- WeekendInvesting

- Posts

- Good, Bad & Ugly Weekly Review : 28 Jun 2024

Good, Bad & Ugly Weekly Review : 28 Jun 2024

Edition : 28 Jun 2024

Hello, Investor !

Markets Overview

This week, Nifty experienced a strong upward movement, starting with a gap down at 23,350 on Monday and closing just above 24,000. This remarkable gain was mainly concentrated in large-cap stocks. The weekly candle shows significant strength, reflecting the impressive climb from around 19,000 in November or December 2023 to 24,000 in June 2024. This surge highlights the importance of staying invested and not trying to predict market boundaries by frequently entering and exiting the market.

Despite concerns about the market being expensive, this sentiment has persisted during its steady rise from 21,000 to 24,000. Historically, while the market may seem overvalued, it’s relatively cheap compared to global markets. For instance, US markets, once considered toppish at 15 to 20 times earnings, now trade at 30 times. If US markets can sustain such valuations, India could potentially follow suit. The market’s continued upward trend suggests that those labeling it as expensive and staying out are missing out on significant gains.

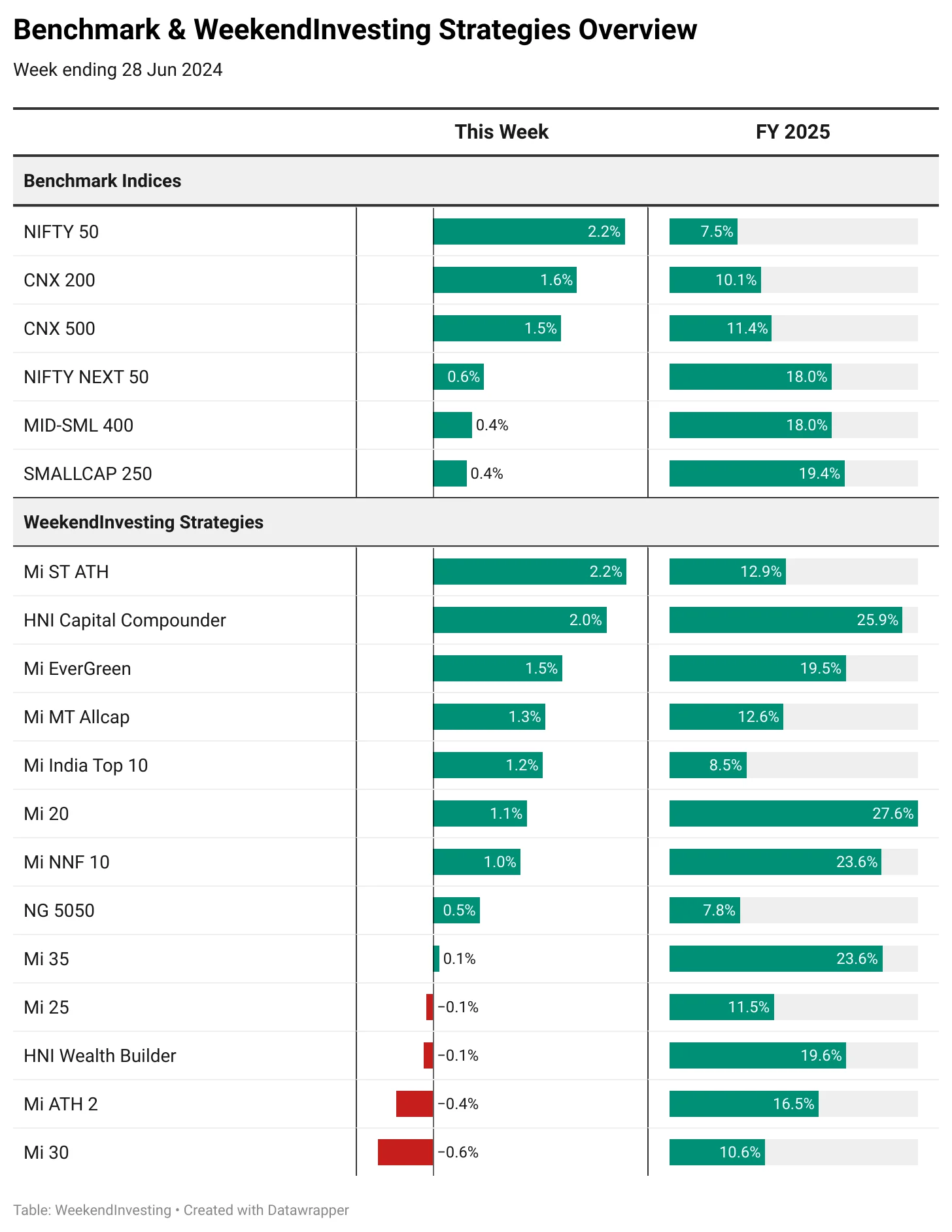

Benchmark Indices & WeekendInvesting Strategies Overview

This week, the Nifty gained the most at 2.2%, followed by CNX 200 and CNX 500, each up about 1.5%. Surprisingly, the Nifty Next 50, Mid & Smallcap 400, and Small Cap 250 only saw gains of around 0.5%. Despite leading significantly in FY 25 so far, these indices have taken a backseat this week.

In terms of weekend investing strategies, the HNI Capital Compounders was a standout, achieving 25.9% for the financial year. Mi ST ATH performed well this week with a 2.2% gain, followed by Mi Evergreen at 1.5%. Other strategies posted gains between 1% and 2%. However, Mi 25, HNI Wealth Builder, Mi ATH 2, and Mi 30 underperformed this week. For the year, Mi 20 leads with 27.6%, with Mi NNF 10 and Mi 35 also showing strong performance.

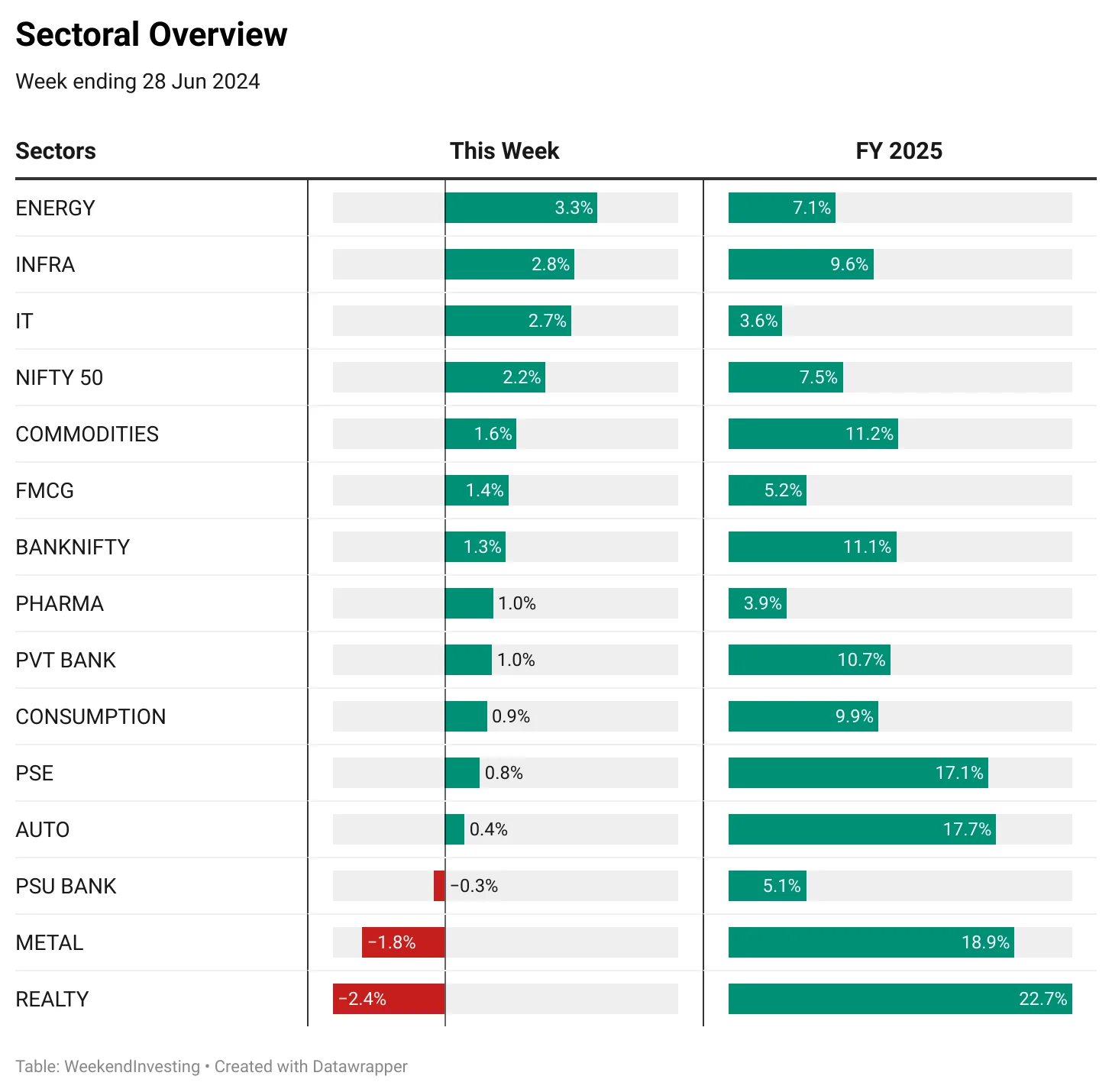

Sectoral Overview

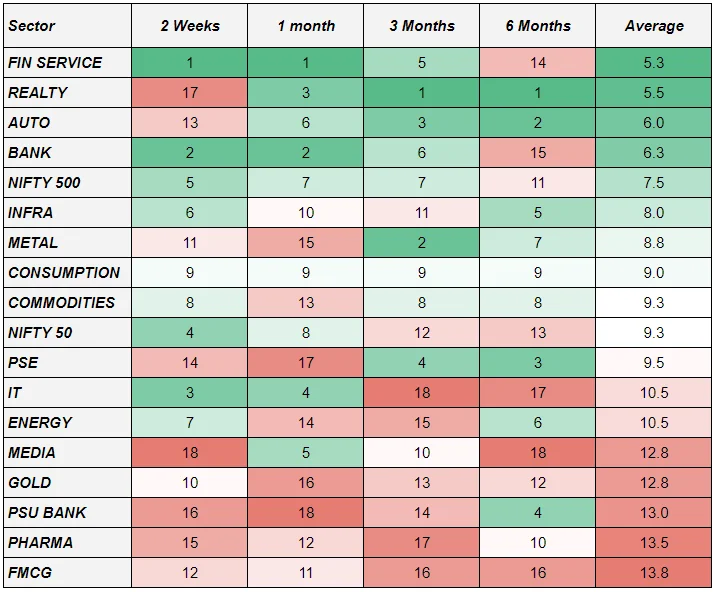

In terms of sector performance, real estate and metals took a backseat this week despite their strong year-to-date performance. PSU banks and pharma have been muted, with PSU banks underperforming and pharma up only 3.9% for FY 25 and 1% this week. FMCG has been sluggish at 5% for the financial year and 1.4% this week. IT stocks gained 2.7% this week, bringing their quarterly gain to 3.6%. Energy stocks rose by 3.3%, infrastructure stocks by 2.8%, and commodities saw a 1.6% increase this week.

In the short term, real estate and autos have dipped, while commodities and infrastructure have performed well. Financial services have led the market, overtaking real estate and autos, which still rank second and third on average. IT stocks are making a comeback, showing improved rankings over the past month and two weeks. The Nifty index is also performing well compared to many sectors.

Spotlight - Mi EverGreen !

No Scope for Regret !

Trent Limited offers a fascinating case study in investor psychology and how regret works. About two decades ago, during the rally from 2003 to 2008, Trent’s share price soared from around Rs 20 to nearly Rs 88. This was a remarkable 350% gain in less than a year and a half. However, the stock then crashed from Rs 90 in January 2006 to Rs 20 by November 2008, a drop of 75% over almost three years.

It is common to experience regret. You might regret not buying a stock at its low price or selling it before it peaked. If you had bought Trent at Rs 20 and sold it at Rs 45, you might feel regret for not holding until Rs 88. But the real challenge is not the regret of selling; it’s the regret of not reentering when the opportunity arises.

After the fall, Trent Limited’s stock price rose from Rs 20 to Rs 5400 over the next 15 years. This consistent upward trend demonstrates that even after a significant drop, there are opportunities for growth. It is crucial to overcome the bias of not buying a stock again after a loss. Each new entry should be seen with fresh eyes, without past regrets influencing the decision.

Every stock position should be treated as a new opportunity. Whether you had a profit or loss in the past with a particular stock should not affect your current decision. If the stock shows momentum, you can enter at any point without regret. Many investors miss opportunities because they are emotionally attached to past experiences with the stock.

To avoid the cycle of regret, it is helpful to follow a structured strategy. This involves having a clear, emotion-free plan for when to buy and sell stocks. By doing so, you shift the responsibility of decision-making from yourself to the strategy. This reduces stress and helps you make better investment decisions.

Join the WeekendInvesting Community

The WeekendInvesting Pro App is a one stop solution for everything about WeekendInvesting and Momentum Investing. This app gives users access to curated market content pieces, insights, discounts and a chance to be part of a community. This app acts as a medium for us to communicate with you and connect you with like minded investors !

Download the WeekendInvesting Pro App now !

Please write to [email protected] if you have any questions.

Reply