- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 10 Jan 2025

Good, Bad & Ugly Weekly Review : 10 Jan 2025

Bears in Total Control ?

Edition : 10 Jan 2025

Hello, Investor !

Markets Overview

This year, 2025, has not started on a positive note for the markets. We’ve already lost ground in just ten days. Foreign Institutional Investors (FIIs) continue to sell, and while retailers are still buying, their enthusiasm might cool off soon. Over the next 20 days, three major events could shape market sentiment. First, the upcoming Budget may put extra money in taxpayers’ pockets by cutting tax rates—at least that’s the expectation. Second, President Trump takes office on January 20th, and any new tariffs he imposes could affect India. Third, there is growing talk that the rupee might weaken to 90 against the dollar (it currently stands near 86). This consensus of a weaker rupee could discourage both foreign investors and NRIs from investing right now, as they may prefer to wait and see if the rupee indeed hits 90.

Looking at the Nifty’s performance within the week, it kept dropping steadily from around 24,200 on January 3rd down to approximately 23,350. The first two trading days of the year were encouraging, but then the market lost momentum. At present, it’s hovering near a key support level from the previous bottom.

Nifty on the Daily Chart – RSI & 200 DMA Perspective

The 200-day moving average (DMA) has been decisively breached, and the 50 DMA is approaching a “death cross” (where the 50 DMA moves below the 200 DMA). We are not yet in oversold territory, which suggests there could be more room for downside. It’s wise to mentally prepare for a potential dip toward the 21,300 mark (the bottom of the “election day” candle). This isn’t guaranteed, but if it happens, being ready for it can avoid a shock.

Nifty – Weekly Perspective

Nifty lost 2.39% this week, and the weekly chart suggests a continuation of the earlier downtrend. We’ve seen multiple swings: a big downward move, a small rally, another move down, another brief rally, and yet another move down. The initial low from that first wave has not been broken yet, which is a small positive. If that low does break, many algorithmic and rules-based traders could trigger sell orders, adding pressure to the market. To truly reverse this trend, the market would need to consolidate here and then take out the most recent pivot high—neither of which has happened yet.

S&P 500 Overview

S&P 500 (often considered the “mother market”) also looks slightly weaker, though not as much as India. It is still forming higher highs and higher lows since November. The U.S. market seems to be waiting for policy announcements from the incoming President, which could decide its next major move.

GOLD Overview

Gold (in INR terms) rose by 2.36% this week. It is now around Rs. 7,894 per gram, calculated by converting the spot gold price (XAU/USD) into rupees and adding about 6% duty, then dividing by 31.109 grams (per troy ounce). This is near an all-time weekly closing high, reminiscent of a similar setup last July that led to a further spike. It wouldn’t be surprising if gold continues upward from here.

Dollar Index Overview

The Dollar Index remains very strong at around 109.64. When the dollar strengthens, global money tends to flow into U.S. assets, and emerging markets often see selling pressure. This dynamic is one reason FIIs have been exiting Indian markets—why hold assets in a falling currency when the dollar is steadily rising? Emerging markets may attract foreign inflows only once the dollar shows signs of weakening.

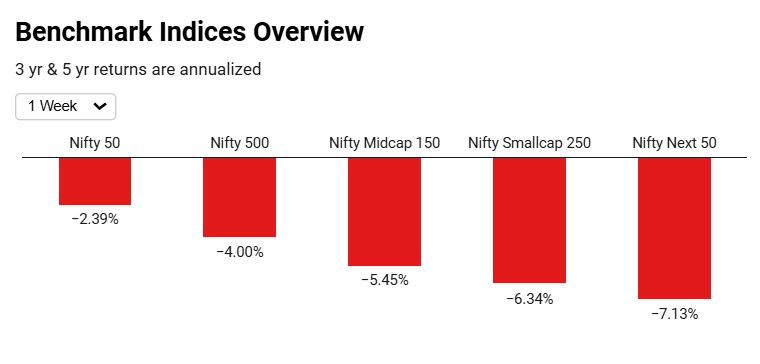

Benchmark Indices Overview

Reviewing benchmark indices this week shows steep drops: the Nifty Next 50 lost 7%, small caps fell 6.5%, mid caps declined by 5.4%, the Nifty 500 by 4%, and the Nifty 50 by 2.39%. Over the past month, similar losses appear, though if we zoom out to a one-year view, returns look better: the Nifty is still up 9%, the Nifty Next 50 is up 19%, and small caps are up 17%. Despite short-term pain, the longer-term picture remains reasonably intact. Even on a three-year or five-year basis, the performance has been robust, which should remind investors of the importance of a longer-term perspective.

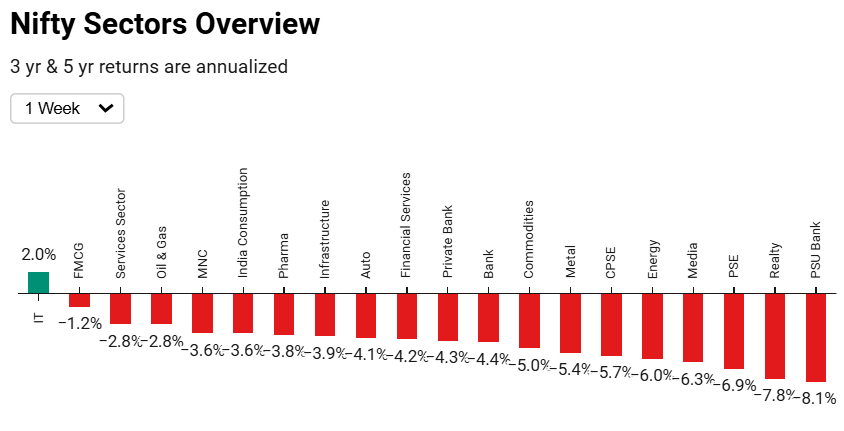

Sectoral Overview

Sector-wise, PSU banks dropped 8%, real estate 7.8%, and public sector enterprise (PSE) around 6.9%. Media, energy, metals, and commodities also fell by more than 5%, leaving virtually nowhere to hide. Ironically, FMCG—previously one of the weakest segments—was the only sector that actually gained this week. Over a one-month span, everything is in the red, especially media, PSU banks, and metals, each down over 12%. However, taking a one-year view, pharma, IT, auto, and CPSE have been top performers, while private banks, energy, and FMCG have lagged. Over three or five years, certain sectors like real estate, CPSE, metals, and autos have delivered excellent CAGR returns, whereas others have underperformed.

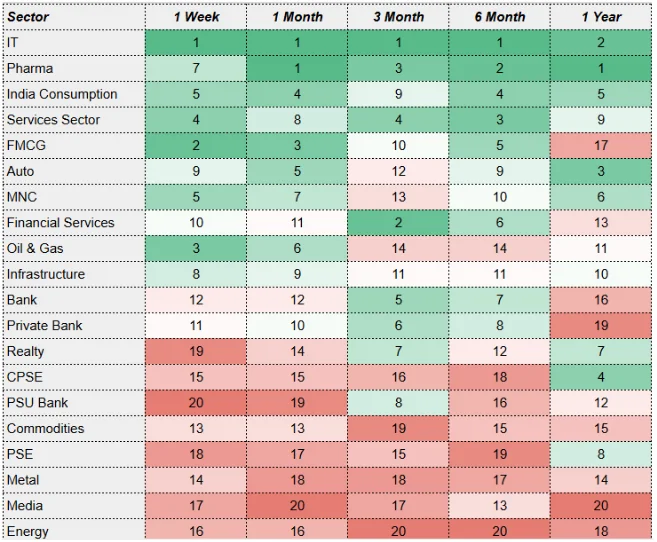

From a momentum perspective, IT, pharma, consumption, and services currently lead in both short- and medium-term horizons. IT, in particular, ranks in the top three across most timeframes. Pharma has slipped slightly in recent evaluations, while FMCG has improved its relative position over the past few weeks. Meanwhile, metals, public sector enterprise, and PSU banks have moved lower in momentum rankings and may need time to recover.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply