- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 03 Jan 2025

Good, Bad & Ugly Weekly Review : 03 Jan 2025

Hopes of a recovery ?

Edition : 03 Jan 2025

Hello, Investor !

Markets Overview

Markets this week

Nifty ended the week with a 0.8% gain in what was largely a dull, low-volume period around the new year. From December-end until January 2, the market showed a strong upswing of nearly 500 points intraday—reflecting a reluctance to head lower in a hurry. The Nifty seems intent on maintaining its current levels, suggesting that while there’s no major bullish signal yet, the market isn’t showing pronounced weakness either.

Nifty on the Daily Chart - RSI & 200 DMA Perspective

Looking at the daily chart, Nifty remains close to its 200 DMA (Daily Moving Average). Since the steep fall from September to mid-November, the index bounced back, fell again, and is now struggling to hold above a key support zone—the June election day high. If Nifty can consolidate above this level, it could serve as a strong base for the next move upward, whenever that occurs.

Nifty - Weekly Perspective

The weekly chart offers a clearer view of how support near the November lows has come into play. Although the index is not completely out of the woods, it has been hanging around the current range. A breakdown below 23,400 would raise significant concerns among short-term traders. However, there’s also a decent chance the market could consolidate further, especially as it awaits potential announcements around U.S. trade policies under President Trump and the Indian Union Budget on February 1. If neither event severely rattles sentiment, there might be no strong reason for a major market drop.

S&P 500 Overview

S&P 500 slipped by 0.48% this week, but overall remains extremely robust. It bottomed out around November 2023 at the 4,000 level and has since rallied to nearly 6,000—a substantial 50% gain in a short span. Higher highs and higher lows continue to form, making the U.S. market appear far more bullish in comparison to the Indian index.

GOLD Overview

Gold in INR terms rose by 1.1% this week, reaching approximately Rs. 7,711 per gram. The chart remains strong, with only minor corrective moves before resuming its uptrend. Over the past year, gold has gained about 25–30%, and there’s a possibility of another 20% gain in the coming year. Notably, gold’s rise has persisted even as the dollar index climbs, which is somewhat unusual.

Dollar Index Overview

Currently at around 109, the dollar index continues to strengthen against a basket of major currencies. A rising dollar generally leads to outflows from emerging markets and puts pressure on precious metals—yet gold, interestingly, is still climbing. If the dollar remains strong, it could drive capital into USD-denominated assets, potentially causing further selling in emerging markets.

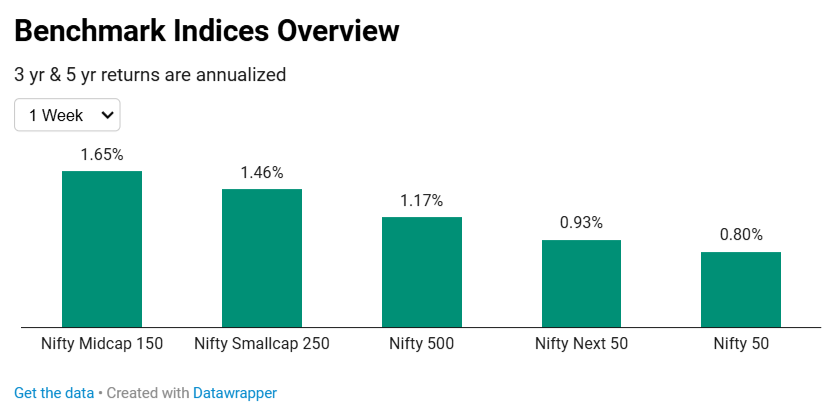

Benchmark Indices Overview

This week, mid caps led with a 1.65% gain, followed by small caps at 1.47%, the Nifty 500 at 1.17%, the Nifty Next 50 at 0.93%, and finally the Nifty 50 at 0.8%. Looking at monthly performance, small caps and mid caps are still in positive territory, whereas the Nifty 50 and Nifty Next 50 have lost ground. Over three months, all indices are down, but small caps have still held up relatively well. The key takeaway is that mid caps and small caps currently exhibit more relative strength compared to the larger cap indices.

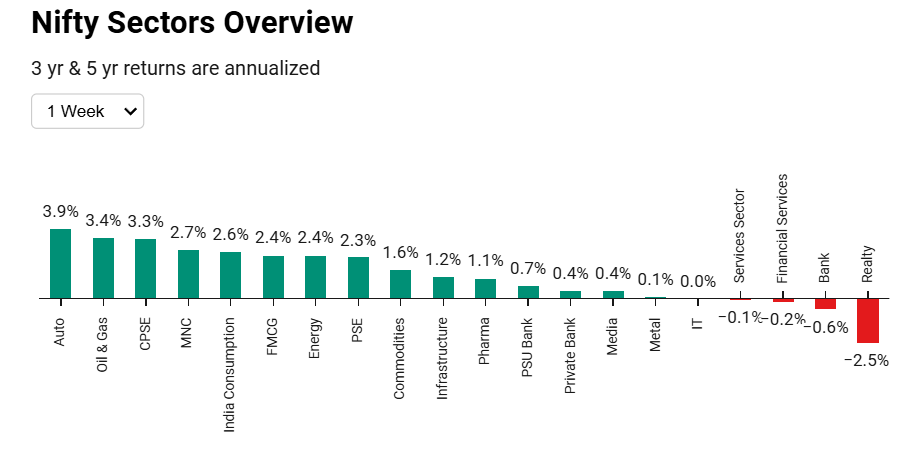

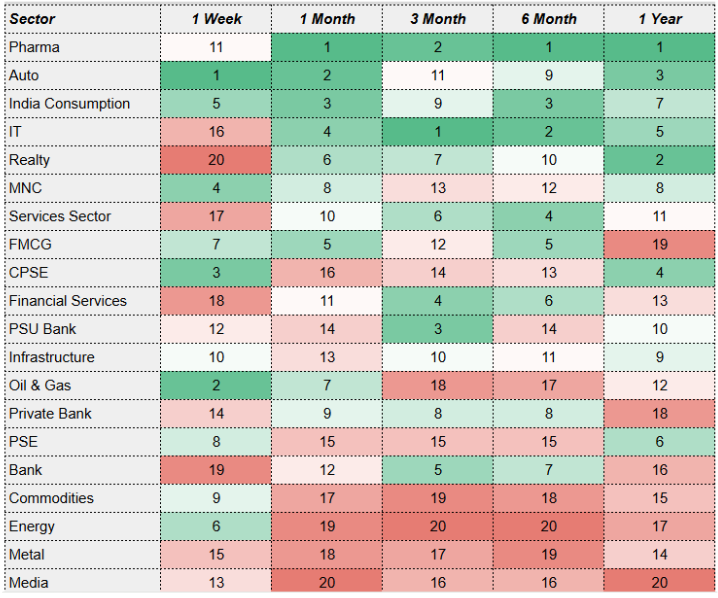

Sectoral Overview

Autos performed particularly well this week, up 3.9%, likely driven by hopes of improved December sales and positive outlooks from various companies. Oil and gas also jumped 3.4%, with central PSU stocks gaining 3.3%, possibly on expectations of budget-related announcements. FMCG is slowly recovering from a recent slump, but remains up only 1.1% over the last year—a relatively modest figure. Real estate, which has been a strong performer (34.3% up over the year), lost some ground this week.

Pharma, autos, and Indian consumption stocks are currently at the top of the momentum rankings, while IT and real estate have dropped slightly in the short term. Discretionary traders or investors seeking to capitalize on near-term strength may want to watch for opportunities in these leading sectors, particularly if prices correct and provide attractive entry points.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply