- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 25 Apr 2025

Good, Bad & Ugly Weekly Review : 25 Apr 2025

Markets Nervous after Recent Attack ?

Edition : 25 Apr 2025

Hello, Investor !

Markets Overview

The Nifty chart this week tells a mixed story. Although Nifty is up 2.68%, this number does not fully capture what is happening internally. The index has bounced for the third time from the 22,775 level, which appears to be a key support.

Nifty – Weekly Perspective

It was a substantially eventful week, marked by rising nervousness in the markets due to the attack in Pahalgam and subsequent countermeasures. Friday saw a sharp fall in the markets during morning trade, although some recovery came by the end of the day. It is likely that volatility will persist until there is more positive news, possibly some victory updates for India. Additionally, with the markets having rallied almost 2,000 points in the past ten sessions, some digestion of these gains was inevitable.

On the Nifty daily chart, the index moved down sharply after three days of relative lull. This lull had been preceded by a steep 2,000-point rally. Importantly, the Nifty has taken support right around the previous highs at the 24,000 mark, a positive technical sign unless this level gets broken.

If the index manages to break above 24,400, it would be a very bullish signal. The next major resistance is likely around the 24,800 mark, corresponding to the December tops. Overall, the market appears to have exited its medium-term downtrend and entered a consolidation phase, although short-term volatility remains possible.

Nifty – Weekly Chart Perspective

The weekly chart further confirms the strength. The Nifty has now posted three consecutive weeks of gains, an encouraging sign in a market that had been sluggish for some time. Breaking out of the downward sloping trendline adds to the bullish setup, although sustainability will depend on further market developments.

S&P 500 Overview

Meanwhile, the S&P 500 performed impressively, rising 4.5% during the week and surpassing the highs of the previous two weeks. This strength could potentially rub off positively on other global markets, including India.

GOLD Overview

Gold, however, remained sluggish, declining 0.24% for the week and closing at ₹9,654. Given the spectacular rally gold has had over the past year and a half, a phase of consolidation—even a correction towards ₹8,500—would not be unusual. Markets typically retrace a portion of steep gains, and gold is no exception.

Dollar Index Overview

The dollar index attempted to bounce back, moving up to 99.5 after having dipped below 98 recently. Although the U.S. establishment appears intent on weakening the dollar to boost exports, there is little willingness among other countries to allow their currencies to appreciate. A market-driven correction is more likely, and if the dollar keeps weakening, the Indian rupee may strengthen marginally. However, given the export lobby’s influence, any substantial rupee appreciation may face resistance from policymakers.

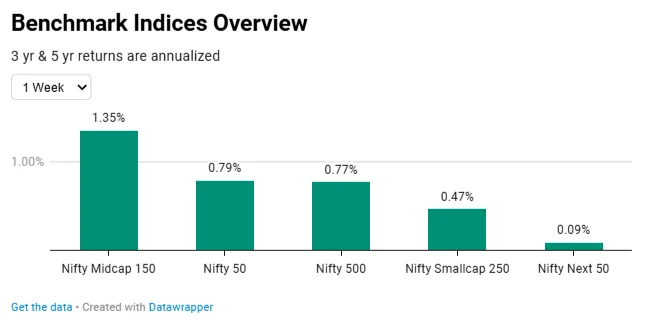

Benchmark Indices Overview

In terms of benchmark indices, the mid-cap index outperformed with a 1.3% gain this week. Other indices were relatively flat, with the Nifty and Nifty 500 up 0.7%, small caps rising 0.4%, and the Nifty Next 50 remaining virtually flat.

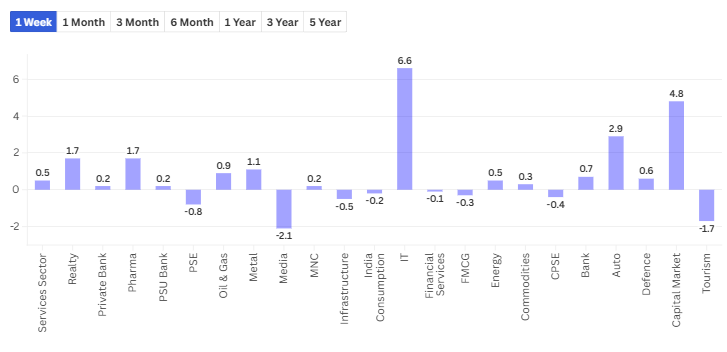

Sectoral Overview

IT stocks led the rally this week with a 6.6% gain, followed by capital markets at 4.8% and autos at 2.9%. On the downside, media and tourism stocks fell by 2.1% each, likely impacted by geopolitical concerns following the attack. Over the past month, capital markets have made a strong comeback with a 12.9% gain, signaling strength in the segment. FMCG has also revived after a prolonged slump, rising 6.4% over the month. Both private and PSU banks gained nearly 6%, while metals and IT faced notable declines.

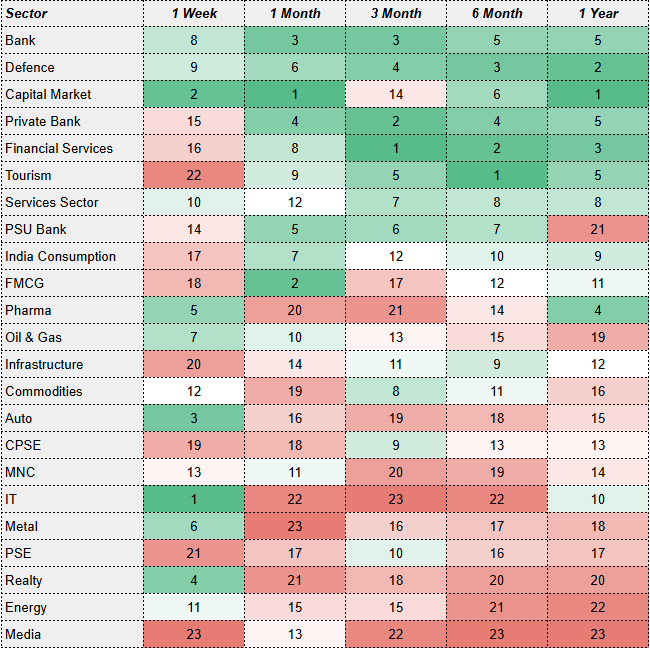

Looking at sectoral momentum, banking has now emerged as the top-performing sector, followed closely by defense and capital markets. Financial services, which were leading earlier, have suddenly dropped, as have private banks. While tourism stocks had surged, IT, after a long slump, is now showing signs of revival along with autos and pharma. Real estate is also gradually picking up.

On the flip side, public sector enterprises and infrastructure stocks continue to lag, and consumption and FMCG sectors, despite brief improvements, are slumping again. Overall, the sectoral leadership is undergoing a significant shift, with capital markets, IT, autos, and pharma looking more promising.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply