- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 24 May 2024

Good, Bad & Ugly Weekly Review : 24 May 2024

Edition : 24 May 2024

Hello Investor !

Markets Overview

This week was remarkably strong for Nifty, reaching an all-time high. The anticipated upward move happened earlier than expected, ahead of the election results. A significant move on Thursday caused many Foreign Institutional Investors (FIIs) to unwind their short positions. The presence of these short positions at all-time highs provides a cushion in case of a market fall. For the last ten weeks, Nifty had been stuck in an 1100 to 1200 point range, but this breakout suggests a potential significant upward move, similar to the July to November period when a similar range led to a substantial rise.

Benchmark Indices & WeekendInvesting Strategies Overview

This week, Nifty moved up by 2.2%, along with gains in the CNX 200 and CNX 500. Mid caps increased by 1.2% and small caps by 0.5%, showing less participation. The standout performer was the Nifty Next 50.

The Nifty Next 50 index performed exceptionally well, with the Mi NNF 10 strategy tracking it and achieving a 6.3% gain this week compared to the formers 2.9%. Mi NNF 10 is up 20% for FY 25. Mi 20 and Mi 35 also showed strong performance with gains of 19.8% and 17.4% respectively for FY 25. HNI Capital Compounder and Mi ST ATH gained nearly 5% this week, while Mi EverGreen and Mi India Top 10 saw around 3% gains. Although Mi 35 was relatively weaker with a 2.2% gain, it still outperformed the small caps’ 0.5%. HNI Wealth Builder, Mi 30, and Mi MT Allcap did not perform as well this week.

Sectoral Overview

Public sector enterprise (PSE) stocks continued their strong performance, up 18% for FY 25. Metals gained 3.9% this week, reaching a 20% gain for the financial year, making them the best performers over the last few months. PSU banks, energy stocks, and commodities also rallied significantly. The overall market saw upward movement, although FMCG and Pharma did not participate in the rally. Private banks performed well with a 1.6% gain while IT is recovering quickly and is now down only 3.1% for FY 25.

Sectoral momentum shows that public sector enterprises, metals, real estate, and autos are top performers across various time frames. GOLD has lost some steam in the recent few weeks after a strong run. MEDIA has also done quite well to recover from the recent weakness to occupy the 5th spot in the fortnightly ranking.

Discretionary investors can focus on opportunities within these strong sectors.

Spotlight - Mi NNF 10

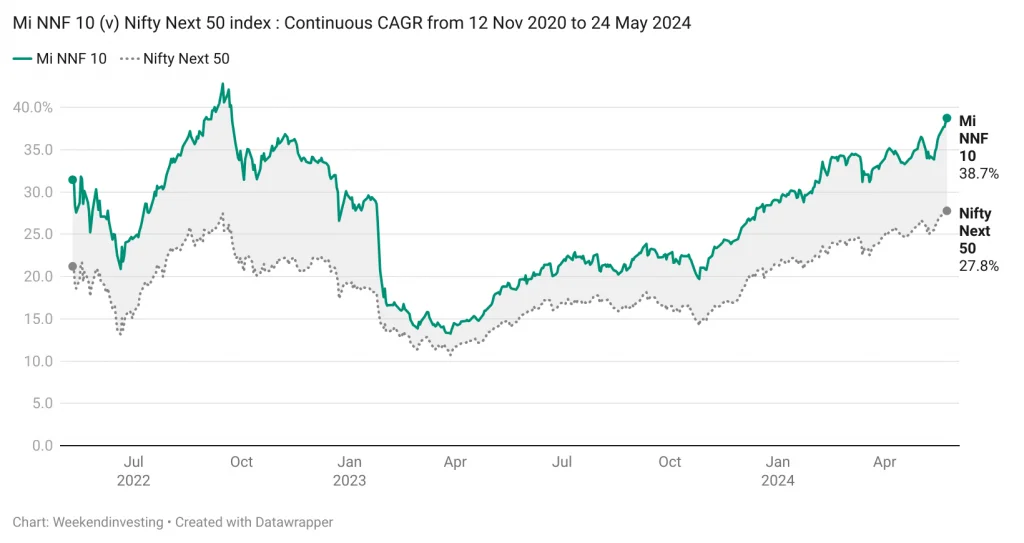

Mi NNF 10 has been one of our most popular strategies right since we launched it back in Nov 2020. The strategy has clocked an impressive 3x (200% gains) since going live on 12 Nov 2020 (3.5 years) at an exceptional CAGR of 38% (till 23 May 2024).

In the same period, Mi NNF 10’s benchmark index, the Nifty Next 50 (also called Nifty Jnr) has clocked 136% (vs 213% on Mi NNF 10) at a CAGR of 27% (vs 38% on Mi NNF 10)

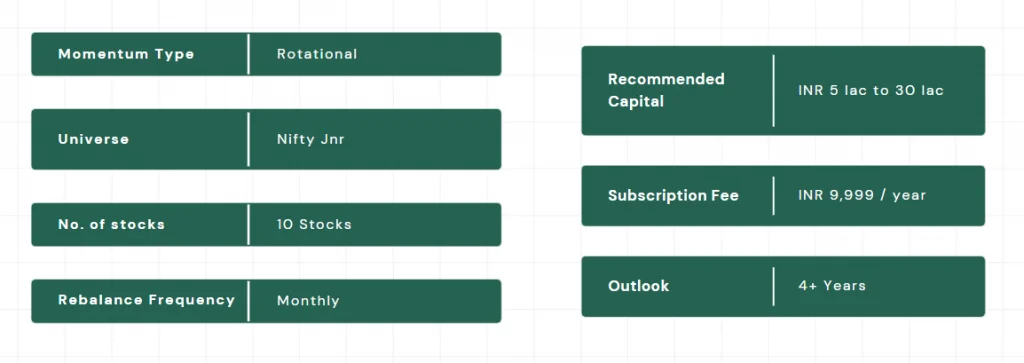

The highlight of the strategy is its ability to rotate into the top performing stocks within the Nifty Jnr index (Nifty universe #51 to #100 stocks) aiming to extract further alpha from this special universe which is already the best performer compared to some of the other popular benchmark indices across several timeframes.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply