- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 27 Sep 2024

Good, Bad & Ugly Weekly Review : 27 Sep 2024

Edition : 27 Sep 2024

Hello, Investor !

Markets Overview

It was another good week where the markets headed for new highs, although there is still disbelief. At every thousand-point level in Nifty, there’s skepticism that it can climb higher. Just six or eight months ago, 20,000 seemed unachievable. Now, with Nifty sitting above 26,000, every milestone seems unlikely until it is reached. While a correction is inevitable—trees don’t grow to the sky—you can’t avoid investing out of fear. Many investors who exited mid and small cap stocks months ago or moved to cash now regret their decision. Even if the market seems irrational, irrationality can persist for a long time. The earnings of top FMCG players in India have defied expectations for decades. If this is India’s decade, the market could continue its strong performance. Trying to time the market by pulling out during highs and re-entering during dips is challenging and often unsuccessful. Instead, it’s wiser to follow the market and adopt the “BBC principle” (Bhav Bhagwan Che) : go where the market goes and profit from it

This week, the Nifty’s trend was consistently upward, continuing from the previous week. Nifty rose from 25,800 to nearly 26,200, gaining around 400 points, with only Friday seeing some profit-taking. The weekly chart shows a three-week strong upward trend. While a short-term pullback may occur, it’s worth noting that from March 2023, Nifty has risen from 17,000 to nearly 26,000—an impressive 9,000-point increase in just 18 months. This translates to more than a 50% gain in that period, which naturally raises expectations of a market correction.

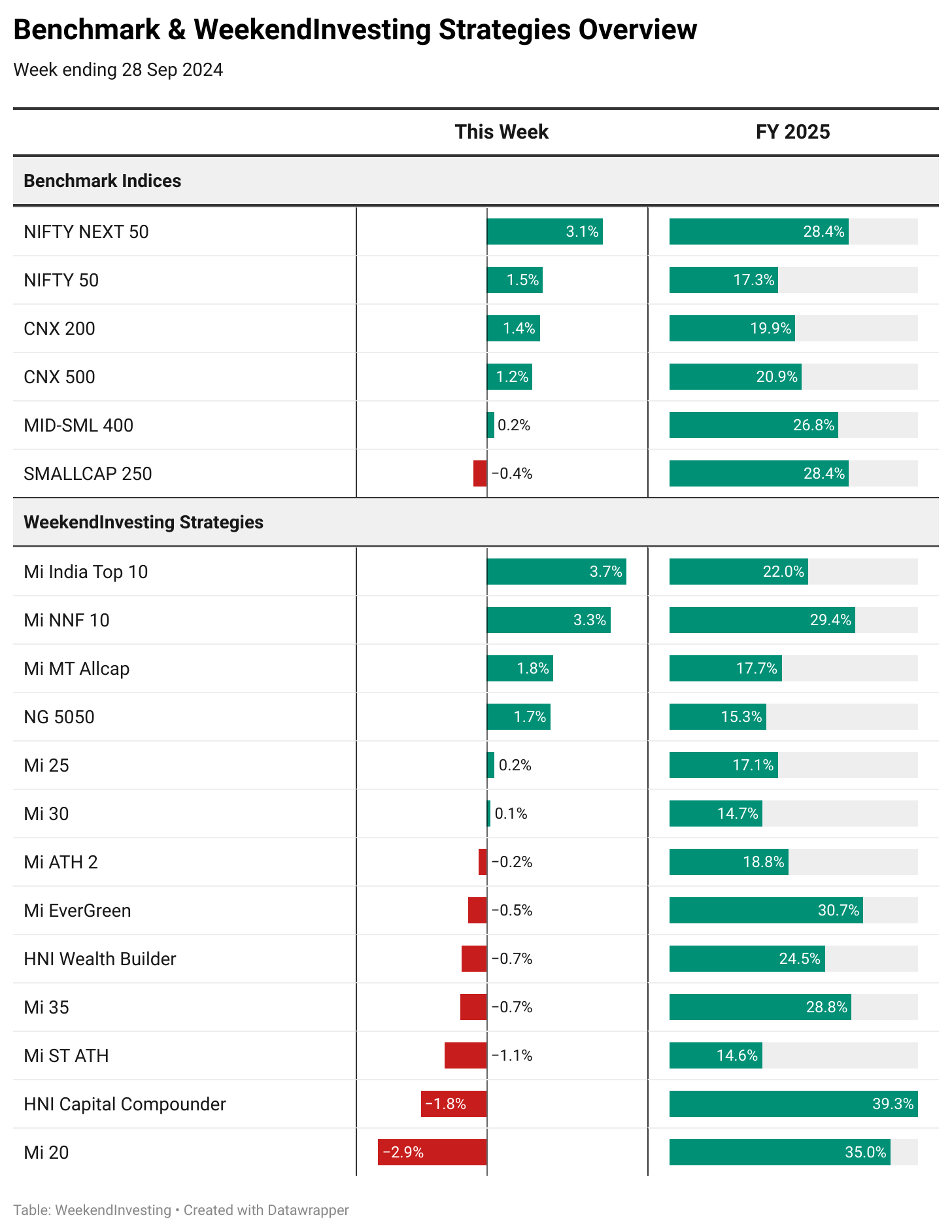

Benchmark Indices & WeekendInvesting Strategies Overview

The Nifty Next 50 made a comeback this week, gaining 3.1%, while Nifty rose by 1.5%. CNX 200 and CNX 500 both gained over 1%, but mid and small caps were largely flat, continuing their underperformance from the previous week.

In terms of Weekend Investing strategies, Mi India Top 10 performed well, up 3.7%, followed by Mi NNF 10 at 3.3% and Mi MT Allcap at 1.8%. NG 5050 gained 1.7%, marking a 15% increase for FY 25, making it a solid performer. On the other hand, small and mid-cap strategies struggled, with Mi ST ATH down 1.1%, HNI Capital Compounder down 1.8%, and Mi 20 falling 2.9%. There is an apparent slowdown in the small and mid-cap space.

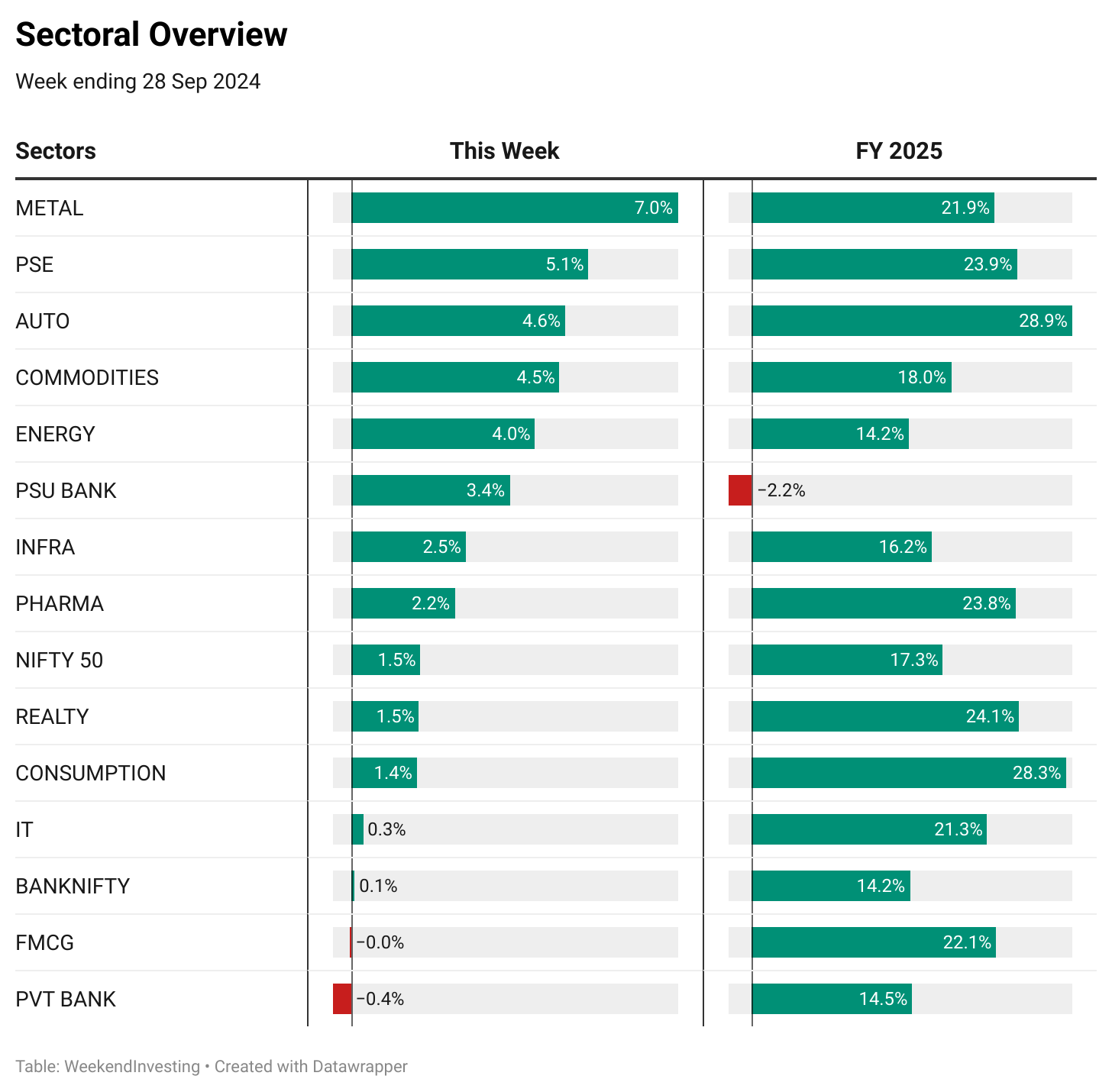

Sectoral Overview

In sectoral performance, metals zoomed ahead with a 7% gain for the week, followed by public sector enterprise stocks up 5.1%, autos up 4.6%, and commodities up 4.5%. Energy rose by 4%, while PSU banks gained 3.4% but are still in the red for FY 25. Other sectors like real estate, consumption, infra, and pharma saw gains of around 1.5%, while IT was knocked out this week. Bank Nifty and FMCG saw little movement, with private banks down 0.4% overall despite some intraday comebacks. It appears that the market is shifting toward a risk-on trade, with sectors like FMCG, IT, and pharma taking a backseat to metals, autos, and commodities.

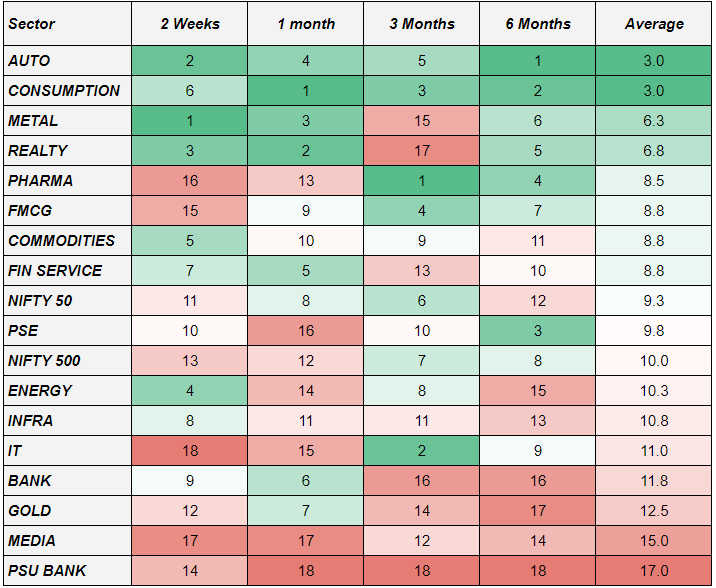

Looking at sectoral momentum, metals are currently leading, followed by autos, real estate, and energy in the short term. Over longer periods, autos, consumption, metals, and real estate are the strongest sectors, with pharma also performing well. This provides a good indication for discretionary long positions, particularly in these sectors. Momentum scores are also helpful in spotting rapid shifts. For example, consumption stocks have dipped recently, while energy is gaining momentum in the short term. PSU banks, on the other hand, remain towards the bottom of the momentum rankings.

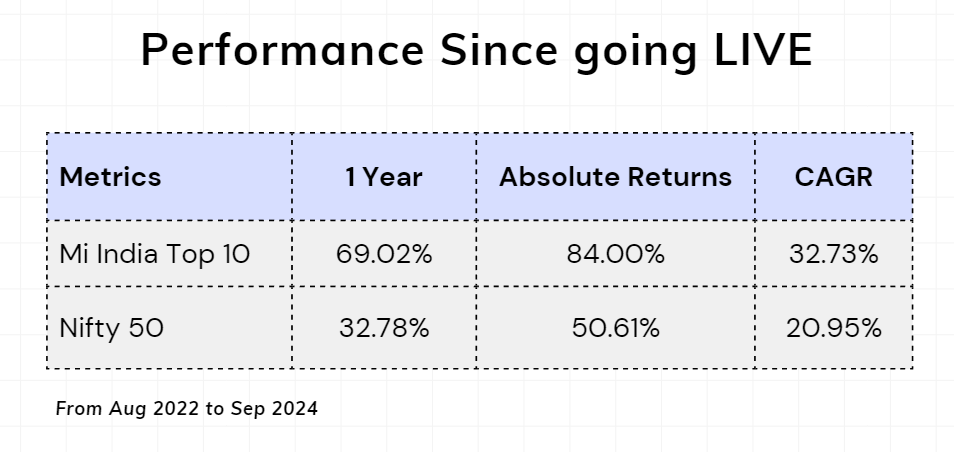

Spotlight - Mi India Top 10

NTPC – 2x (Mi India Top 10)

This week’s spotlight is on NTPC, a stock that was long overlooked. From 2007 to 2021, NTPC was stuck in a consolidation phase, and investors largely ignored it. Public sector stocks like NTPC were often dismissed as poor investments. However, these stocks have performed well in recent times.

Without any sector bias, a solid strategy can pick up momentum in stocks like NTPC when the trend shifts. NTPC has surged from below ₹100 to ₹436 since 2021, an unexpected rise for many investors. Mi India Top 10 identified NTPC near its all-time highs at ₹218, and we’re still holding onto it.

This demonstrates the power of markets—stocks that stagnate for years can suddenly surge. The consolidation period can act as a foundation for a fresh momentum. NTPC could continue to rise or slump again for years; a good strategy will manage both scenarios.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply