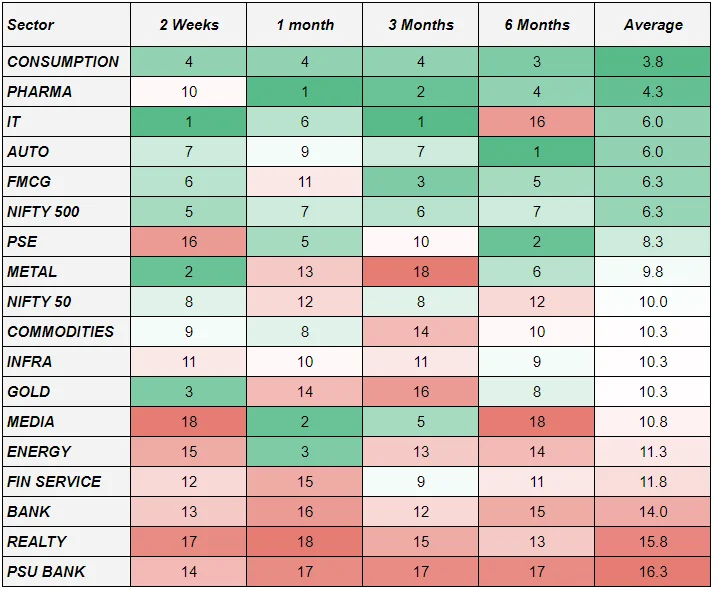

In terms of sectors, the real estate sector stood out with a 2.9% decline this week. The chart for this sector looks a bit dull, but upcoming interest rate cuts could provide some tailwinds. However, it’s possible that this is already priced in. On the other hand, metals performed very well, up 3.3%, and PSU banks recovered their full financial year loss with a 2.5% gain. FMCG and pharma sectors also rose by nearly 2% each, contributing to the overall strong performance of most sectors for FY 25, with the exception of PSU banks. IT, metals, and gold have shown significant strength in the very short term this week.

Consumption stocks have been stable, while consumption, pharma, and IT have ruled the top momentum ranks, along with auto and FMCG. These sectors have seen consistent action over the last six months, while real estate and PSU banks have fallen, along with financial services. Energy stocks have also taken a significant hit.

Spotlight - Mi ST ATH

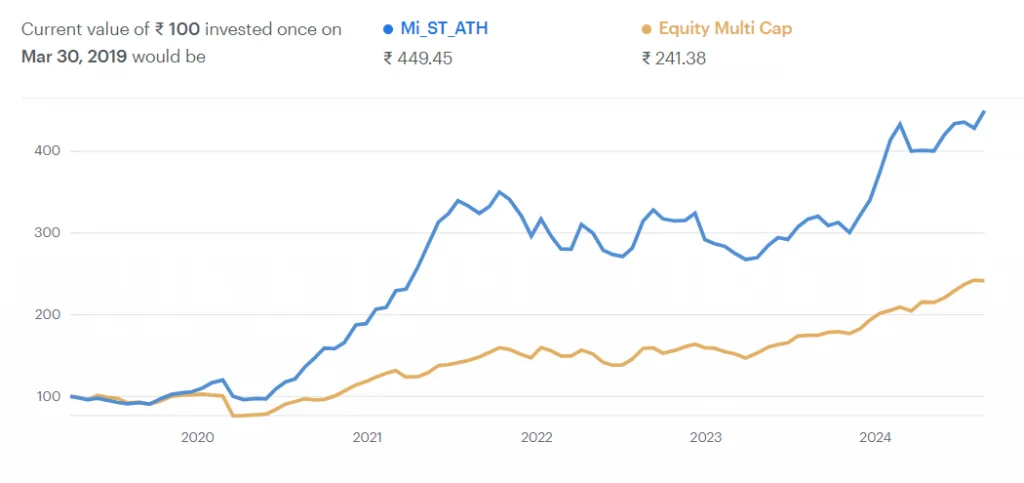

Mi ST ATH is on a comeback trail. Although it has been lagging for some time, last week was very positive for the strategy. On a since-live basis, the strategy has performed well, but there were some challenges during the recent rally. Over a one-year period, Mi ST ATH is just above the multi-cap benchmark, while it is still lagging over three years.

However, the five-year performance and CAGR since launch are strong. Mi ST ATH is a good strategy that goes to cash immediately in the face of trouble, which has protected it from deep drawdowns. This design feature will allow the strategy to outperform the market during downturns. Once we experience such an event, Mi ST ATH and Mi ATH 2 are likely to perform very well compared to others.

The strategy is based on stocks with a market cap up to ₹1,000 crore, with a weekly rebalance. The recommended capital is between ₹5 to ₹30 lakhs, and the outlook is five years.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply