- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 26 Jul 2024

Good, Bad & Ugly Weekly Review : 26 Jul 2024

Edition : 26 Jul 2024

Hello, Investor !

Markets Overview

This week, Nifty remained flat despite significant market volatility. After a couple of days of gains, a holiday interrupted the momentum, followed by a rapid surge on Thursday likely due to short covering and positive TCS results. However, by Friday, all gains were erased, closing the week where it started. While Nifty saw no net change, other market segments experienced declines. The weekly candle pattern, an inverted hammer, often signals a potential top and suggests several weeks of consolidation ahead. Given the strong uptrend since March 2023, a cooling-off period seems likely, especially with cautious expectations around the upcoming budget.

Benchmark Indices & WeekendInvesting Strategies Overview

Markets this week was a complete seesaw. For the first few sessions, the market was down and out. The budget was the highlight of the week, causing wild swings on budget day but remaining very stable post-budget. The next day was an inside day relative to the budget, and the third day post-budget was also an inside day but without significant declines. Friday, however, was a blockbuster day, with the market closing at a new all-time high of 24,851. This surprising turn of events saw FIIs buying a couple of thousand crores on Friday.

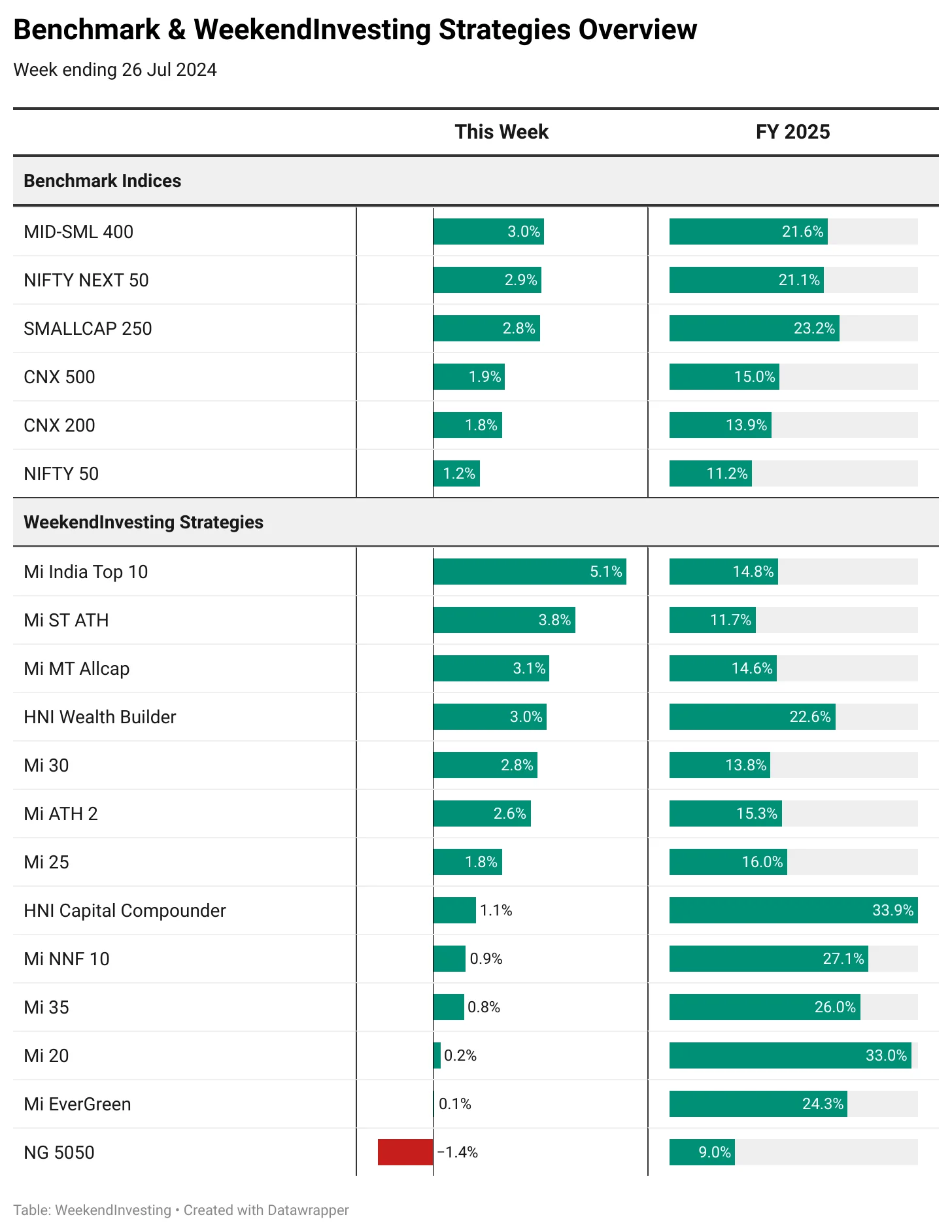

Nifty weekly performance remained very strong, showing no signs of weakness. The upward trend continued with Nifty up 1.2%, CNX 200 and CNX 500 up about 2%, and small caps leading the way with a 2.8% increase. Nifty Next 50 and Mid-Small 400 indices also performed well, up 2.9% and 3% respectively. Small caps reached 23.2% for FY25, indicating robust growth.

In terms of Weekend Investing strategies, Mi India Top 10 led the chart with a 5.1% increase this week compared to Nifty 50’s 1.2%. Mi ST ATH also performed well at 3.8%, Mi MT Allcap at 3%, and HNI Wealth Builder at 3%. Mi 30, Mi ATH 2, and Mi 25 showed gains between 2.8% and 1.8%. HNI Capital Compounder, though slow this week at 1.1%, is still leading for FY25 at 33.9%. Mi NNF 10 was muted this week at 0.9% versus 2.9% on the Nifty Junior index, but it is performing exceptionally well for FY25 at 27%. Mi 35 also remained subdued. It appears there has been a rotation in stocks, where previously leading stocks have slowed down, allowing other sectors to take the lead. Mi 20 and Mi 35 have taken a backseat despite the rise in small caps. Mi Evergreen was flat at 0.1%, and NG 5050 was impacted by cuts in duty on gold.

Sectoral Overview

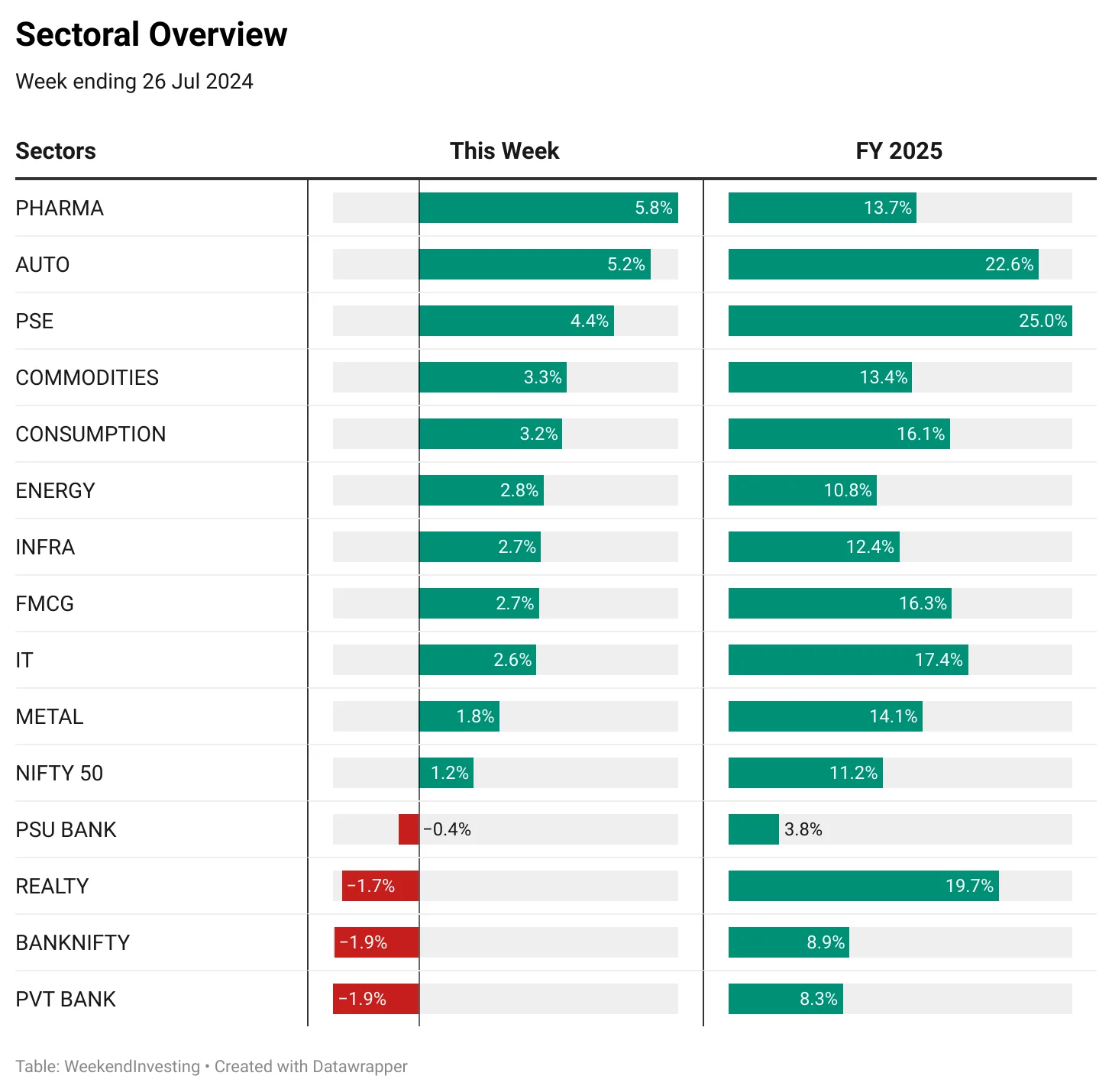

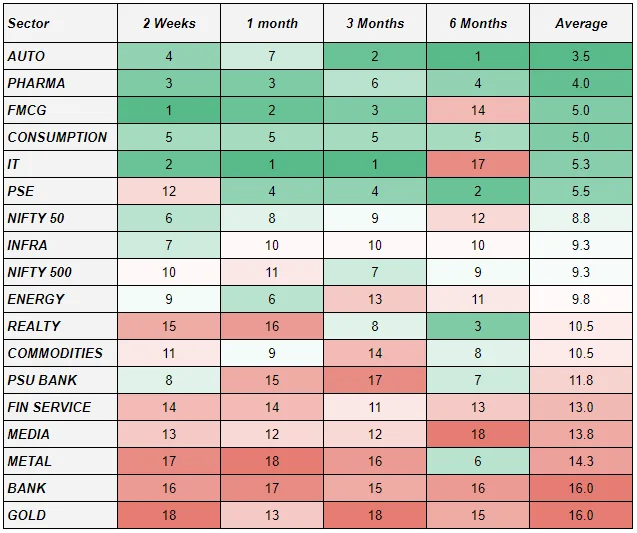

Pharma and autos led the market this week, up 5.8% and 5.2% respectively. This shift marks a new leadership trend. Public sector enterprise stocks rose by 4.4%, maintaining a 25% gain for FY25. Commodities, consumption, energy stocks, infrastructure, and FMCG stocks also performed well. Real estate stocks were the only laggards. Bank Nifty, primarily led by private banking, declined by 1.9%, with PSU banks not rallying at all. For FY25, they remain the weakest sector tracked. Autos and pharma are leading on a longer-term basis, but FMCG is showing strong short-term momentum.

Sectoral momentum in the short term is led by pharma, autos, and consumption stocks, but over a two-week, one-month, three-month, and six-month average, the same sectors maintain importance. Public sector enterprise stocks have suddenly lost momentum, dropping from fourth to twelfth position. Energy and commodities have also seen some declines.

Spotlight - Mi EverGreen

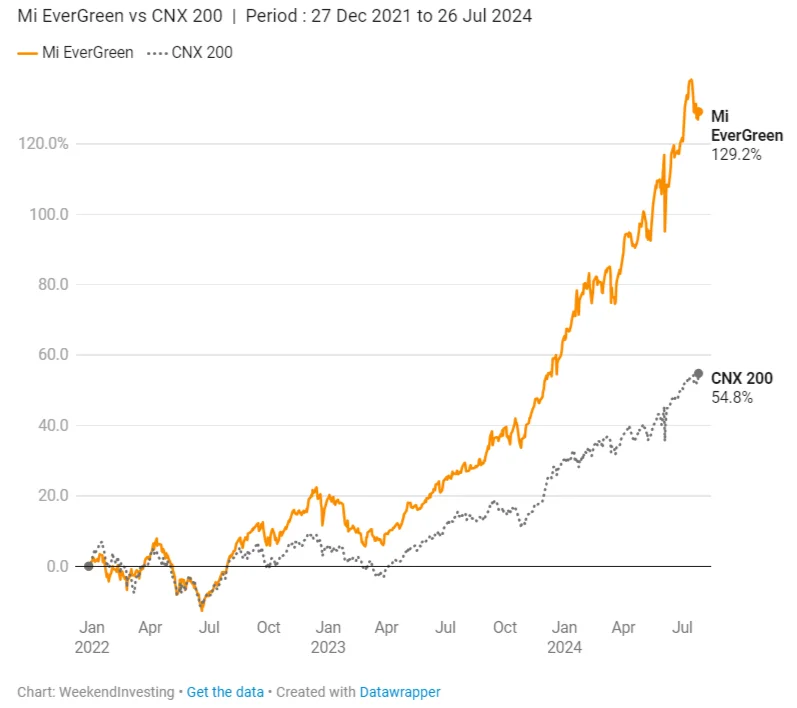

Mi EverGreen strategy, since its inception on December 27, has completed two years and seven months, showing impressive absolute returns. This strategy invests 25% in gold as a fixed percentage, providing a hedge when the equity part is not performing well.

The performance from July 2022 shows a significant takeoff, virtually doubling returns compared to the CNX 200 benchmark. Mi EverGreen is a 20-stock strategy investing in CNX 200 stocks, with 25% allocated to gold, ensuring a balanced portfolio.

Disclaimers & Disclosures : https://tinyurl.com/2763eyaz

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply